In this article we will discuss about the importance of time element in the theory of value.

The price of a commodity is determined under perfect competition by its demand-supply. But, demand and supply do not exercise the same degree of influence on the determination of the price of a commodity in all circumstances. In order to explain the relative role of demand and supply in price determination Alfred Marshall has stressed the role of time in the theory of value.

He has mentioned the four different time periods and has shown the relative influence of demand and supply in each of these periods:

1. The Very Short Period or Momentary Equilibrium:

ADVERTISEMENTS:

In the very short-period market, the supply of a commodity remains absolutely fixed, i.e., the supply curve becomes a vertical straight line. In such a period demand or marginal utility is more active than supply in determining the price of a commodity. As the supply remains absolutely fixed (e.g., the supply of fish or of vegetables, etc., in a local market), the prices rise or fall with the rise or fall in the demand.

When the demand increases, the new demand curve will cut the vertically straight line supply curve at a higher period and the new equilibrium will be attained at a higher price. The opposite happens when the demand falls in the very short-period market. The equilibrium in such a period is called momentary equilibrium, and the price prevailing in such a market is called the market price.

2. The Short-Period Equilibrium:

In the short period, a firm does not get sufficient time to alter its fixed equipment and plant size. In such a market, the supply can be partly adjusted to the change in demand. The price will rise when demand is higher, but the rise will not be of such an extent as is observed in the very short-period. Such a price is called the short-run normal price.

ADVERTISEMENTS:

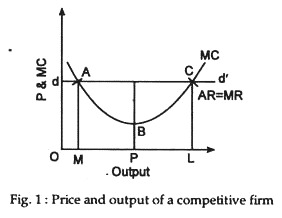

Supply or cost of production has some influence over the short-run normal price in a perfectly competitive market. It is found that a competitive firm produces a commodity up to that level at which P=MC (rising). As in the short run, neither the free entry of new firms nor the free exit of the old firm is possible, the short-run competitive price may be greater than equal to, or less than ATC provided it is greater than, or equal to AVC.

It means that the short-run competitive price must cover the full amount of variable cost and at least a portion of the fixed cost. Or, alternatively the average variable cost sets the louver limit below which the short-run price must not fall (the shut-down point).

3. The Long-Period Equilibrium:

The long run is a period which is long enough to bring about a change in the existing scale of operations and equipment. Now, supply can be fully adjusted to changes in demand. The equilibrium price in the long rim is called the long-run normal price. The supply or cost of production is more important than the demand or marginal utility in the determination of the long-run normal price.

ADVERTISEMENTS:

Moreover, in the long run, a competitive firm produces an output up to that level at which P=MC. But, due to free entry of new firms and free exit of the existing firms, the long-run competitive price cannot be greater or less than the average cost. It should be exactly equal to average cost. So, the long-run competitive price is equal to both marginal and average costs.

4. The Very Long-Period Equilibrium:

The very long-period is one in which increased or decreased demand for capital equipment leads to changes in their supply. In such a situation the supply of a commodity can be fully adjusted to demand, and the supply or cost of production is more important than the demand in the determination of price. During this period cost may fell due to technological progress or innovation.

Thus, in the final analysis, both demand and supply forces play a greater role in the price determination in different time periods. Which forces are stronger than the other depends on the length of time. Just like the pair of blades of a scissors, both demand blade and supply blade are necessary in market price determination.

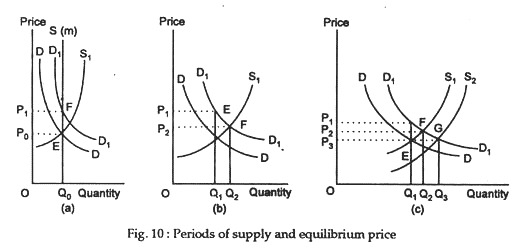

The above relationships are illustrated in Fig.1, which shows the effects of an increase in demand, in the momentary period, the short period, and the long period. S (m) is the momentary period supply curve and the original short-period supply curve.

In Fig. 10(a), we see the effect of an increase in demand in the momentary period. Supply is perfectly inelastic and price rises from OP0 to OP1 that is, by the full extent of the change in demand.

Fig. 10(b) shows the situation after sufficient time has elapsed for the industry to react to the increase in demand. The higher price has stimulated an increase in output and this is depicted by a movement along the existing short-period supply curve. Quantity supplied has increased and price has fallen from OP1 to OP2. This higher (short period) price, if sustained, will lead to changes in the productive capacity of the industry. Existing firms will be eager to expand and new firms will join the industry.

In Fig. 10(c) we see the effects of this increase in the scale of production. The new supply situation is shown by an entirely new short-term supply curve S2. The increase in supply has caused the price to fall from OP2 to OP3 because the quantity demanded has increased. The price OP3 may be higher or lower than the original price OP0, depending upon the extent to which the expansion of the industry has yielded economies of scale.

ADVERTISEMENTS:

Conclusion:

Thus, it can be said that the shorter the time period, the greater becomes the influence of demand and marginal utility and the longer the time period, the greater becomes the influence of supply and cost of production on value.