In this essay we will discuss about Economic Models. After reading this essay you will learn about: 1. Meaning of Economic Model 2. Nature of Economic Model 3. Uses 4. Building a Micro-Static Model 5. The Process of Building and Testing an Economic Model 6. Choice Among Economic Models 7. Limitations.

Contents:

- Essay on the Meaning of Economic Model

- Essay on the Nature of Economic Model

- Essay on the Uses of Economic Model

- Essay on Building a Micro-Static Model

- Essay on the Process of Building and Testing an Economic Model

- Essay on the Choice Among Economic Models

- Essay on the Limitations of Economic Models

Essay # 1. Meaning of Economic Model:

An economic model is an organised set of relationships that describes the functioning of an economic identity under a set of assumptions from which a conclusion or a set of conclusions is logically derived. The economic identity may be a household, a single industry, a region, an economy or the world as a whole.

As a matter of fact, an economic model is a set of economic relationships which is generally expressed through a set of mathematical equations. Each equation involves at least one variable which also appears in at least one other relationship which is part of the model.

Essay # 2. Nature of Economic Model:

An economic model is a deliberately simplified representation of the real world. “Deliberately simplified” in two senses: first, it leaves out many elements that operate in reality, and second, it falsifies reality in a number of respects.

ADVERTISEMENTS:

Instead of representing a real situation, it explains the essential relationships that are sufficient to analyse and explain the main features of the particular situation at hand. The relation of a model to reality is through its assumptions. But assumptions do not exactly represent reality.

Rather, they are “reasonable abstractions” from reality which means that certain aspects of reality are contained in the assumptions that are relevant to the model. If the assumptions of a model are somewhat realistic, the conclusion that is drawn can be shown to apply to the real world situation. Thus a model does not describe the true economic world since by its nature it is constructed as an abstraction from the ‘truth’. However, abstraction does not imply unrealism, but is a simplification of reality.

An economic model may be compared to a map which does not show every aspect of the terrain but only those features that are of interest for the particular situation at hand. The map is not the territory. Nor is the model the real world. But neither can be understood without a map or a model.

ADVERTISEMENTS:

An economic model, like a map, pinpoints the particular situation and keeps it free from many complicating and irrelevant factors found in the real world like the real territory in a map.

Analysis:

A model is built for two main purposes: analysis or explanation and prediction. Analysis means breaking up a thing into the elements that go to make it. We analyse a phenomenon into its various elements. It is on the basis of assumptions that facts are analysed. For this, assumptions are made in a model from which a law is logically derived that describes, explains and analyses the phenomenon under study.

For example, in the theory of consumer’s behaviour, the Law of Demand is deduced from such assumptions as given tastes, prices of related goods, and income of the consumer. Based on these assumptions, this law states that demand is a function of price. Thus the assumptions of the Law of Demand together constitute the market behaviour of consumer in this microeconomic model.

ADVERTISEMENTS:

Prediction:

A model is built to predict future events. For instance, a model may be constructed to explain the price of wheat in the market for the next year based on the expected size of the wheat crop, the past trend of the crop, the quantity of wheat in buffer stocks and prices in the previous years. Thus such a model will predict the future price of wheat in the market.

Validity:

The usefulness or “goodness” of a model depends on its validity. The validity of a model can be judged on the basis of several criteria: its predictive power, consistency, realism of its assumptions, its explanatory power, its generality and its simplicity. But there is no general agreement among economists as to which criterion is most important.

For Friedman, the most important criterion of the validity of an economic model is its predictive power and not the realism of its assumptions. The model should yield usable predictions and implications for the real world situations.

According to him, a model is a simplified representation of the economy and is tested to make predictions about how the real world will behave like a model aircraft. But Friedman’s criterion of a model has no explanatory power because he ignores the realism of assumptions.

No doubt, a model should be tested by checking its predictions, but the assumptions on which it is based also provide an indirect test of its validity. On the other hand, Samuelson regards the realism of assumptions and the explanatory power of the model in explaining the behaviour of consumers or producers, as the important criteria of a valid model.

Testable:

A model should be built in such a manner that it may be testable. And the validity of a model can be tested through the process of observation and verification. If the model is able to explain as well as predict accurately, its validity is proved.

ADVERTISEMENTS:

For instance, if a model of the firm produces predictions about firm’s behaviour which are testable and if these predictions are supported by evidence, then the model can be said to be valid. Moreover, the greater the degree of consistency between the model and the real world situation, the greater the validity of the model.

General:

To be valid, a model must be general. For instance, a model relating to a theory of the firm is general in nature because its conclusions are applicable to all firms regardless of size or market structure. Real firms are supposed to behave as if they conform to the assumptions of the model and the process of deriving and testing predictions can follow from the assumptions.

If the firms use this model in practice, it may be refuted if the assumptions are unrealistic.

ADVERTISEMENTS:

Simple:

Lastly, a model should be simple. For a model to be simple, the assumptions on which the model is based should be general in nature and small in number. If a model-builder constructs two models concerning the same problem with a different set of assumptions and each predicts equally well, the simpler of the two should be chosen. The simpler the model, the greater is its generality.

Equations:

A simple model should consist of a limited number of algebraic equations that can be solved simultaneously and also represented graphically. To have simultaneous algebraic or graphic solution, there must be as many relationships among variables as there are variables to be solved.

ADVERTISEMENTS:

In such a simple model, the model-builder not only finds the solution but also attempts to understand the individual adjustments and the overall pattern of their movements which are occurring in the model.

Essay # 3. Uses of Economic Models:

Economic models possess the following uses:

1. The major use of models is in theoretical economic analysis. The relative importance of assumed relationships can be illustrated more clearly and comparisons among different theoretical structures become somewhat simpler.

2. By changing given assumptions, it is also possible to analyse the effects of these changes upon the operation of the model.

3. Static and dynamic models are constructed for the study of micro and macro economic problems.

4. Model-building has also been extended to developing planning and growth economics.

ADVERTISEMENTS:

5. From the methodological viewpoint, the use of econometrics and computers in model building represents an important step in evolving the integration of economic research process.

6. Economic models help in taking policy decisions.

7. Finally, economic models are essential aids to clear thinking. As opined by Prof. Myrdal, the first virtue of economic models is that they can make explicit and rigorous what might otherwise remain implicit, vague and self-contradictory.

Even if a model is totally unrealistic, it may have a therapeutic value. The most justifiable claims for the use of economic models are that they are curves for excessive rigidity of thoughts and energies in searching for interdependent relationships.

Essay # 4. Building a Micro-Static Model:

Let us construct a micro-static model to determine the price of tea in a perfectly competitive market. This model can be constructed by expressing a functional relationship among three variables: quantity demanded (Qd) of tea, quantity supplied (Qs) of tea and price (P) of tea. Here quantity demanded and supplied are the dependent variables and price is the independent variable.

Thus the fundamental relationships among the three variables are:

ADVERTISEMENTS:

Qd = f (P)

Qs = f (P)

and Qd = Qs

Its Assumptions:

The assumptions of this model are:

(1) The quantity demanded is a decreasing function of price.

(2) The quantity supplied is an increasing function of price. But if price does not exceed a minimum, there is no supply.

ADVERTISEMENTS:

(3) Quantity demanded and quantities supplied are stock variables.

(4) The market is in equilibrium when excess demand is zero, i.e., Qd – Qs = 0. In other words, the equilibrium condition is Qd = Qs.

The Model:

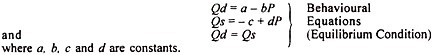

In this static market model, there are two behaviour equations and one equilibrium condition,

Suppose we have the following values of the behavioural equations for the market model.

Qd = 36 – 4P – (1)

ADVERTISEMENTS:

Qs = – 12 + 12P – (2)

Qd = Qs – (3)

Substituting (1) and (2) in (3), we have

36-4P =-12+ 12P

– 4P- 12P = – 12- 36

-16P = – 48

P = 3

Putting the value of P in equations (1) and (2), we obtain

Qd = 36-4 x 3 = 24

Qs = -12+12 x 3 = 24

Qd = Qs = 24

Thus the market for tea is in equilibrium at the price of Rs.3 per kg. when 24 tonnes quantity of tea is bought and sold. When the price is less or more than the equilibrium price, there is disturbance in the quantity sly, the equilibrium price will prevail.

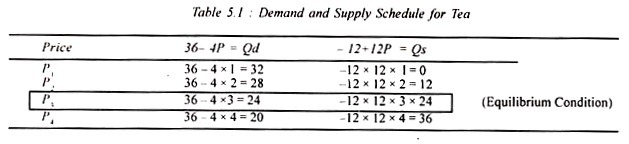

This process is explained in Table 5.1:

The above demand and supply schedule shows that when the price of tea is Rs.2 per kg which is less than the equilibrium price (Rs.3), the quantity demanded increases to 28 tonnes and the quantity supplied falls to 12 tonnes.

Less supply of tea in relation to higher demand will raise the price to Rs.3. As a result, the quantity demanded will fall to 24 tonnes and the quantity supplied will also rise to 24 tonnes so that the equilibrium condition is re-established.

On the contrary, with the rise in the price to Rs. 4 per kg., the quantity demanded of tea will fall to 20 tonnes and the quantity supplied will increase to 36 tonnes. At the price higher than the equilibrium price, every seller will try to sell his quantity first. For this, he has to lower his price a little. Others will follow him. As a result of competition among sellers, the price will come down to Rs.3 and the equilibrium condition is restored.

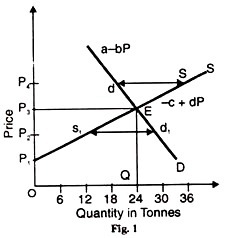

The mathematical model explained above is shown graphically in Figure 1 where D is the demand curve with the behavioural equation 36 – 4P and S is the supply curve with the behavioural equation – 12+12P. The two curves intersect at point E which is the equilibrium point.

OP3 is the equilibrium price at which OQ (= 24 tonnes) equilibrium quantity is bought and sold. These fulfil the equilibrium condition. If the price falls below the equilibrium level to OP2 the quantity demanded exceeds the quantity supplied by s1d1. A shortage of tea arises and the price is bid up towards the equilibrium level E.

On the other hand, if the price rises above the equilibrium level to OP4 the quantity supplied exceeds the quantity demanded by ds. A surplus of tea results and the price is bid down towards the equilibrium level E. Thus in this market- equilibrium model once the equilibrium condition is fulfilled any deviation from it will be restored by the automatic forces of demand and supply.

Essay # 5. The Process of Building and Testing an Economic Model:

The following are the steps involved in the construction and testing of an economic model:

1. To Define the Problem:

Defining the problem covers three stages. The first is to define the problem about which the model is to be built. It may relate to an individual household, a firm, an industry, the market for a single product or the economy as a whole.

The second, stage is to formulate questions which a model is required to answer. They may relate to the causes of the phenomenon, in the last stage, the major variables relating to the problem are identified.

2. To Formulate Assumptions:

Having defined the terms of the model, the second step is to formulate a set of assumptions relating to the problem to be modelled. It is on the basis of assumptions that the tentative relationships are established among the variables of the model.

3. To Collect Data:

The third step is to collect, enumerate and classify the necessary data for estimating the parameters of the model. A variety of statistical techniques are used for making such estimates.

4. To Derive Logical Deductions:

The next step in the process is one of logical deduction whereby various implications of assumptions are discovered and identified. These implications are the predictions about the model.

5. To Test the Model Empirically:

The next step is to test the predictions of the model against data on the actual behaviour of the phenomenon being modelled. This is done by observations or by checking the consistency of predictions with related facts with the help of mathematical, statistical or econometric methods.

6. To Accept Reject or Revise the Model:

If the predictions of the model are correct, the model is scientifically valid and reliable. It passes the test, is accepted and needs no further action. If predictions are not supported by data, the model is in conflict with facts and is either rejected or amended. In the latter case, predictions should be tested on the basis of new data because there might have been some lacuna in the data collected earlier.

Essay # 6. Choice Among Economic Models:

1. The problem to be modelled should be narrow.

2. The concepts to be used in the model must be clear and meaningful having a meaningful empirical content.

3. The assumptions on which the model is to be based must be stated clearly. The lesser the assumptions, the better the model would be.

4. The assumptions must be logically consistent with each other so that valid conclusions follow from them.

5. They should not be contradictory by observation. For instance, the dependent variables must not be assumed to be independent variables and vice versa.

6. The model should be a systematically related set of questions addressed to the observable data.

7. The model should be confined initially to the formulation of sufficient conditions until new evidence proves them to be correct.

8. The model as a whole must not be refutable by empirical evidence.

9. If the model is applied to areas outside the field of study, estimates of the excluded relationships must be added to make it complete.

10. For deriving policy conclusions from the model, estimates of the known economic conditions in the social system and their modus operandi must be made.

11. The model should be simpler.

12. The model should have wider applicability to the real world situation.

Essay # 7. Limitations of Economic Models:

Economic models are beset with a number of limitations.

1. Pure theoretical models do not provide full explanations or correct predictions of the phenomenon under study.

2. Economic models are not comprehensive but partial.

3. They tend to neglect those factors that prove difficult to quantify. Thus they become quite irrelevant.

4. The use of econometrics in model-building has given rise to the problems of identification and random disturbances.

5. When expressed mathematically, economic models lack in relevance and realism.

6. When they are applied to real economic situations, they are selective, abstract and arbitrary. Thus a model is unrealistic since it leaves out many of the elements that operate in actual economies.

7. There are four ways in which errors enter into economic models as a result of assumptions which are not made explicit:

(i) Certain parameters may stay constant;

(ii) The number of strategic variables may be narrowed down by a single one;

(iii) Very dissimilar items may be analysed in terms of a single category; and

(iv) Certain sequences may be isolated and analysed without regard to their relationships to other sequences.