The balance of payments (BOP) of a country is a summary record of all its external economic transactions completed during a given period of time, usually a year.

To understand the meaning of an equilibrium and disequilibrium in a country’s BOP we will have to make a distinction between the “autonomous” international transactions those which are the result of the free and voluntary choices of individual transactors and “induced” or “accommodating” international transactions those which are undertaken by foreign exchange authorities to reconcile the free choice of the individual transactors.

If during a given period of time, a country’s total external receipts from the autonomous transactions is equal to total payments for the autonomous transactions the BOP is in equilibrium; if total receipts exceed total payments it is in surplus disequilibrium and if the total payments exceed total receipts, then it is in deficit disequilibrium. More we are concerned with this deficit disequilibrium in a country’s BOP.

The magnitude of deficit disequilibrium is also indicated by the presence of the accommodating transactions.

ADVERTISEMENTS:

In case of a deficit, the country can only sustain the deficit without changing the exchange rate of its currency or resorting to restrictive measures of its imports (particularly direct trade controls) as long as it has adequate stock of international liquidity reserves. But this can continue for a limited period of time. “The function of international liquidity is to finance deficits that are in process of being corrected, not to remove the need for correction.”

The deficit disequilibrium is caused by the excess of demand for foreign exchange over its supply.

Thus, the problem can be overcome by:

(i) Reducing the demand for foreign exchange

ADVERTISEMENTS:

(ii) Or increasing the supply of foreign exchange or

(iii) Changing the price of country’s currency in terms of foreign currencies, that is to say by changing the rate of exchange.

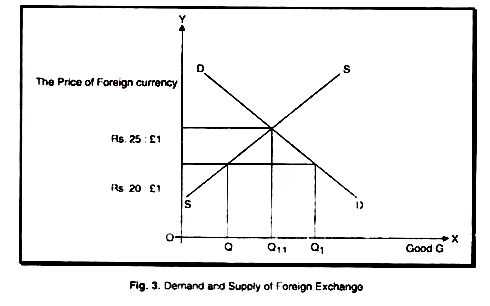

This can be explained by means of a diagram:

In the diagram DD curve represents the demand for and SS curve represents the supply of foreign exchange. At the exchange rate Rs. 20: 1, £ India has deficit in its BOP because at this rate of exchange the demand for foreign exchange (OQ1) exceeds the supply of foreign exchange (OQ). If the price of pound sterling is raised from Rs. 20 to Ks. 25 per pound, then at this rate of exchange both the demand and supply of pound sterling will be equal. This amounts to the devaluation of rupee in terms of pound sterling by 25 percent.

ADVERTISEMENTS:

When a country is confronted with persistent deficit disequilibrium in its BOP, the presumptive remedy is probably devaluation which has come to be regarded as measure o last resort. Devaluation is also encouraged by the articles of agreement of the I.M.P. whenever a country’s BOP is in “fundamental disequilibrium” whether that disequilibrium is the product of exogenous or endogenous developments.

Meaning of Devaluation:

Currency devaluation refers to the reduction in the value of a country’s currency in terms of foreign currencies whereas revaluation refers to the increase in the value of a country’s currency in terms of foreign currencies.

The beneficial effects of devaluation on trade balance are highly doubtful but there seems to be little question about export advantages which devaluation makes possible. According to our earlier example, before devaluation of rupee, the exchange rate was Rs. 20:£ 1 but after devaluation it becomes Rs. 25: f 1.

When devaluation takes place, the immediate price effects are:

(i) In terms of rupees, the price of India’s exports is unchanged but he price of her imports rises, and

(ii) In terms of foreign currency the price of exports falls whereas the price of imports remain unchanged.

This means that the Indian exporters now receive Rs. 25 instead of Rs. 20 for the same amount of exports to England whereas the Indian importers must now give up Rs. 25 instead of Rs. 20 for the same amount of imports. Looking it from the standpoint of I5ritish buyers, the later now find the Indian market a cheaper place in which to buy in as much as they can now get Rs. 25 worth of Indian goods in exchange for same amount of their currency. In examining how these price changes effected by devaluation react upon the trade balance of India, four elasticities are import which we will discuss later on.