Let us make an in-depth study of the Marginal Efficiency of Investment (MEI) of all firms.

Marginal Rate of Investment (MEI) # Subject Matter:

The expected profit from an investment, as percent of the investment, measures the rate of return on the investment.

Economists call the expected rate of return on an addition to capital investment as the marginal efficiency of investment (MEI).

More precisely, it is the expected rate of return over cost of an additional unit of a capital good. Thus, there can be MEI or expected rate of return of 25 percent for one type of investment, 15 percent for another, and so on.

ADVERTISEMENTS:

As pointed out by terner, what Keynes had called MEC was in fact the MEI.

In order to gain a better understanding of the MEI we study its graph given in Figure.

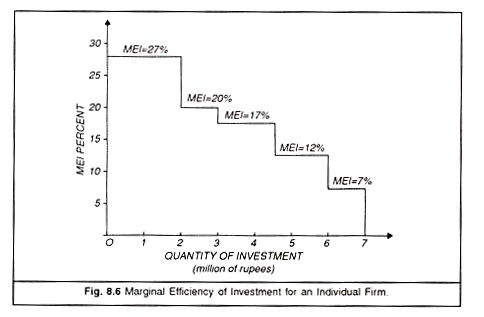

The figure 8.6 shows that, at any given time, a business firm is faced with a number of investment opportunities these may include:

1. Renovating its existing plant

ADVERTISEMENTS:

2. Purchasing new machines

3. Acquiring additional power facilities

4. Installing a computer system

Each project competes for a firm’s limited funds. However, some projects are expected to be more profitable—that is, to have a higher rate of return (or MEI) than others. In view of this, which projects should management select? Or, in other words, how much investment expenditure should management undertake?

ADVERTISEMENTS:

The first step in answering this question is to imagine that the management of a firm rank alternative investment projects in decreasing order of their MEIs.

If we assume that the risks of loss associated with these investments are the same, the descending order of MEI suggests two things:

1. Fewer investment opportunities are available to a firm at higher rates of return than at lower ones. For example, it is harder to find investment yielding 25 percent than to find investments yielding 10 percent.

2. A firm will tend to choose those investment projects which have the highest MEIs. Therefore, a project with a higher anticipated rate of return over cost is likely to be selected over a project with a lower one.

Figure 8.6 shows the solid stepped line as an individual firm’s MEI curve. It shows the amount of investment the firm will make at various interest rates or cost of funds at any given time. The MEI curve is then the firm’s demand curve for investment. These are many such stepped curves at any given time, one for each firm in the economy.

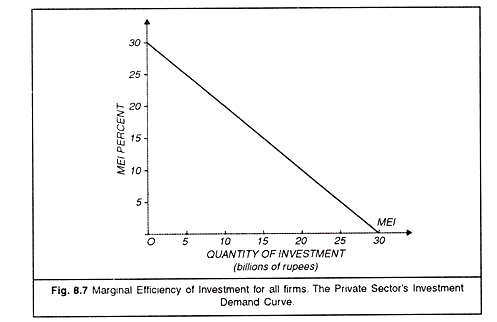

Figure 8.7 shows the MEI curve for all firms. It is a smooth line obtained by summing individual MEI curves. It shows the total amount of private sector investment which will be made at various interest rates. The MEI curve in this chart is the economy’s aggregate demand curve for private-sector investment.

Marginal Rate of Investment (MEI) # Cost of Funds: The Rate of Interest:

Once the MEI (or rate of return) on an investment is estimated, the next step is to establish the cost of funds needed to finance the investment. Only then can one decide if the investment is worth undertaking. The cost of funds needed to finance an investment is expressed as a percentage.

ADVERTISEMENTS:

Thus, if a business firm borrows money for investment and agrees to pay an annual interest charge of, say, 10 percent, then that is the firm’s cost of funds.

Alternatively, if the firm uses its own money, instead of borrowing, the interest return sacrificed by not lending the money in the financial markets (through the purchase of bonds or other securities) may be thought of as the company’s cost of funds.

This cost of course is the opportunity cost of funds. In any case, the MEI and the cost of funds are each quoted as percentages. Therefore, they can be easily compared. This makes it possible to determine the amount of investment which will take place.

Marginal Rate of Investment (MEI) # The MEI and the Rate of Interest:

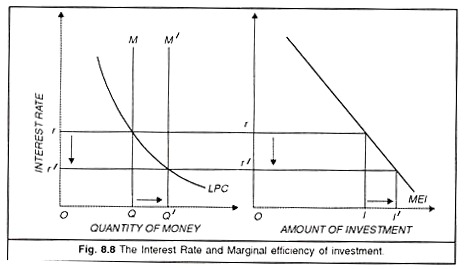

Figure 8.8 illustrates the relationship between the MEI and the rate of interest in deciding the amount of investment in the economy at a particular time. In Figure (a), the equilibrium rate of interest is determined by the intersection of the demand and supply curves of money—the IPC and M curves.

ADVERTISEMENTS:

This rate is the cost of money capital to firms. Hence in Figure (b), the amount of investment undertaken by the business sector at this rate of interest, shown by the aggregate MEI curve, is I.

What happens if this volume of investment is insufficient to achieve full employment? In that case the monetary authorities can lower the rate of interest by increasing the money supply any from Q to Q’. Assuming that the LPC curve remains fixed, the equilibrium rate of interest will decline from r to r’, causing the amount of investment to increase from I to I’.

This increase in investment will have a magnified effect on income owing to the working of the investment multiplier. Further, since the liquidity preference curve (LPC) depends on income, it will shift to the right when income rises. Thus, the effects of monetary policy on investment and employment depend on a variety of factors.

Marginal Rate of Investment (MEI) # Criticism of the Marginal Efficiency of Capital Concept:

ADVERTISEMENTS:

Keynes’s concept of Marginal Efficiency of capital has been criticized on two counts.

Firstly, it has been pointed out by A.P. Lerner that what Keynes called MEC is really efficiency of Investment and not capital. Keynes’ MEC was a vague and even ambiguous concept.

Secondly, Keynes failed to realise that interest rates were as much governed by expectation, as was the MEC otherwise he would have considered the rate of interest to be as much a dynamic clement as the MEC. In fact, Keynes had recognised only partly the role of expectations in his speculative demand for money.