Here we detail about the four reasons for lags in investment.

1. Indivisibility of the Machines or Plant:

Increased demand for output induces the firms to increase their output. They do increase their output until the full capacity utilization of the machine.

Beyond that though their desired stock of capital is more than the actual stock but cannot increase investment to meet the desired stock of capital because of the fixity of the huge productive capacity of the machines.

To buy machine of a big size may be un-remunerative. Machine of the small size when in-fact is required to meet the gap may at times not be available in the market. It takes time in the whole process. Therefore, investment lags behind the increasing demand for capital and output.

2. Fall in the User Cost of Machine:

ADVERTISEMENTS:

It may happen that the user cost (real interest + depreciation) of the machines due to inventions may fall to a very low level. Then capital becomes cheaper to labour. Capital starts replacing labour in production. But most of the times firms do not possess that much of funds to satisfy the investment requirements resulting into investment lags. Longevity in investment lag depends on the extent of the fall in user cost and the extent of the availability of the funds.

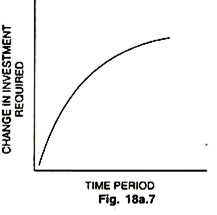

3. Investment Lag is more in the Early Years:

Investment lag is of a bigger size in the early years of the gap between desired stock of capital and the actual stock of capital. Because only a part of the gap can be completed in one period. In subsequent years as the gap is narrowed down so the size of the investment lag also becomes smaller.

4. Change of Plant:

If the firm finds it profitable to make the plant capital intensive due to the fall in user cost, the investment lag will be larger. Because the required huge investment cannot be completed within a couple of years. In such a case net investment would rise sharply in the early years.