The firm needs money for investment. This money can be raised either by borrowing or by selling shares, equity, etc. When the firm sells the share, the buyer buys the share to earn a capital gain from the increase in the market value of the shares.

The purchaser of share, therefore, purchases shares when he expects a high capital gain. This is because:

During boom:

The share price is high. The firm by selling only few shares can raise a lot of money. Thus when stock markets are high, firms are willing to sell equity to finance investment than when the stock market is low. James Tobin was the first person to explain this relation between the stock market and investment and that is why it is also referred as “Tobin’s q” theory.

ADVERTISEMENTS:

q = market value of the firm/ Replacement cost of capital

Or

q = Value the stock market places on the firm’s asset /Cost of producing those assets

(i) If q ratio is high → it means the price of share is high.

ADVERTISEMENTS:

... Firms will invest more.

(ii) If q > 1 → Firm will buy physical capital, that is, add to the capital stock.

Reason:

for every Rupee worth of new machinery, the firm can sell the stock for q rupee and earn a profit = q – 1.

ADVERTISEMENTS:

In other words, when q > 1, firms find it profitable to acquire additional capital because value of capital exceeds the cost of acquiring it.

Thus, when q > 1 → Investment will increase.

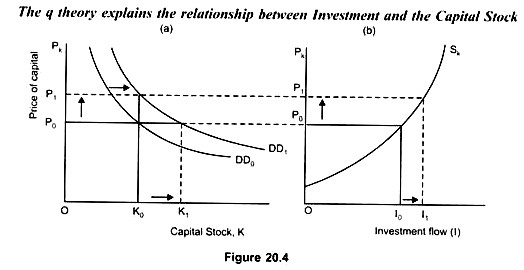

(a) Initial capital stock → K0 (Fig. 20.4a)

Pk → P0

Investment → I0 (Fig. 20.4b)

(b) In the Short run:

Assume demand for desired capital increases from K0 to K1. Demand curve of capital shifts to the right from DD0 to DD1.

Due to increase in demand for capital, price of capital increases from P0 to P1 (Fig. 20.4a)

ADVERTISEMENTS:

Although, desired capital stock is K1 and Investment is I1, but, actual capital stock is K0

Therefore, in the short run there exists a gap between the Actual Capital stock (K0) and the desired Investment (I1, that is K1).

Reason:

Factors of production and other inputs required to produce additional capital are in short supply. Therefore, capital stock cannot be increased immediately in short run.

ADVERTISEMENTS:

(c) In the long run:

The gap between the capital stock (K0) and Investment flow (I1) is filled in long run such that:

Desired capital stock (K1) = Actual capital stock (K1)

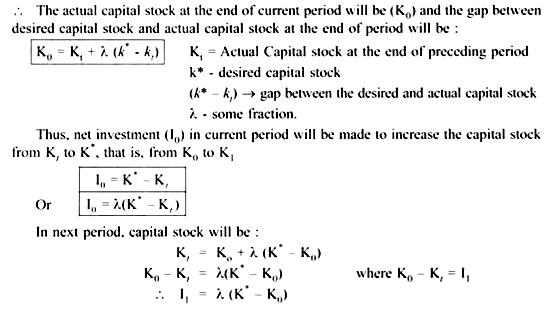

The speed at which the firms plan to adjust their capital stock over time can be explained with the help of Flexible Accelerator Model.

ADVERTISEMENTS:

The Model shows that Investment contains dynamic behaviour which depends on the values of the economic variables in different time periods.

The firm wants to bridge the gap between the existing capital stock and the desired capital stock. If the gap is large, firm’s investment will be greater. In each period the firm tries to bridge a fraction of the gap.

Thus, in next period, increase in investment will be I1

... K0 < K1

... Investment in period 1 (I0) < Investment in period 2 (I1).

ADVERTISEMENTS:

Increase in Investment will continue till Actual capital Stock reaches desired capital stock.

However, the speed with which the gap is reduced depends on (λ).

Greater the λ, lesser will be the time period required to fill the gap and thus, faster will be the capital accumulation. Thus, greater the λ, faster the gap will be reduced.

Conclusion:

Thus, current Investment depends on: (1) K* , and

(2) Kt

ADVERTISEMENTS:

Increase in desired capital stock would lead to increase in investment. Thus, the rate of investment will increase when:

(i) expected output will increase

Or

(ii) real interest rate decreases

Or

(iii) Investment tax credit increases