In this article we will discuss about:- 1. Construction of Cash Flow Statement 2. Utility of Cash Flow Analysis 3. Limitations.

Construction of Cash Flow Statement:

There are numerous variations in the form and terminology employed in statements of cash flow. The format of a funds statement based on the working capital concept. The cash flow statement may be divided into two principal sections, sources of cash and applications of cash. The difference between the totals of sources and applications of cash represents net increase/ decrease as the case may be in the cash balance.

This when added to or deducted from the opening balance of cash would be equal to the closing balance. A variant is to begin the statement with the beginning cash balance, add the total of sources, subtract the total applications and conclude with cash balance at the end of the period.

The data for the preparation of the cash flow statement are obtained from the two comparative balance sheets (one at the beginning and the other at the end of the period for which the statement is being prepared).

ADVERTISEMENTS:

Supplemented by such other details which could be developed either from analysis of the receipts and disbursements recorded in the cash account or from the statement of income and retained earnings. Some of the relevant data might be obtained from accounts in the ledger or from the initial entries in the journals.

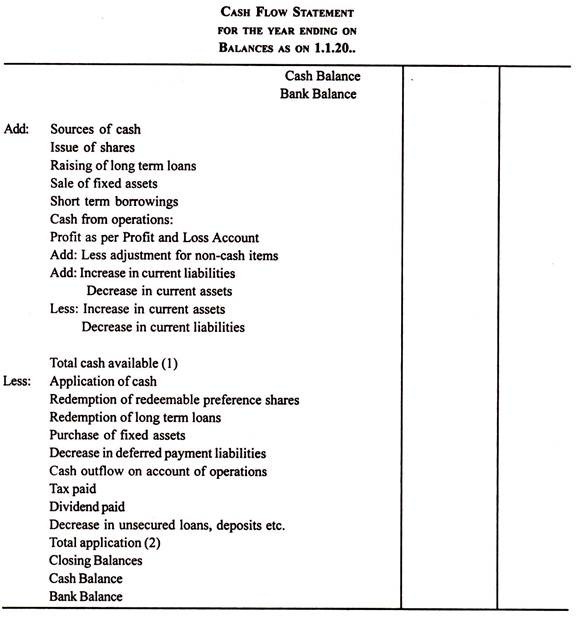

Format of a Cash Flow Statement:

A cash flow statement can be prepared in the following form:

Utility of Cash Flow Analysis:

Cash flow statement has the same utility as fond flow statement and at the same time it may highlight those financial facts which are generally concealed by the fond flow statement.

ADVERTISEMENTS:

Generally, cash flow statement may be used for the following purposes and there lies its utility:

(i) Projected cash flow statement may enable the financial manager to plan the acquisition and uses of cash, so that the minimum financial costs and sound financial position may be achieved.

(ii) It helps the management to evaluate its ability to meet its obligations i.e. payment to creditors, repayment of bank loans, payment of interest, taxes and dividends.

ADVERTISEMENTS:

(iii) Cash flow statement may also be used for making appraisal of various capital investment projects just to determine their viability and profitability.

(iv) It provides detailed information for making plans for more immediate future, i.e. short term financial planning is greatly facilitated by this statement.

(v) It is also very useful to external analyst particularly to the bankers. Now a days, financial institutions including bank, review the financial position of the borrowers and such review is greatly facilitated by cash flow statement.

Limitations of Cash Flow Statement:

Cash flow statement is a very useful tool of financial analysis.

However, it suffers from some limitations. These limitations are:

i) Cash flow statement only reveals the inflow and outflow of cash. But the cash balance disclosed by this statement may not depict the true liquid position of the business. True liquid position is obscured by the exclusion of some near cash items from the cash flow statement.

ii) Cash flow statement is not a substitute for income statement. Cash flow statement should not be equated with income statement. The net cash flow disclosed by cash flow statement does not necessarily mean net income of the business, because net income is determined by taking into account both cash and non-cash items.

iii) Cash used to signify fund is a narrow concept. It does not give a complete picture of the financial position of the concern. Even the term cash is not precisely defined.

iv) Cash flow statement suffers from all those limitations which limit the use of fund flow statement.

ADVERTISEMENTS:

v) The cash balance is too easily influenced by postponing purchases and other payments.