Balance of Payments (BOP)!

Subject Matter:

The balance of payments (henceforth BOP) is a consolidated account of the receipts and payments from and to other countries arising out of all economic transactions during the course of a year.

In the words of C. P. Kindleberger : “The balance of payments of a country is a systematic record of all economic transactions between the residents of the reporting and the residents of the foreign countries during a given period of time.” Here by ‘residents’ we mean individuals, firms and government.

By all economic transactions we mean individuals, firms and government. By all economic transactions we mean transactions of both visible goods (merchandise) and invisible goods (services), assets, gifts, etc. In other words, the BOP shows how money is spent abroad (i.e., payments) and how money is received domestically (i.e., receipts).

ADVERTISEMENTS:

Thus, a BOP account records all payments and receipts arising out of all economic transactions. All payments are regarded as debits (i.e., outflow of money) and are recorded in the accounts with a negative sign and all receipts are regarded as credits (i.e., inflow or money) and are recorded-in the accounts with a positive sign. The International Monetary Fund defines BOP as a “statistical statement that subsequently summarises, for a specific time period, the economic transactions of an economy with the rest of the world.”

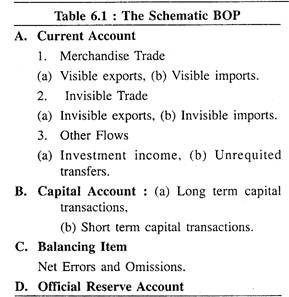

Components of BOP Accounts:

A. The Current Account:

The current account of BOP includes all transaction arising from trade in currently produced goods and services, from income accruing to capital by one country and invested in another and from unilateral transfers— both private and official. The current account is usually divided in three sub-divisions.

The first of these is called visible account or merchandise account or trade in goods account. This account records imports and exports of physical goods. The balance of visible exports and visible imports is called balance of visible trade or balance of merchandise trade [i.e., items 1(a), and 2(a) of Table 6.1].

The second part of the account is called the invisibles account since it records all exports and imports of services. The balance of these transactions is called the balance of invisible trade. As these transactions are not recorded—in the customs office—unlike merchandise trade we call them invisible items.

ADVERTISEMENTS:

It includes freights and fares of ships and planes, insurance and banking charges, foreign tours and education abroad, expenditures on foreign embassies, transactions out of interest and dividends on foreigners’ investment and so on. Items 2(a) and 2(b) comprise services balance or balance of invisible trade.

The difference between merchandise trade and invisible trade (i.e., items 1 and 2) is known as the balance of trade.

There is another flow in the current account that consists of two items [3(a) and 3(b)]. Investment income consists of interest, profit and dividends on bonus and credits. Interest earned by a US resident from the TELCO share is one kind of investment income that represents a debit item here.

ADVERTISEMENTS:

There may be a similar money inflow (i.e., credit item). Unrequited transfers include grants, gifts, pension, etc. These items are such that no reverse flow occurs. Or these are the items against which no quid pro quo is demanded. Residents of a country received these cost-free. Thus, unilateral transfers are one-way transactions. In other words, these items do not involve give and take unlike other items in the BOP account.

Thus the first three items of the BOP account are included in the current account. The current account is said to be favourable (or unfavourable) if receipts exceed (fall short of) payments.

B. The Capital Account:

The capital account shows transactions relating to the international movement of ownership of financial assets. It refers to cross-border movements in foreign assets like shares, property or direct acquisitions of companies’ bank loans, government securities, etc. In other words, capital account records export and import of capital from and to foreign countries.

The capital account is divided into two main subdivisions: short term and the long term movements of capital. A short term capital is one which matures in one year or less, such as bank accounts.

Long term capital is one whose maturity period is longer than a year, such as long term bonds or physical capital. Long term capital account is, again, of two categories: direct investment and portfolio investment. Direct investment refers to expenditure on fixed capital formation, while portfolio investment refers to the acquisition of financial assets like bonds, shares, etc. India’s investment (e.g., if an Indian acquires a new Coca- Cola plant in the USA) abroad represents an outflow of money. Similarly, if a foreigner acquires a new factory in India it will represent an inflow of funds.

Thus, through acquisition or sale and purchase of assets, capital movements take place. Investors then acquire controlling interests over the asset. Remember that exports and imports of equipment do not appear in the capital account. On the other hand, portfolio investment refers to changes in the holding of shares and bonds. Such investment is portfolio capital and the ownership of paper assets like shares does not ensure legal control over the firms.

[In this connection, the concepts of capital exports and capital imports require little elaboration. Suppose, a US company purchases a firm operating in India. This sort of foreign investment is called capital import rather than capital export. India acquires foreign currency after selling the firm to a US company. As a result, India acquires purchasing power abroad. That is why this transaction is included in the credit side of India’s BOP accounts. In the same way, if India invests in a foreign country,, it is a payment and will be recorded on the debit side. This is called capital export. Thus, India earns foreign currency by exporting goods and services and by importing capital. Similarly, India releases foreign currency by importing visible and invisibles and exporting capital.]

C. Statistical Discrepancy Errors and Omissions:

The sum of A and B (Table 6.1) is called the basic balance. Since BOP always balances in theory, all debits must be offset by all credits, and vice versa. In practice, it rarely happens—particularly because statistics are incomplete as well as imperfect. That is why errors and omissions are considered so that the BOP accounts are kept in balance (Item C).

D. The Official Reserve Account:

The total of A, B, C, and D comprise the overall balance. The category of official reserve account covers the net amount of transactions by governments. This account covers purchases and sales of reserve assets (such as gold, convertible foreign exchange and special drawing rights) by the central monetary authority.

ADVERTISEMENTS:

Now, we can summarise the BOP data:

Current account balance + Capital account balance + Reserve balance = Balance of Payments

(X – M) + (CI – CO) + FOREX = BOP

X is exports,

ADVERTISEMENTS:

M is imports,

CI is capital inflows,

CO is capital outflows,

FOREX is foreign exchange reserve balance.

BOP Always Balances:

ADVERTISEMENTS:

A nation’s BOP is a summary statement of all economic transactions between the residents of a country and the rest of the world during a given period of time. A BOP account is divided into current account and capital account. Former is made up of trade in goods (i.e., visible) and trade in services (i.e., invisibles) and unrequited transfers. Latter account is made up of transactions in financial assets. These two accounts comprise BOP

A BOP account is prepared according to the principle of double-entry book keeping. This accounting procedure gives rise to two entries— a debit and a corresponding credit. Any transaction giving rise to a receipt from the rest of the world is a credit item in the BOP account. Any transaction giving rise to a payment to the rest of the world is a debit item.

The left hand side of the BOP account shows the receipts of the country. Such receipts of external purchasing power arise from the commodity export, from the sale of invisible services, from the receipts of gift and grants from foreign governments, international lending institutions and foreign individuals, from the borrowing of money from the foreigners or from repayment of loan by the foreigners.

The right hand side shows the payments made by the country on different items to the foreigners. It shows how the total of external purchasing power is used for acquiring imports of foreign goods and services as well as the purchase of foreign assets. This is the accounting procedure.

However, no country publishes BOP accounts in this format. Rather, by convention, the BOP figures are published in a single column with positive (credit) and negative (debit) signs. Since payments side of the account enumerates all the uses which are made up of the total foreign purchasing power acquired by this country in a given period, and since the receipts of the accounts enumerate all the sources from which foreign purchasing power is acquired by the same country in the same period, the two sides must balance. The entries in the account should, therefore, add up to zero.

In reality, why should they add up to zero? In practice, this is difficult to achieve where receipts equal payments. In reality, total receipts may diverge from total payments because of: (i) the difficulty of collecting accurate trade information; (ii) the difference in the timing between the two sides of the balance; and (iii) a change in the exchange rates, etc.

ADVERTISEMENTS:

Because of such measurement problems, resource is made to ‘balancing item’ that intends to eliminate errors in measurement. The purpose of incorporating this item in the BOP account is to adjust the difference between the sums of the credit and the sums of the debit items in the BOP accounts so that they add up to zero by construction. Hence the proposition ‘the BOP always balances’. It is a truism. It only suggests that the two sides of the accounts must always show the same total. It implies only an equality. In this book-keeping sense, BOP always balances.

Thus, by construction, BOP accounts do not matter. In fact, this is not so. The accounts have both economic and political implications. Mathematically, receipts equal payments but it need not balance in economic sense. This means that there cannot be disequilibrium in the BOP accounts.

A combined deficit in the current and capital accounts is the most unwanted macroeconomic goal of ,an economy. Again, a deficit in the current account is also undesirable. All these suggest that BOP is out of equilibrium. But can we know whether the BOP is in equilibrium or not? Tests are usually three in number: (i) movements in foreign exchange reserves including gold, (ii) increase in borrowing from abroad, and (iii) movements in foreign exchange rates of the country’s currency in question.

Firstly, if foreign exchange reserves decline, a country’s BOP is considered to be in disequilibrium or in deficit. If foreign exchange reserves are allowed to deplete rapidly it may shatter the confidence of people over the domestic currency. This may ultimately lead to a run on the bank.

Secondly, to cover the deficit a country may borrow from abroad. Thus, such borrowing occurs when imports exceed exports. This involves payment of interest on borrowed funds at a high rate of interest.

Finally, the foreign exchange rate of a country’s currency may tumble when it suffers from BOP disequilibrium. A fall in the exchange rate of a currency is a sign of BOP disequilibrium.

ADVERTISEMENTS:

Thus, the above (mechanical) equality between receipts and payments should not be interpreted to mean that a country never suffers from the BOP problems and the international economic transactions of a country are always in equilibrium.

Implications of an Unbalance in the BOP:

Although a nation’s BOP always balances in the accounting sense, it need not balance in an economic sense.

An unbalance in the BOP account has the following implications:

In the case of a deficit:

(i) Foreign exchange or foreign currency reserves decline,

(ii) Volume of international debt and its servicing mount up, and

ADVERTISEMENTS:

(iii) The exchange rate experiences a downward pressure. It is, therefore, necessary to correct these imbalances.

BOP Adjustment Measures:

BOP adjustment measures are grouped into four:

(i) Protectionist measures by imposing customs duties and other restrictions, quotas on imports, etc., aim at restricting the flow of imports,

(ii) Demand management policies—these include restrictionary monetary and fiscal policies to control aggregate demand [C + I + G + (X – M)],

(iii) Supply-side policies—these policies aim at increasing the nation’s output through greater productivity and other efficiency measures, and, finally,

(iv) exchange rate management policies— these policies may involve a fixed exchange rate, or a flexible exchange rate or a managed exchange rate system.

ADVERTISEMENTS:

As a method of connecting disequilibrium in a nation’s BOP account, we attach importance here to exchange rate management policy only.

Exchange Rate Management:

An exchange rate is the price at which one currency is converted into or exchanged for another currency. Exchange rate connects the price system of two countries since this (special) price shows he relationship between all domestic prices and ill foreign prices. Any change in the exchange rate between rupee and dollar will cause a change in the prices of all American goods for Indians and the prices of all Indian goods for the Americans. In the process, equilibrium in the BOP accounts will be restored.

Every government has to make international decisions of what type of exchange rate it wants to adopt. This means that government will have to decide how its own currency should be related to other currencies of the world. For instance, it may choose to fix the value of its currency to other currencies of the world so as to adjust its BOP difficulties, or it may choose to allow its currency to move free against other currencies of the world so as to adjust its BOP difficulties. This means that there are two important exchange rate systems—the fixed (or pegged) exchange rate, and the flexible (or fluctuating or floating) exchange rate.

These two exchange rates have been tried and tested in the past. Fixed exchange rate system had been tried by the IMF during 1947-1971 when this system was abandoned. After 1971, the world’s exchange rate became a flexible one or a floating one. Truly speaking, the exchange rate that is being followed by the IMF now is known as the ‘managed floating system’, or the ‘managed flexibility’.

(A) Fixed Exchange Rate:

A fixed exchange rate is an exchange rate that does not fluctuate or that changes within a pre- determined rate at infrequent intervals.

Government or the central monetary authority intervenes in the foreign exchange market so that exchange rates are kept fixed at a stable rate. The rate at which the currency is fixed is called par value. This par value is allowed to move in a narrow range or ‘band’ of ± 1 per cent. If the sum of current and capital account is negative, there occurs an excess supply of domestic currency in the world markets. The government then intervenes using official foreign exchange reserves to purchase domestic currency.

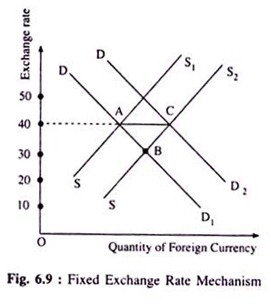

Fixed or the pegged exchange rate can be explained graphically. Let us suppose that India’s demand for US goods rises. This increased demand for imports causes an increase in the supply of domestic currency, rupee, in the exchange market to obtain US dollars. Let DD1 and SS1 be the demand and supply curves of dollar in Fig. 6.9. These two curves intersect at point A and the corresponding exchange rate is Rs. 40 = $1. Consequently, the supply curve shifts to SS2 that cuts the demand curve DD1 at point B.

This means a fall in the exchange rate. To prevent this exchange rate from falling, the Reserve Bank of India will demand more rupees in exchange for US dollars. This will restrict the excess supply of rupee and there will be an upward pressure in exchange rate. Demand curve will now shift to DD2. The end result is the restoration of the old exchange rate at point C.

Thus, it is clear that the maintenance of fixed exchange rate system requires that foreign exchange reserves are sufficiently available. Whenever a country experiences inadequate foreign currency reserves it won’t be able to purchase domestic currency in sufficient quantities. Under the circumstances, the country will devalue its currency. Devaluation refers to an official reduction in the value of one currency in terms of another currency.

(B) Flexible Exchange Rate:

Under the flexible or floating exchange rate, the exchange rate is allowed to vary to international foreign exchange market influences. Thus, government does not intervene. Rather, it is the market forces that determine the exchange rate.

In fact, automatic variations in exchange rates consequent upon a change in market forces are the essence of freely fluctuating exchange rates. A deficit in the BOP account means an excess supply of the domestic currency in the world markets. As price declines, imbalances are removed. In other words, excess supply of domestic currency will automatically cause a fall in the exchange rate and BOP balance will be restored.

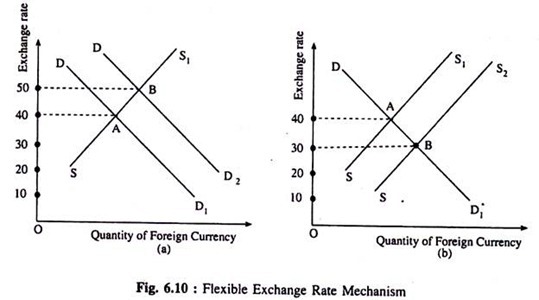

Flexible exchange rate mechanism has been explained in Fig. 6.10 where DD1 and SS1 are the demand and supply curves. When Indians buy US goods, there arises supply of dollar and when US people buy Indian goods, there occurs demand for rupee. Initial exchange rate—Rs. 40 = $1—is determined by the intersection of DD1 and SS1 curves in both the Figs. 6.10(a) and 6.10(b).

An increase in demand for India’s exportable means an increase in the demand for Indian rupee. Consequently, demand curve shifts to DD2 and the new exchange rate rises to Rs. 50 = $1. At this new exchange rate, dollar appreciates while rupee depreciates in value [Fig. 6.10(a)].

Fig. 6.10(b) shows that the initial exchange rate is Rs. 40 = $1. Supply curve shifts to SS2 in response to an increase in demand for the US goods. SS2 curve intersects the demand curve DD1 at point B and exchange rate drops to Rs. 30 = $1. This means that dollar depreciates while Indian rupee appreciates.

(C) Managed Exchange Rate:

Under this heading, floating exchange rates are ‘managed’ partially. That is to say, exchange rates are determined in the main by market forces, but the central bank intervenes to stabilise fluctuations in exchange rates so as to bring ‘orderly’ conditions in the market, or to maintain the desired exchange rate values.