Let us make an in-depth study of the determinants of private investment.

Private investment (or induced investment) depends upon expected profitability or marginal efficiency of capital which, in turn, depends upon future expectations that are often fluctuating violently.

Hence, private investment becomes highly capricious it is very high in boom periods and low in the period of depression.

Private investment must be stabilized if full employment is to be maintained but unfortunately in a capitalist economy it is very unstable. In a depression private, investment must be raised but it is very low when it is needed to be very high.

ADVERTISEMENTS:

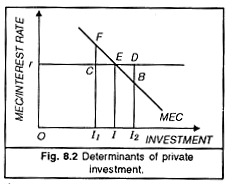

Prospective entrepreneurs keep on comparing the marginal efficiency of capital with the rate of interest and decide to invest only when the former is higher than the latter. There will be no investment if the rate of interest is higher than the MEC in other words, if profit expectations are not very bright there will be some investment if the rate of interest is slightly lower than the MEC. This is explained with the help of the diagram (Fig. 8.2) given here.

Suppose the rate of interest is given at the level Or and the MEC schedule is falling from left down to the right. Then the equilibrium level of private investment is given as 0I as indicated by the point E. Levels of investment I1 and I2 are of disequilibrium. Keynes told us that during depression, MEC falls to low-levels; that is why investments fall to low level during depression period, despite all types of encouragements given to private investors to invest more.

Classical economists regarded investment as dependent only on the rate of interest; this to them was an important lever by which investment in the system was regulated. This is why they relied too heavily on the rate of interest as an instrument to control fluctuations. They always held that by manipulating the rate of interest, stability in the economic system could be restored.

ADVERTISEMENTS:

Until the Great Depression of the thirties, Keynes also adhered to this view and believed in the efficacy of the rate of interest in solving the problem of cyclical fluctuations. But later on Keynes realised that investment depended more on the psychological factors like the marginal efficiency of capital than on the rate of interest.

Subsequent statistical investigations also corroborated the view that the interest rate is an unimportant determinant of the level of investment. The empirical investigations were conducted by asking businessmen to list the factors that determine their decision to invest, the replies placed very little emphasis on the cost of borrowing funds. Such a conclusion, obtained by questionnaires, has not been starting.

Firstly, the supply of funds to an individual firm may be quite interest-inelastic; i. e. the rate of interest may be quite irrelevant to the firm because it cannot get additional funds at the rate of interest.

Secondly, we do not expect most firms to regard the cost of borrowing as important since most of their prospective investment projects have expected returns substantially in excess of that cost.

ADVERTISEMENTS:

The evidence against the potency of interest rate in determining investment level strengthened the Keynesian belief; that the rate of interest as a determinant of investment is not so much effective as many economists had believed.

In Keynes’ view, it is, no doubt, true that the marginal efficiency of capital has become the chief determinant of investment, yet the influence of interest cannot be ignored altogether. Since private or induced investment is highly changeable.

The significant role of public investment, also called autonomous investment (which the Government may incur to save the economy from falling further to lower income levels) comes to the forefront. In the nature of case, public investment is independent of the profit motive.

Since a steady investment is essential for the investment multiplier to have positive effects on income, output and employment during depression, motives other than profit are necessary to guide more investment-a function which is fulfilled only by public investment.

Further, the amount of public investment cannot only be controlled but is also capable of expansion to such an extent as to make the investment multiplier work with greater force than would otherwise be possible. Moreover, government can prevent it from leaking out of the spending stream and is capable of timing it so as to let the multiplier have its full and free play.