This article will help you to learn about the difference between specific tax and AD valorem tax on monopoly.

Difference between Specific Tax and AD Valorem Tax on Monopoly

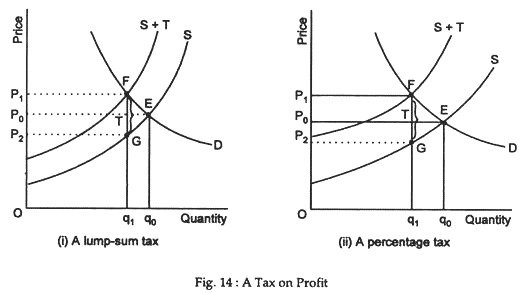

If a sales tax is imposed on a commodity its market supply curve will shift to the left exactly by the amount of the tax, as is shown by Fig. 14. It shows that the competitive market is in equilibrium with the demand and supply curves D and S intersect at E0 to produce equilibrium price and output of p0 and q0. A tax of Rs T per unit is then levied on the commodity.

If the tax is imposed the new supply curve S + T shifts to the left because production cost now includes not only fixed and variable costs but the tax that must be paid to the government. If a per unit tax is imposed every point on the supply curve shifts vertically upwards by the amount of the tax, the intersection of the new supply curve S + T with the original demand curve D yields the new equilibrium quantity (q1) and price (p1).

ADVERTISEMENTS:

Thus we see that a sales tax generally changes a firm’s optimum output level. It shifts the firm’s supply curves and therefore the market supply curves as well. This alters the equilibrium price-quantity combination. The firm is willing to supply less than before at every price. All other things remaining the same, the equilibrium price varies directly and the equilibrium quantity inversely with the tax rate.

One can verify that the proportion of the per unit tax passed on to the consumer is the greater; the more inelastic are the demand and supply curves. Now the revenue of the producers is Op1Fq1 of which a portion (p2 p1 FG) has to be surrendered to the government in the form of tax. In other words, producers receive revenue of p2 (= p1 – T) per unit and sell q1 units. So their total revenue is p2 x q1 = op2Gq1.

Thus one thing is clear from the diagram: the price of the product rises by less than the amount of the tax. In other words, the tax burden is shared between buyers and sellers. The following diagram may clarify the point.

Here we observe that a tax of 90 paise per unit is imposed. As a result the price rise from Rs. 5 to Rs. 5.50. The 50-paise increase in the price represents the portion of the unit tax that is passed on to the consumer; the remainder, i.e., 40 paise is the burden on the producer (seller).

ADVERTISEMENTS:

So the price received by the producer, after tax, falls to Rs. 4.60, but the price paid by the consumer rises to Rs. 5.50. The difference between the two, i.e., Rs. 5.50 – Rs. 4.60 = 90 paise is the revenue of the government per unit of the commodity traded.

Indirect taxes like sales tax or excise duty may be either specific or ad valorem. A specific or per unit tax is stated in terms of the number of rupees which the seller has to pay per unit but sold an ad valorem tax is stated in terms of a percentage of the sales price.

A simple example may clarify the point. Suppose a tax of 20% is imposed on electric fans. When the ex-factory price is Rs. 500 the tax payable is Rs. 100 and its retail price is Rs. 600. If the ex-factory price goes up to Rs. 600, the retail price will be Rs. 720. On the other hand, suppose a specific tax of Rs. 100 is imposed on electric fans. Thus when the per unit or specific tax is imposed the retail price will be Rs. 600 and Rs. 700 in the two cases, respectively.

If an ad valorem tax is imposed the gap between the two supply curves will be wider as Fig. 14(ii) shows. As the consumption of the commodity increases, the tax burden of consumer will also increase. The tax burden of producers will also increase. The converse is also true. Thus an advalorem tax leads to greater loss of social welfare. This is why a specific or a per unit tax is always preferred to an ad valorem tax.

Monopoly:

A lump sum or a profit tax (at a constant rate of 20%) will reduce the after-tax profit of the monopolist but will leave his optimum price-quantity combination unchanged.

ADVERTISEMENTS:

It is not possible for a monopolist to avoid a tax. A monopolist has to pay it regardless of the physical quantity or value of his total revenue and total cost. The only way to avoid a profit tax is to reduce his profit before taxes. He will maximise his profit after taxes by equating MR with MC when MC includes the unit tax. However, the imposition of a specific sales tax results in smaller quantity sold and a higher price.

A sales tax, which is normally ad valorem in nature (i.e., whether based upon quantity sold or value of sales) will reduce his profit and output levels and raise the price of the product. Suppose the equilibrium output of a monopolist is 10 units, price is Rs. 60 and total profit is Rs. 350. Now assume that the government imposes a tax of Rs. 8 per unit upon the output of the monopolist.

It is observed that as a result of the tax sales fall by only 1 unit (from 10 to 9) but profit falls from Rs. 350 to Rs. 274 (i.e., by Rs. 76). Price rises by less than the amount of the tax per unit, but the total profit 350 to Rs. 274). Price rises by less than the amount of the tax per unit, the total profit of the monopolist decreases by more than Rs. 2 which is the revenue of the government (i.e., 9 units x Rs. 8).

Alternatively the government could impose a lump sum tax of Rs. 72 upon the monopolist. In this case it would receive the same revenue but total profit of the monopolist would fall by Rs. 4, i.e., from Rs. 76 (as in the case of ad valorem tax) to Rs.72 (as in the case of lump-sum tax) and the consumer would not have to pay a higher price for the taxed product. This example makes it clear that a lump-sum or per unit tax is preferable to an ad valorem (or percentage) tax.