The administered-pricing doctrine employs either of two major theories to explain how oligopolists set prices. There are known as cost-plus pricing and target-return pricing.

Cost-plus pricing:

Perhaps the most widely accepted method in oligopoly industries like automobiles or newspapers or steel or even aluminium is cost-plus pricing or full-cost pricing. It is a method used by firms to produce goods and services. Firms simply calculate the variable cost of the product, add to it an allocation for fixed costs and then add a profit percentage or mark-up on top of this total cost to arrive at price.

Thus, for instance, if the direct (variable) cost of a product is Rs. 8, its allocated overhead is Rs. 6 and the desired mark-up is 25%, the price of the product will be Rs. 17.50 (= Rs. 8 + Rs. 6 + 0.25 x Rs. 14). Mark-up is usually calculated as a percentage of cost. Profit margin is commonly computed as a percentage of prices. Thus, a 25% mark-up is equivalent to a 20% profit margin.

ADVERTISEMENTS:

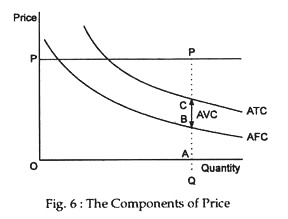

The cost-plus pricing method is illustrated in Fig.6. The price (OP) is made up of three elements:

(1) A contribution to cover part of the firm’s overhead costs (average fixed costs) — AB;

(2) The actual unit cost (average variable cost) of producing a planned output of OQ units — BC;

(3) A profit margin expressed as fixed percentage of total unit costs (average variable cost plus average fixed cost) — CD.

Full-cost pricing is a rule which postulates that firms will add a mark-up onto average variable cost (AVC) so as to cover its average total cost.

Hence, price (P) can be written as:

P = AVC + GPM = ATC

where GPM = gross profit margin (mark-up) and is comprised of an overhead element and a fixed net profit margin thought ‘normal’ or ‘fair’ for the industry. Given adoption of this rule supply factors will be predominant consideration in the price-setting process. The term ‘full-cost pricing’ carries the significance that it is a pricing rule where firms add a net profit margin onto unit costs where the calculation for the latter includes all costs.

ADVERTISEMENTS:

The modern version of cost-plus pricing theory contends that, at any given level of output, a selling price (P) is determined by adding a percentage mark-up to the direct cost or average variable cost of the product. Thus:

P = AVC+ % mark-up (AVC)

Example:

An example will make the concept clear. Suppose, at a firm’s planned level of production, its average variable cost is Rs. 40 per unit. If management believes that a 50% mark-up on AVC will maximise its profit, it will charge a price of Rs. 60 per unit: P = Rs. 40 + 0.50 x Rs. 40 = Rs. 60 per unit.

If management finds that this price is too high to maximise profits, it may decide to reduce the mark-up to, say, 20% of AVC.

This results is a price of Rs. 48 per unit:

P = Rs. 40 + 0.20 x Rs. 40 = Rs. 48 per unit

The mark-up percentage is known in the real commercial world as the contribution margin. Usually it is said that the mark-up should guarantee the seller a ‘fair profit’ or some target profit margin or target rate of return. The margin represents that part of the price, above a firm’s AVC, which contributes to the recovery of the fixed costs or overhead and earning of profit.

Target-return Pricing:

ADVERTISEMENTS:

In administered-pricing doctrine, the alternative theory to cost-plus pricing is called target-return pricing. It assumes that firms set their prices so as to achieve a desired (targeted) percentage rate of return on stockholders’ equity or ownership at the planned level of output, Q.

Thus, the target return price, P, may be expressed as:

P = % target return (shareholders’ equity)/planned output quantity, Q + AVCQ

For example, suppose a clothing manufacturer plans to produce 10,000 suits next year at an average variable cost of Rs. 80 per suit. If stockholders’ equity is Rs. 5 million and the firm targets a 20% return, it will charge a price of Rs 180 per suit:

ADVERTISEMENTS:

P = 20 (Rs. 5,000,000)/10,000 + Rs. 80 = Rs. 1,000,000/10,000 + Rs. 80 = Rs. 180 per cent

What are the economic implications of target-return pricing?

As we can see from the equation, three points are especially important:

1. The “mark-up” is added to the firm’s average variable cost. In this case, the mark-up, which is Rs 100, is added to the firm’s AVC, which is Rs 80. The reason is that the amount of the mark-up determines the firm’s contribution margin (= P – AVC).

ADVERTISEMENTS:

This, as we saw in the case of cost-plus pricing, contributes to the recovery of fixed costs or overhead and the earning of profit. Of course, management may choose to use a full-cost mark-up based on average total cost, ATC, if sufficient information is available to do so. In reality, the AVC basis is the one that is commonly employed because it represents the firm’s direct cost of producing the product.

2. Price varies directly with average variable cost and inversely with the quantity produced. For example, prices will increase if AVC rises or if Q declines. This helps to explain why oligopolists often increase their prices in the face of rising costs and/or declining output.

3. The theory assumes that the firm can sell its planned quantity of output at the target-return price. To the extent that this is true, it is a factor that helps to explain why oligopolistic firms tend to resist price decreases, preferring instead to reduce output, in the face of declining demand.