The below mentioned article provides an overview on Investment in Business:- 1. Concept of Investment 2. Autonomous and Induced Investment 3. Marginal Efficiency of Capital vs. the Marginal Efficiency of Investment 4. Investment Treated as a Constant.

Concept of Investment:

In business literature investment refers to capital expenditure, i.e., expenditure on the purchase of physical assets such as plant, machinery and equipment (fixed capital) and stock (working capital), i.e., physical or real investment. In economic analysis, ‘investment’ refers specifically to physical investment, which creates new assets and thus adds to the country’s productive capacity.

Investment depends on savings and savings require a sacrifice of current consumption so as to release the resources to finance investment. Investment expenditure is a component of aggregate effective demand and is treated as an injective into, or an addition to, the circular flow of income. Normally investment expenditure refers to private sector investment spending.

Investment may be gross or net. Gross investment is equal to net investment plus depreciation. Gross investment is the total amount of investment that is undertaken in an economy over a specified time period (usually an accounting year). Net investment is gross investment less depreciation or capital consumption.

ADVERTISEMENTS:

Depreciation is also known as replacement investment, i.e., investment which is necessary to replace that part of the society’s stock of capital which is used up in producing this year’s output. Depreciation may be defined as the reduction in the value of capital goods due to their contribution to the production process.

Autonomous and Induced Investment:

Private business investment is often divided into two broad categories; autonomous investment and induced investment. In a like manner investment which is brought about by changes in the level of income (i.e., GNI) or output (i.e., GNP), is called induced investment. However, the major portion of private investment does not depend on national income or output.

Let us consider what might happen to a new invention, e.g., 3D television. It is quite likely that business firms would make investment in developing the new product even if there had been no prior change in national or per capita income. This investment which is independent of national income or its rate of change is called autonomous investment.

In other words, investment which depends on national income or its rate of change is called induced investment. On the other hand, investment which depends on all other variables except motional income is called autonomous (i.e., income-independent) investment.

ADVERTISEMENTS:

In his income and employment theory J. M. Keynes considered only autonomous investment. He ignored induced investment because he was concerned with the economic problems of depreciation. During depression national income tends to fall steadily. Therefore induced investment is unlikely to occur.

However, in 1917, J. M. Clark developed the famous acceleration principle on the basis of the concept in induced inducement. The acceleration principle, shows the relationship between investment and the rate of change of consumption demand.

Thus, if the demand for textiles in India increases due to an increase in per capita income there will be a large (or an accelerated) increase in the demand for textile producing machines. In fact the demand for capital goods is a derived demand. All other types of investment are autonomous in nature. However, in practice it is difficult to draw a line between the two.

Determinants of Autonomous Investment:

ADVERTISEMENTS:

Business firms make investment in plant and equipment in order to make profits. They wish to spend money on investment if they except the investment to yield a net return over all its costs. Various factors affect these expectations and thus determine the amount of aggregate desired investment expenditures in the economy.

The following factors usually influence investment decisions:

1. The Rate of Interest:

The rate of interest is the cost of capital to the firm. If the firm borrows money from financial institutions to spend on investment, it has to pay the market rate of interest. If on the other hand, the firm is having sufficient internal resources, the real cost of capital is its opportunity cost.

It is measured by the revenue the firm has to forego by investing the money in a project. If the firm had lent out those funds to others it could earn the rate of interest (if not more) in return.

The lower the rate of interest, the lower the cost of borrowing money to acquire an income-earning asset like a machine. So business firms in general would be willing to make more investments. We may illustrate the point by considering the investment opportunities open to a firm.

Suppose a firm has succeeded in arranging its opportunities for investing in new capital in order of profitability. Some project will surely offer large returns, others slightly lower, yet quite substantial, return. There will be still others which will offer only moderate returns. If the rate of interest is very high the funds for investment to the firm will be really expensive.

In such a situation the firm will undertake the most profitable projects (investments) from those that are available. If the rate of interest is low, the firm will consider it worthwhile to undertake more investments that will yield a net profit after the cost of the investment funds is deducted.

A simple example may make the point clear. Suppose a firm is faced with four investment opportunities. The cost of each investment is Rs. 100 and each one involves receiving a single cash flow after one year. Suppose the most profitable project pays Rs. 121, the next Rs. 116, the next Rs. Ill, and the least profitable one only Rs. 106. If the rate of interest is 22 per cent at present, none of the investment will be profitable.

ADVERTISEMENTS:

At rates of interest between 16 per cent and 21 per cent only the first project will be profitable. If, for instance, the rate were 18 per cent then Rs. 100 could be borrowed at a cost of Rs. 18.

After one year the investment would yield Rs. 121, showing a profit of Rs. 3 after repaying the initial sum borrowed (viz. Rs.100) and paying interest of Rs. 18. At rates between 11 per cent and 16 per cent the first two opportunities would be the most profitable.

A rate below 11 per cent makes the third project profitable. Similarly a rate below 6 per cent makes even the fourth project profitable. Thus, with every fall in the rate of interest, more and more projects become economically feasible.

In this example, as the rate of interest falls, first one, then two, then three and finally all four projects turn out to be profitable. Thus, desired investment expenditure gradually rises from Rs. 100 to Rs. 200 to Rs. 300 and ultimately to Rs. 400 on account of these four investment opportunities.

ADVERTISEMENTS:

Induced Investment and the Accelerator:

We have noted that one of the determinants of investment is the level of income. This point was first established by J. M. Clark in 1917. And on the basis of this proposition he developed the famous acceleration theory of investment. According to this theory the level of new investment is determined not only by the level of output or GNP but by the rate of change of national income.

The theory shows the relationship between the amount of net or induced investment and the rate of change of national income. The theory is based on the fact that the capital stock of a nation is considerably greater than is GNP. The reason is too easy to find out.

A nation’s capital stock has been built over the years and it takes several rupees of capital equipment to produce Re. 1 of output. For example, it may take Rs. 3 of capital to produce Re. 1 of output.

ADVERTISEMENTS:

Now a rapid rise in income and consumption expenditure will put pressure on existing capacity and encourage business people to invest not only to replace existing capital as it wears out but also to invest in new plant and equipment to meet the increase in demand.

Suppose total demand in the economy were to rise but all the capital stock of society was already fully employed. Then, in order to meet the new demand, Rs. 3 of capital equipment would have to be built to meet each Re. 1 of new demand. The converse is also true. If national income falls it may not even be necessary to produce capital goods to replace those that are wearing out.

The accelerator theory makes the following prediction:

Small changes in the level of national income or output will lead to much greater (accelerated) changes in the demand for capital goods. A simple example may make the idea clear.

Let us suppose a textile producing firm meets the existing product by utilizing 10 machines, one of which wears out every year and has to be replaced. If demand for textiles increases by a modest 20 per cent the firm invests in two new machines to meet the new level of demand in addition to the one replacement machine.

ADVERTISEMENTS:

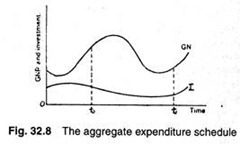

The following figure illustrates the concept. The graph shows how GNP and the level of investment depends upon the rate of change of GNP. When GNP is rising rapidly then investment will be at a high level, as business people are eager to add to their capacity (time to in Fig. 32.8).

However, as the rate of growth slows down from to onward, business people will no longer add as rapidly to capacity, and investment will fall to replacement level. In other words, gross investment to the extent of depreciation will take place but net investment (or net addition) to the stock of capital will be zero.

Investment is thus, in part, a function of changes in the level of income: I — ƒ(∆Y). This type of investment is known as induced investment and is different from autonomous investment of the Keynesian type.

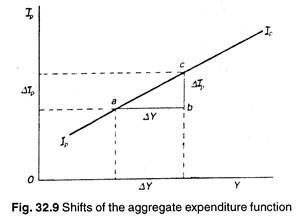

A small change in output or sales may thus provide the necessary inducement for investment. From this idea we may develop a new concept, viz, the marginal propensity to invest (MPI). This is expressed as MPI = ∆Ip/∆Y.

In Fig. 32.9 the line Ip is the line of induced investment. When national income increases by ∆Y. investment increases by ∆Ip. The slope of the line investment is MPI.

Thus like consumption, investment is also a function of national income and changes in it. So total investment has two components: autonomous and induced. Or, symbolically: I = Is + Ip, where I is total investment, Is is autonomous and Ip is induced private investment.

There is, of course, controversy among economists regarding the existence of the acceleration effect. However, investment is a volatile component of aggregate effective demand. Hence it is certainly true that there are much greater variations in the level of investment demand than there are in the level of aggregate demand.

Marginal Efficiency of Capital vs. the Marginal Efficiency of Investment (Optional):

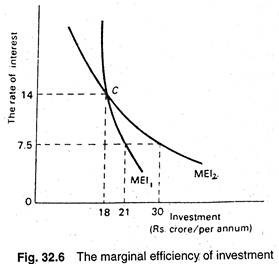

So we have noted that there is relationship between the rate of interest and the stock of capital which business firms wish to hold. This was shown by the MEC schedule, which relates the desired stock of capital to the rate of return (yield) an additional unit of capital will produce. The yield is related to the rate of interest, as in Fig. 32.6. It shows that a fall in the rate of interest increases the size of the desired stock of capital.

Post-Keynesian economists have drawn a distinction between the MEC and the marginal efficiency of investment (MEI). As J. Beardshaw has noted: ‘While the MEC shows the relationship between the rate of interest and the desired stock of capital, the MEI shows the relationship between the rate of interest and the actual rate of investment per year.

Thus MEC is concerned with a stock while MEI is concerned with a flow. There will be important differences between the capital stock people desire and the capital investment that takes place. This is because there are physical constraints upon the construction of capital.

Fig. 32.6 shows two possibilities for MEI. Suppose the rate of interest falls from 14 per cent to 7.5 per cent. If the MEI curve is MEI. then the rate of investment increases substantially from Rs. 18 crores to Rs. 30 crores. On the other hand, if the curve is MEI1, then there is just a small increase in the rate of investment—from Rs. 18 crores to Rs. 21 crores. Thus, the MEI curve shows the interest elasticity of investment.

ADVERTISEMENTS:

In an extreme situation the MEI line may be vertical implying that there would be no relationship between investment and the rate of interest. This is no doubt theoretically possible. But it is difficult to think of such a situation in reality.

1. Exception:

There is, however, one major exception to this general rule. During depression there is widespread business pessimism. So investment opportunities are lacking. At such times changes in the rate of interest are unlikely to affect investment decisions appreciably.

2. The Marginal Efficiency of Capital (or the Yield):

J. M. Keynes first introduced the term ‘marginal efficiency of capital’ in 1936. According to Keynes it is an important determinant of autonomous investment.

The stock of capital of a firm at a fixed point of time may be measured in physical units—so many machines, factories, etc. As with labour or land, there is an average and a marginal product of capital. The marginal (physical) product of capital is the contribution made to the firm’s output when the quantity of capital is increased by a single unit (the quantities of all other factors being held constant).

ADVERTISEMENTS:

A profit-maximizing firm is not very much interested in the marginal physical product of capital. It is more interested in knowing how much money can be earned by selling the output produced by one extra unit of capital. So we have to arrive at a measure of the value of the marginal physical product (MPP). This can be obtained by multiplying MPP by the market price of the output.

The marginal efficiency of capital (MEC) gives the monetary return on each extra rupee’s worth of capital added. In short, the MEC is the rate at which the value of the stream of output of a marginal rupee’s worth of capital has to be discounted to make it equal to Re. 1. And since the quantities of other factors are held constant the MEC tends to fall, due to the operation of the Law of Diminishing Returns.

The following example illustrates the concept. Suppose a machine costs Rs. 100, if purchased today Suppose, if put to use to produce children’s toys, it yields a net revenue of Rs. 110 after one year. Its productive life is one year. So it has to be scrapped after receiving a return of Rs. 110 in a year’s time.

The yield of the asset may be expressed as a percentage, known also as the rate of return on capital:

Yield = 110/100 = 1.1 per cent

We may now look at the capital asset from a different view point. Suppose we know only that it will yield a return of Rs. 110, one year from now. That yield will, of course, be worth something, even today, because the asset could be sold for cash to someone who wanted Rs. 110 next year. Whatever that person was prepared to pay for the asset today gives us the present value of the capital—its purchase price.

Thus, in the words of Lipsey, the MEC is “the rate of discount that will just make the present value of the flow of receipts it generates equal to the purchase price of the piece of capital.”

If the cash flow is constant (uniform) throughout, we can calculate the MEC using the formula: e = R/C, where C is the purchase price of the piece of capital, R is the constant flow of gross return and e is the unknown MEC. In this simple case e = R/C = Rs. 110/ Rs.100 =1.1 per cent.

Usually the present value is calculated by using the rate of interest as the discount factor.

If the rate of interest is 10 per cent the present value of Rs. 110 in a year’s time is calculated by using the following standard formula:

Present value (PV) = Yield/ 1+r

where r is the rate of interest. It is expressed as a decimal fraction, rather than a percentage.

As the yield is Rs. 110 and r = 10 per cent (0.1), we get:

PV = 110/1.1 = Rs. 100

Thus the PV of a capital asset represents the purchase price that an individual will be expected to pay to enjoy its yield in the future

3. The Cost and Productivity of Capital Goods:

Like the cost of funds needed for investment expenditure, the price and productivity of the machines being purchased have an influence on the profitability of investment.

In the words of R. G. Lipsey and C. Harbury, “A new process that reduces the price of capital goods will make any given line of investment more profitable because the interest costs involved will be reduced.” For example, a duplicating machine costing Rs. 120,000 will have an interest cost of Rs. 12,000 per year at a rate of 10 per cent, but if the price of the machine falls to Rs. 80,000 its interest cost will be only Rs. 8,000.

Moreover, “any new invention that makes capital equipment more productive will make investment more attractive. For example, if the replacement of typewriters by word-processors makes a given amount spent on office equipment more productive, this will lead to a burst of investment expenditure to obtain the new capital equipment.”

4. Business Expectations:

The classical economists were of the view that if a project yield 12 per cent and interest was 10 per cent then the project would take place. Keynes also endorsed the same view. However, the future is uncertain. So one cannot look into the future to be able to judge future profitability of a project with such accuracy, nor can one tell whether or not circumstances will change.

Since investment decisions take time to accomplish, they are characterised by a high degree of uncertainty. Thus business expectations, i.e., what business people expect to happen in future is very important.

If they are pessimistic about the future, even low rates of interest will not encourage them to borrow. On the other hand, if they are optimistic then a high rate of interest will not necessarily discourage them. A wide range of factors—from a change in government to the weather—may affect business expectations.

Investment decisions are largely influenced by expectations of future demand conditions and future cost conditions.

Expected demand conditions exert influence on investment because the profitability of any investment depends on being able to sell the output produced with capital goods and to sell it at a satisfactory price. The implication of making investment expenditure today is producing goods for sale in the future.

The following quote from Lipsey and Harbury bears relevance, “If firms have favourable expectations about the amount that they will be able to sell in the future and the price that they will be able to obtain, they will be inclined to invest now to create the capacity to sell in the favourable market that they expect in the future. If firms have low expectations about quantities they will be able to sell and about future market prices, they will be much less inclined to spend on capital equipment now.”

Since profits are the most important motivation behind investment, expected cost conditions also affect investment decisions. Profits depend both on market prices for output and on the costs of producing that output. When a machine is purchased today its price is known. Thus, the calculation of the cost of the machine is very easy.

On the other hand the cost of operating the machines is likely to vary in the future due to variation in labour cost. Moreover, the cost of raw materials will also vary over the life time of the machine. All these will affect total costs in future and thus total profits.

At times such expectations about the future can change dramatically and suddenly. These were called by Keynes the ‘Animal Spirits of Businessmen.’ When such changes occur, there is dramatic change in desired investment.

Just as a sudden swing from pessimism to optimism about the future can lead to a large increase in desired investment expenditure, an opposite swing (i.e., from optimism to pessimism) can lead to a drastic curtailment of investment plans and programmes.

4. Profits:

Most investments are financed by borrowed funds. But small and medium-sized firms have little access to the capital market. Thus, a great deal of investment it also financed by firm’s internal resources.

Most companies do not distribute their entire profit after tax among the shareholders in the form of dividends. A certain portion is retained for reinvestment. Such reinvestment or ploughing back of profit is necessary for expansion and diversification.

Thus, current profit appears to be an important determinant of investment expenditure. In a year of good business profit are large. So there is a large flow of funds that can be reinvested by the firms that made profits. If, on the other hand, there is no profit or even loss, as during recession, hardly any fund will be available within the firm to finance new investment expenditures.

5. Process Innovations:

We live in a dynamic world characterized by technological progress and growing competition among the (business) firms. Technological progress is also known as industrial innovation. Such innovation is of two types—process innovation and product innovation.

In a competitive world the price of a product has to fall so that the market for it becomes wider and wider. This has happened recently in case of pocket calculators and ballpoint pens. This is known as cost- reducing innovation. Modern firms are constantly trying to invent new ways of producing old products.

There new are normally embodied in new capital goods or equipment. For example, in recent years robotization has changed assembly line processes quite drastically. The installation of robots has largely accounted for huge investment being made in manufacturing industries in the USA, Japan, Canada, Germany and other industrially advanced countries.

6. Product Innovations:

It is not enough to produce an old product cheaply so that more people, who could not afford it earlier, may buy it. The development of altogether new products is equally vital. However, in order to produce new products it is necessary to make new investment in plant and equipment.

Sometimes it is possible to modify existing plant and equipment, but at a high cost, i.e., expenditure on modification and adaptation. However, at other times, altogether new arrays of capital equipment are needed to make the new product.

7. The Level of Income:

A high level of national income is likely to stimulate investment. The proximate reason seems to be that it has an effect upon business expectations, i.e., high level of investment lead to high levels of income tend to make business people more optimistic about the future.

Secondly, a high level of income means high profits. Therefore, business firms would have more funds with which to invest. This argument reinforces the point established earlier that profits affect investment decisions.

However, there is much disagreement about whether or not level of income determines the level of investment. Many economists would reverse the causality of the relationship and say that high levels of investment lead to high levels of income. However, the fact remains that high levels of income are often associated with high levels of investment.

Investment Treated as a Constant:

J. M. Keynes found it convenient to study how the level of national income gets adjusted to a fixed level of investment. This is why he assumed that all the factors influencing investment decisions, listed above, remain constant. So he found it convenient to assume that firms plan to make a fixed amount of expenditure each year (irrespective of the level of national income).

Initially, we follow the Keynesian logic. However, at a later stage we drop the assumption and permit any one of the determinants of investment to change. If such a change occurs the investment plans of business firms will be altered. However, our basic objective in this is to investigate the determination of national income under the assumption of a fixed level of (desired) investment expenditure.

Autonomous expenditure:

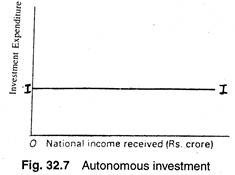

In Keynes’ theory all investment is autonomous and hence independent of national income. Since Keynes’ basic objective was to explain how changes in national income occur, he treated investment as an autonomous expenditure flow. So investment does not vary with national income in Keynes’ model.

A graphical representation:

In Fig. 32.7 we measure national income on the horizontal axis and investment expenditure on the vertical axis. Since investment does not vary as national income varies, the investment curve is a horizontal straight line labelled I in Fig. 32.7, showing a fixed level of desired investment I, at all levels of national income.

In fact, this is the type of the graph for all types of autonomous (income-independent) spending. In a modern economy there are two other types of autonomous spending, viz., government expenditure and export. The graph of each one will be a horizontal straight line like the graph of autonomous investment, implying that the expenditure in question does not vary with national income.