Balance of Payments on Current Account!

Balance of payments on the other hand is more comprehensive in scope than balance of trade.

It includes not only imports and exports of goods which are visible items but also such invisible items as shipping, banking, insurance, tourism, interest on investments, gifts, etc.

A country, say India, has to make payments to the other countries not only for its imports of merchandise but also for banking, insurance and shipping services rendered by other countries; it has to pay further the royalties for foreign firms, expenditure of Indians in foreign countries, interest on foreign investments in India, or on loans obtained by India from other countries and such international organizations as the I.M.F., I.B.R.D., etc.

ADVERTISEMENTS:

These are debit items for India, since these transactions involve payments abroad. In the same way, foreign countries import goods from India, make use of Indian films and so on, for all of which they make payments to India. These are the credit items for India as the latter receives payments. Balance of payments thus gives a comprehensive picture of all such transactions including imports and exports of goods and services.

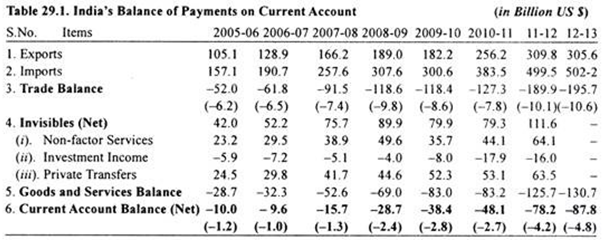

The Table 29.1 (given below) we give the position of India’s balance of payments on current account for the years 2005-06 to 2012-13. In this table of balance of payments are given the visible as well as invisible items of trade. The visible items are export-import trade and the invisible items of balance of payments on current account are travel, transportation and insurance, interest on loans given and other investment income and private transfers such as remittances from Indians living abroad.

Both visible and invisible items together make up the current account. Invisible items such as interest on loans, tourist expenditure, banking and insurance charges, etc., are similar to visible trade since receipts from selling such services to the foreigners are very similar in their effects on receipts from sales of goods; they provide income to the people who produce the goods or services.

It will be noted from Table 29.1 above that the most important item in the balance of payments on current account is balance of trade which refers to imports and exports of goods. In the Table 29.1 balance of trade does not balance and shows a deficit in all the seven years. In the years 2011-12 and 2012-13 trade deficit has substantially increased. Trade deficit was over 10 per cent of GDP in both these years.

ADVERTISEMENTS:

In fact, it is huge trade deficit in these two years that has caused huge current account deficit of over 4% of GDP in these two years Economic slowdown in advanced countries and its spill over effects on Emerging Market Economies coupled with high crude oil and gold prices were responsible for sharp increase in trade deficit. Due to surplus in invisibles account, there was a surplus on current account for three years, 2001-2002, 2002-03 and 2003-04.

In India’s balance of payments on current account for three years, 2004-05 onwards there has been a deficit. Contrary to popular perception, deficit on current account is not always bad provided it is within reasonable limits (which in case of India is estimated to be 2.5% of GDP) and can be easily met by non-debt capital receipts. In fact, deficit on current account represents the extent of absorption of capital inflows in India during a year.

It may be noted that when there is deficit on the current account, it is financed either by using foreign exchange reserves held by Reserve Bank of India or by capital flows that come into the country in the form of foreign direct investment (FDI) and portfolio investment by FIIs, external commercial borrowing (ECB) from abroad and by NRI deposits in foreign exchange account in our banks.

ADVERTISEMENTS:

However, due to global financial crisis in 2008-09, there was first slowdown and then decrease in exports. As a result, there was a large deficit of 2.4 of per cent of GDP on current account which could not be met by capital inflows as they were quite meagre ($ 8.6 billion) as a result of global financial crisis. Therefore, to finance the deficit on current account in 2008-09 we had to withdraw US $ 20 billion from our foreign exchange reserves. Again in the last two years 2011-12 and 2012-13 the current account deficit (CAD) has been quite high.

It may be noted that high current deficit tends to weaken the rupee by raising the demand for US dollars. In 2011-12, current account deficit tended to weaken the rupee by raising the demand for US dollars. In 2011-12, the current account deficit was 4.2 per cent of GDP. Since capital inflows in this year were not adequate to finance the current account deficit, RBI had to withdraw 12.8 billion US dollars from its foreign exchange reserves to meet the demand for US dollars.

In the year 2012-13 the current account deficit was estimated to be even higher at 4.8 per cent of GDP, capital inflows through portfolio investment by FIIs picked up in the latter half of 2012-13 but capital inflows through FDI had fallen. However, in 2012-13 we were able to finance the current account deficit with capital inflows without withdrawing from our foreign exchange reserves.

In 2013-14 current account deficit situation has worsened as FIIs have pulled out both from debt and equity markets since June 2013. This has led to the sharp depreciation of rupee by increasing demand for dollars. Thus current account deficit poses a serious challenge to macroeconomic management of the economy.

The dependence on volatile capital inflows through FIIs to meet the current account deficit is unsustainable as these capital flows go back when economic situation in their home countries improve and thereby causes sharp depreciation in exchange rate of rupee and crash in stock market prices.

Since in the recent years, 2011-12, 2012-13 and 2013-14 current account deficit has widened, which has increased the balance of payments vulnerability to sudden reversal of capital flows, especially when sizable flows are comprised of debt and volatile portfolio investment by FIIs.

The priority has therefore been to reduce current account deficit (CAD) through improving trade balance. Efforts have been made to promote exports by diversifying the export commodity basket and export destinations. One way to limit imports is to bring prices up to the international level so that users bear the full cost.

Accordingly, petrol has been decontrolled and diesel prices have been revised upward in Jan. 2013 to curtail subsidy on it. To discourage the imports of gold which has played a significant role in causing trade deficit, customs duty on its import was first raised from 6% to 8% and then to 10 per cent.

Further, to improve the current account deficit emphasis has been on facilitating remittances and encouraging software exports that have been responsible for surplus on the invisible account. In recent years this surplus has lowered the impact of widening trade deficit on current account deficit (CAD) significantly.

ADVERTISEMENTS:

The two components together constituted nearly two thirds of the trade deficit that was more than 10 per cent of GDP in 2011 -12 and 2012-13. Remittances particularly are known to exhibit resistance when the country is hit by external shock as was evident during the global crisis of 2008. Besides, several incentives have been given to NRIs to deposit their foreign exchange savings in Indian banks.