The below mentioned article provides quick notes on the Marginal Efficiency of Capital (MEC).

Firms make investments in their businesses since managers believe it to be profitable.

Thus, in making a decision whether to invest in a new plant, managers must take into account the following three interrelated elements:

(i) The cost of purchasing new plant or machine. Let the price of machine be PK.

ADVERTISEMENTS:

(ii) The stream of expected future returns from the machine in question. Such expected income flow is designated here by R1, R2…. Rn, where the subscripts stand for time periods, 1, 2,…. n, and the machine is expected to have a life of n years.

(iii) The market rate of interest on borrowed money to buy the machine.

Thus, whether a particular investment project is profitable or not is rather a complicated process because yields from such investment project are spread over a number of years in the future. One such process is the present value criterion.

To calculate present value, future income streams are compared with the cost of investment (i.e., interest on borrowed money) and then present value is compared with the present cost of investment. If present value exceeds present cost, investment becomes profitable.

ADVERTISEMENTS:

In weighing the relative costs and benefits of the proposed investment, the following mathematics of investment is considered:

If I have Rs. 100 in a savings bank account that pays 10 p.c. compound interest annually, then the sum of Rs. 100 would yield a return at the end of the year Rs. 110, i.e., 1 + (0.10) 100 = Rs. 110. Thus, the present value of Rs. 110 is (Rs. 110) + (1.10) = Rs. 100.

Thus, the future income that can be obtained from lending, R, after n years will have a present value (PV) of

PV = R/ (1 + i)n (A)

ADVERTISEMENTS:

Thus, in general, if an individual expects R rupees in n years, then he must discount the expected future income by applying equation (A) to determine its present value.

Let us now apply this formula for an investment project that yields income over the life of this project.

Equation (A) can now be used to calculate the present value of investment:

PV = R1 /(1 + i) + R2 /(1 + i)2 ….. + Rn /(l + i)n (B)

Where,PV = present value of investment

R1 R2 … Rn = expected future returns for the years 1 … n;

i = rate of interest.

Thus, the decision to invest rests on the calculation of the present value of income stream associated with investment project and cost of the project. If the cost of the project is less than the PV, then investment is profitable.

It is to be remembered here that the market rate of interest (i) is the most crucial element in an investment decision-making process, though, under the PV criterion, expected future returns and the cost of the investment project are considered. An alternative approach, however, puts emphasis on the market rate of interest.

ADVERTISEMENTS:

Under the alternative approach, the comparison is made between marginal efficiency of capital (MEC) [r], and the market rate of interest (i). The MEC is the rate of interest which equates the cost of the investment project and the discounted value of expected future returns stream associated with the project.

According to Keynes, it is the MEC that determines the fate of launching of an investment project. Keynes defines “MEC as being equal to that rate of discount which would make the present value of the series of annuities, given by the returns expected from the capital asset during its life just equal to its supply price.”

In other words, MEC is the ratio of expected rate of returns from an investment project to the cost of the investment project. To calculate the rate of return on a prospective investment, MEC (i.e., r), we calculate estimates of the cost of the investment project, PK, and the expected future returns associated with the project, R1, … Rn.

These values are substituted into the general formula to obtain:

ADVERTISEMENTS:

PK = R1/(1 + r) + R2 /(1 + r)2 ….. + Rn/(1 + r)n (C)

Equation (C) is used by the businessmen to determine the feasibility of investment project. MEC is often referred to as the ‘internal rate of return’. If i > r, investment should not be undertaken; if i < r then investment is profitable. Thus, whether investment should be undertaken or not depends on two factors: one is the rate of interest and the other is the MEC.

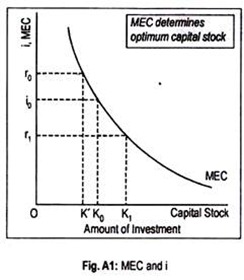

Keynes opined that MEC declines as new investment increases. In Fig. A1, the MEC curve slopes downwards from left to right due to diminishing returns. Further, economists argue that investment is related to the rate of interest, i.e.,

I = f (i)

ADVERTISEMENTS:

Given the MEC, r, and the market rate of interest, i0, there will be one equilibrium level of investment.

At an interest rate i0, the equilibrium amount of capital stock becomes K0. Suppose, a smaller amount of investment OK'(< OK0) takes place. Now the return an additional investment (r0) exceeds the interest cost of investment project (i0). So, additional investment must take place until the equality between return on investment and market rate of interest is established.

Similarly, a larger investment OK1 takes place, with the market rate of interest i0. In this situation, return on capital is less than the market rate of interest (r, < i0). Investment now must shrink to K0. So, the optimum stock of capital is determined by the MEC in conjunction with the market rate of interest.

Thus, the two important determinants of investment are:

(i) Market rate of interest

ADVERTISEMENTS:

(ii) The MEC.

However, there are some situations where investment tends to be fairly interest-inelastic. In other words, investment does not depend on the rate of interest. So, we come to the third determinant of investment. This is businessman’s expectations regarding future economic activity.

If expectations regarding rate of return from the installation of a modern sophisticated machine are too high then more investment at any given interest rate would take place. Or if businessmen are optimistic about the future then high market interest rates would not discourage investment.

Finally, investment depends on changes in consumption or output. Investment theory based on changes in income or output or consumption is called acceleration theory.

Determinants of MEC:

Changes in the market rate of interest are considered to be the most crucial determinant of investment. However, expected rate of return from investment projects or the MEC is another determinant of investment—as Keynes pointed out. Now the question is: On what factors does MEC depend?

ADVERTISEMENTS:

The most important determinant of MEC is the expected rate of return which businessmen estimate on the basis of present state of affairs. It is true that future is uncertain and, hence, estimation of future income can never be perfect. Expected income stream from capital goods is influenced by future trend.

This results in a change in investment character and, therefore, MEC fluctuates rather rapidly and frequently.

It is to be pointed out here that, in the short run, as anticipation regarding future becomes more or less correct; volume of investment does not change. As a result, MEC also remains more or less stationary. But anticipation for a much longer date must be imperfect, thereby leading to wide fluctuations in investment and MEC.

Secondly, MEC might improve due to improvement in technology or invention of new machines. This results not only in a decline in cost of production but also leads to an increase in the quality of produced goods. Consequently, expected rate of return from an investment project tends to rise and, hence, a rise in MEC.

Thirdly, an increase in corporate tax rate or an imposition of newer taxes causes MEC to decline.

Fourthly, volume of investment depends on factor prices. We know that machine replaces man. If prices of labour and other allied inputs rise compared to the prices of machine, anticipated income from capital goods investment would be larger.

ADVERTISEMENTS:

Finally, in the long run, changes in population have an important bearing on the MEC. Increase in population means increase in consumption expenditure and, hence, expansion in market. This will cause investment and, hence, MEC, to rise.

However, Keynes gave primary emphasis to expectation regarding future as a determinant of MEC.