In this article we will discuss about the individual firm’s demand curve for labour when several variable inputs are used.

The MPT gives us an individual firm’s labour demand curve (under perfect competition) when only one variable input is used—this curve slopes downwards to the right. We shall now assume that the firm uses more than one variable input.

This assumption is more realistic than the single variable input assumption. Let us assume that the firm uses labour along with some other variable inputs. We have to derive the firm’s labour demand curve in these conditions.

Let us state, to begin with, that here a single MRPL = VMPL curve of the firm would not be its labour demand curve. This is because, in this multiple variable input case, a change in the price of labour causes a change in the quantities used of the other variable inputs, which, in its turn, would affect the MPL, and cause a shift in the MPL curve.

ADVERTISEMENTS:

A ceteris paribus change in W would have three effects upon the use of labour and upon the uses of the other variable inputs. These effects are known as the substitution effect (SE), the output effect (OE) and the profit maximising effect (PME).

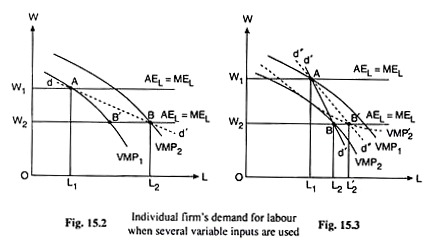

Let us suppose that in Fig. 15.2, initially the firm is in equilibrium at W = W1, at the point A on the VMP, curve, which is the point of intersection between its MRPL = VMPL (viz., VMP1) curve and the MEL curve.

At point A, the firm is buying L1 of labour at the wage rate W = W1, Let us suppose now that W falls from W1 to W2. As a consequence of this, the firm’s VMPL curve would shift rightwards from VMP1 to VMP2. We may explain this shift in the following way.

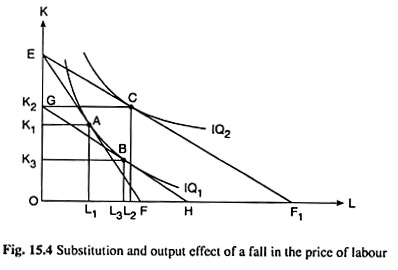

Let us refer to Fig. 15.4 where we have assumed that the firm uses only two variable inputs, labour and capital. Initially, with W = W1 and a given price of capital, the firm’s iso-cost line (ICL) is, say, EF and the firm is in equilibrium at the point A, where the ICL has touched one of its IQs, viz, IQ1. At the point A, the firm uses L1 of labour with of capital.

ADVERTISEMENTS:

Let us now suppose that W falls, the price of K remaining constant and the firm’s expenditure remaining unchanged. As a result, the firm’s ICL would rotate from EF to EF1—the ICL would now become flatter because the ratio of the prices of L and K has fallen. In Fig. 15.4, the firm’s equilibrium point would now move from the point A to the point C on a higher IQ1 viz., IQ2.

The firm now buys more of both the inputs and produces a higher level of output. This effect may be called the total effect (TE) of the fall in W. This TE can be broken up into a substitution effect (SE) and an output-effect (OE).

The Substitution Effect:

ADVERTISEMENTS:

The SE is the effect of a change in the relative prices of the inputs, the firm producing the same quantity of output. First, we have to obtain this effect (i.e., SE). With the fall in W, the price of K (rK) remaining constant, relative prices of the inputs have changed. If, now, the firm has to produce the same quantity of output, its expenditure would fall.

So, let us curtail its expenditure accordingly. As a result, its ICL would have a parallel leftward shift from EF1 to GH, the latter being a tangent to IQ1 at the point B.

In other words, if W falls from W1 to W2, rK remaining constant, causing a change in the relative prices and if the firm has to produce the same quantity of output as at A, then its equilibrium point would have to move from A to B along IQ1.

At the point B, the firm would use more of labour, viz., L = L3 and less of capital, viz., K = K3—it would substitute labour, which has become relatively cheaper, for capital, which has become relatively dearer. This is the SE of the said change in W.

The Output Effect:

We may now obtain the output effect (OE). In order to obtain the SE, we had curtailed the firm’s expenditure. Let us now restore the expenditure to its original level. The firm’s ICL, viz., GH, will have a parallel rightward shift from GH to EF1, and the firm’s equilibrium point (the point of tangency) would move from B on IQ1, to C on a higher IQ, IQ2, raising the firm’s output to a higher level.

That is, if W falls, rK and the expenditure remaining constant, firm’s output would increase. This is the output effect of the said fall in W. This effect is represented by the movement of the firm’s equilibrium point from B to C. In Fig. 15.4, owing to the output effect, the firm would be increasing its use of both the inputs (unless any of them is an inferior input).

Shift in the VMPL Curve:

What we have obtained, then, is this. The SE of a fall in W would cause a substitution of labour for capital. Owing to this effect, the MPL curve would shift to the left, for, now there is less of capital to work with. But the total effect (SE + OE) of the said fall in W would generally result in increasing the use of both the inputs.

In Fig. 15.4, if we compare the points A and C, we find that as a result of a ceteris paribus fall in W, the firm uses more of capital along with an increased use of labour. Since labour now has more of capital to work with, the total effect of a fall in W would cause the MPL curve and, therefore, the MRPL = VMPL curve, to shift to the right.

It may be noted, however, that the output effect alone may cause the MPU curve to shift to the right. In Fig. 15.4, owing to the output effect, use of labour has increased by L3L2 and the use of capital has increased by K3K2 which is larger than the SE fall in the use of capital by K1K3.

ADVERTISEMENTS:

Derivation of the Demand Curve for Labour:

We may now come back to Fig. 15.2 to see that as W falls from W1 to W2, the MRPL = VMPL curve of the firm shifts to the right from VMP, to VMP2. Therefore, at W = W2, the firm would be in equilibrium at the point B on the VMP2 curve and not at the point B’ on the VMP1 curve. The equilibrium point, B at W = W2, is the point of intersection between the MRPL = VMPL curve of the firm which is VMP2 and its MEL curve.

We have obtained, therefore, that at W = W, the firm’s equilibrium labour-demand point is A and it buys L1 of L and at W = W2, that point is B and the firm buys L2 of L. So, in more than one variable input case, the firm’s labour demand curve would be obtained if we join the points like Aon VMP] curve and B on VMP2 curve, etc.

In Fig. 15.2 this curve is dd’, which would, of course, be sloping downward towards right giving us the usual inverse relation between the rate of wage and demand for labour.

ADVERTISEMENTS:

We may conclude, therefore, that in a perfectly competitive labour market when the firm uses more than one variable input, its labour demand curve is not obtained as a particular segment of a single MRPL = VMPL curve. The labour demand curve would be made up of the points like A and B in Fig. 15.2 on the shifting VMPPL curves.

We shall end our discussion of the topic by mentioning one final point. In Fig. 15.2, we have assumed that, as W falls, by any amount whatsoever, the MPL curve, and, therefore, the MRPL = VMPL curve shifts to the right, i.e., as W falls, the MRPL = VMPL curve shifts uniformly to the right. But this may not happen always.

Everything depends on how the quantity used of capital (in the two-input, L and K, case) responds to a fall in W. It may so happen, therefore, that the MPL curve and so MRPL = VMPPL curve shifts uniformly to the left as W falls, for example, from VMP1 to VMP2 curve in Fig. 15.3.

We may also obtain that as W falls, the VMPL curve shifts from VMP1 in Fig. 15.3 to a twisted VMP2 curve—some part of the latter lying to the left and some part lying to right of the former curve.

ADVERTISEMENTS:

In either case, as W falls, use of labour rises—from L1 to L2 or L’2, i.e., in either case, the labour demand curve slopes downwards to the right—passing through points like A and B or through A and B’. The labour demand curves in these two cases have been obtained in Fig. 15.3 to be d’d’ and d”d”, respectively.

The Profit Maximising Effect:

We have said that a change in W would have three effects. Two of them, viz., SE and OE. However, we have not yet discussed the third effect, viz., the profit- maximising effect (PME).

For, we have seen the second effect, viz., the output effect (OE) was alone sufficient to cause a shift in the firm’s MPL and MRPL = VMPL curve. We shall now see that the PME also normally causes an increase in the use of both the inputs (L and K). We shall now discuss the PME.

First, let us suppose that in Fig. 15.4, the initial output-maximising and profit-maximising equilibrium point of the firm is A. After a ceteris paribus fall in W, the new output-maximising equilibrium—subject to a given expenditure—is obtained at point C.

The input combination (L2, K2) at point C is, generally, not the profit-maximising combination. As W falls, the firm’s marginal cost curve (the upward sloping portion) shifts to the right reflecting a fall in MC at each output (unless labour is an inferior input).

As the MC curve shifts to the right, the firm’s profit-maximising output at the given price increases. In order to produce a larger quantity of output, the firm would have to increase its expenditure and move out along its expansion path to a point to the right of the point C, normally increasing both L and K. Therefore, the PME also causes the MPL curve to shift to the right.