Balance of Payments on Capital Account

In the balance of payments on capital account given in Table 29.2 important items are borrowings from foreign countries and lending funds to other countries.

This takes two forms:

(i) External assistance which means borrowing from foreign countries under concessional rate of interest;

ADVERTISEMENTS:

(ii) Commercial borrowing under which the Indian Government and the Private sector borrow funds from world money market at higher market rate of interest. Besides non-resident deposits are another important item in capital account.

These are the deposits made by non-resident Indians (NRI) who keep their surplus funds with Indian Banks. Another important item in balance of payments on capital account is foreign investment by foreign companies in India. There are two types of foreign investment. First is portfolio investment under which foreign institutional investors (FII) purchase shares (equity) and bonds of Indian companies and Government.

The second is foreign direct investment (FDI) under which foreign companies set up plants and factories on their own or in collaboration with the Indian companies. Still another item in capital account is other capital flows in which the important source of funds is remittances from abroad sent by the Indian citizens working in foreign countries. The Table 29.2 gives the position of India’s capital account for the years 2004 -05 to 2011-12.

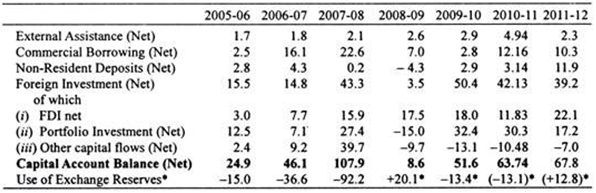

Table 29.2. India’s Balance of Payments on Capital Account (in Billion US $):

Capital inflows in the capital account can be classified into debt creating and non-debt creating. Foreign investment (both direct and portfolio) represents non-debt creating capital inflows, whereas external assistance (i.e. concessional loans taken from abroad), external commercial borrowing (ECB) and non-resident deposits are debt-creating capital inflows.

It will be seen from Table 29.2, during 2007-08, there was net capital inflow of 43.3 billion US dollars on account of foreign investment (both direct and portfolio). The Table 29.2 gives the position of India’s balance of payments on capital account for seven years, 2005-06, 2006-07, 2007-08, 2008- 09 and 2009-10, 2010-11 and 2011-12.

When all items of balance of payments on capital account are taken into account we had a surplus of 107.9 billion US dollars in 2007-08. Taking into current account deficit of $ 15.7 billion on current account in year 2007-08 there was accretion to our foreign exchange reserves by $ 92.2 billion in 2007-08. Global financial crisis affected our capital account balance as there was reversal of capital flows after Sept. 2008 with the result that we used $ 20.1 billion of our foreign exchange reserves in 2008-09 resulting in decrease of our foreign exchange reserves.

That is, because we used our foreign exchange reserves equal to $ 20.1 billion, there was decline in our foreign exchange reserves by $ 20 billion in 2008-09. The situation improved in 2009-10 as foreign direct investment (FDI) and portfolio investment by FIIs picked up.

ADVERTISEMENTS:

As a result there was net capital account surplus of $ 51.6 billion in 2009-10 and after meeting the current account deficit of $ 38 billion there was addition to our foreign exchange reserves by $ 13.4 billion in 2009-10. In 2010- 11 also there was surplus on capital account of $ 63.74 billion and after meeting current deficit we added $ 13.1 billion in our foreign exchange reserves in 2010.11.

However, in 2011-2012 and 2012-13 the situation regarding capital flows changed significantly and capital flows were not sufficient to meet the large current account deficit (CAD). Consequently, in 2011- 12 withdrawals from foreign exchange reserves of 12.8 billion US dollars was made. However, in 2012-13 we were able to finance large deficit on current account by capital inflows and therefore without withdrawal from our foreign exchange reserves.

Capital flows are driven by pull factors such as economic fundamentals of recipient countries and push factors such as policy stance of source countries. The capital flows have implications for exchange rate management, overall macroeconomic and financial stability including liquidity conditions. Capital account management therefore needs to emphasize promoting foreign direct investment (FDI) and reducing dependence on volatile portfolio capital.

This would ensure that to the extent current account defect is bridged through capital surplus it would be better if it is done through stable and growth enhancing foreign direct investment flows. In the present international financial situation, reserves are the first line of defence against the volatile capital flows. However, the decline in reserves as a percentage of GDP is a source of concern.