The demand for capital comes from the business in form of machines and the households in form of houses.

Desired capital stock is the amount of capital goods that a firm would like to have to maximize its profit.

Therefore, firms before investing will compare the cost, that is, rental cost of capital (rc) and benefit of capital, that is, the Marginal product of capital (MPk) or (VMPk)

MPk → It is an increase in the output by using an additional unit of capital.

ADVERTISEMENTS:

VMPk → Value of marginal physical product

VMPk = MP k.Px where : Px → Price of output

Rental cost of capital is the cost incurred by firm for using capital.

They are:

ADVERTISEMENTS:

1. Real interest rate

2. Depreciation

3. Taxes

Reason:

ADVERTISEMENTS:

1. If the firm finances the purchase of capital by borrowed funds then it pays interest rate (i) If inflation occurs then nominal value of capital increases. As interest rate is known but inflation rate is not known, therefore, expected inflation rate (πe) is taken.

... Real interest rate (r) = i – πe

2. Over a period of time capital wears out. Therefore, cost of depreciation is added to the rental cost of capital (rc)

3. as regards taxes:

(a) In case of corporate income tax, which is a proportional tax on profit, a higher tax will lead to an increase in rc. ... desired capital stock decreases

(b) In case of investment tax credit, where the firms are allowed to deduct from their taxes a fraction of their investment expenditure, a higher credit will lead to a fall in rc.

Reason:

Investment tax credit reduces price of capital goods.

... Demand for desired capital stock increases

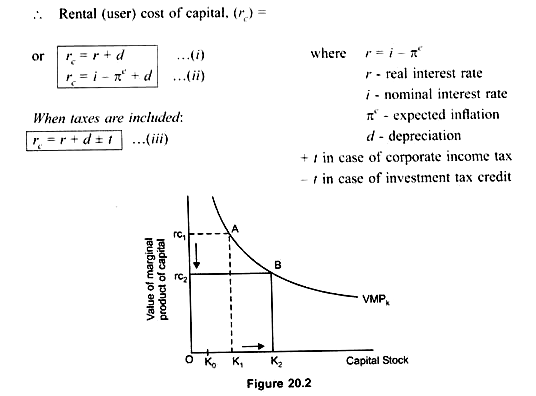

MPk curve is negatively sloped showing, as we increase the use of capital, the MPk falls because of law of diminishing returns (Fig. 20.2).

Fig. (20.2) shows : lower the rc, higher is the demand for capital and vice versa.

(a) When demand for desired capital stock increases from K1 to K2, VMPk falls from AK1 to BK2

ADVERTISEMENTS:

Therefore, when VMPk falls, people will invest more only when user cost of capital falls from rc1 to rc2

This implies that the cost of using capital falls. Therefore, demand for capital increase from K1 to K2 (inspite of the fact that MPk is falling).

Thus, when rc falls from rc1 to rc2 demand for capital increases from K1 to K2 Firms’ decision to invest will depend on the profitability from the investment.

Profit = Revenue – Cost

ADVERTISEMENTS:

= MPk – rc

= MPk – (i – πe + d) …(iv)

The equation (iv) shows that the Business Fixed Investment depends on:

(1) MPk

(2) Cost of capital

(3) Depreciation.

ADVERTISEMENTS:

(i) If : MPk > rc : Firm will invest more,

e.g. at rc2 → MPk = AK1

rc = rc2

... Investment will increase from K1 to K2

(ii) Similarly, if MPk < rc : Firm will invest less because it will incur loss

Thus the firm will invest till the point where MPk = rc ← Steady state level