Credit Rating is an assessment in terms of alphanumeric symbols to convey the creditworthiness of an individual, company financial instruments or a country. It is a simple and easily understood tool enabling the investor or lender the relative degree of risk associated with a loan amount on a debt instrument or a financial obligation.

Credit rating is just an opinion about the creditworthiness of the instrument. However, it does not give any assurance of repayment of the rated instrument. The rating is representative of the financial history and current assets and liabilities of the rated instrument. A credit rating does not provide recommendations to buy, hold or sell a debt instrument.

It just represents a guideline to help the investors or lenders for making an investment decision. A high credit rating represents a good investment with very low risk of non-payment on a loan, whereas a poor credit rating represents investments with a high level of risk of default. Investors expect a risk return trade off. The investors who want high returns invest in low rated instruments and get compensated for high risk involved with it.

Credit rating is not a permanent credit rate. It is a continuous review process and the rating keeps on changing periodically based on the availability of information. For example, recently reliance on communication rating to its bonds was reduced with the information that the company is unable to pay interest in time.

ADVERTISEMENTS:

Credit rating is generally done for various debt instruments like bonds, debentures, fixed deposits, Bank loans, commercial paper and other.

CRISIL, the first rating agency in India defines credit rating as “an unbiased and independent opinion as to the issuer’s capacity to meet its financial obligations. It does not constitute a recommendation to buy/sell or hold a particular security”.

Contents

- Introduction to Credit Rating

- Meaning of Credit Rating

- Definitions of Credit Rating

- Origin and Development of Credit Rating

- Objectives of Credit Rating

- Concept of Credit Rating

- Features of Credit Rating

- Significance of Credit Rating

- Kinds of Credit Rating

- Classification of Credit Rating

- Functions of Credit Rating

- Sovereign Credit Ratings

- Stages in Rating Process

- Analysis Involved in Rating Methodology

- Symbols in Credit Rating

- Sources of Information for Credit Rating

- Credit Ratings Scales

- Parameters to Keep in Mind While Rating an Organization

- Short Term Ratings and Long Term Ratings

- Mapping of Short Term and Long Term Credit Rating

- Credit Rating Agencies

- Credit Rating Agencies in India

- SEBI Guidelines on Credit Rating Agencies

- Credit Rating of Structured Obligations

- Credit Rating of an Issuer and Credit Rating of an Issue

- Benefits of Credit Rating to Different Classes of People

- Advantages of Credit Rating Concerned with Various Parties

- Merits of Credit Rating

- Problems of Credit Rating

- Limitations of Credit Rating

What is Credit Rating: Meaning, Definition, Origin, Development, Objectives, Advantages, Concept, Features, Significance, Kinds, Classification, Functions and More…

Credit Rating – Introduction

A credit rating is an opinion expressed by the credit rating agency on the debt repayment ability of the Issuer.

ADVERTISEMENTS:

When we talk about fixed income securities, the topic of credit rating has to be around the corner. Credit ratings have assumed a significant role in today’s investment world, and rightly so.

The credit rating agencies save investors a lot of time in researching their potential investment products and also keeping a tab on any events that may affect the credit quality of the product.

Credit rating can be considered as a reasonably good proxy for the credit quality of a fixed income security. The credit quality of one particular Issue may be different from the fundamentals of the Issuer; there are several ways in which credit quality of an Issue may be enhanced.

Credit rating, we have to understand that credit rating is only a reasonably good proxy. It is not perfect. It is not the final word on credit quality; it is a research-based opinion.

ADVERTISEMENTS:

What a credit rating measures is credit risk -or more specifically, the risk of default.

When we talk of default, there are only two reasons why this may occur:

i. The Issuer does not have the money to repay.

ii. The Issuer has adequate money, but just doesn’t want to!

This brings us to the two aspects of default risk that a credit rating measures – ability to repay and willingness to repay.

Over the years, credit ratings have formed an integral part of the fixed income investments. They are so well-knit in the fixed income world that credit spreads (additional return you demand for a lower quality investment) are calculated based on rating groups- for example, AAA rated over AA rated and so on.

Credit Rating – Meaning

Credit Rating is an assessment in terms of alphanumeric symbols to convey the creditworthiness of an individual, company financial instruments or a country. It is a simple and easily understood tool enabling the investor or lender the relative degree of risk associated with a loan amount on a debt instrument or a financial obligation.

Credit rating is just an opinion about the creditworthiness of the instrument. However, it does not give any assurance of repayment of the rated instrument. The rating is representative of the financial history and current assets and liabilities of the rated instrument. A credit rating does not provide recommendation to buy, hold or sell a debt instrument.

It just represents a guideline to help the investors or lenders for making an investment decision. A high credit rating represents a good investment with very low risk of non-payment on a loan, whereas a poor credit rating represents investments with a high level of risk of default. Investors expect a risk return trade off. The investors who want high returns invest in low rated instruments and get compensated for high risk involved with it.

ADVERTISEMENTS:

Credit rating is not a permanent credit rate. It is a continuous review process and the rating keeps on changing periodically based on the availability of information. For example, recently reliance on communication rating to its bonds was reduced with the information that the company is unable to pay interest in time.

Credit rating is generally done for various debt instruments like bonds, debentures, fixed deposits, Bank loans, commercial paper and other.

SEBI defines credit rating as “an opinion regarding securities, expressed in the form of standard symbol or in any other standardized manner, assigned by a credit rating agency, it is mandatory for an issuer of such securities, to comply with a requirement specified by SEBI regulations and provide the credit rating as an information to the investors of the bonds”.

Credit Rating – Definitions

CRISIL, the first rating agency in India defines credit rating as “an unbiased and independent opinion as to the issuer’s capacity to meet its financial obligations. It does not constitute a recommendation to buy/sell or hold a particular security”.

ADVERTISEMENTS:

According to Moody’s Investor Service, an International Credit Rating agency, “Ratings are designed exclusively for the purpose of grading bonds according to their investment qualities”.

According to ICRA, a leading Credit Rating Agency in India, “Ratings are opinions on the relative capability of timely servicing of corporate debt and obligations. These are not recommendations to buy or sell, neither the accuracy nor the completeness of the information is guaranteed”.

Credit rating is, essentially, the symbolic indicator of the current opinion of the rating agency regarding the relative ability and willingness of the issuer of a debt instrument to meet the debt service obligations as and when they rise.

Origin and Development of Credit Rating

Credit rating concept originated in the USA in 1840’s. In the background of a great financial crisis of 1837 in the USA, Louis Tappan established the first mercantile bank credit agency in New York in 1841 which rated the ability of merchants and traders to pay their financial obligations. The mercantile agency was subsequently acquired by Robert Dun. This had published its first rating guide in 1859.

ADVERTISEMENTS:

John Brad Street established another credit rating agency in 1849 who published a rating book in 1857. In 1933, these two rating agencies merged together to form Dun & Bradstreet, which became the owner of Moody’s Investors Service in 1962. The history of Moody itself goes back about a 100 years. In 1900 John Moody founded Moody’s Investors Service.

In 1909 it published ‘Manual of Railroad Securities’. It was followed by the rating of utility and industrial bonds in 1914. Rating of bonds issued by U.S. cities and other municipalities was there in the early 1920’s.

Yet another credit rating company took place in 1916 when the Poor’s Publishing Company published its first ratings, followed by the standard statistics company in 1922 and Fitch Publishing Company in 1924.

The Standard Statistics Company and the Poor’s Publishing company merged in 1941 to form standard & Poor’s which was subsequently taken over by McGraw Hill in 1966. During the 1970’s numerous credit rating agencies started operations all over the world.

In 1972, Canadian Bond Rating Service was incorporated. In 1974, Thomson Bank watch was established. Later many other countries had their own credit rating agencies.

India was the first developing country to set up a credit rating agency in 1987. CRISIL, the first credit rating agency established in 1988, sponsored by the ICICI, UTI, other financial institutions and public sector banks.

ADVERTISEMENTS:

It was followed by establishment of credit rating agencies ICRA and CARE in 1991 and 1993 respectively. In 1996, a joint venture between international credit rating agency Duff and Phelps and JM Financial and Alliance Group leads to the establishment of OCR India (P) Ltd.

In 2000, DCR India (P) Ltd. was acquired by Fitch Ratings, an International Credit Rating Agency and changed its name to Fitch Ratings India Pvt. Ltd. In 1993, the first Individual credit rating agency in India, ONICRA was promoted by ONIDA group.

Credit Information Bureau (INDIA) Ltd. (CIBIL) was established in 2000 to provide comprehensive credit information about consumer and commercial borrowers to credit granting institutions.

Brickwork Ratings India Pvt. Ltd is another rating agency established in 2007 offering rating and grading of different instruments issued by corporate, Governments, Local bodies, international agencies etc. SAMERA, an SME rating agency is also a new entrant in the field. At present there are 5 SEBI registered credit rating agencies.

Top 6 Objectives of Credit Rating

Following are the objectives of credit rating:

i. To rate the debt instruments as objectively as possible in order to build market confidence in them;

ADVERTISEMENTS:

ii. To promote the growth of primary market in particular and capital market in general;

iii. To ensure absorption of capital issues by the investors since inadequate subscription would leave the projects high and dry;

iv. To protect the interests of investors especially the small and gullible investors by giving adequate clues in the form of ratings regarding safety and/or profitability of investments;

v. To ensure optimum allocation of capital as market absorbs highly rated credit instruments;

vi. To minimize the cost of floatation because highly rated securities advertise on their own. A corporate need not spend much on such securities.

Concept of Credit Rating

Credit rating is a process by which risk associated with a credit instrument is evaluated. However, it does not indicate market related risk or predict prices or yields of credit instruments. It is an expert opinion on the relative ability and willingness of an issuer to make timely payments on specific debtor related instruments.

ADVERTISEMENTS:

In other words, it shows the chances of timely payment of interest and principal by a borrower. It provides a relative ranking of the credit quality of debt instruments.

The ratings are usually expressed either in alphabetic or alphanumeric symbols. They enable the investor to differentiate between debt instruments on the basis of their credit quality. Thus, credit rating is a symbolic indicator of the current opinion of the relative capability of the issuer to service its debt obligations in a timely fashion. Ratings indicate safety, liquidity and profitability of debt instruments.

Independent rating agencies perform this function. They make this judgement on the basis of the company’s past performance, existing and expected market for the product, market competitors and their performance, risk associated with the project etc.

Different rating notations such as highest safety, adequate safety, high risk, substantial risk, in default etc. are used for this. They convey sufficient information to the investor regarding the debt instruments floated by the entities.

In brief, credit rating is an assessment of the capacity of an issuer of debt security, by an independent agency, to pay interest and repay the principal as per the terms of issue of debt.

The rating agency may not have a fixed formula for its work. It has to encounter a number of subjective elements like management quality, asset-quality, accounting accuracy etc. The credit rating agency rates the instruments only and not the company. It is only guidance to the investors and not a recommendation to a particular debt instrument.

11 Important Features of Credit Rating

Following are the features of credit rating:

ADVERTISEMENTS:

1. Credit rating is basically aiming at guiding the lay investors about corporate entities.

2. Ratings are chalked out exclusively for the purpose of grading debentures, bonds, Government bonds, municipality bonds, public deposits, commercial paper etc. according to their investment qualities.

3. Rating is a current assessment of the creditworthiness of an issuer of securities with respect to specific obligations.

4. Credit rating provides lenders with a simple system of gradation.

5. Credit rating is an opinion of credit rating agencies indicating relative safety of timely payment of interest and principal on a debenture, preference share, fixed deposit or short- term instrument by a company.

6. Credit rating is exhibited either in alphabetical manner or alphanumerical way for quick understanding by lay and prospective investors.

7. Credit rating is not a. general evaluation of the issuing organization but a specific disclosure reflecting the opinion on repayment capacity of the issuer body.

8. Rating is not based on audit.

9. Rating can be revised, either upward or downward by assessing various conditions and factors of an entity. Thus, credit rating is flexible in nature.

10. Rating helps investment decisions by the investors.

11. Rating is based on current information about issuer of obligations and securities.

Significance of Credit Rating

In an open economy a number of companies, both national and foreign, enter the capital market with their instruments to raise money. The investors are very often at a dark to evaluate the company and its debt instruments.

A third party who is expert in analyzing the financial position of the company and who is credit worthy can help the investor in his judgement. A credit rating agency takes up this function.

The credit rating agencies provide a yardstick to measure the risk inherent in an instrument. A prospective investor makes use of this yardstick to assess the risk level in relation with the expected rate of return.

Thus, credit rating is used to optimize the risk return trade off. As the ordinary investors do not have the expertise in credit evaluation, the credit rating agencies provide the same.

Credit rating also helps the issuers to have a wide range of investors scattered in different parts of the country. If the instruments are rated high, people will readily purchase them. Moreover, regulatory agencies like SEBI makes it mandatory to get certain credit instruments rated. This will create a quality consciousness in the capital market.

Globalization of the financial market and lack of effective government control in the financial market make the functions of credit rating agencies all the more relevant in the present world.

Following are the different kinds of credit rating:

Kind # 1. Bond/Debenture Rating:

Rating the debentures/bonds issued by corporate, government etc. is called debenture or bond rating.

Kind # 2. Equity Rating:

Rating of equity shares issued by a company.

Kind # 3. Preference Share Rating:

Rating of preference share issued by a company.

Kind # 4. Commercial Paper Rating:

Commercial papers are instruments used for short-term borrowing. Commercial papers are issued by manufacturing companies, finance companies, banks and financial institutions and rating of these instruments is called ‘commercial paper rating’.

Kind # 5. Fixed Deposits Rating:

Fixed deposits programs are medium-term unsecured borrowings. Rating of such programs is called ‘fixed deposits rating’.

Kind # 6. Borrowers Rating:

Rating of borrowers is referred to as ‘borrower rating’.

Kind # 7. Individuals Rating:

Rating of individuals is called ‘Individual’s credit rating’.

Kind # 8. Structured Obligation:

Structured obligations are also called ‘debt obligation’, different to debenture or bond or fixed deposit programs and commercial paper.

Kind # 9. Sovereign Rating:

It is a rating of a country which is being considered whenever a loan is to be extended or some major investment is envisaged in a country.

Classification of Credit Rating – Equity, Bond, Commercial Paper, Individual, Asset Backed Securities, Country Rating and More…

Classification of Credit Rating are as Follows:

Classification # 1. Equity Rating:

The equity shares and preference shares of companies are rated as to its worth. This is a help to prospective investors in taking a decision.

Classification # 2. Bond Rating:

This is the primary and major business of credit rating agencies. Bonds and debentures issued by companies, governments, quasi-governments etc. are included in this type of ratings.

Classification # 3. Commercial Paper Rating:

Commercial papers are issued by companies to raise short- term funds. Regulatory agencies insist that manufacturing companies, banks and finance companies should get credit ratings for issues of commercial paper.

Classification # 4. Individual Rating:

Borrowers and customers are rated to assess their paying capacity. On the basis of assessment the rating agencies put grades to borrowers and individuals. This is a help to the creditors.

Classification # 5. Asset Backed Securities Rating:

These are undertaken to assess the risk associated with debt securitization. The securitization companies would like to know the cash flows from the assets so as to make timely payments.

Classification # 6. Country Rating:

This is also known as sovereign ratings. The international investors would like to know the creditworthiness of a country and its debt paying capacity before making any investment in that country or granting credit to that country.

The fiscal deficit, inflation rate, government policies etc. are considered in this rating process. International rating agencies like standard and poor, Moody’s, Morgan Stanly etc. undertake country ratings.

Classification # 7. Rating of States:

Just like a country, the states would also like to get rated to attract investors. In a globalized economy, national and foreign direct investments are needed for development. International financial agencies like the World Bank, Asian Development Bank etc. would like to get the rating and grades before they grant funds to the states.

Classification # 8. Other Ratings:

Banks, real estate agencies, chit funds etc., are also rated nowadays. Both investors and creditors would like to get ratings before they commit funds.

6 Main Functions of Credit Rating – Superior Information, Low Cost Information, Basis for a Proper Risk-Return Trade-off, Healthy Discipline on Corporate Borrowers and More…

The following are the functions of credit rating:

Function # 1. Superior Information:

Debt rating by an independent, professional rating firm offers a superior and more reliable source of information on credit risks. As an independent rating firm, unlike brokers and underwriters who have vested interest in an issue, it can provide an unbiased opinion.

Moreover, due to its professional resources, a rating firm has greater ability to assess risks. A rating firm has access to a lot of information which may not be publicly available.

Function # 2. Low Cost Information:

A rating firm which gathers, analyses, interprets, and summarizes complex information in a simple and readily understood format is a very cost-effective arrangement. Hence, it is highly welcome for most investors who could not do such credit evaluation on their own.

Function # 3. Basis for a Proper Risk-Return Trade-off:

If debt securities are rated professionally and such ratings enjoy wide-spread investor acceptance and confidence, a more rational risk-return trade-off would be established in the capital market. Securities which have a high rating would have a lower effective cost and securities which have a low rating would have a higher effective cost.

Function # 4. Healthy Discipline on Corporate Borrowers:

Public exposure is a good motivator to improve performance. The rating of a firm’s debt security increases its public ‘visibility’. It has a healthy influence over its management because of its desire to appear in a favourable light.

The influence of a rating firm is somewhat analogous to the influence of a scorekeeper in a game – if you know that someone is keeping the score you tend to play well.

Function # 5. Greater Credence to Financial and Other Representations:

When a rating firm rates a debt security of an issuer, its own reputation is at stake. So it seeks financial and other information, the quality of which is acceptable to it. As the issuer complies with the demands of the rating agency on a continuing basis, its financial and other representations acquire greater credibility.

Function # 6. Formulation of Public Policy Guidelines on Institutional Investment:

Public policy guidelines on what kinds of securities are eligible for inclusion in different kinds of institutional portfolios can be developed’ with greater confidence if debt securities are rated professionally by independent rating firms.

Sovereign Credit Ratings – Meaning and Factors

Meaning:

Sovereign credit rating refers to the credit rating of the government of a sovereign state (central government). As debt has become an important source of funding the budget deficit of countries across the world, sovereign credit ratings have assumed significant importance.

A sovereign credit rating is assigned differently for debts Issued by a government in its own currency and one issued in foreign currency. The reason for such a distinction is that a government tends to have a unique control over the economy within the country.

From a theoretical stand point, a sovereign local currency debt may never default – the government simply has to print new currency if it falls short of funds. But this is easier said than done. Such a naive action can have serious political and economic consequences and is often avoided.

Nevertheless, a sovereign local-currency debt rating will almost always be higher than its foreign-currency debt rating. A debt issued in foreign- currency has restrictions in respect of availability of that foreign currency for repayment.

The risk of default by a sovereign is also called sovereign risk. Sovereign risk has two components- economic risk and political risk. Economic risk measured the ability of a sovereign to repay its debt. And, as you guessed it right, political risk measures the willingness of a sovereign government to repay its debt.

Some of the factors that are peculiar in the case of a sovereign credit rating assignment are:

i. Political stability in the country

ii. Effectiveness of the ruling government in bringing about effective and progressive policies

iii. Transparency of the statistical data released by the government

iv. Internal and external security

v. Extent of involvement of supra-national organizations (ASEAN, IMF, et cetera) in policy making

vi. GDP growth rate, inflation, per capita income

vii. Balance of payments, trade deficit

viii. Existing level of outstanding debt

ix. Profile of country’s imports and exports

Credit Rating – Stages in Rating Process: Initiating Rating Action, Analytical Team, Meeting with the Issuer, Rating Committee and Surveillance (With Figure)

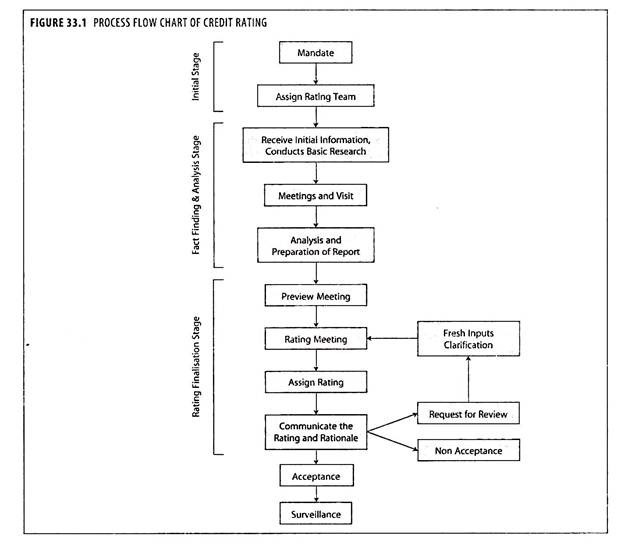

There are various aspects related to the functioning of rating agencies such as the rating process and methodology followed to assign the rating, symbols to indicate rating etc. There are various stages which an instrument has to pass through before it gets rated.

The rating process is thus divided in the stages as:

1. Initiating Rating Action:

Rating process in India is initiated on the receipt of a formal request (or mandate) from the prospective issuer, however, the rating agencies abroad undertake assessment even if the company does not approach them i.e. unsolicited rating is issued. This is the only difference between the rating process of Indian rating agencies and the rating agencies abroad. Thereafter the process of assigning ratings is the same for all the rating agencies worldwide.

2. Analytical Team:

The credit rating agency assigns the task to a ‘rating team’, which usually consists of two analysts with the expertise and skills required to evaluate the business of the issuer. An issuer is provided a list of information requirements and the broad framework for discussions. These requirements are worked out on the basis of understanding of the issuer’s business, and broadly cover all aspects that may have a bearing on the rating.

3. Meeting with the Issuer:

The rating involves assessment of a number of qualitative factors with a view to estimating the future earnings of the issuer. This requires extensive interactions with the issuer’s management, specifically on subjects relating to plans, outlook, competitive position, and funding policies. The team of specialists thus obtains and analyzes the information received from the detailed schedules and interactions with clients.

This enables to incorporate non-public information in the rating decision and it is the duty of the agency to maintain the complete confidentiality of the information provided by the company. In the case of manufacturing companies, plant visits are made to gain a better understanding of the issuer’s production process. These visits also help in assessing the progress of projects under implementation.

4. Rating Committee:

After completing the analysis, a rating report is prepared, which is then presented to the rating committee comprised of senior analysts with expertise in relevant fields. A presentation on the issuer’s business and management is also made by the rating team.

The rating committee is the final authority for assigning ratings. It minutely goes through the data, the analysis is prepared by the team and assigns a rating after detailed scrutiny. The assigned rating, along with the key issues, is communicated to the issuer’s top management for acceptance.

5. Surveillance:

If the issuer does not find the rating acceptable, it has a right to appeal for a review by providing certain fresh inputs. The rating committee would revise the initial rating decision, if the inputs and fresh clarifications so warrant. It is mandatory to monitor all assigned ratings over the tenure of the rated instruments.

They are generally reviewed yearly or when circumstances have altered and there are greater doubts about the creditworthiness of the issuer. Regular surveillance helps upgrading or downgrading the given ratings. Before downgrading the issue, the agency put it on ‘credit watch’ i.e. the rating is under review and might get lower in the near future. When a debt issue is on credit watch, the rating agency will advise investors to use the rating with caution.

Credit Rating – Analysis Involved in Rating Methodology: Management Evaluation, Regulatory and Competitive Environment, Business Analysis, Financial Analysis and Fundamental Analysis

The rating methodology involves an analysis of the following:

A. Management Evaluation:

A rating exercise would obviously not be an analysis of the numbers alone. The quality and ability of the management would be judged on the basis of past track record, their goals, philosophies and strategies, and their ability to overcome difficult situations etc. would be analyzed. In addition to ability to repay, an assessment would be made of the management’s willingness to repay debt. This would involve an opinion of the integrity of the management.

B. Regulatory and Competitive Environment:

Structure and regulatory framework of the financial system would be examined. Trends in regulation/deregulation would also be examined keeping in view their likely impact on the company.

C. Business Analysis:

The credit rating analysts will undertake analysis in the following business aspects:

1. Industry risk including analysis of the structure of the industry, the demand supply position, a study of the key success factors, the nature and basis of competition, the impact of government policies, cyclicality and seasonality of the industry etc.

2. Market position of the company within the industry including market share, product and customer diversity, competitive advantage, selling and distribution arrangements etc.

3. Operating efficiency of the company, this would include locational advantages, labour relationship, technology, manufacturing efficiency as compared to competitors etc.

4. Legal position including the terms of the prospectus, trustees and their responsibilities, systems for timely payment etc.

D. Financial Analysis:

The financial analysis looks into the following angles:

1. Accounting Quality:

This is of particular importance in India where till recently reporting practices of companies varied substantially. Here, CRISIL would look at any overstatement/understatement of profits, auditors’ qualifications in their report, methods of valuation of inventory, depreciation policy etc.

2. Earning Protection:

It includes sources of future earnings growth for the company, future profitability etc.

3. Adequacy of Cash Flows:

Under this, CRISIL would take note of whether cash flows would be sufficient to meet debt servicing requirements in addition to fixed and working capital needs. An opinion would be formed regarding the sustainability of the cash flows in future and the working capital management of the company.

4. Financial Flexibility:

This is a very important area which would be examined minutely by any rating agency. A company’s ability to source funds from other sources (e.g., group companies), ability to defer capital expenditure, alternative financing plans in times of stress are some of the main considerations here.

E. Fundamental Analysis:

The strength of the following will have impact on credit rating:

1. Capital Adequacy:

Including an assessment of the true net worth, its adequacy as compared to the volume of business and the risk profile of assets.

2. Asset Quality:

This would encompass the company’s credit risk management, systems for monitoring credit, exposure to individual borrowers, management of problem credits etc.

3. Liquidity Management:

Capital structure, term matching of assets and liabilities and policy on liquid assets in relation to financing commitments would be some of the areas examined.

4. Profitability and Financial Position:

A great deal of weightage would be paid by the agency on past historical profits, the spreads on funds deployed, accretions to reserves etc.

5. Interest and Tax Sensitivity:

Exposure to interest rate changes, tax law changes etc. would be examined.

The rating methodology thus involves coverage of a wide spectrum of the company’s activities and is extremely exhaustive. Internationally most good debt instruments are rated by two independent agencies simultaneously and the market tends to follow the lower one of the two, usually such ratings do not vary by more than one grade.

Consequent upon the deregulation in the Indian capital market and SEBI’s compulsion for credit rating, the role of Indian credit rating agencies has increased manifold. They have occupied a place of pride in the financial market. These agencies should work independently and should give professional and impartial assessment of instruments/ obligations without any fear or favour.

Here are some important facts about credit rating:

1. Rating can be revised.

2. Rating is not based on audit.

3. Rating only helps in investment decision-making.

4. Rating is based on current information.

5. Rating is assigned to a specific instrument.

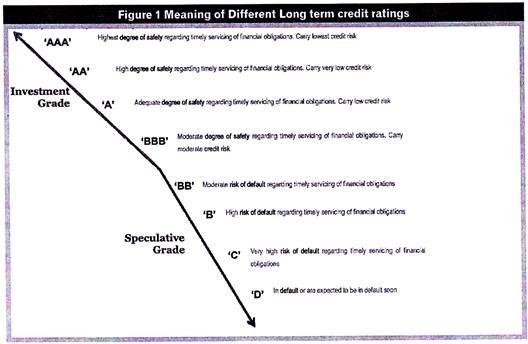

Credit Rating – Symbols: Investment Grade and Speculative Grade

The rating agency reduces complex risk factors into simplistic outcomes by assigning simple to understand symbols like A, B or C, the symbols are used to convey the safety grade to the investor. Some agencies use alphabets, others use numbers, and many use a combination of the two for ranking the risk of default.

Sometimes, the suffix ‘+’, ‘-’ are used along with the main symbol to indicate the comparative position of the instrument within the group i.e. if the position is better than most of the companies’ instruments in the same group then the suffix V are added. Suffix (P) is also quite common, it shows that the money raised shall be put into a new project.

The default risk varies from extremely safe to highly speculative. Separate symbols are used for long, medium and short-term debt instruments. Long-term instruments include debentures and bonds of companies, medium-term includes public deposits and short-term includes the commercial paper issued by corporate e.g. CRISIL uses AAA to B for long-term instruments, FAAA to FD for medium-term instruments and P1 to P5 for short-term instruments to convey their risk from highest safety to default expected.

The credit rating symbols are divided into two grades:

(a) Investment Grade:

Denotes highest safety in terms of timely payment of interest and principal, the issuer is fundamentally strong e.g., securities rated AAA, and

(b) Speculative Grade:

Denotes inadequate safety in terms of timely payment of principal and interest, e.g., the securities rated below BBB. The credit rating agencies earn their revenue by charging fees from the issuers they rate.

Initially, ratings were published and the rating agencies financed their operations through sale of publications and related materials to the users of rating services, such as investors, financial intermediaries.

7 Important Sources of Information for Credit Rating

The following are the important sources of information for credit rating:

1. Trade References:

Prospective customers may be required to give 2 or 3 trade references. Thus, the customers may give a list of personal acquaintances or some other existing creditworthy customers. The credit manager can send a short questionnaire, seeking relevant information, to the referees.

2. Bank References:

Customer requests his banker to provide the required information to the credit rating agencies.

3. Credit Bureau Reports:

Associations for specific industries may maintain a credit bureau which provides useful and authentic credit information for their members.

4. Past Experience:

Past experience of dealings with an existing customer also provides requisite information. The transactions should be carefully scrutinized and interpreted in the light of changes in the ensuing period for finding out the credit risk involved.

5. Published Financial Statements:

These statements of a customer, read along with its audit report and observations can be examined to determine the creditworthiness.

6. Reports from Point of Sale:

Creditworthiness can be evaluated by the reports provided by the consulting salesmen or persons engaged at the point of sale. Such reports are useful as they are first hand reports.

7. Reports from other Agencies:

Non-banking financial companies (leasing companies etc.) may maintain a defaulting customers/suit-filed cases, etc. CRISIL is one of the entities which maintain a detailed list of defaulters.

Credit Ratings Scales (With Meaning, Categories, Figures and Table)

These days, rating upgrades and downgrades are much publicized. So let’s try and understand what exactly you infer from a particular assigned credit rating.

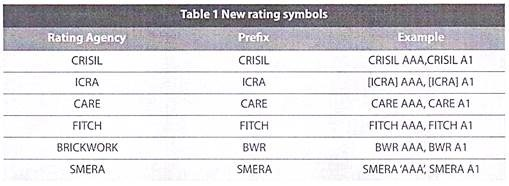

Until recently, each credit rating agency had its own stylized rating symbol and corresponding interpretation. However, this was causing confusion, especially among small investors about how to interpret them. To save investors of all the trouble, the market regulator SEBI has asked all rating agencies to standardize their rating symbols.

The new rating symbols are grouped into the following six broad categories:

1. Long Term Debt Instruments

2. Short Term Debt Instruments

3. Long Term Structured Finance Instruments

4. Short Term Structured Finance Instruments

5. Long Term Debt Mutual Funds

6. Short Term Debt Mutual Funds

As you can see, the basic classification is between long term and short term debt instruments. Each category is further split into regular debt instruments, structured finance Instruments and Mutual Funds.

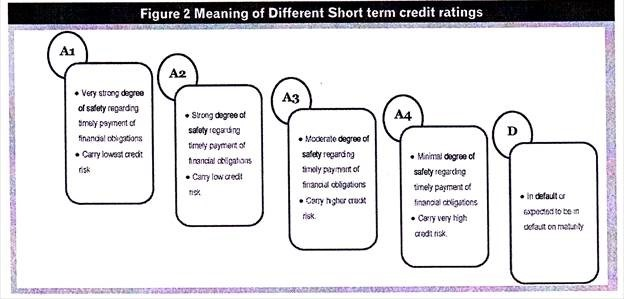

Given below are the rating symbols for long term and short term debt instruments:

Long Term Debt Instruments:

Short Term Debt Instruments:

This rating symbols given above are those for regular debt instruments. If the instrument is a structured finance product, the credit rating is followed by ‘(SO)’. For Example- AAA (SO), AA (SO) or A1 (SO), A2 (SO) and so on.

The reason for such a suffix is that the method for evaluation of structured finance products and factors considered in assigning credit ratings are slightly different from those of regular debt product. It informs the reader that the instrument being rated is a structured finance product and not a regular debt product.

Similarly, in the case of Mutual Funds, the rating symbol is followed by ‘mfs’. For example: AAAmfs, AAmfs or A1mfs, A2mfs and so on. The reason behind such suffix is that it distinguishes a mutual fund from the investments underlying in the funds and it also signifies the fact that rating criteria and process for rating mutual funds is different from that of debt instruments.

A rating agency may also add a modifier ‘+’ or ‘-‘after a rating. These signs signify the relative standing of the instrument within the particular rating category. For example, a product with ‘AA+’ rating is better off than one with a simple ‘AA’ rating, but still a notch lower than one with an ‘AAA’ rating. It is important to note that there is no modifier for an ‘AAA’ rating and a ‘D’ rating. There can be nothing like a ‘AAA+’ or ‘AAA-‘ or ‘D+’ or ‘D-‘ rating.

In order to know which rating agency has issued a particular rating, the credit rating is preceded by the credit rating agency’s name.

Credit Rating – Top 13 Parameters to Keep in Mind While Rating an Organization

The following are the parameters keeping in mind while rating one organization:

1. Total volume of outstanding debt and their nature.

2. Ability of the company to service the debt. For this, the rating agency analyse the past and future cash flows in the context of interest payments.

3. The earning capacity of the firm.

4. Track record of promoters and directors.

5. Market position of the product, the demand for product, substitutes available, strength of competitors etc. are analyzed in this respect.

6. Operational efficiency- This is judged by capacity utilization, technologies used, services of experts available etc.

7. The current ratio- This is assessed to get an idea about the liquidity position of the company.

8. The value of assets pledged- This is assessed to get an idea about the repaying capacity of loans by the firm.

9. The interest coverage ratio- This is evaluated in order to know the ability of the company to pay interest for the specified period.

10. The norms and guidelines of regulatory authorities.

11. The accounting quality of the firm.

12. The efficiency and quality of management.

13. The asset quality.

Credit Rating – Short Term Ratings Vis-à-Vis Long Term Ratings

The first level of distinction between credit rating of various investment products is short term and long term ratings. Short term instrument means one having original maturity of up to one year. The reason for such a distinction is plain and simple.

A short term instrument is one about to be maturing in less than a year. This means the need for funds to repay is more pressing than in the case of long term instruments. Even to roll over the Issue (make a new Issue to retire the old one), the Issuer needs to have the ability to Issue fresh debt. Both of these depend on the financial position of the Issuer.

In the short term, the most important aspect of the financial position is liquidity. Thus, cash flow analysis plays a major role in short term credit ratings. An Issuer may not have the highest grade rating in the long term. However, if he demonstrates a good liquidity position in the short term he may have the highest grade of short term rating.

When it comes to market psychology, a less than top-most grade for a long term instrument may still be acceptable to the market. However, a less than top-most grade rating in the short term is viewed poorly by the markets.

The perception is that if it is probable that the Issuer may be unable to raise adequate funds to retire the existing debt within a period as close as one year, there are serious doubts about his credit quality.

There are many Issuers having the highest short term credit rating (A1 +) but less than highest rating in the long term. This is possibly because the forecasting ability of the rating agency is much better in the short term than when the time horizon is longer.

Credit enhancements like liquidity back-up are also of importance in assigning short-term credit ratings. If the Issuer has a line of credit available from a Bank, it can be regarded as a good source of liquidity in the short term.

While short term ratings primarily rest on liquidity position of the Issuer, long term ratings have several different factors to be considered. The factors considered in long term credit rating are qualitative as well as quantitative.

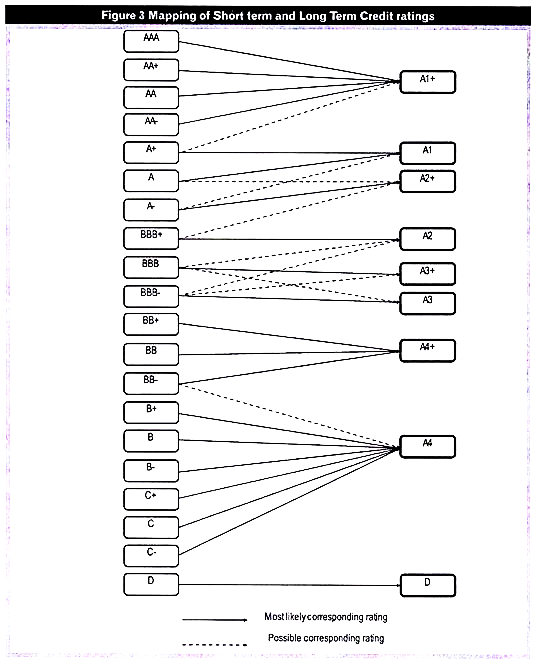

Mapping of Short Term and Long Term Credit Rating (With Figure)

While the short-term ratings are highly linked to the long-term ratings, the liquidity position plays an important role in arriving at the short term credit ratings.

Thus, while the long term credit ratings generally set the way in arriving at the short term credit rating, a better (or worse) liquidity position in the short term may have a positive (or negative, as the case may be) on the short-term ratings.

The Chart below provides a set of possible mappings between the long term and the short term credit ratings in the manufacturing/infrastructure sector. This is based on the information available on the website of CRISIL.

For companies in the financial sector, the mapping adopted may be a bit more lenient than for manufacturing companies, primarily on account of better liquidity position and easier access to funds by finance companies as compared to their peers in the manufacturing sector.

Credit Rating Agencies – Meaning, Role, Functions, Flaws and Suggestions for Improvement

Meaning of Credit Rating Agencies:

Credit rating is an expert opinion on the future ability of the issue of a specific fixed income security to make timely payments of principal and interest thereon. The rating measures the probability that the issuer will default on the security during its life. Credit ratings are usually expressed in alphabetical (e.g., A, B, C) or alpha-numeric symbols (A1, A2, A3, etc.)

A credit rating agency is a specialised institution that evaluates securities (e.g., debentures, bonds, mutual funds, etc.,) and assigns rating symbols to them. In India, the first credit rating agency to be set up was credit Rating and Information Services of India Limited (CRISIL). It was established in 1987 jointly by ICICI, ADB, UTI, other financial institutions, and banks.

Thereafter, The Investment Information and Credit Rating Agency of India (ICRA) was setup in 1992 by IFCI, SBI, GIC, and other financial, and banking institutions. In 1993, IDBI and other institutions established the Credit Analysis and Research (CARE) Limited. Standard and Poor, Moody’s, and The Fitch are globally recognised credit rating agencies.

The distinctive features of credit rating agencies are given below:

(i) A credit rating agency rates the financial strength or creditworthiness of a specific security. It is the instrument not the issuer which is rated. It indicates the ability to meet the specified obligations.

(ii) Rating is done for debt and hybrid securities rather than the equity shares. In India, public issue of debentures and bonds (redeemable/convertible) beyond a period of 18 months, commercial paper, and specified fixed deposit schemes must be rated,

(iii) Credit rating agencies consider liquidity, earnings, leverage, and other relevant factors in their assessment.

(iv) The rating is a quantitative indicator but quality review is an essential part of credit analysis. Such review includes assessment of the management and internal controls of the company.

(v) The techniques used for credit rating analysis may vary from one agency to another. But it is usually based on publicly available information, non-public information, and management discussion.

(vi) Almost every issuer of public securities is now required to get rated by an Indian or global agency.

(vii) The issuers (rather than investors) pay for credit rating.

(viii) The credit rating system originated in the USA in the 1970s due to several defaults in capital markets. Thereafter, the regulatory agencies in the USA made credit rating mandatory for many securities and schemes. Now the credit rating system has become an integral part of the financial system all over the world.

Role of Credit Rating Agencies in Corporate Governance:

Credit rating agencies occupy a significant position in the financial system. They provide a valuable external check and balance. They play an important role in the process of external governance by adding another layer of scrutiny. Investors now prefer to buy only rated securities and schemes. Therefore, companies have access to public debt and capital markets mainly through credit rating.

Now, credit rating agencies review the quality of governance in the issuing company before assigning a rating. For example, Standard and Poor’s provides a separate Corporate governance rating on a scale of 1 (poor) to 10 (excellent).

Credit rating agencies are beneficial to:

(i) Investors

The ratings provide investors with an independent and professional judgment which they themselves are unable to make. Investors can hedge the risk and balance return with the help of credit rating.

(ii) Issuers

Ratings provide a wider access to capital markets. They can reduce cost of funds.

(iii) Intermediaries

Investment banks, merchant banks, and other financial intermediaries use the ratings for pricing, in placement, and marketing of securities.

Functioning of Credit Rating Agencies:

The main functions relating to the working of credit rating agencies are as under:

1. Rating Process:

The process of credit rating involves the following stages:

(а) Receipt of Request:

In India, the rating process begins when the prospective investor makes a formal request or gives a mandate to the rating agency. But rating agencies abroad issue ratings even if the issuer does not approach them.

(b) Constitution of Rating Team:

The task of rating is assigned to a rating team. The rating team usually consists of two analysts having the required expertise and skills.

(c) List of Information:

The agency provides a list of information requirements to the prospective issuer. These requirements depend on the issuer’s business and cover all aspects that may have a bearing on the rating.

(d) Meetings with the Issuer:

The rating team holds meetings with the management of the issuing company to assess its plans, financial policies, and competitive position. The information so collected is analysed. Plant visits are made in case of manufacturing companies to understand the production process and to judge the progress of its projects.

(e) Review by Rating Committee:

After a thorough analysis, the rating team submits its rating report. The rating team also makes a presentation on the business and management of the issuer. A committee of senior analysts reviews this report and the presentation. After detailed scrutiny the rating committee assigns a rating which is conveyed for acceptance by the issuing company’s top management.

(f) Surveillance:

In case the rating is not acceptable to the issuer, it can make an appeal for a review. The rating committee may revise its rating if the new information and clarifications so justify. The rating agency is required to monitor all assigned ratings over the tenure of the related securities.

Ratings are usually reviewed annually or when credit worthiness undergoes a significant change? Regular monitoring helps in upgrading or downgrading the assigned ratings. The rating agency puts an instrument on “Credit watch” (the rating is under review) before downgrading it. During credit watch, the rating agency advises investors to use the rating with caution.

2. Rating Symbols:

Rating agencies assign easy to understand symbols to convey the safety level to investors. Some agencies use alphabets (A, B, C) others use numbers (1, 2, 3) and still others use a combination of both (A1, A2, A3). In some cases the suffix “+” or “-” are used along with the main symbol.

Separate symbols are used for long-term instruments (company debentures and bonds and public deposits) and short-term instruments (commercial paper). The ratings are classified into two grades depending on the risk level. Investment grade indicates highest safety while speculative grade indicates inadequate safety.

3. Coverage:

Rating agencies rate instruments of manufacturing companies, finance companies, banks, financial institutions, infrastructure firms, mutual funds, etc. These days, real-estate developers, insurance companies, asset management companies, educational institutions, hospitals, states, and countries are also rated.

4. Rating Fees:

Credit rating agencies charge fees from the issuers rated by them. They also sell publications to investors and other users of rating services.

Flaws in the Role of Credit Ratings Agencies:

Investors usually rely on credit ratings while putting their money in various securities and schemes. Therefore, an impartial (true and fair) rating is critical for them. Credit rating agencies have a fiduciary responsibility towards investors. But they have failed in discharging this responsibility in the case of Enron, Worldcom, Satyam Computers, and other cases of corporate scandals.

Credit rating agencies all over the world play a critical role as intermediaries between issuers and investors. Regulatory authorities encourage investors to rely on credit ratings. Credit rating agencies can destroy companies by downgrading their securities.

These agencies have acquired considerable power as watchdogs of capital markets. They can cause great damage to the interests of issuers and investors in case their ratings are inaccurate, untimely and/or biased.

Credit rating agencies have been accused of their lax attitude and negligence in performing their jobs. They have been accused of a dubious role. They have assigned misleading ratings in case of the US Subprime Crisis, and other fiascos. Regulatory authorities all over the world are concerned about the reliability of ratings and are asking for improvement in the functioning of rating agencies.

In case of subprime mortgages the rating agencies gave flimsy ratings without assessing the safety of underlying mortgages and credit history of borrowers. Market participants questioned the misleading ratings and are reviewing the trust placed on the rating agencies.

While using ratings investors must act with caution.

They must remember:

(a) Credit ratings are to guarantee or protect against default. They are only opinions.

(b) Credit ratings do not measure all the factors influencing risk.

(c) A rating is specific to the instrument and is not a rating of the issuer.

Suggestions for Improvement:

Regulatory authorities must take effective steps to improve the functioning of the rating agencies for the efficient working of financial markets. These credit rating agencies play a vital role and they must be made accountable to different participants in financial markets.

Some of the steps that can be taken to ensure efficient functioning of the credit rating agencies are given below:

1. Selection of Agency by the Stock Exchange:

At present the issuer appoints the credit rating agency and negotiates the fees. As a result the agencies depend on issuers for their revenue and a conflict of interest arises. Regulatory authorities should develop a system where the issuing company is required to get rating from an agency selected by the stock exchange on which the instrument is listed.

The fee can also be decided by the regulator keeping in view the type of instrument to be rated and other relevant factors.

2. Ban on Ancillary Services:

In order to ensure their independence, credit rating agencies should not be allowed to provide allied services to the clients whose debt instruments they rate.

3. Close Supervision of Rating Agencies:

Measures on the lines of Securities and Exchange Commission of the USA may be introduced to maintain a closer watch on rating agencies. Under these measures it is mandatory for nationally recognised agencies in the USA to publicly disclose a random sample of the issuer paid ratings along with documentary evidence.

4. Reliability:

In several cases of market failures credit rating agencies have not been held liable even though market participants widely rely on ratings. Regulatory authorities must intervene in the functioning of these agencies to make ratings more reliable.

Ratings are reliable when the credit risks are estimated accurately and ratings are not influenced by interested parties. Disclosure of the credit rating process, and methodologies, conflicts of interest, etc., will ensure greater transparency. Excessive reliance on ratings will be discouraged when limitations inherent in the rating process are known to the user.

5. Enforcement of IOSCO Code:

The International Organisation of Securities Commissions (IOSCO) has laid down a code of conduct to improve transparency and accountability in the credit rating industry. The code also seeks to improve the quality of credit ratings and their usefulness to investors.

The principles of this code are divided into three sections as follows:

(a) The Quality and Integrity of the Rating Process.

(b) Independence of Rating Agencies and Avoidance of Conflicts of Interest.

(c) Responsibilities of Rating Agencies to the Investors and issuers.

The credit rating agency which does not comply with the code can lose its license. Global rating agencies like Standard and Poor’s and Moody’s have aligned their policies and procedures with the IOSCO code by publishing their own codes of professional conduct.

Top 4 Credit Rating Agencies in India

At present there are three credit rating agencies in India:

1. Credit Analysis & Research. (CARE)

2. Investment information and Credit Rating Agency of India. (ICRA)

3. Credit Rating Information Services of India Limited. (CRISIL)

1. Credit Analysis and Research Ltd. (CARE):

Services Offered:

a. Credit Rating:

CARE will undertake credit rating of all types of debt instruments, both short-term and long-term. Credit rating is an opinion on the relative ability and willingness of an issuer to make timely payments on specific debt or related obligations over the life of the instrument. Credit rating thus provides a relative ranking of the credit quality of debt instruments.

In a developing market which is shedding its strict regulatory framework, as in India, credit rating agencies have a significant role to play. In such a market, the rating agency forms an integral part of a broader programme of disintermediation, broadening and deepening of the market and removal of barriers.

b. Information Services:

The broad objective of the Information Service will be to make available information on any company, industry or sector required by a business enterprise. Value addition, through incisive analysis, will enable the users of the service, like individuals, mutual funds, investment companies, residents or non-residents, to make informed decisions regarding investments. CARE hopes that this service will, in course of time, meet a clearly emerging need in the context of the liberalisation and deregulation of the capital market and the financial services industry.

c. Equity Research:

Another major activity of CARE will be Equity Research. This will involve extensive study of the shares listed and to be listed in the major stock exchanges and identification of the potential winners and losers among them on the basis of the fundamentals affecting the industry, market share, management capabilities, international competitiveness and other relevant factors.

Beneficiaries:

Rating serves as a useful tool for different constituents of the capital market.

The following are some of the beneficiaries of the services offered by CARE:

a. Investors, both individuals and institutions, can draw up their credit risk policies and assess the adequacy or otherwise of the risk premium offered by the market on the basis of credit ratings. While rating will enable investors to effectively monitor and manage their investments in debt instruments, the information service offered by CARE is expected to help investors in their decisions relating to the equity component of their portfolios.

b. Issuers of Debt Instruments will have a wider access to capital, leading to lower cost of borrowing. Rating will facilitate the best pricing and timing of issues and will provide financing flexibility.

c. Financial Intermediaries like Banks, merchant bankers and investment advisors for whom rating will be a very useful input in the decisions relating to lending and investments.

d. Business Counterparties will benefit from the credit rating and other information services provided by CARE in establishing business relationships, particularly for opening letters of credit, awarding contracts, entering into collaboration agreements etc.

e. Regulators can with the help of credit ratings determine eligibility criteria and entry barriers for new securities, monitor financial soundness of organisations and promote efficient in the debt securities market. In general, the services offered by CARE will increase the transparency of the financial system, leading to a healthy development of the market.

Types of Instruments Rated:

Credit rating is used extensively for evaluating debt instruments. These include long-term instruments like bonds and debentures as well as short-term obligations like commercial paper. In addition, fixed deposits, certificates of deposits, structured obligations including non-convertible portions of PCDs and preference shares are rated. Equity shares are not rated.

CARE also undertakes Credit Analysis Rating of companies, without reference to any particular instrument.

Rating Methodology:

Rating is a search for long-term fundamentals and the probabilities for changes in the fundamentals. The analytical framework for CARE’s rating methodology is divided into two interdependent segments. The first deals with operational characteristics and the second with financial characteristics.

Besides quantitative and objective factors, qualitative aspects like assessment of management capabilities play a very important role in arriving at the rating for an instrument. The relative importance of qualitative and quantitative components of analysis varies with the type of issuer.

Key areas considered in a rating analysis include the following:

a. Business Risk:

Industry characteristics, performance and outlook, operating position (capacity, market share, distribution system, marketing networks etc.), technological aspects, business cycles, size and capital intensity.

b. Financial Risk:

Financial management (capital structure, liquidity position, financial flexibility and cash flow adequacy, profitability, leverage, interest coverage), projections, with particular emphasis on the components of cash flow and the claims thereon, accounting policies and practices, with particular reference to practices of providing for depreciation income recognition, inventory valuation, off-balance sheet claims and liabilities, amortisation of intangible assets, foreign currency transactions etc.

c. Management Assessment:

Background and history of issuer, corporate strategy and philosophy, organisational structure, qualification of management and management capabilities under stress, personnel policies including succession planning.

d. Environment Analysis:

Regulatory environment, operating environment, national economic outlook, areas of special significance to the company, pending litigation, tax status, possibility of default risk under a variety of future scenarios.

What Ratings Do Not Measure?

It is important to emphasise the limitations of credit ratings. They are not recommendations to invest in. They do not take into account many aspects which influence an investment decision. They do not, for example, evaluate the reasonableness of the issue price, possibilities for capital gains, or (take into account the liquidity in the secondary market. Ratings also do not take into account the risk of prepayment by issuer, or interest or exchange risks. Although these are often related to the credit risk, the rating essentially is an opinion on the relative quality of the credit risk.

2. Investment Information and Credit Rating Agency of India Ltd. (ICRA):

Investment Information and Credit Rating Agency of India Limited (ICRA) was set up as an independent and professional Credit Rating Agency promoted by Industrial Finance Corporation of India jointly with other leading investment institutions, commercial banks and financial services companies.

Objective:

The primary objective of ICRA is to provide guidance to investors/creditors in determining the credit risk associated with a debt instrument/credit obligation. ICRA ratings reflect an independent, professional and impartial assessment of such credit risk. The ratings are not recommendations to buy, sell or hold securities.

Ratings:

The ICRA rating is a symbolic indicator of the current opinion of the relative capability of timely servicing of debts and obligations by the corporate entity with reference to the instrument rated.

The rating is based on an objective analysis of the information and clarifications obtained from the concerns as also other sources, which are considered by ICRA to be reliable. ICRA rates long term, medium term and short term debt instruments.

The Process:

The rating process commences at the request of the prospective issuer and on receipt of required information as may be available with such issuer. A team of analysts takes up the work of collection of data and information from the books and records of the concern and interacts with its executives. The support of in-house research and database of ICRA as well as industry studies of reputable agencies are also availed of.

ICRA ensures strict confidentiality of all information collected during the rating process. ICRA offers the rated concern an opportunity to get itself rated confidentially and also an option regarding use of the rating.

However, once the rated Company decides to use the rating, ICRA monitors the rating till the redemption/repayment of the debt obligation. Based on the information obtained from the rated Company, or collected by ICRA on its own, during that period, the rating may be changed suitably.

ICRA reserves the right to make such rating/change in rating public. ICRA reserves the right to disclose, in the public interest, to the appropriate regulatory government bodies the correct position in case of allegation of mis-statement by the Company in the public documents or publicity materials about the rating assigned or about whether the Company has been rated by ICRA or not.

Methodology:

ICRA analyses and appraises all relevant factors that have a bearing on the creditworthiness of the borrowing entity. The key factors looked into depend on the nature of the borrowing entity.

The ratings are based on an in-depth study of the industry as also an evaluation of the strengths and weaknesses of the unit. The inherent protective factors, marketing strategies, competitive edge, level of technological development, operational efficiency, competence and effectiveness of management, HRD policies and practices, hedging of risks, cash flow trends and potential, liquidity, financial flexibility, asset quality and past record of servicing debts and obligations as well as the government policies and statutes affecting the industry and the units are looked into.

Credit Assessment:

ICRA also takes up assignment for credit assessment of companies/Undertakings intending to use the same for obtaining specific line of assistance from commercial Banks, Financial Investment Institutions, Factoring Companies and Financial Services Companies. The assessment indicates the broad opinion of ICRA as to the relative degree of capability of the Company/Undertaking to repay the interest and principal as per the terms of the contract.

General Assessment:

ICRA provides services of General Assessment at the request of Banks/potential users of such General Assessment Reports. This service is also likely to be useful for other non-banking, non- financial agencies for the purpose of merger, amalgamation, acquisition, joint venture, collaboration and factoring of debts, etc.

ICRA does not assign any specific symbol in respect of such General Assessment. It provides a report on different aspects of the Companies’ operations/managements.

The Benefits:

The ICRA ratings/assessments help the borrowing companies to access Money Market and Capital Market for tapping a larger volume of resources from a wider range of the investing public. As “name recognition” is replaced by objective ratings, the lesser known companies are also able to access the money market and capital market.

Investment Information Publications:

In today’s market-driven economy, there is a genuine need for authentic investment information characterized by authenticity, quality analysis and good presentation, and specifically designed to facilitate the decision-making process of investors and other participants in the financial services world. ICRA, therefore, decided in 1993 to initiate several studies, with the help of outside experts and in-house staffers. These are in two series.

The first, ICRA Sector Focus Series, aims to present in-depth analysis of different sectors/industries, focussing on specific issues. It is oriented towards all those who have an interest in contemporary developments in the Indian economy and in the specific industries being covered. It will be useful to researchers, academics, practitioners in the financial services world and corporate managers in industry.

The second series, titled ICRA Industry Watch Series, has a distinct corporate orientation. It will be a useful information and analytical tool for investment and portfolio managers. Key elements which govern the business environment of the industry, the likely future direction, and the performance of the major corporate entities in the industry/sector, forms the substance of the series.

These reports will be primarily based on information that is publicly available, such as company annual reports, newspaper items, publications of government, private and public bodies, proceedings of conferences/seminars, as also interactions with industry leaders and experts.

Rating the Builders – ICRA’s Builder Rating Service Should Prove Useful to Property Buyers:

When you are going to invest money in an upcoming project, you must try to find out the credibility of developers and constructors. Unfortunately, for small investors, experiences are not very good here. Half of the projects which are started get shelved because of some problem or the other.

There are other issues like adhering to stipulated norms which are important for security reasons. The devastation in Gujarat earthquake has revealed the callousness of builders here. Builders and constructors flout norms to make fast money. But the common investors find it difficult to keep track of all the constructors and developers.

However, rating agencies have come forward to give impartial information on the various intermediaries. ICRA has recently launched its new service to grade real estate developers.

The grading is designed to provide objective opinions as input in the pricing and credit decisions of banks and financial institutions. The rating agency has launched the service with the National Real Estate Development Council (NAREDCO).

As part of efforts to enhance the efficiency and transparency in the construction industry, ICRA, along with the Construction Industry Development Council, has already started assigning gradings to construction companies. The agency has recently announced the first gradings of construction entities. The grading, which encompasses all players in the construction sector, provides valuable inputs to investors and lenders.

3. Credit Rating Information Services of India Ltd. (CRISIL):

About CRISIL:

The Credit Rating Information Services of India Limited (CRISIL), the first rating agency in India, was promoted in 1987 by the Industrial Credit and Investment Corporation of India Limited (ICICI) and Unit Trust of India (UTI).

Other shareholders include Asian Development Bank, Life Insurance Corporation of India, State Bank of India, Housing Development Finance Corporation of India and its subsidiaries, Standard Chartered Bank, Banque IndoSuez, Sakura Bank, Bank of Tokyo, Hongkong and Shanghai Banking Corporation, Citibank, Grindlays Bank, Deutsche Bank, Society Generaete, Banque Nationale de Paris, Bank of India, Bank of Baroda, UCO Bank, Canara Bank, Central Bank of India, Allahabad Bank, Indian Overseas Bank, Vysya Bank Ltd., and Bank of Madura Ltd.

CRISIL’s principal objective is to rate debt obligations of Indian companies. Its ratings provide a guide to the investors as to the degree of certainty of timely payment of interest and principal on a particular debt instrument. CRISIL rates debentures, fixed deposit programmes, short-term instruments like Commercial paper, structured obligations and preference shares.

CRISIL Ratings:

The CRISIL rating symbols indicate in a summarised manner CRISIL’s current opinion as to the relative safety of timely payment of interest and principal on a debenture, structured obligation, preference share, fixed deposit programme of short-term instrument.

A CRISIL rating relates to the particular debt instrument and is not a rating for the company as a whole inasmuch as it takes into account the specific terms of the instruments. The rating is not a recommendation to invest or not to invest.

Methodology:

CRISIL assigns ratings after an assessment of all factors that could affect the creditworthiness of the borrowing company, the ratings are based on current information provided to CRISIL by the borrowing company, or obtained by CRISIL from sources it considers reliable.

The key factors considered are as under:

a. Business Analysis:

i. Industry Risk (nature and basis of competition; key success factors; demand supply position; structure of industry; cyclical/seasonal factors; Government policies; etc.)

ii. Market position of the company within the industry (market share; competitive advantages; selling and distribution arrangements; and customer diversity; etc.)

iii. Operating efficiency of the company (locational advantages; labour relationships; cost structure; technological advantages and manufacturing efficiency as compared to those of competitors; etc.

iv. Legal position (terms of prospectus, trustees and their responsibilities; systems for timely payment and for protection against forgery/fraud; etc.)

b. Financial Analysis:

i. Accounting quality (overstatement/understatement of profits; auditors’ qualifications; method of income recognition; inventory valuation and depreciation policies; off balance sheet liabilities; etc.)

ii. Earnings protection (sources of future earnings growth; profitability ratios; earnings in relation to fixed income charges; etc.)

iii. Adequacy of cash flows (in relation to debt and fixed and working capital needs; sustainability of cash flows; capital spending flexibility; working capital management etc.)

iv. Financial flexibility (alternative financing plans in times of stress; ability to raise funds; asset redeployment potential; etc.)

c. Management Evaluation:

i. Track record of the management; planning and control systems; depth of managerial talent; succession plans

ii. Evaluation of capacity to overcome adverse situations

iii. Goals, philosophy and strategies

The above factors are considered for companies with manufacturing activities.

The assessment of finance companies lays emphasis on the following factors in addition to the financial analysis and management evaluation as outlined above:

a. Regulatory and Competitive Environment:

i. Structure and regulatory framework of the financial system

ii. Trends in regulation/deregulation and their impact on the company

b. Fundamental Analysis:

i. Capital Adequacy (assessment of true net worth of the company, its adequacy in relation to the volume of business and the risk profile of the assets).

ii. Asset Quality (quality of the company’s credit-risk management; systems for monitoring credit; sector risk; exposure to individual borrowers; management of problem credits; etc.)

iii. Liquidity Management (capital structure; term matching of assets and liabilities; policy on liquid assets in relation to financing commitments and maturing deposits.)

iv. Profitability and Financial Position (historic profits; spreads on fund deployment; revenues on non-fund based services; accretion to reserves; etc.)

v. Interest and Tax Sensitivity (exposure to interest rate changes; tax law changes and hedge against interest rate; etc.)

Rating Process:

CRISIL evaluation is carried out by professionally qualified persons and includes data collection, analysis and meetings with key personnel in the company to discuss strategies, plans and other issues that may affect CRISIL’s credit evaluation of the company.

The rating process begins at the request of a company. On receipt of the request, CRISIL assigns a team that will be responsible for carrying out the rating assignment.

The team obtains and analyses information, meets the company’s executives and interacts with a back-up team which would have also collected industry information. Their findings are presented to an Internal Committee consisting of Senior Executives of CRISIL and, thereafter, presented to the Rating Committee (which comprises some Directors not connected with any CRISIL shareholder) which then decides on the rating. The rating is, thereafter, communicated to the company. Should the company want to present some additional information, it can do so at this stage.

The rating process ensures objective analysis and strict confidentiality of client information; the Board of Directors of CRISIL does not get involved in the rating process.

CRISIL offers companies the opportunity to be evaluated on a confidential basis. Once the company decides to use the rating, CRISIL is obligated to monitor the rating over the life of the debt instrument.

In assigning a rating, CRISIL takes into account the effects of a normal business cycle; however, depending upon new information, or developments concerning the company, CRISIL may change the rating. Any change so effected is made public by CRISIL.

Communication: