Various goods and services are produced by an economic system. These are divided into two broad categories, viz., consumer goods and capital goods. Consumer goods are those which satisfy wants directly. By contrast, goods that satisfy wants indirectly — for example, a textile producing machine or a tractor—are classified as producer goods.

Expenditure on producer goods is known as investment or capital formation. This is also known as real investment which is different from financial (paper) investment, e.g., when someone ‘invests’ in the purchase of shares, hi economics, buying shares is to be treated as saving and the term ‘investment’ is used to focus on the role of real investment.

Who Invests?

In a modern economy, investment is largely undertaken by firms in the private sector and the major portion of this is ‘business investment.’

ADVERTISEMENTS:

Three Elements of Investment:

Business firms make investment in the following three ways. The basic objective is to produce saleable goods to make profit.

1. To replace existing capital:

Capital goods wear out through use and have to be replaced. So, a firm has to make provision for depreciation, i.e., reduction in the value of capital goods due to their contribution to the production process. At any fixed time, there will be some investment which is needed to replace worn-out capital.

ADVERTISEMENTS:

2. To expand capacity:

If the amount of total (gross) new investment taking place happened to just equal the amount of depreciation, the size of the stock of capital employed would remain constant. Any excess of gross investment over depreciation represents net investment in expanded capacity or net capital formation.

Net investment is needed to introduce new products and groups of products or to produce existing products on a much larger scale. In a period of rising demand for goods and services existing capacity will be fully utilised and there will be need for fresh investment.

3. To increase efficiency:

ADVERTISEMENTS:

To survive in a competitive world, firms will be under constant pressure to raise productivity of resources, especially labour power. This can be achieved through process of innovation, i.e., introduction of new production processes.

This is often associated with the application of new technology. In fact, the greater the pressure and scope for increased efficiency, the larger the volume of investment firms are likely to undertake if they are to survive and expand.

Factors Affecting Levels of Investment:

Investment which refers to the construction of a new capital asset like machinery or factory building is made for the purpose of earning profit. Various theories have been developed from time to time to explain the behaviour of investment.

Keynes believed that investment does not depend on the current level of income. It is not a function of income or its rate of change. According to Keynes, the volume of investment depends on all other factors except national income. However, post-Keynesian economists consider income as a determinant of investment.

A study of the various theories brings into focus the main influences on the level of business investment which are the following:

1. Investment and profitability:

Ceteris paribus, higher profitability will improve the prospects for investment. First, the major portion of business investment in India is financed out of retained profits. So, the higher their level the more funds become available for financing investment. Secondly, increased current profits may be taken to indicate a higher return on new, future capital projects. This could induce firms invest their funds instead of lending them in the open market.

According to Keynes, the volume of investment in a community depends mainly on two factors: the marginal efficiency of capital and the rate of interest on long-term loans. Both the factors are highly unstable, the former being more unstable than latter.

ADVERTISEMENTS:

a. Marginal Efficiency of Capital:

The marginal efficiency of capital is the highest rate of return over cost expected from producing one more unit of a particular type of capital asset. Suppose, that a go-down built at a cost of Rs 20,000 is expected to fetch a rental of Rs 1,200 per year.

Suppose, that depreciation and maintenance amount to Rs 200 per year. Then, the net income which will probably be obtained by the owner is Rs 1,000, i.e., a return 5%. If the rate of interest is 4% there will be an inducement to construct such go-downs.

The marginal efficiency of this type of capital is 5%. If 5% is the highest rate of return which is expected to be secured from any type of investment, the marginal efficiency of capital in general in that community at that time is 5%.

ADVERTISEMENTS:

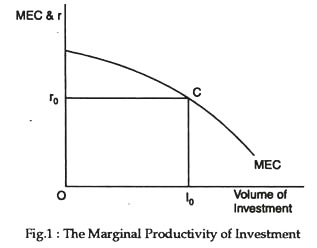

Investment continues as long as the marginal efficiency of capital is greater than the rate of interest. Thus, the level of investment is determined at the point where the marginal efficiency of capital is equal to the market rate of interest.

b. The rate of interest: ‘the cost of investing’:

The main objective of business firms in investing in plant, equipment and machinery is to make profit. If a firm is unable to make profit from its investment, it will not be able to retain a portion of its earning for expansion arid diversification.

Similarly, if an investment project does not return sufficient money it will turn out unviable. The decision to make investment in a project (such as setting up of a paper mill) will depend on the relationship between the anticipated rate of return and the expected rate of interest over the life of the project, which measures the cost of financing the project.

ADVERTISEMENTS:

If the expected (estimated) rate of return (profit) on a project were 20% then having to pay 22% interest for investment funds would lead to a loss — the project would not be economically viable. At an anticipated rate of interest of 15%, however, the same project would become viable. As J.E. Meade put it, “A greater amount of fixed capital should be invested so long as the annual interest on the capital plus the annual cost of repair, depreciation, etc. is less than the price of any additional output expected from the investment”.

The same rule would apply for investment financed out of a firm’s own funds. In this case, the rate of interest measures the opportunity cost of employing these funds in alternative uses. In fact, the rate of interest influences investments, because it represents the cost of borrowing.

The profit from an investment is equal to the total revenue obtained from it minus the expenses, of which interest is a part. The entrepreneur expects a certain net yield from an investment and if the rate of interest is high the net yield is reduced. Hence, a high rate of interest will cut out a number of investments and the total volume of investments will be less.

Conversely, a low rate of interest will make some investments attractive and the volume of investments will increase. Increase of investment is desirable because it increases income and employment. Keynes, therefore, recommended that central banks should follow cheap money policy, i.e., a policy of reducing the rate of interest. This will encourage business people to invest more.

Moreover, movement in interest rates can also influence investments by providing an indicator of likely future economic conditions. Rising interest rates may be a signal of government action to restrain the growth of demand — which could have an adverse effect on firms’ sales and returns.

At a fixed point of time, there will exist a range of potential investment projects over the economy, some expected to yield higher rates of return (in terms of profit), some lower costs and others possibly a loss. Ceteris paribus, the lower the anticipated rate of interest, the larger will be the number of viable projects and hence the higher the level of total investment undertaken.

ADVERTISEMENTS:

At the same time, the profitability of marginal investment — what Keynes calls the marginal efficiency of capital — will also decline as Fig. 1 shows. So long as MEC exceeds the rate of interest (r) new investment will take place and once MEC is equated to r no further investment will occur, as indicated by point E.

As Keynes has pointed out, “The amount of current investment depends on the inducement to invest and the inducement to investment, in its turn, depends on the relation between the schedule of marginal efficiency of capital and the interest rates on loans of varying maturities and risks”.

However, it is a matter of great surprise that most study show little connection between investment and rates of interest. Investment appears to be very interest-elastic. One explanation seems to be that investment is actually relatively interest- inelastic but other factors, which influence investment, tend to neutralise this effect.

2. Inflation:

A high rate of inflation, when it is anticipated, can have favourable effects on investment. It is likely to reduce the burden of debt- repayment and make it easier — at least for a time — for firms to widen profit margins following an investment. However, there is an offsetting consideration. One of the characteristics of high inflation is that it is also likely to be more variable. High and variable inflation is likely to have a damaging effect on investment prospects.

ADVERTISEMENTS:

The reasons are the following:

First, high and variable inflation makes it difficult to assess future conditions, leading to greater uncertainty and risk. In order to offset this, firms will require higher returns and will be likely to reject otherwise viable investment opportunities.

Secondly, savers and lenders may need ‘risk premium’ in the form of higher interest rates, which will tend to reduce investment. For these two reasons, economists believe that high and variable inflation has an adverse effect on investment.

3. Investment and changes in consumer demand: the acceleration effect:

Another factor influencing the level of investment is the ‘acceleration effect’. This relates the level of planned investment to the rate of change of income and consumer demand for the output of business firms. The acceleration effect indicates that the level of aggregate demand is the function of the rate of change of income and product demand.

If, for instance, the demand for textiles in India increases (say, due to a rise in per capita income) there will be more demand for textile-producing machines. This is so because the demand for capital goods is a derived (indirect) demand.

ADVERTISEMENTS:

Thus, anything which increases consumption demand, such as per capita income growth or even population growth is always good for industries capital goods producing. Growth of population leads to higher demand for capital. Entrepreneurs get more profit and, therefore, there occurs more investment.

4. Investment and capital stock adjustment:

If capital-output ratios are flexible firms would be able to obtain more output from a given capital stock. This is the essence of capital stock adjustment theory, which states that investment levels are likely to be positively related to firms’ level of output and negatively related to their existing capital stock.

So, for a given acceleration of output, the larger is the inherited capital stock, the less will be the level of investment required for replacing or adding to existing capacity. This simply means that at times of low economic activity with low levels of capacity utilisation there will be very weak relation between demand and investment.

Higher investment in response to rising demand will tend to take place at times of high economic activity, when output is increasing sufficiently to expand firms’ production capacity. Empirical studies have shown that the capital stock adjustment theory is quite effective in explaining investment levels.

5. Investment and debt levels:

ADVERTISEMENTS:

Debt levels of firms also influence investment. When business firms struggle to pay-off debts they have incurred in the past, their current investment levels fall. The same thing happens when many businesses find it difficult to collect debts from one another. Only when this ‘overhang’ of debt is reduced will business be prepared to commit substantial funds for new investments.

6. Technological improvement:

Advancement of technology increases output and profit opportunities. This factor is especially important for the deepening of capital.

7. Flexible wage rates:

Lower wages provide profit opportunities. Therefore, it leads to more investment.

8. Changes in the tax structure:

The inducement to invest may be increased by lowering taxes. In many countries, rebates are given for new capital investment, e.g., advantages as regards rates of depreciation.

Conclusion:

After all, investment depends on business confidence. And the most important factor in determining the volume of investment is the marginal efficiency of capital. Which itself depends on business confidence. Hope of profit leads to demand for capital and more investment. Fear of loss causes deflation and unemployment and, thus, decreases the volume of investment. However, marginal efficiency of capital is unstable in the short run and causes investment fluctuations.

But, in the long run, MEC declines. According to Keynes, this is due to the fact that the prospective yield from capital gradually diminishes as the stock of capital assets grows. The supply price of capital (i.e., its cost) may also rise but this is a short run factor.

The declining tendency may be held in check by dynamic factors like increase of population, territorial expansion and certain type of technological changes. But, in the long run the tendency to decline inevitably appears.