I. M. Pandey defines capital budgeting decision as, “the firm’s decision to invest its current funds most efficiently in the long term assets, in anticipation of an expected flow of benefits over a series of years”.

Capital budgeting decisions may either be in the form of increased revenues, or reduction in costs. Capital expenditure decisions therefore include, addition, disposition, modification and replacement of fixed assets.

In other words, the system of capital budgeting is employed to evaluate expenditure decisions, which involve current outlays, but are likely to produce benefits over a period of time, longer than one year.

Contents.

- Meaning of Capital Budgeting Decisions

- Concept Of Capital Budgeting Decisions

- Characteristics of Capital Budgeting Decisions

- Features of Capital Budgeting Decisions

- Importance of Capital Investment Decisions

- Kinds of Capital Budgeting Decisions

- Different Types of Capital Budgeting Decisions

- Classification of Capital Budgeting Decisions

- Steps Which Help Financial Manager to Increase the Value of the Firm

- Risk Analysis in Capital Budgeting Decisions

- Cost and Benefits of Project

- Estimation of Cost and Benefits of a Proposal

- Principles of Cash Flows Estimation

- How Certain Conditions Affect Capital Budgeting?

- Ranking of Capital Budgeting Proposals

- Advantages and Limitations of Discounted Cash Flow Methods

- Issues Pertaining to Cross-Border Investments and their Implications in Capital Budgeting Decisions

Capital Budgeting Decisions: Meaning, Concept, Features, Types, Steps, Risk Analysis, Advantages and Limitations of Discounted Cash Flow Methods and More…

Capital Budgeting Decisions – Meaning

Financial management focuses not only on the procurement of funds, but also on their efficient use, with the objective of maximising the owner’s wealth. The efficient allocation of funds is an important function of financial management.

ADVERTISEMENTS:

It involves the decision to allocate and invest funds, to assets and activities. Thus, it is known as an investment decision, because it is making a choice, regarding the assets in which funds will be invested.

These assets fall into two categories:

(a) Short term or current assets, and

ADVERTISEMENTS:

(b) Long term or fixed assets.

Thus there are two types of investment decisions. The first type is also known as management of current assets, or working capital management. The second type of decision is known as long term investment decision, or capital budgeting, or the capital expenditure decision.

I. M. Pandey defines capital budgeting decision as, “the firm’s decision to invest its current funds most efficiently in the long term assets, in anticipation of an expected flow of benefits over a series of years”.

In other words, the system of capital budgeting is employed to evaluate expenditure decisions, which involve current outlays, but are likely to produce benefits over a period of time, longer than one year.

ADVERTISEMENTS:

Capital budgeting decisions may either be in the form of increased revenues, or reduction in costs. Capital expenditure decisions therefore include, addition, disposition, modification and replacement of fixed assets.

For Example:

(a) Dis-investment of a division of business.

(b) Change in the method of sales distribution.

(c) Changing the advertising campaign.

(d) Major investment in the research and development program.

(e) Labour welfare projects.

(f) Diversification projects.

(g) New projects-For example- installation of pollution control equipment as per the legal requirements, etc.

Capital Budgeting Decisions – Concept

Concept of Capital Budgeting Decisions as follows:

ADVERTISEMENTS:

Successful operation of any business depends upon the investment of resources in such a way as to bring in benefits or best possible returns from any investment. An investment can be simply defined as expenditure in cash or its equivalent during one or more time periods in anticipation of enjoying a net inflow of cash or its equivalent in some future time period or periods.

An appraisal of investment proposals is necessary to ensure that the investment of resources will bring in desired benefits in future. If the financial resources were in abundance, it would be possible to accept several investment proposals which satisfy the norms of approval or acceptability.

Since resources are limited, a choice has to be made among the various investment proposals by evaluating their comparative merit.

ADVERTISEMENTS:

Capital Budgeting is defined as the firm’s decision to invest its current funds most efficiently in long-term activities in anticipation of an expected flow of future benefits over a series of years. It should be remembered that the investment proposal is common both for fixed assets and current assets.

Capital Budgeting is employed to evaluate expenditure decisions which involve current outlay but are likely to produce benefits over a period of time longer than 1 year. These benefits may be either in the form of increased revenues or reduced costs.

Van Home has defined capital budgeting as – “The process of identifying, analysing and selecting investment projects whose return (cash flows) are expected to extend beyond one year.”

As per Robert N. Anthony, “Capital Budget is essentially a list of what management believes to be worthwhile projects for the acquisition of new capital assets with the estimated cost of each product”.

ADVERTISEMENTS:

Hence, Capital Budgeting may be defined as the decision making process by which firms evaluate the purchase of major fixed assets, including buildings, machinery, and equipment or investment in any project or extension of existing capacity, etc.

The firm’s Capital Budgeting Decisions will include addition, disposition, modification and replacement of fixed assets.

Main Characteristics of Capital Budgeting Decisions

The main characteristics of capital budgeting decisions may be summarized as under:

(а) It involves huge outflow of funds or capital.

(b) There is a time gap between the investment of funds and’ anticipated or future benefits.

(c) Involves a high degree of risk as the decisions have a long term effect on the profitability of a company.

ADVERTISEMENTS:

(d) Most of the capital budgeting decisions are of irreversible nature i.e., once the firm has initiated the investment, it cannot revert back otherwise it has to incur heavy losses.

(e) It helps an enterprise from making over investment and under investment relative to its size of business.

Because of aforesaid features of the capital budgeting decisions, they constitute most important decisions in corporate management and are exercised with great caution. Any decision taken under capital budgeting has long term effect on the functioning and profitability of the company.

If the decision taken goes in the right direction, it will have positive impact on the profitability of the company and if it goes in the wrong direction it will have negative impact on the profitability of the company. Reversing the decisions already initiated leads to unnecessary heavy loss to the company.

Capital Budgeting Decisions – Features

The features of capital budgeting decisions are as follows:

(1) In anticipation of future profits, investment is made in present times.

ADVERTISEMENTS:

(2) Investment of funds is made in long-term assets.

(3) Future profits accrue to the firm over several years.

(4) These decisions are more risky.

Here, it is worth noting that capital expenditure decisions affect wealth of the firm. If investment proposals are beneficial, they increase the wealth of the firm. As a result of investment decisions, value of the firm is affected.

Some of the other features of capital decision are as follows:

Capital budgeting decision has three basic features:

ADVERTISEMENTS:

1. Decision regarding the investment for more than one year.

2. Anticipated benefits of the project will be received in future dates.

3. Require a large amount of funds for investment with a relatively high degree of risk.

Capital Budgeting Decisions – Importance of Capital Investment Decisions

Importance of Capital Investment Decisions are as follows:

Capital investment involves a cash outflow in the immediate future in anticipation of returns at a future date. The capital investment decisions assume vital significance in view of their marked bearing on corporate profitability needs no emphasis. The investment proposals need to be related to the underlying corporate objectives and strategies.

A key challenge for all organizations is to identify projects which fit these strategies and promise to be profitable in the broadest sense i.e., to create wealth for the organization. Capital investment decisions usually involve large sums of money, have long time-spans and carry some degree of risk and uncertainty.

ADVERTISEMENTS:

A capital investment decision involves a largely irreversible commitment of resources that is generally subject to significant degree of risk. Such decisions have a far-reaching efforts on an enterprise’s profitability and flexibility over the long-term. Acceptance of non-viable proposals acts as a drag on the resources of an enterprise and may eventually lead to bankruptcy.

For making a rational decision regarding the capital investment proposals at hand, the decision-maker needs some techniques to convert the cash outflows and cash inflows of a project into meaningful yardsticks which can measure the economic worthiness of projects.

Realistic investment appraisal requires the financial evaluation of many factors, such as the choice of size, type, location and timing of investments, taxation, opportunity cost of funds available and alternative forms of financing the outlays.

This shows that capital investment decisions are difficult on account of their complexity and their strategic significance. The planning and control of capital expenditure is termed as ‘capital budgeting’. Capital budgeting is the art of finding assets that are worth more than they cost, to achieve a predetermined goal i.e., optimizing the wealth of a business enterprise.

Kinds of Capital Budgeting Decisions – Accept Reject Decisions, Mutually Exclusive Decisions and Capital Rationing Decisions

Kind # 1. Accept Reject Decisions

This type of decision is basic to capital budgeting. If the proposed project is accepted by the top management the company proceeds with the investment of funds there in. Alternatively if the project is rejected the company does not make any investment. All those proposals which yield a rate of return or greater than the cost of capital are accepted and the rest are rejected.

Kind # 2. Mutually Exclusive Decisions

It includes all those projects which compete with each other in a way that acceptance of one precludes the acceptance of other or others. Thus some technique has to be used for selecting the best among all and eliminates the other alternatives.

Kind # 3. Capital Rationing Decisions

Capital budgeting decision is a simple process in those firms where funds is not the constraint but in majority of the cases firms have the fixed capital budget. So large number of projects compete for these limited budget.

So firms ratio them in a manner as to maximize the long run returns situation where in the firm which have more acceptable investments requiring greater amount of finance than is available with the firm. It is concerned with the selection of a group of investment out of many investment proposal ranked in the decision order of the rate of return.

Different Types of Capital Budgeting Decisions (With Examples From Indian Market)

Following are few different types of capital budgeting decisions with practical recent examples from Indian market:

1. Expansion of existing business (Bharti Airtel acquiring African Assets of Zain telecom to expand its business in South Africa)

2. Expansion of new business (Reliance entering into retail segment)

3. Replacement and Modernization (Amul replacing its delivery vans)

4. Research and development decisions (GlaxoSmithKline spending on research for HIV medicines)

5. Make or Buy Decisions (Maruti contemplating whether to buy the spare parts from outside or manufacture it in house).

Top 3 Types of Capital Budgeting Decisions

Basically, there are three types of capital budgeting decisions, usually taken by the business or corporate organizations.

Such decisions are:

1. Accept-Reject Decisions of Independent Projects:

This is a fundamental decision in capital budgeting. If the project is accepted, the firm invests in it, if the proposal is rejected, the firm does not invest in it. All those proposal which yield as rate of return greater than a minimum rate of return or cost of capital are accepted and if the rate of return lesser than a minimum rate of return or cost of capital the projects are rejected. According to this criterion, only the independent projects are selected because those projects do not compete with one another.

In the case of mutually exclusive projects the project which has lower PBP, higher ARR, higher or positive NPV, higher PJ and higher IRR criterion rules are applicable while accepting the project for investment or for other decisions mentioned above.

2. Decisions on Mutually Exclusive Investment Projects:

Mutually exclusive projects are those projects, which compete with other projects, in such a way that the acceptance of one will exclude the acceptance of the other projects. That means, in the case of these proposals only one or some of the proposals can be accepted and the other projects have to be rejected.

The alternative are mutually exclusive and only one may be chosen. In the case of these proposals, only the most profitable proposal will be accepted. The acceptance of the best alternatives automatically eliminates the other alternatives.

3. Capital Rationing Decisions:

If the firm has unlimited funds capital budgeting decision is a simple process. But in case of limited funds, the firm must therefore ration them. Capital rationing is a situation in which due to financial constraints the limited funds are allocated as a number of mutually exclusive capital budget projects.

Steps Which will Help the Financial Manager to Increase the Value of Firm Through Capital Budgeting Decisions

Following steps will help the financial manager to increase the value of the firm through capital budgeting decisions:

1. Evaluation of different projects by appraising them technically and otherwise.

2. Correct estimation of cash outflow and inflows of the projects.

3. Consideration of time value of money in estimation of cash outflows and inflows of the project.

4. Correct measurement and incorporation of risk and uncertainty while appraising capital investment decisions.

5. Selection of suitable evaluation method which will increase the value of the firm.

6. Finally, selection of the project out of the various alternatives and commitment of funds to it.

7. Implementation of the project, its continuous performance evaluation and taking remedial actions wherever necessary so that objectives underlying the project can be achieved.

Risk Analysis in Capital Budgeting Decisions – Methods: Risk Adjusted Discount Rate Method, Certainty-Equivalent Method, Sensitivity Analysis, Probability Assignment and More…

Risk Analysis in Capital Budgeting Decisions:

So far our analysis of investment decisions has been based on conditions of certainty regarding the future and the proposed investment does not carry any risk. The assumptions of certainty and no risk were made simply to facilitate the understanding of capital investment decisions.

But in practice, all investment decisions are undertaken under conditions of risk and uncertainty. Since investment decisions involve projecting the future cash inflows and outflows, uncertainty inevitably creeps in.

Neither rupee amounts nor the dates of cash flows can be known with precision. The amount and timing of the long term future cash flows could vary significantly from those predicted.

It is therefore essential to consider risk factors at the time of determining cash flows from a project for the purpose of capital budgeting decisions. However, incorporation of risk factors in capital budgeting decisions is a difficult task.

Some of the popular methods used for this purpose are as follows:

1. Risk adjusted discount rate method

2. Certainty – equivalent method

3. Sensitivity analysis

4. Probability assignment

5. Standard deviation and coefficient of variation.

6. Decision tree analysis.

These methods are discussed one by one in detail:

Method # 1. Risk Adjusted Discount Rate Method:

This method is also known as a varying discount rate method. It is based on the presumption that investors expect a higher rate of return on risky projects as compared to less risky projects.

The rate requires determination of

(a) risk free rate and

(b) risk premium rate.

Risk free rate is the rate at which the future cash inflows should be discounted had there been no risk. Risk premium rate is the extra return expected by the investors over the normal rate (i.e., the risk free rate), on account of the project being risky.

Thus Risk adjusted discount rate is a composite discount rate that takes into account both the time and risk factors. A higher discount rate will be applied for projects which are considered more risky, conversely, a lower discount rate is applied for less risky projects.

Method # 2. Certainty-Equivalent Method:

Under this method, the risk element is compensated by adjusting cash inflows rather than adjusting the discount rate. Expected cash flows are converted into certain cash flows by applying certainty-equivalent coefficients, depending upon the degree of risk inherent in cash flows.

To the cash flows having higher degree of certainty, higher certainty – equivalent coefficient is applied and for cash flows having low- degree of certainty, lower certainty equivalent coefficient is used. For evaluation of various projects, cash flows so adjusted are discounted by a risk free rate.

Method # 3. Sensitivity Analysis:

In the methods discussed above, only one figure of cash flow for each year is considered. However, there are chances of making estimation errors. The sensitivity analysis approach takes care of this aspect by giving more than one estimate of the future cash flow of a project.

It is thus superior to one figure forecast as it provides a more clear idea about the variability of the return. Generally, sensitivity analysis gives information about cash inflows under three assumptions i.e., ‘Optimistic’, ‘Most likely’ and ” Pessimistic” outcomes associated with the project.

It explains how sensitive the cash flows are under these three situations. Further cash inflows under these three situations are discounted to determine net present values. The larger the difference between the pessimistic and optimistic cash flows, the more risky is the project and vice versa.

Method # 4. Probability Assignment:

Although sensitivity analysis approach provides different cash flow estimates under three

assumptions, it does not provide chances of occurrence of each of these estimates. The chances of occurrence can be ascertained by assigning appropriate probabilities to each of these estimates.

In most of the capital budgeting situations, the probabilities are usually assigned by the decision maker on the basis of some relevant facts and figures and his subjective considerations. If the decision maker foresees a risk in the proposal, then he has to prepare a separate probability distribution to summarise the possible cash flow for each year through the economic life of the proposal. Thereafter he has to find out the expected value of probability distribution for each year.

To determine the expected value, each cash flow of the probability distribution is multiplied by the respective probability of the cash flow and then adding the resulting products. This final figure is then considered as the expected value of the cash flow of that year for which probability distribution has been considered.

This procedure is to be adopted for the probability distribution for all the years and the expected value of cash inflows are discounted at an appropriate discount rate to determine the NPV of the proposal.

Method # 5. Standard Deviation and Coefficient of Variation:

The probability assignment discussed above does not give a precise value indicating about the variability of cash flows and therefore the risk. This limitation can be overcome by following a standard deviation approach. Standard deviation (SD) is a measure of dispersion. It is defined as the square root of squared deviation calculated from the mean.

In case of capital budgeting, SD is applied to compare the variability of possible cash flows of different projects from their respective mean or expected value. A project having a larger SD will be more risky as compared to a project having smaller SD.

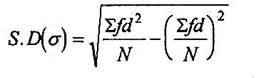

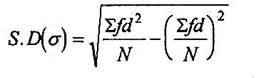

The SD is calculated by using following formula:

Coefficient of variation (CV) is a relative measure of dispersion and can be applied in the capital budgeting decision process to measure the risk of a project particularly in case when the alternative projects are of different size. It is defined as the standard deviation of the probability distribution divided by its expected value.

The formula for calculation of CV is as follows :

The advantage of C V over SD is that the former can be used to compare the riskiness of mutually exclusive projects even if their expected values are not equal. The CV is also useful in evaluation of those proposals whose initial outlays differ substantially.

Method # 6. Decision Tree Analysis:

This is a useful alternative for evaluating risky investment proposals. It takes into account the impact of all probabilistic estimates of potential outcomes. Every possible outcome is weighed in probabilistic terms and then evaluated. A decision tree is a pictorial representation in tree form which indicates the magnitude probability and inter-relationship of all possible outcomes.

The format of the problem of the investment decision has an appearance of a tree with branches and therefore this analysis is termed as decision tree analysis. The decision tree shows the sequential cash flows and NPV of the proposed project under different circumstances.

Capital Budgeting Decision – Cost and Benefits of Project: Initial Investment and Net Annual Cash Inflows

Cost and Benefits of Project (Capital Budgeting Decision):

For a capital budgeting decision, it is required to identify the cost and benefits involved in a project. These cost and benefits are termed as cash flows (both inflow and outflow).

We can justify such cash flows in terms of cost and benefits as follows:

(i) Initial Investment / Outlay:

When a new project is launched, there are so many expenditures to be made. Hence all the expenditures incurred in zero time period (at initial stage) on a fixed assets (project) are called initial investment.

It includes:

(a) Cost of the project (Asset)

(b) Opportunity cost of the Asset

(c) Additional Working Capital involved.

(ii) Net Annual Cash Inflows:

An investment is made with a specific purpose of getting satisfied return especially in term of cash inflows. When cash inflows from a project regularly with same amount throughout the life of the project (with variation year to year), it is called net annual cash inflows. This is net income of the firm before charging depreciation and after tax.

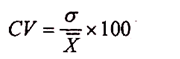

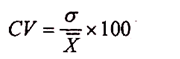

This may be computed as follows:

Capital Budgeting Decisions – Estimation of Cost and Benefits of a Proposal

In capital budgeting, cost and benefits of a proposal are measured in terms of cash flows. The term cash flow is the difference between rupee received and rupee paid out. It should not be misinterpreted as profit. All estimates of receipts and payments are based on cash. This is so because cash flows are a very certain amount.

The term cash flow means movement of cash because of a proposal. Every payment of cash, for whatever reason is an outflow, while every receipt of cash is an inflow. Any non-cash expenditure (like depreciation) will not be accounted for, as it doesn’t involve any cash outflow.

Therefore, cash flow will be calculated as under:

Cash flow = Profit after tax + Non-cash expenditure

The cash flows for the purpose of capital budgeting decisions can be estimated mainly under the following three heading:

1. Initial Cash Outflow or Initial Investment:

The estimation of initial cash outflow includes cost of purchase of an asset, its installation cost and an increase in working capital requirement due to adoption of the decision.

2. Subsequent Annual Net Cash Inflows for the Life:

The initial cash outflow incurred on a project is expected to generate future benefits over a longer period of time in terms of net cash inflows. These net cash inflows for the entire life of the project are calculated on an annual basis.

3. Terminal Cash Inflows:

In the last year of the project life, certain cash inflows are generated due to the termination of the project. These cash inflows are in addition to the regular net annual cash inflow of the terminal year.

These cash inflows are known as terminal cash inflows. Realisation of scrap value of an asset and release of investment in working capital at the time of termination of the project are the examples of terminal cash inflows.

Capital Budgeting Decisions – Principles of Cash Flows Estimation

Now, we are going to see how a capital budgeting decision is to be made and what are the principles that must be observed in order to make an estimation of cash flows in a scientific manner.

All estimates of receipts and payments should be based on cash-flows rather than on revenue and expenditure or profit and loss. The reason is that cash flows are very certain amounts and are not subject to different interpretation by different people.

Although accrual principle is considered better for the purpose of accounting, (probably because it calculates profit or loss for a given year), but for a long term investment decision making cash principle will be better.

Every payment of cash, for whatever purpose, is an outflow, while every receipt of cash, for whatever purpose is an inflow. Any non-cash expenditure (like depreciation) will not be accounted for because it does not involve any cash outflow.

The following principles should be adhered to in estimating cash-flows in respect of a project:

(i) All calculations of cash flows should be done on an incremental basis rather than on aggregate basis. If any inflow is in addition to the existing inflows, it should be accounted for, otherwise not. If a machine costs Rs. 1, 00,000 and it replaces an old machine which has fetched Rs. 20,000, then the cash outflow should be taken as only Rs. 80,000, even if the cost of the machine is Rs. 1,00,000.

(ii) Cash flow should be taken on ‘After-tax’ basis. Each income of a company is subject to corporate income tax. So the amount of tax is cash outflow even if we may not consider it as expenditure. Hence, if we have to find net cash inflow, the amount of tax paid should be subtracted and ‘cash flow after tax’ (CFATs) should be calculated.

(iii) Sunk- costs should be ignored. The costs which have already been incurred and which are non-recoverable should not be taken into account while calculating cash outflows for a period. This is because no net cash flows are taking place on account of a particular decision (since they have already been incurred and cannot be recouped).

(iv) Calculation of cash flows should also take into account the opportunity cost even if no actual cash inflow or outflow takes place. For example, if we are using our own premises for a particular project, then possible rental should be taken as the cash outflow while making our calculations.

This is because in making our decision we are foregoing this income and this should be regarded as a cost.

(v) Another very important aspect of cash flow calculation is that cash flows on account of interest payments are not to be considered while making the calculation of cash flows.

This may look odd, because the interest payment is an actual outflow and ignoring it may appear to be incorrect. However, it must be understood that the discounting of cash flows for their time value automatically takes into account the interest cost of any investment.

Therefore, subtracting interest payment and then discounting it for time value will lead to double counting. Rate of interest is a compensation for time value of money and when we discount the cash flows for their time value, at the given rate of interest, there is no need to subtract interest payments separately.

(vi) Cash needs for working capital should be treated as a cash outflow at the time of commencement of a project and should be treated as inflows when that cash is released at the time of closure or termination of project. Increases or decreases of working capital should be treated as outflows and inflows respectively as and when they take place.

Capital Budgeting Decisions – Conditions Affecting Capital Budgeting (With Determination of Cash Flows)

Certain conditions affecting capital budgeting:

The consideration of the formal process of capital budgeting analysis by examining it under conditions of certainty is the theme of this section. By certainty we mean that the forecast of future cash flows a project may create is known with 100 percent accuracy. No element of risk need be considered when examining the capital budgeting process under conditions of certainty.

The general goal in evaluating investment proposals is to judge them on the basis of the return they will yield and compare that to what investors might demand in terms of a return. The measure of return on the project should be equal to or greater than what the investors require. The measure of the rate of return is the key to determining the effect of the investment of the market price of the common stock.

This is of vital importance, since we have defined as the primary goal of the firm the maximization of the value of the firm. This is achieved through the maximization of the wealth of the shareholders, and this is reflected in the price of the common stock.

Firstly, we examine the process involved in gathering the relevant data necessary to evaluate the profitability of one project versus another. This includes the definition of cash flows and an illustration of how a determination of future cash flow estimates is arrived at.

When we estimate the benefits to be received from a project, we are interested in the cash flows the project will generate rather than an estimate of future net income.

This is because cash in essence is critical to all decisions of the firm. The firm is committing cash now in the form of an investment in the hopes of receiving cash in the future that will be in excess of that investment.

In the final analysis, it is cash and only cash that can be reinvested in the firm or distributed to the shareholders in the form of dividends. This is why, in the capital budgeting process, we are interested in cash flows rather than net income.

Later we shall examine some different methods for ranking investment alternatives and then consider which ranking technique is the best to use for capital budgeting analysis.

Determination of Cash Flows:

One of the primary tasks in the evaluation of investment alternatives is the determination of the net cash flow stream. This task must be accomplished for all investment proposals under consideration. This determination is very important, because the profitability analysis of alternatives depends on the accuracy of the net cash flow information.

Prospective investments which compete with one another in terms of the functions they perform are classified as mutually exclusive; if you accept one you must automatically reject the other. Investments which do not compete in terms of their function are classified as non-mutually exclusive investments.

When the cash flows generated from one project are contingent upon other projects, these investments are classified as contingent cash flow streams. If the cash flows of a project do not depend upon any other project, they are termed independent.

Capital Budgeting Decisions – Ranking of Capital Budgeting Proposals: Mutually Exclusive Investment and Contingent Projects

A firm should select its own projects after considering the merits and demerits of each one of them. For this purpose, it should rank the proposals.

Proposals are ranked on the basis of the following considerations:

1. Mutually Exclusive Investment:

Where it is technically impossible to undertake the first, when the second has been accepted, then the two investments are mutually exclusive. These projects do not depend upon each other. In other words, one can be rejected and the other can be accepted. It is easier for a firm to take capital budgeting decisions in such projects.

2. Contingent Projects:

In this case, the utility of one proposal is mutually exclusive. In other words, with the acceptance of one project, a few other incidental projects have to be accepted. A project may be described here as the main project, which may be considered along with a bunch of other incidental projects.

An investment proposal is said to be economically independent, if the cash flows or benefits expected from it would be the same regardless of whether any other investment is accepted or rejected.

An investment is economically dependent if a decision to undertake an investment increases or decreases the benefits from another. In the first case, the second investment is the complement of the first. In the second case, it is a substitute for the first.

Some investments may be economically independent but statistically dependent. The statistical dependence affects the risk of the two investments.

Capital Budgeting Decisions – Advantages and Limitations of Discounted Cash Flow Methods

Advantages of Discounted Cash Flow Methods:

The phrase ‘discounted cash flow’ has evoked considerable discussion in regular commercial enterprises as well as in those which undertake development projects.

The World Bank and other financial institutions use the DCF method extensively while measuring the economic success of new development ventures in order to arrive at sound capital expenditure decisions. A sound evaluation under this method greatly depends on price stability.

Moreover, the DCF method is more suitable for long-term planning. In situations in which a strict credit squeeze and other restrictions on credit prevail, entrepreneurs may not opt for a long-range plan and may prefer the convention payback principle to pay off the original investment within the shortest possible time.

The DCF approach produces investment decisions which best serve the interest of shareholders. The DCF criterion encourages managers to take a long-range view, for it takes into account benefits over many future periods.

Discounting methods make precise allowances for the distance (from the present) of receipts and payments and the notion of the discounting is common to most methods of investments appraisal.

Because the discounted cash flow method explicitly and automatically weighs the time value of money, it is the best method to use for long-range decisions.

Given that there will always be some uncertainty in investment decisions, the greatest contribution to investment appraisal made by the discounted cash flow technique is to provide the frame-work for measuring the degree of uncertainty, thereby reducing it to a quantifiable factor for making an investment decision.

Limitation of Discounted Cash Flow Methods:

It is a neat, mathematical exercise but suffers from some drawbacks. What follows are factors which need to be considered when an assessment of that likely return which a project will achieve is calculated.

In this connection, B.H. Walley says, “Some are obviously trite, others are of considerable significance. Together they form a total criticism which shows that the DCF by itself is a highly suspect method of evaluating competitive projects”.

The DCF approaches do not consider the impact of an investment on accounting profits. The investment may generate a low, or even a negative, net cash flow in early years, but produce high cash flows in subsequent years. In such cases, the accounting profits of a firm are adversely affected.

The discounted present value notion, though exact in concept, is often fuzzy in use. From an accounting point of view, it may be necessary to use procedures which are exact in use, but fuzzy in concept.

Possibly the greatest criticism of the current application of the DCF is that little or no discrimination is usually made between the risk of the projects. There is a universal application of a standard required rate of return, no matter what the project, what part of the company it is required for, or how well or badly it is likely to be managed.

The sophisticated DCF techniques can very well be applied in a country where there is a relative price stability. Long-term financial planning is not quite feasible in India, primarily because of high inflation.

A firm’s competitive position (besides some other factors) is a non-financial factor which is given much consideration in making decisions on capital expenditure proposals in India. Community relations and shareholder relations are practically given no (or very low) weightage. Under the present conditions, the traditional techniques (with modifications) are very effective in developing economies.

An effective DCF analysis calls for much more than arithmetic calculations, important as these are. As we have seen, the critical task of choosing a proper discount rate involves top management policy as to the financial and growth objectives of the whole company.

Before arriving at a realistic estimate of future cash flows, many functional departments of the company have to combine their specialised analysis into a consistent prediction, with an allowance for the risk element.

Although the idea of discounting the income stream of an investment is centuries old, non- discounting methods of investment appraisal are still employed today. That the use of these methods should have persisted as long as it has utility in some business circles is perplexing, but it is presumably accounted for by a reluctance to change and this survival, or even a good living, is possible with poor decisions, if the quality of competition is low enough.

Many writers attribute the relatively slow acceptance of DCF to a lack of understanding or a feeling of futility about projecting cash flows more than a few years into the future, or to a preference for payback benchmarks on the part of risk-conscious decision-makers with strong liquidity preferences.

The familiar present value approach to capital budgeting requires that the project which lowers the present value of a company should not be adopted at all.

The imposition of an earning growth constraint changes the approach to capital budgeting in two important ways:

(a) It makes income flows as well as cash flows relevant to the investment decision. It, therefore, results in a portfolio of accepted projects which have a lower present value that the unconstrained method allows,

(b) More importantly, it raises a policy question of what planning horizon a corporation should use in preparing its capital budget.

Much has been written about the use of the discounted cash flows (DCF) as a tool for investment appraisal and project ranking. Little can be added to the theoretical framework at present.

But there is still a considerable misunderstanding about how to apply the DCF. The difficulties most often encountered relate to the consequences of the decision to use the DCF; and all too often, these consequences are not fully understood and are under-estimated. This is especially true when the cash flow is complex-that is when a great many variables are involved.

Issues Pertaining to Cross-Border Investments and their Implications in Capital Budgeting Decisions – Parent vs. Project Cash Flows, Tax Issue, Exchange Control, Tax Holidays, Lost Exports and More…

We shall now discuss important issues pertaining to cross-border investments and their implications in capital budgeting decisions:

Issue # 1. Parent vs. Project Cash Flows:

The first specific issue that arises in respect of the overseas project is which cash flows should be considered for evaluating the project-cash flows available to the project or cash flows accruing to the parent company or both.

Evaluation of an overseas project on the basis of project’s own cash flows provides insight into its competitive status vis-a-vis domestic or regional firms. The project is expected to earn a risk adjusted rate of return higher than that on its locally based competitors otherwise the MNC should invest money in the equity of local firms.

This approach has the advantage of avoiding currency conversions, thus eliminating the margin of error involved in forecasting exchange rates over the life cycle of the project. Such an approach is appreciated by local manager, local joint venture partners and host governments.

However, the parent MNC is generally keen to evaluate a foreign project from the view point of net cash flows available to it because it decides the level of earnings per share and dividends distributed to the stockholders.

It is these funds that actually make it possible to pay dividends to the shareholders and make interest and principal payments to the lenders. Further, project evaluation from the parent’s viewpoint furnishes the basis for raising funds from the market to finance overseas operations.

Now the question arises which one of the above would be useful for making international investment decisions. It must be noted that in international capital budgeting, a significant difference usually exists between the cash flows of a project and the amount that is remittable to the parent. The reasons are tax regulations and exchange controls.

Further, project expenses such as management fees and royalties are earnings to the parent company. Furthermore, the incremental revenue available to the parent MNC from the project may vary from total project revenues particularly when the project involves substituting local production for parent company exports or if transfer price adjustments shifts profits elsewhere in the system.

According to Corporate Finance theory, value of a project is determined by the present value of future cash flows that are available to the investor. Thus, the parent multinational should value only those cash flows that are repatriated net of any transfer costs because only these remaining funds can be used to pay interest at home and corporate dividends, for an amortization of the firm’s debt, and for re-investment.

A three-stage analysis has been recommended for overseas project evaluation. In the first stage, project cash flows might be computed from the overseas subsidiary’s standpoint, exactly as if the subsidiary were a separate national corporation. Focus in the second stage shifts to the parent.

Here the analysis requires specific forecasts concerning the amounts, timing of distributable cash flows and form of transfers to headquarters, as well as information about what taxes and other expenses will be incurred in the process of transfer.

It should be noted here that it is incremental distributable parents cash flows which are relevant from the standpoint of the multinational firm in the third and final stage. The MNC must consider the indirect benefits and costs that this investment confers on the rest of the system, such as an increase or decrease in export sales by another affiliate.

According to several surveys, MNCs tend to evaluate overseas projects from both the parent and projects’ viewpoints. Undoubtedly, the MNC must prognosticate a project’s true profitability which involves determining the marginal revenue and marginal cost associated with the project.

Incremental cash flows to the parent can be ascertained only by subtracting worldwide parent company cash flows without the investment from post investment parent company cash flows.

While making these estimates following adjustments have to be made:

a. Adjust for the effects of Transfer pricing and fees and royalties by –

(i) Using market costs/prices for goods, services and capital transformed internally;

(ii) Adding back fees and royalties to project cash flows;

(iii) Removing the fixed portions of such costs as corporate overhead.

b. Adjust for global costs/benefits that are not reflected in the project’s financial statements. These costs/benefits include –

(i) Cannibalization of sales of other units;

(ii) Creation of incremental sales of other units;

(iii) Additional taxes owed when repatriating profits;

(iv) Foreign tax credits usable elsewhere;

(v) Diversification of production facilities;

(vi) Market diversification;

(vii) Provision of a key link in a global service network;

(viii) Knowledge of competitors, technology, markets, products.

Issue # 2. Tax Issue:

In capital budgeting only after-tax cash flows are relevant. This is true both for domestic and overseas projects. The tax issue for multinational capital budgeting purposes is complicated by the existence of host country and home country taxes as well as a number of factors.

Thus, earnings on foreign projects first of all fall in host country tax net. Then on distribution, it is subjected to withholding tax and finally, in the home country the earnings are further taxed.

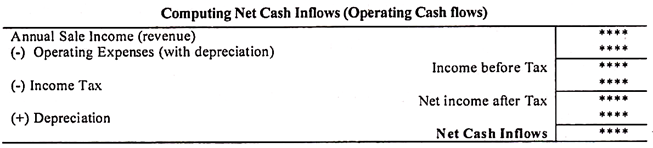

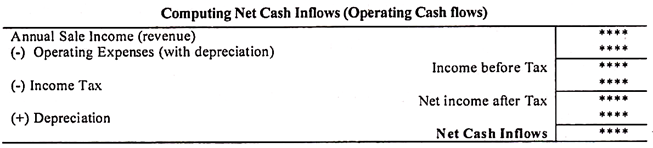

Assume that an MNC with a proposed project in one overseas territory expects to earn pre-tax the foreign currency profit equal to $2 million with an overseas tax rate of 15 per cent, a withholding tax of 10 per cent and a home corporate tax rate of 33 per cent. After tax net cash inflows will be, as given in Table 48.1.

In case the parent firm decides to re-invest the entire post-foreign tax earnings of $17,00,000 in the host country, it is not required to pay withholding tax nor home tax.

In case the firm decides to pay out the earnings to an intermediate holding company, which are then to be onward re-routed for reinvestment elsewhere in the worldwide operations of the multinational, the amount available for reinvestment would be $15,30,000 (the amount left after payment of foreign and withholding taxes but before payment of home country tax). Thus, the management will accept the project proposal so long as the return is positive in parent terms under the harshest tax scenario.

Issue # 3. Exchange Control:

Exchange control restricting the repatriation of earnings to the parent country is another reason that causes discrepancy between the project value from the parent’s perspective and from the local perspective.

When an MNC is contemplating investment in a country having exchange control the present value calculation from the parent’s point of view will be based on the following facts:

a. The Pattern of financing investment by MNC — Debt or equity or both. In case of investment to be funded via debt, cash generated by the project is returned to the home country to the extent of debt repayment and interest. However, this will not be possible in case of equity funded investment.

b. Remittances of Net Cash flows expected to be generated by the foreign projects. Not all remittances under exchange restrictions are permissible. Hence, forecasts of the proportion of the cash flows, which can be remitted to the parent company, will have to be made.

c. Remittances expected to be back to the parent company by way of parent’s debt service — Debt capital plus interest and management fees and royalties, of course, are subject to ceilings by exchange control regulations.

d. Allowances for parent contribution of equipment as part of its input.

e. Any real operating option effects.

f. In case cash earnings expected to be generated by the foreign project are permanently blocked with no way out to get back the money to the parent, the value of such blocked funds must be zero. But in real life this does not happen because countertrade and similar other techniques present ways of unblocking.

Further, there is usually some expectation of existing controls being relaxed or removed altogether. A profitability factor may be applied to model such expectations.

g. An allowance for any terminal value. This terminal value, calculated in overseas currency terms, will be converted back to home currency values at estimated on going exchange rate of the terminal value date.

So as to attract foreign investments in key strategies, the governments of developing economies generally provide financial support at subsidized rates. Likewise, international agencies entrusted with the responsibility of promoting cross- border trade sometimes offer financing at below market rates.

Thus, in the case of subsidized financing, the MNC pays rather than receives the below rate. The value of the subsidized loan should be added to that of the project while making the investment decision if the subsidized financing is inseparable from the project.

But if subsidized financing is separable from a project, the additional value from the subsidized financing should not be allocated to the project. In such a case, the manager’s decision is that so long as the subsidized loan is unconditional, it should be accepted. If the MNC can use the proceeds of subsidized financing at a higher rate in a comparable risk investment, it will lead to positive NPV to the firm.

Issue # 4. Tax Holidays:

More often than not, developing countries’ governments offer tax holidays to encourage foreign direct investment in their economies. Other tax holidays in the form of a reduced tax rate for a period of time on corporate income from a project are negotiable knowing how much the tax holiday is worth valuable when the firm negotiates the environment of the project with the host government.

A tax holiday in the project’s early years is not worth much. In fact, if the project expects to suffer losses in the first few years which can be carried forward, the tax holiday robs the firms of a valuable tax – loss carry forward.

In such a scenario, an MNC would prefer to be subsidized to a high tax rate during the early loss- making (and tax-credit creating) years of a project. The management should, therefore, compute project value both with and without the tax holiday to uncover such types of situations.

Issue # 5. Lost Exports:

Another issue relating to direct foreign investment decisions is the issue of lost exports arising out of engaging in undertaking projects abroad. Profits from lost exports represent a reduction from the cash flows generated by foreign projects for each year of its duration.

This downward adjustment in cash flows may be total, partial or nil depending upon whether the project will replace a projected export or none of them.

Issue # 6. International Diversification Benefits:

Dispersal of investment in a number of countries is likely to produce diversification benefits to the parent company’s shareholders. However, it would be difficult to quantify such benefits as can be allocated to a particular project.

Generally, such non-quantifiable variables are ignored in capital budgeting decisions. However, in case of a marginal project or a project which is not acceptable on its merits, this factor may be taken care of.

Sometimes, a marginal project may be found worthwhile when its beneficial diversification effect on the overall pattern of cash flow generation by the MNC is taken into consideration.

Issue # 7. Risk Analysis in International Investment Decision:

MNCs have to face a host of additional risks while investing in foreign countries. These risks may be political and economic. Political risk is the possibility that political events in a host country or political relationships with a host country will affect the value of corporate assets in the host country. The most extreme form of political risk is the risk expropriation in which a host government seizes local assets of an MNC.

Besides, MNCs’ foreign investments are subject to risks arising out of exchange rate fluctuations and inflation. While a firm knows that the exchange rate will typically change overtime, it does not know whether the foreign currency will strengthen or weaken in the future and how the cash flows will be affected.

Further, there has been a tendency for rising, variable cost per unit and product prices have been going up overtime. However, inflation can be quite volatile from year to year in some countries and can, therefore, strongly influence a project’s net cash flows.

Inaccurate inflation forecasts could lead to inaccurate net cash flow forecasts. So MNCs, while contemplating investing overseas, must assess the consequences of various political risks for the viability of political investment.

Three main methods are used for incorporating additional political and economic risks such as the risks of currency fluctuations and expropriation into foreign investment analysis.

These are –

(i) Shortening the minimum pay-back period;

(ii) Raising the required IRR;

(iii) Adjusting cash flows to reflect the specific impact of a given risk.

Issue # 8. Adjusting the Discount Rate or Payback Period:

The additional risk exposure to overseas investment is expressed usually in general terms rather than in terms of their effect on specific projects. This vague view of risk probably explains the use of two unsystematic approaches to account for additional foreign investment risks.

One is to employ a higher discount rate for overseas business and the other one is to use a shorter period of payback. For example, if there is likelihood of embargo on remittances, a normal required rate of 12% might be raised to 16% or a 4-year payback period might be shortened to 3 years.

However, these methods fail to assess precisely the actual impact of a particular risk on cash flows. Comprehensive risk analysis calls for an evaluation of the magnitude and timing of risks and their implications for the projected cash flows. There does not seem to be logic in using a uniformly higher discount rate to cash flows from the proposed project to incorporate risk of likely embargo on remittances 4 years hence.

Further, the choice of a risk premium is an arbitrary one. Further, these methods do not consider the favourable currency movements due to procurement of project inputs from different sources.

This is why an alternative method of adjusting the annual cash flows taking into consideration the impact of a specific risk on the future returns from an investment, has to be employed.

Issue # 9. Adjusting the Annual Cash Flows:

There are two techniques employed to adjust the annual cash flows, keeping into consideration the risk factor for each year.

In the first method, adjustment for uncertainty involves reducing each year’s cash flows by an amount equivalent to a risk or an insurance premium, even if such arrangement is not actually made by management.

For example, if an MNC insures with an insurance company to hedge risk due to occurrence of a political event, the premium paid by the firm will be deducted from cash flows.

However, uncertainty absorption principle suffers from certain fundamental weaknesses. First, risk insurance covers only a fixed proportion of the book value of the firm in the case of expropriation the economic value of expropriated assets normally exceeds the book value.

Secondly, there are a number of political decisions such as import restrictions, higher tariff rates on the imports and/or exports to neighbouring markets, as well as variety of measures designed create problems of the MNC’s subsidiary, which do impact the operation and profitability of the subsidiary business, for which no insurance coverage is available.

In the second method, probability and certainty equivalents techniques can be employed to adjust political risk. The MNC generally employs a statistical technique called the “Decision Tree” analysis to estimate the probability of expropriation.

Thus, a forecast of point of time of occurrence of expropriation is made. With the help of this technique the MNC finds an NPY for the foreign project based on cash flows adjusted for the probability of expropriation for the particular year.

The above techniques can be used for adjusting foreign exchange rate risk. For instance, probability analysis can be employed to estimate the exchange rate (of the host versus parent currency) for each time period.

The firm is required to construct several exchange rate scenarios over the project’s life-cycle. Projected cash flows for each year would then be converted into home currency for each of these years. Finally, cash flows for each of these years would be converted into equivalent cash flows by applying the assigned probability for each of the scenarios.However, this approach has certain inbuilt weaknesses. For instance, this approach does not consider the range of possible outcomes which the management may also be interested. Furthermore, it is doubtful if calculation of the expected values of alternative scenarios would be superior to one based on purchasing power parity assumption or any other forecasting technique.

I. M. Pandey defines capital budgeting decision as, “the firm’s decision to invest its current funds most efficiently in the long term assets, in anticipation of an expected flow of benefits over a series of years”.

Capital budgeting decisions may either be in the form of increased revenues, or reduction in costs. Capital expenditure decisions therefore include, addition, disposition, modification and replacement of fixed assets.

In other words, the system of capital budgeting is employed to evaluate expenditure decisions, which involve current outlays, but are likely to produce benefits over a period of time, longer than one year.

Contents.

- Meaning of Capital Budgeting Decisions

- Concept Of Capital Budgeting Decisions

- Characteristics of Capital Budgeting Decisions

- Features of Capital Budgeting Decisions

- Importance of Capital Investment Decisions

- Kinds of Capital Budgeting Decisions

- Different Types of Capital Budgeting Decisions

- Classification of Capital Budgeting Decisions

- Steps Which Help Financial Manager to Increase the Value of the Firm

- Risk Analysis in Capital Budgeting Decisions

- Cost and Benefits of Project

- Estimation of Cost and Benefits of a Proposal

- Principles of Cash Flows Estimation

- How Certain Conditions Affect Capital Budgeting?

- Ranking of Capital Budgeting Proposals

- Advantages and Limitations of Discounted Cash Flow Methods

- Issues Pertaining to Cross-Border Investments and their Implications in Capital Budgeting Decisions

Capital Budgeting Decisions: Meaning, Concept, Features, Types, Steps, Risk Analysis, Advantages and Limitations of Discounted Cash Flow Methods and More…

Capital Budgeting Decisions – Meaning

Financial management focuses not only on the procurement of funds, but also on their efficient use, with the objective of maximising the owner’s wealth. The efficient allocation of funds is an important function of financial management.

It involves the decision to allocate and invest funds, to assets and activities. Thus, it is known as an investment decision, because it is making a choice, regarding the assets in which funds will be invested.

These assets fall into two categories:

(a) Short term or current assets, and

(b) Long term or fixed assets.

Thus there are two types of investment decisions. The first type is also known as management of current assets, or working capital management. The second type of decision is known as long term investment decision, or capital budgeting, or the capital expenditure decision.

I. M. Pandey defines capital budgeting decision as, “the firm’s decision to invest its current funds most efficiently in the long term assets, in anticipation of an expected flow of benefits over a series of years”.

In other words, the system of capital budgeting is employed to evaluate expenditure decisions, which involve current outlays, but are likely to produce benefits over a period of time, longer than one year.

Capital budgeting decisions may either be in the form of increased revenues, or reduction in costs. Capital expenditure decisions therefore include, addition, disposition, modification and replacement of fixed assets.

For Example:

(a) Dis-investment of a division of business.

(b) Change in the method of sales distribution.

(c) Changing the advertising campaign.

(d) Major investment in the research and development program.

(e) Labour welfare projects.

(f) Diversification projects.

(g) New projects-For example- installation of pollution control equipment as per the legal requirements, etc.

Capital Budgeting Decisions – Concept

Concept of Capital Budgeting Decisions as follows:

Successful operation of any business depends upon the investment of resources in such a way as to bring in benefits or best possible returns from any investment. An investment can be simply defined as expenditure in cash or its equivalent during one or more time periods in anticipation of enjoying a net inflow of cash or its equivalent in some future time period or periods.

An appraisal of investment proposals is necessary to ensure that the investment of resources will bring in desired benefits in future. If the financial resources were in abundance, it would be possible to accept several investment proposals which satisfy the norms of approval or acceptability.

Since resources are limited, a choice has to be made among the various investment proposals by evaluating their comparative merit.

Capital Budgeting is defined as the firm’s decision to invest its current funds most efficiently in long-term activities in anticipation of an expected flow of future benefits over a series of years. It should be remembered that the investment proposal is common both for fixed assets and current assets.

Capital Budgeting is employed to evaluate expenditure decisions which involve current outlay but are likely to produce benefits over a period of time longer than 1 year. These benefits may be either in the form of increased revenues or reduced costs.

Van Home has defined capital budgeting as – “The process of identifying, analysing and selecting investment projects whose return (cash flows) are expected to extend beyond one year.”

As per Robert N. Anthony, “Capital Budget is essentially a list of what management believes to be worthwhile projects for the acquisition of new capital assets with the estimated cost of each product”.

Hence, Capital Budgeting may be defined as the decision making process by which firms evaluate the purchase of major fixed assets, including buildings, machinery, and equipment or investment in any project or extension of existing capacity, etc.

The firm’s Capital Budgeting Decisions will include addition, disposition, modification and replacement of fixed assets.

Main Characteristics of Capital Budgeting Decisions

The main characteristics of capital budgeting decisions may be summarized as under:

(а) It involves huge outflow of funds or capital.

(b) There is a time gap between the investment of funds and’ anticipated or future benefits.

(c) Involves a high degree of risk as the decisions have a long term effect on the profitability of a company.

(d) Most of the capital budgeting decisions are of irreversible nature i.e., once the firm has initiated the investment, it cannot revert back otherwise it has to incur heavy losses.

(e) It helps an enterprise from making over investment and under investment relative to its size of business.

Because of aforesaid features of the capital budgeting decisions, they constitute most important decisions in corporate management and are exercised with great caution. Any decision taken under capital budgeting has long term effect on the functioning and profitability of the company.

If the decision taken goes in the right direction, it will have positive impact on the profitability of the company and if it goes in the wrong direction it will have negative impact on the profitability of the company. Reversing the decisions already initiated leads to unnecessary heavy loss to the company.

Capital Budgeting Decisions – Features

The features of capital budgeting decisions are as follows:

(1) In anticipation of future profits, investment is made in present times.

(2) Investment of funds is made in long-term assets.

(3) Future profits accrue to the firm over several years.

(4) These decisions are more risky.

Here, it is worth noting that capital expenditure decisions affect wealth of the firm. If investment proposals are beneficial, they increase the wealth of the firm. As a result of investment decisions, value of the firm is affected.

Some of the other features of capital decision are as follows:

Capital budgeting decision has three basic features:

1. Decision regarding the investment for more than one year.

2. Anticipated benefits of the project will be received in future dates.

3. Require a large amount of funds for investment with a relatively high degree of risk.

Capital Budgeting Decisions – Importance of Capital Investment Decisions

Importance of Capital Investment Decisions are as follows:

Capital investment involves a cash outflow in the immediate future in anticipation of returns at a future date. The capital investment decisions assume vital significance in view of their marked bearing on corporate profitability needs no emphasis. The investment proposals need to be related to the underlying corporate objectives and strategies.

A key challenge for all organizations is to identify projects which fit these strategies and promise to be profitable in the broadest sense i.e., to create wealth for the organization. Capital investment decisions usually involve large sums of money, have long time-spans and carry some degree of risk and uncertainty.

A capital investment decision involves a largely irreversible commitment of resources that is generally subject to significant degree of risk. Such decisions have a far-reaching efforts on an enterprise’s profitability and flexibility over the long-term. Acceptance of non-viable proposals acts as a drag on the resources of an enterprise and may eventually lead to bankruptcy.

For making a rational decision regarding the capital investment proposals at hand, the decision-maker needs some techniques to convert the cash outflows and cash inflows of a project into meaningful yardsticks which can measure the economic worthiness of projects.

Realistic investment appraisal requires the financial evaluation of many factors, such as the choice of size, type, location and timing of investments, taxation, opportunity cost of funds available and alternative forms of financing the outlays.

This shows that capital investment decisions are difficult on account of their complexity and their strategic significance. The planning and control of capital expenditure is termed as ‘capital budgeting’. Capital budgeting is the art of finding assets that are worth more than they cost, to achieve a predetermined goal i.e., optimizing the wealth of a business enterprise.

Kinds of Capital Budgeting Decisions – Accept Reject Decisions, Mutually Exclusive Decisions and Capital Rationing Decisions

Kind # 1. Accept Reject Decisions

This type of decision is basic to capital budgeting. If the proposed project is accepted by the top management the company proceeds with the investment of funds there in. Alternatively if the project is rejected the company does not make any investment. All those proposals which yield a rate of return or greater than the cost of capital are accepted and the rest are rejected.

Kind # 2. Mutually Exclusive Decisions

It includes all those projects which compete with each other in a way that acceptance of one precludes the acceptance of other or others. Thus some technique has to be used for selecting the best among all and eliminates the other alternatives.

Kind # 3. Capital Rationing Decisions

Capital budgeting decision is a simple process in those firms where funds is not the constraint but in majority of the cases firms have the fixed capital budget. So large number of projects compete for these limited budget.

So firms ratio them in a manner as to maximize the long run returns situation where in the firm which have more acceptable investments requiring greater amount of finance than is available with the firm. It is concerned with the selection of a group of investment out of many investment proposal ranked in the decision order of the rate of return.

Different Types of Capital Budgeting Decisions (With Examples From Indian Market)

Following are few different types of capital budgeting decisions with practical recent examples from Indian market:

1. Expansion of existing business (Bharti Airtel acquiring African Assets of Zain telecom to expand its business in South Africa)

2. Expansion of new business (Reliance entering into retail segment)

3. Replacement and Modernization (Amul replacing its delivery vans)

4. Research and development decisions (GlaxoSmithKline spending on research for HIV medicines)

5. Make or Buy Decisions (Maruti contemplating whether to buy the spare parts from outside or manufacture it in house).

Top 3 Types of Capital Budgeting Decisions

Basically, there are three types of capital budgeting decisions, usually taken by the business or corporate organizations.

Such decisions are:

1. Accept-Reject Decisions of Independent Projects:

This is a fundamental decision in capital budgeting. If the project is accepted, the firm invests in it, if the proposal is rejected, the firm does not invest in it. All those proposal which yield as rate of return greater than a minimum rate of return or cost of capital are accepted and if the rate of return lesser than a minimum rate of return or cost of capital the projects are rejected. According to this criterion, only the independent projects are selected because those projects do not compete with one another.

In the case of mutually exclusive projects the project which has lower PBP, higher ARR, higher or positive NPV, higher PJ and higher IRR criterion rules are applicable while accepting the project for investment or for other decisions mentioned above.

2. Decisions on Mutually Exclusive Investment Projects:

Mutually exclusive projects are those projects, which compete with other projects, in such a way that the acceptance of one will exclude the acceptance of the other projects. That means, in the case of these proposals only one or some of the proposals can be accepted and the other projects have to be rejected.

The alternative are mutually exclusive and only one may be chosen. In the case of these proposals, only the most profitable proposal will be accepted. The acceptance of the best alternatives automatically eliminates the other alternatives.

3. Capital Rationing Decisions:

If the firm has unlimited funds capital budgeting decision is a simple process. But in case of limited funds, the firm must therefore ration them. Capital rationing is a situation in which due to financial constraints the limited funds are allocated as a number of mutually exclusive capital budget projects.

Steps Which will Help the Financial Manager to Increase the Value of Firm Through Capital Budgeting Decisions

Following steps will help the financial manager to increase the value of the firm through capital budgeting decisions:

1. Evaluation of different projects by appraising them technically and otherwise.

2. Correct estimation of cash outflow and inflows of the projects.

3. Consideration of time value of money in estimation of cash outflows and inflows of the project.

4. Correct measurement and incorporation of risk and uncertainty while appraising capital investment decisions.

5. Selection of suitable evaluation method which will increase the value of the firm.

6. Finally, selection of the project out of the various alternatives and commitment of funds to it.

7. Implementation of the project, its continuous performance evaluation and taking remedial actions wherever necessary so that objectives underlying the project can be achieved.

Risk Analysis in Capital Budgeting Decisions – Methods: Risk Adjusted Discount Rate Method, Certainty-Equivalent Method, Sensitivity Analysis, Probability Assignment and More…

Risk Analysis in Capital Budgeting Decisions:

So far our analysis of investment decisions has been based on conditions of certainty regarding the future and the proposed investment does not carry any risk. The assumptions of certainty and no risk were made simply to facilitate the understanding of capital investment decisions.

But in practice, all investment decisions are undertaken under conditions of risk and uncertainty. Since investment decisions involve projecting the future cash inflows and outflows, uncertainty inevitably creeps in.

Neither rupee amounts nor the dates of cash flows can be known with precision. The amount and timing of the long term future cash flows could vary significantly from those predicted.

It is therefore essential to consider risk factors at the time of determining cash flows from a project for the purpose of capital budgeting decisions. However, incorporation of risk factors in capital budgeting decisions is a difficult task.

Some of the popular methods used for this purpose are as follows:

1. Risk adjusted discount rate method

2. Certainty – equivalent method

3. Sensitivity analysis

4. Probability assignment

5. Standard deviation and coefficient of variation.

6. Decision tree analysis.

These methods are discussed one by one in detail:

Method # 1. Risk Adjusted Discount Rate Method:

This method is also known as a varying discount rate method. It is based on the presumption that investors expect a higher rate of return on risky projects as compared to less risky projects.

The rate requires determination of

(a) risk free rate and

(b) risk premium rate.

Risk free rate is the rate at which the future cash inflows should be discounted had there been no risk. Risk premium rate is the extra return expected by the investors over the normal rate (i.e., the risk free rate), on account of the project being risky.

Thus Risk adjusted discount rate is a composite discount rate that takes into account both the time and risk factors. A higher discount rate will be applied for projects which are considered more risky, conversely, a lower discount rate is applied for less risky projects.

Method # 2. Certainty-Equivalent Method:

Under this method, the risk element is compensated by adjusting cash inflows rather than adjusting the discount rate. Expected cash flows are converted into certain cash flows by applying certainty-equivalent coefficients, depending upon the degree of risk inherent in cash flows.

To the cash flows having higher degree of certainty, higher certainty – equivalent coefficient is applied and for cash flows having low- degree of certainty, lower certainty equivalent coefficient is used. For evaluation of various projects, cash flows so adjusted are discounted by a risk free rate.

Method # 3. Sensitivity Analysis:

In the methods discussed above, only one figure of cash flow for each year is considered. However, there are chances of making estimation errors. The sensitivity analysis approach takes care of this aspect by giving more than one estimate of the future cash flow of a project.

It is thus superior to one figure forecast as it provides a more clear idea about the variability of the return. Generally, sensitivity analysis gives information about cash inflows under three assumptions i.e., ‘Optimistic’, ‘Most likely’ and ” Pessimistic” outcomes associated with the project.

It explains how sensitive the cash flows are under these three situations. Further cash inflows under these three situations are discounted to determine net present values. The larger the difference between the pessimistic and optimistic cash flows, the more risky is the project and vice versa.

Method # 4. Probability Assignment:

Although sensitivity analysis approach provides different cash flow estimates under three

assumptions, it does not provide chances of occurrence of each of these estimates. The chances of occurrence can be ascertained by assigning appropriate probabilities to each of these estimates.