This article will help you to learn about the difference between Control of Money Stock and Interest Rate.

Difference between Control of Money Stock and Interest Rate (With Diagram)

The central bank has the monopoly power to control the stock of money in circulation.

But just as a monopolist cannot control both price and quantity at the same time, the central bank cannot control the money stock and the interest rate at the same time.

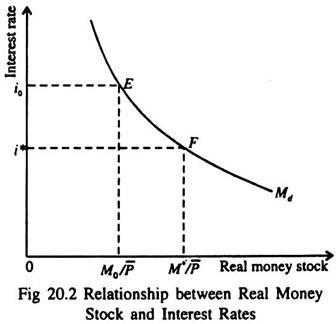

This point is illustrated in Fig. 20.2. Suppose the central bank, for some reason, wants to fix the interest rate at a level i* and the money stock at M*.

The curve Md is the demand curve for money. Although the central bank can alter the supply of money (just as a monopolist can alter the quantity of his product it offers for sale) it cannot alter the demand for money (just as a monopolist has hardly any influence over consumer demand).

The central bank can set only the combinations of the interest rates and the money supply along the demand curve for money — the Md curve (just like a monopolist who chooses the best possible combination of price and quantity on the elastic part of his demand curve). At the target rate of interest i0, it can have money supply M0/P̅.

At the target money supply MVP it can have interest rate i0. But it cannot fix both the targets and have the best of both the worlds — in this case M*/P̅ and i*. The reason is easy to find out. When the central bank decides to fix the interest rate target it loses control over the money supply. If the demand curve for money shifts, the central bank will have to adopt an accommodating monetary policy.

This means that if the central bank follows the policy of fixing (pegging) the interest rate it has to supply whatever amount of money is demanded by the people at that fixed interest rate. In the very short run the central bank cannot control the money stock, but it can alter the interest rate through open market operations — by buying and selling government securities.

ADVERTISEMENTS:

If it wants to raise the price of government securities (by lowering the interest rate) it can buy the securities at that price. If it wants to reduce the price of government securities (by raising the interest rate), it can dispose of an adequate amount of securities from its existing stock. Thus the central bank can determine the market interest rate fairly accurately on a daily basis.

However, over a slightly longer period the central bank can determine the money supply quite accurately. As it collects information on the behaviour of the money stock and the money multiplier from time to time, the central bank can make necessary changes in its monetary base.

For example, if the central bank were targeting a money supply growth of 5% over a given period, it might start the base growing at 5%. If it is found at the middle of the period that the value of the money multiplier has been falling, and the money stock, therefore, growing at less than 5%, the central bank will have to make compensatory adjustments by increasing the rate of growth of the money supply.

In short, since the central bank has to have both interest rate and money supply targets, it cannot reach both the targets simultaneously.

ADVERTISEMENTS:

Effects of Policy Alternatives:

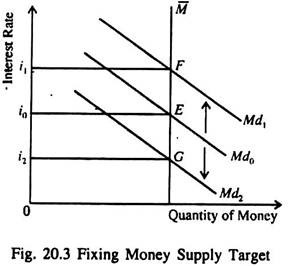

Fig. 20.3 shows that if money supply targets are fixed, i.e., if the nominal money supply is fixed at M̅, the rate of interest moves up or down if the demand for money is unstable, (i.e., if the money demand curve shifts up or down).

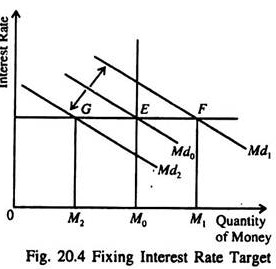

Fig. 20.4 shows that when the central bank fixes the real nominal interest rate at j volatility occurs in the money supply if the demand curve for money shifts either to the right or to the left, as is indicated by two arrows.