For determination of price of a commodity we are more interested in the size of total market demand for the commodity.

Apart from the factors affecting individuals demand such as price of a product, his income, prices of related commodities, individual’s preferences, market demand for a product depends on an additional factor, namely the number of consumers which in turn depends on the population of a region or city or country (for which demand is being considered) who consume the product.

Mathematically, market demand function of a product can be expressed in the general functional form as under.

QD = f (Px, I, Pr, T, A ,N)

ADVERTISEMENTS:

where the additional factor is N which stands for the number of consumers or population.As explained above, for the purpose of estimation of demand for a product we need a specific form of the above market demand function. Generally, it is the linear form which is chosen for estimating market demand function.

So in the linear form, the market demand function is given below:

QD = C + b1 Px + b2 I + b3 Py + b4 T + b5 A + b6 N

C is a constant term which shows the intercept of the market demand curve on the X-axis b1, b2, b3 etc. are coefficients (these are generally called parameters) which show the quantitative relationship of various independent variables with the market demand. In other words, these coefficients, b1, b2, b3 show how much market demand changes as a result of a unit change in various variables such as price, income, advertising expenditure, population (i.e., the number of consumers).

ADVERTISEMENTS:

Suppose we are interested in market demand for a specific brand of tea, say Brooke Bond Tea We assume that tastes (T) and the number of consumers for tea (N) remain the same and further if we have estimated the coefficients of various variables determining the market demand for Brooke Bond Tea we can write market demand function for Brooke Bond Tea.

QD = 2.0 – 1.5 Px + 0.6 I + 0.8 Py – 0.7 Ps + 1.5 A

Where QD represents market demand for Brooke Bond Tea, Px is the price of Brooke bond Tea per kilogram, I is disposable per capita income of the country, Py is the price of Tata Tea which is the competitor of Brooke Bond Tea, Ps is the price of sugar which is complementary with tea. A is advertisement expenditure made by manufacturers of Brooke Bond Tea.

From the above market demand function, it follows that change of Re. 1 of Brooke Bond Tea will cause 1.5 unit change in quantity demanded of Brooke Bond Tea. Similarly, a fall in price by one rupee of Tata Tea, a competing product, will cause 0.8 unit reduction in quantity demanded of Brooke Bond Tea.

ADVERTISEMENTS:

On the other hand, one rupee fall in price of sugar will cause 0.7 unit change in the quantity demanded of Brooke Bond Tea and similarly for other variables. Given these values of the coefficients, if we write the values of different determining variables such as price of Brooke Bond Tea, per capita personal disposable income, and price of sugar (Ps) we can calculate the change in market demand for Brooke Bond Tea.

As pointed out in case of individual demand, in economics it is considered important and useful to focus on the relationship between quantity demanded of a product and its price, holding other factors constant. Therefore, if income (I), prices of other related commodities (P), tastes or preferences of the people (T), advertising expenditure are held constant, the market demand function can be written as

QD = a – b1 Px

where a is the constant term in the function or intercept of the market demand curve on the X-axis, b1 is the coefficient which indicates how much quantity demanded of product X in the market will change as a result of a unit change in its own price, other factors held constant.

Market Demand Curve:

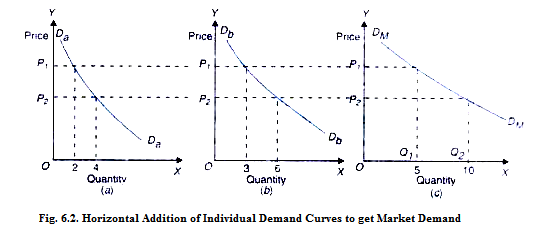

We have drawn above an individual’s demand curve of a commodity. We can graphically obtain the market demand curve by making horizontal addition of the demand curves of all individuals buying the commodity. In order to do so we add the various quantities demanded by the number of consumers in the market. In this way we can obtain the market demand curve for a commodity which like the individual consumer’s demand curve will slope downward to the right.

How this summation is done is illustrated in Fig. 6.2. Suppose there are two individual buyers of a good in the market. Fig. 6.2 (a) and (b) show the demand curves of the two independent individual buyers. Now, the market demand curve can be obtained by adding together the amounts of the goods which individuals wish to buy at each price. Thus, at price P1, the individual A wishes to buy 2 units of the goods; individual B wishes to buy 3 units of the goods. The total quantity of the goods that the two individuals plan to buy at price P1 is therefore 2 + 3 = 5, which is equal to OQ1 in Fig. 6.2(c).

Now, as shall be seen from the figure, at price OP2, individual A demands 4 and individual B demands 6 units of the commodity. So the market demand at price OP2 of the commodity is 4 + 6 = 10 units or OQ2. Similarly, we can plot the quantity of the goods that will be demanded by the two individuals at every other price of the good.

When all the points showing the amounts demanded of the good by the two individuals at various prices are joined we get a market demand curve for the goods. For the sake of convenience we have supposed that there are two individuals or buyers in the market for a good. Whatever be the number of individuals in the market, their demand curves can be added together, as illustrated above, to get a market demand curve for the good.

ADVERTISEMENTS:

The market demand curve slopes downward to the right, since the individual demand curves whose lateral summation gives us the market demand curve, normally slope downward to the right. Besides, as the price of the goods falls, it is very likely that the new buyers will enter the market and will further raise the quantity demanded of the goods. This is another reason why the market demand curve slopes downward to the right.

As in case of individuals’ demand curves, factors other than price which affect market demand such as prices of related goods, per capital income of the individuals, their preferences for goods, number of consumers, etc. are held constant while drawing the demand curve.