This article will help you to learn about the difference between Balance of Trade and Balance of Payments.

Difference between Balance of Trade and Balance of Payments

Balance of Trade:

A comparison of the total imports and exports of a country is its balance of trade.

The balance of trade is regarded as favourable’ or ‘active’ or ‘positive’ when the value of exported goods exceeds that of imported goods.

It is ‘unfavorable’ or ‘adverse’ or ‘negative’ when imports exceed the value of exports. In the middle Ages, it was thought that a favourable balance was the only way to make a country “rich”, as it brought in gold and silver from outside. Now, however, this idea has been discarded, and it is believed that, in the long run, exports and imports, including services of all kinds, should balance.

ADVERTISEMENTS:

If, however, an unfavorable balance of trade persists for a long time and is very large in amount, gold shall have to be exported. In that case, steps shall have to be taken to set it right. It should, however, be noted that the ‘visible’ unfavorable balance of trade may be corrected by the export of ‘invisible’ items which do not enter into the account books.

These terms ‘favourable’ and ‘unfavorable’ are only technical terms. Thus, the ‘favourable’ balance may not really be favourable and make the country rich and prosperous. For a long time under the British regime. India had a favourable balance of trade: still India was poor. Britain has always had an unfavorable balance, but she has always been prosperous. It is not the balance of trade, but the balance of payments, which throws light on the economic condition of a country.

Balance of Payments:

Definition:

The balance of payments is a comprehensive record of economic transactions of the residents of a country with the rest of the world during a given period of time. This record is so prepared as to provide meaning and measure to the various components of a country’s external economic transactions. Thus, the aim is to present on account of all receipts and payments on account of goods exported, services rendered and capital transferred by the residents of a country.

ADVERTISEMENTS:

The main purpose of keeping these accounts is to inform the government of the country of the international economic position of the country and to help it in making decisions on monetary and fiscal policies to be pursued as well as on the trade and payments issues.

The balance of trade includes only the visible items in foreign trade. They are material goods exported and imported. Only these are entered in the port registers maintained by the customs authorities. But there are a large number of other items which fall outside and are called ‘invisible’. The balance of payments includes all ‘visible’ and ‘invisible’ items.

The invisible items are:

Services:

ADVERTISEMENTS:

India uses a good deal of foreign banking, shipping and -insurance services. She does not have enough of her own ships, insurance companies and exchange banks. Hence foreign agencies, like Lloyds Bank provided these services. India has to pay for all such services. Now, however, India has filled up the gap almost.

Tourist’s Expenses:

When Indian students and tourists purchase goods and services in Europe, it is like importing these goods and services. The only difference is that instead of goods coming to the consumers, the consumers have gone to them. They have to be paid for in goods exported from India. In the case of Indian students receiving education abroad, India is importing education as ii were and has to pay for it.

Interest on Borrowed Capital:

The services of capital have to be paid for by the borrowing country. An investment- made abroad is an export item and remains so till withdrawn. Ultimately, all loans borrowed in foreign money markets have to be paid back and adjusted through exports. Besides the above, there are various minor items like gifts, donations and money remitted home by foreign settlers; these are also invisible items.

All these invisible items produce exactly the same effect on a country’s account with the rest of the world as the export and import of commodities. When they are added to the balance of trade, we have a complete list of all the items which have to be paid for or received by trading countries. Their sum-total is called the balance of payments.

The balance of payments has two parts: Current and Capital Accounts

(a) Balance on current account

(b) Balance on capital account

ADVERTISEMENTS:

The balance of payments on current account includes items like imports and exports, expenses on travel, transportation, insurance, investment income, etc. These relate to current transactions.

The Capital Account:

The capital account, on the other hand, is made up of capital transactions, e.g. borrowing and lending of capital, repayment of capital, sale and purchase of securities and other assets to and from foreigners—individuals, governments and international organisations.

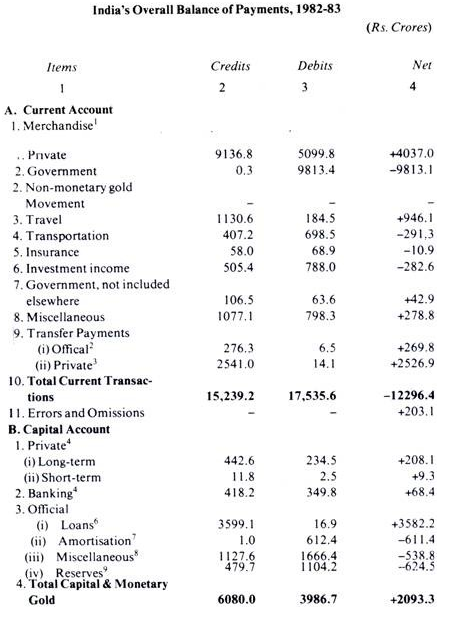

When both current and capital accounts are taken, it is called Over-all Balance of payments. It is the over-all balance of payments which must balance. By way of illustration we give below India’s overall balance of payments for 1982-83, the latest year for which figures are yet available.

ADVERTISEMENTS:

1. Merchandise Credits:

Exports f.o.b., Debits: Imports c.i.f. (f.o.b. stands for free-on-board and c.i.f. for cost, insurance and freight).

2. Transfers Official:

ADVERTISEMENTS:

Credits include grants received from various foreign governments and international agencies.

3. Transfers:

Private credits include contra entries for imports under PL 480 Title II Programme.

4. Private:

Includes foreign official loans received and repaid by the private sector.

5. Banking:

ADVERTISEMENTS:

Represents movement in banking capital, excluding Reserve Bank of India (RBI).

6. Loans:

Credits represent utilisation of various foreign loans and credits received by the official sector, including drawings from the (IMF).

7. Amortization:

Credits cover repayments by the countries of official loans extended to them while debits show repayments of loans on official account.

8. Miscellaneous:

ADVERTISEMENTS:

Cover other official receipts and payments, including those of RBI.

9. Reserves:

Represent changes in official foreign exchange holdings, gold holdings of the RBI and SDR holdings of Government. It is not very harmful if the balance of payments is unfavorable now and then But the balance of payments must balance over a long period, just as a man’s income and expenses must be equal.

If he is spending more than he is earning, he must borrow. And if he is earning more, he must be saving something. He may keep it in a bank or hoard it or lend it. Thus, if his savings and borrowings are included in his budget, it will balance, Similar is the case with countries.

A country may be collecting a balance in its favour or against itself in another country. But over a sufficiently long period, its balance of payments must show the two sides to be exactly equal, if it does not want to become bankrupt. That is why it is said “exports pay for imports” or, in the long run, exports and imports must be equal.

How does the Balance of Payments Balance?

ADVERTISEMENTS:

The balance of payments (on current account) is said to balance when the total of the credit items is exactly equal to the total of the debit items. But it is seldom so. Hence, there is either a deficit or a surplus in the current account of the balance of payments. This deficit or surplus is met by transfers in the capital account. In other words, the balance of payments is made to balance through the capital account.

Suppose there is a deficit in the current account of the balance of payments.

This deficit will be covered by:

(a) Drawing upon the country’s foreign exchange reserve

(b) By borrowing from abroad

(c) By exporting gold. Now the I.M.F. grants temporary accommodation to bridge the gap