This article will help you to learn about the difference between GDP deflator and CPI.

Difference between GDP Deflator and CPI

The first difference is that the GDP deflator measures the prices of all goods and services produced, whereas the CPI or RPI measures the prices of only the goods and services bought by consumers. Thus, an increase in the price of goods bought by firms or the government will show up in the GDP deflator but not in the CPI or RPI.

The second difference is that the GDP deflator includes only those goods produced domestically. Imported goods are not part of GDP and do not show up in the GDP deflator. For example, an increase in the price of Toyota made in Japan and sold in the U.K. affects the CPI or RPI, because the Toyota is bought by consumers in the U.K., but it does not affect the GDP deflator.

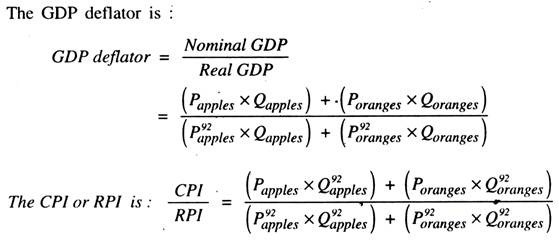

The third difference concerns how the two measures aggregate the many prices in the economy. The CPI or RPI assigns fixed weights to the prices of different goods, whereas the GDP deflator assigns changing weights. In other words, the CPI or RPI is computed using a fixed basket of goods, whereas the GDP deflator allows the basket of goods to change over time as the composition of GDP changes. To see how this works, consider an economy that produces and consumes only apples and oranges.

These equation show that both the CPI and the GDP deflator compare the cost of a basket of goods today with the cost of that same basket in the base year. The difference between the two measures is whether the basket changes over time. The CPI uses a fixed basket, whereas the GDP deflator uses a changing basket. The following example shows how these approaches differ.

Suppose that major frosts destroy the nation’s orange crop: the quantity of oranges produced falls to zero, and the price of the few oranges that remain is driven sky-high. Because oranges are no longer part of GDP, the increase in the price of oranges does not show up in the GDP deflator.

But the CPI is computed with a fixed basket of goods that includes oranges, so the increases in the price of oranges causes a substantial rise in the CPI. A price index with a fixed basket of goods is called a Laspeyres index and a price index with a changing basket is called Paasche index. Economists have studied the properties of these different types of price indexes to determine which is better. The answer is that neither is clearly superior.

The purpose of any price index is to measure the cost of living — that is, how much it costs to maintain a given standard of living. When prices of different goods are changing by different amounts, a Laspeyres index tends to overstate the increase in the cost of living, whereas a Paasche index tends to understate it.

ADVERTISEMENTS:

A Laspeyres index uses a fixed basket and thus does not consider that consumers have the opportunity to substitute less expensive goods for more expensive ones. Conversely, a Paasche index accounts for the substitution of alternative goods, but it does not reflect the reduction in consumer’s welfares that may result from such substitutions.

For example, the CPI is a Laspeyres index; it overstates the impact of the increase in orange prices on consumers: by using a fixed basket of goods, it ignores consumers’ ability to substitute apples for oranges. By contrast, the GDP deflator is a Paasche index, it understates the impact on consumers: the GDP deflator shows no rise in prices, yet surely the high price of orange makes consumer’s worse off.