Read this article to learn about the top four frequently asked questions on the Balance of Payments.

Q.1. Give reasons why people desire to have foreign exchange.

Ans. People demand foreign exchange for the following purposes:

(i) To buy better products from other countries

ADVERTISEMENTS:

(ii) To make financial investments in other countries

(iii) To send gifts and remittances abroad.

(iv) To hedge as such can be profitable of foreign currencies.

Q.2. Should a current account deficit be a cause for alarm? Explain.

ADVERTISEMENTS:

Ans. Deficit in current account is not a cause for alarm since deficit of current account is carried over to the capital account of Balance of Payments where usually any deficit gets compensated by surplus. The current account deficit is generated due to deficit in export and imports of goods & services.

This can also be due to lack of unilateral transfers also. But on the other hand this is compensated by the surplus of capital account of BOP. It has put a cause of concern for any economy.

Q.3. Distinguish between the nominal exchange rate and the real exchange rate. If you were to decide whether to buy domestic goods or foreign goods, which rate would be more relevant? Explain.

Nominal Exchange Rate:

ADVERTISEMENTS:

Ans. It is the rate of exchange or price of foreign currency in terms of domestic currency.

Real Exchange Rate:

Price of goods abroad as compared to those at home is known as Real Exchange Rate. Real exchange rate is usually considered as more appropriate measure in buying domestic goods or foreign goods. Hence that would be more relevant to consider if I were to decide between buying domestic goods or foreign goods.

Q.4. How is exchange rate determined under a flexible exchange rate regime?

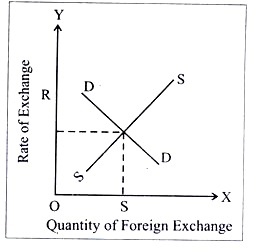

Ans. In case of flexible exchange rate regime, when there is no intervention by the central bank, exchange rate fluctuate in such a way that market is cleared.

The equilibrium rate occurs where demand for foreign exchange and supply of foreign exchange are equal.

In the above diagram, equilibrium exchange rate is R when quantity demanded and supplied of dollars are equal.