This article will help you to learn about the difference between proportional tax and progressive tax.

Difference between Proportional Tax and Progressive Tax

Adam Smith stressed the principle of equality in tax levy. But how can this equality be achieved? According to Smith, equality is secured by taxing everyone at an equal rate. This is known as Proportional Taxation.

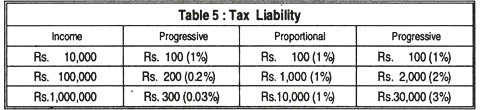

Under this system, if a man with an annual income of Rs.1, 000 pays Rs.100 as tax, then a man with an annual income of Rs.10, 000 will pay Rs.1, 000. According to the classical economists, the levy of tax at a uniform rate on all persons secures equality of sacrifice.

However, taxes which require the same payment by the poor as by the rich are unfair in the sense that the poor people pay a higher proportion of their income in tax than the rich people do. Such taxes are called regressive. One example is a flat rate tax (that is, a tax of a fixed sum per head). A proportional tax is fairer than equality of payment because it takes away a larger sum in tax from the rich than from the poor.

ADVERTISEMENTS:

But, modern economists do not admit that a proportional rate of tax would secure equality of sacrifice. According to the modern view, the taxable capacity of a person increases more than in proportion to the increase of income. In other words, with the increase of income, the taxable capacity increases at a rate more than what is proportional.

Thus, if a man with an income of Rs.1000 a year pays income tax at a rate of 10 per cent, then a person whose income is Rs.10, 000 a year ought to pay tax at a higher rate. This very fact has led to general acceptance of the principle of progression, whereby taxation takes a larger proportion of people’s incomes, the higher their incomes are.

A progressive tax is one which charges different rates from different incomes. Under this system, the higher the income the higher is the rate of taxation. This means that the amount of tax to be paid increases more than proportionately with income.

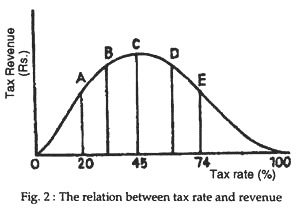

Thus, if a man with an income of Rs.10, 000 a year pays 10% of his income as tax, a man with an income of Rs.20, 000 a year will have to pay 15%, 20% or more. Under the proportional tax system the marginal tax rate (MTR) exceeds the average tax rate (ART). The MTR is the proposition of an additional rupee of real GDP that flows to the government in net taxes (taxes minus transfer payment). The ATR is the ratio of total tax to current GDP. See Fig. 2.

Progressive taxes are equitable because they make the rich people (who have greater ability) to pay more. The rates of a progressive tax can be so fixed as to secure equality of sacrifice between the rich and the poor. A tax is said to be regressive if it falls more heavily on lesser incomes. Commodity taxes like excise duty and sales tax are obvious examples.

All modern mixed economies have adopted progressive taxation. Apart from securing equality of sacrifice, it reduces disparity in income and wealth among the various classes of the people. In India, all personal taxes such as the income tax, wealth tax and gift tax are progressive in nature.

On the other hand, indirect taxes are regressive because lower-paid people often spend as much on consumption goods as the higher-paid. But it is difficult to define both the concepts precisely because different people have different ideas of equity. However, the generally accepted modern concept of equity is that taxes should be on a progressive scale.

ADVERTISEMENTS:

The theory of declining marginal utility (of income) provides a theoretical basis of progressive taxation. Since to a man the first Rs.1, 000 is more valuable than the second Rs.1, 000, there is a case for taxing him at a progressive rate. But people differ in tastes and preferences as also in their range of wants. Different people also face different circumstances. So, the case for progressive taxation is not very strong on this ground.

A second point with regard to progressive taxation is that where high incomes accrue they almost invariably include large elements of rent. Economic rents are regarded as unearned and, therefore, a good object of taxation.

It is really difficult to achieve progression in case of indirect taxes. It may, no doubt, be possible to impose higher rates of entertainment tax on higher class tickets for cinema or sports. But in the case of ordinary consumer goods, like cigarettes or kerosene, this discrimination in tax rates is not possible. On such goods, excise duties are imposed at one flat rate which is applicable to all classes of consumers.

Another disadvantage of progressive taxation is that it reduces the incentives to work and save. For example, the rate of income tax on high incomes is so high in most countries that rich people do not want to undertake new enterprises.