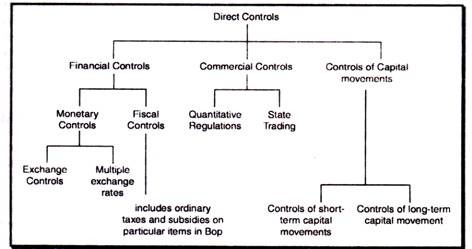

“Direct controls” refer to any measure of governmental intervention which is directly aimed at increasing or decreasing some particular group of payments or receipts in the balance of payment. As means of improving a country’s BOP, the government may resort the:

(i) Complete prohibition of certain luxury imports into that country and

(ii) A general deflationary financial policy designed to reduce the general level of money incomes and prices in that country.

The former is a direct intervention in one small item of the BOP; the latter exerts its influence on the general economic situation. The former is quantitative control which pays no regard to the price mechanism; the latter works through its effect upon relative money prices and money incomes. Import and ex.port duties and subsidies on particular products are certainly examples of direct controls.

(i) Exchange Control:

An important means by which the authorities in a deficit country may attempt to restore equilibrium to the BOP is the restriction of payments to another country by means of exchange control. It aims at equilibrating the demand and supply of foreign balance. The main feature of any system of exchange control is that all incoming payments to the country, representing a receipt of foreign currencies surrendered to government’s exchange control authority which In turn allocates and sanctions all payments to foreigners.

Exporters must sell foreign currencies at the official exchange rates to the authority and must dispose of foreign currencies in no other way. Importers must purchase foreign exchange from the exchange authority. The purchase and sale of foreign exchange should be made illegal except through the agency of the central authority. Thus the available foreign currency is pooled and rationed to users according to government established criteria of priority.

The chosen official exchange rate may he maintained by always holding the foreign currencies supplied to those wishing to make payments abroad to the amount becoming available from foreign currency earnings. Thus all foreign currencies earned by home nationals must be surrendered to the central bank. The central bank seeks to regulate demand and supply so as to maintain the official exchange rate.

ADVERTISEMENTS:

The vesting of a monopoly of foreign exchange dealing in the central monetary authority confers upon that authority formidable powers to manipulate its monopoly in a variety of ways. It can determine scales of priorities according to which foreign exchange will or will not be supplied to importers, it can act as a discriminating monopolist charging low rates of exchange for foreign currencies purchasing essential imports and high rates for those purchasing luxury imports, and it can subsidize exports to certain countries by extending advantageous rates or facilities to those of its national earning especially desirable foreign currencies.

It also involves a cost in terms of elaborate bureaucratic machinery which it necessitates. then with such machinery, it is doubtful if the monopoly of the monetary authorities can ever be made absolute. Leakages may occur. For example, currency notes may be imported and exported through the post or in the pockets of travelers.

The exchange of such notes may then take place in a “Black” currency market, usually at a depreciated rate. Moreover, nationals of the controlling country find ways of avoiding the surrender of all their foreign currency earnings to the controlling authority.

They may hold such earnings abroad as a contingency balance. More likely they will sell them for their own currency at a rate of exchange lower than the official rate. Foreigners who acquire the currency may also sell it in “free” markets outside the country.

ADVERTISEMENTS:

Thus, despite the efforts of the controlling country to monopolize dealings in its currency, free markets for it inevitably develop abroad in which the rate is lower than the official rate. Once monopoly of dealing in the currency is established by the monetary authority, numerous variants of exchange control are possible.

The major objectives of the exchange control are:

(i) To correct deficit disequilibrium in the BOP;

(ii) To prevent “capital flights” from the country;

(iii) To permit national economies and their policy architects a “broad freedom of action” not only in times of national emergency but in more normal times as well;

(iv) To insulate the national economy from BOP disequilibrium. Exchange controls provide greatly increased freedom of domestic economic policy;

(v) To facilitate servicing of foreign debt, that is, repayment of foreign loans and interest payments on those loans;

(vi) To maintain stable exchange rate vis-a-vis the currencies of other countries with which the country has important economic and trade relations;

(vii) To over-value domestic currency in relation to foreign exchange in order to obtain cheap imports of essential raw materials and intermediate capital goods. Overvaluation of a currency through exchange control mechanism may also be used to liquidate a country’s external debt more cheaply in terms of home currency.

ADVERTISEMENTS:

A country may use exchange controls to deliberately under value its currency in order to make its exports cheaper and imports dearer.

Defects:

Exchange controls give enormous powers to the government bureaucrats and politicians, because these are the people who are vested with the authority to issue import licenses and allocate foreign exchange among several competing buyers. Exchange controls, once Introduced, become a source of illegal income and corruption; they are also a source of wielding enormous power, influence and distributing favours.

The politicians and bureaucrats will be unwilling to do away with the exchange controls even when they are no longer needed for the country. Exchange controls then come to stay indefinitely because they could be a perpetual source of income to many politicians and bureaucrats under the table. This is the political economy of exchange controls.

ADVERTISEMENTS:

There are three methods of exchange control:

They are:

(i) Foreign exchange rate regulation through intervention to prevent appreciation and depreciation of domestic currency;

(ii) Exchange restriction; and

ADVERTISEMENTS:

(iii) Exchange clearing agreements which may be bilateral or multilateral.

(ii) Multiple Exchange Rate Policy:

Controls of foreign exchange dealings have to be policed very thoroughly in order to be efficient. To neutralize some of these difficulties the government may try to introduce a system of multiple exchange rates. The policy of multiple exchange rates is also called selective devaluation policy as opposed to general devaluation policy. In the case of general devaluation policy, imports of all goods and services are made expensive, regardless of whether they are essential all nonessential types of imports.

Similarly, general devaluation would make all exports attractive regardless of what the export commodity is multiple exchange rate policy undertakes selective devaluation; it would make essential imports cheaper and non-essential imports expensive; it would make some exports attractive and other exports unattractive. A multiple exchange rate system can discriminate by commodities, by countries or both. Thus, multiple exchange rate policy will have different exchange rates not for only for different goods (imported and exported) but also for different countries with whom the home country is trading.

The advantage of this policy is chat it eliminates the need for employing quantitative restrictions on imports (or exports) and licensing of imports (or exports). To that extent this system can eliminate inefficiency and corruption that usually go with import licensing and quantitative restrictions on imports. This is perhaps the great merit of multiple exchange rates vis-a-vis physical controls on imports.

There are some shortcomings of the system. It introduces complexity and lot of confusion with regard to the number of exchange rates applicable to number of commodities in relation to number of countries. Sometimes they can harm healthy economic development of a country.

ADVERTISEMENTS:

The scheduling of imports of essential food stuffs at low exchange rates hampered the development of agricultural sector in Chile. From being a net exporter of agricultural products in 1950s, Chile had become within a decade by late 1940s, a net importer of these products. Similarly in Peru when meat imports were subsidized by low exchange rate policy there was a drastic fall in the home production of meat. Ecuador had a similar experience with wheat flour.

All this is not meant to suggest that multiple exchange rate policy is a great source of danger. What is suggested, however, is that a judicious selection of rates and of commodities imported and exported is very vital in order to make best use of this system of multiple exchange rates.

Exchange control clears the exchange market by rationing supply of exchange among the demanders. This rationing is necessarily discriminating. The system of discrimination may operate by country, by commodity, or by mixture of two. It may also incorporate elements of exchange rate fluctuation.

(iii) Fiscal Controls:

By “fiscal controls” we mean the use of taxes and subsidies for the purpose of influencing the various items in a country’s BOP. The clearest example of such fiscal controls are the imposition of import duties in order to reduce the amount of foreign products purchased and so to decrease the total expenditure in foreign currency upon them, and the imposition of an export duty (whether the foreign elasticity of demand is thought to lie less than unity or of an export subsidy, whether the foreign elasticity of demand is thought to be greater than unity) in order to increase the total receipts of foreign exchange from’ the exports concerned.

It should be clear from what has been said above that the “fiscal controls” of import and export duties and subsidies and the “monetary controls” of multiple exchange rates are two different administrative devices for attaining the same economic results.

ADVERTISEMENTS:

(iv) Commercial controls-Quantitative restrictions:

The total payments or receipts in a country’s BOP may be influenced by commercial measures which set a limitation upon the amount (or the value) of a particular product which may be imported III exported. Such a form of direct control is most likely to be applied to “visible” commodity exports and imports, since it can be readily enforced as the commodity in question passes over the country’s frontier.

The quantitative import restrictions may limit the volume of the commodity which may be imported into the country or the value of the commodity which may be imported. It may be administered through an “open” or “global” quota (that is, as soon as four motor cars have used the frontier into the country, the country will be closed to the Import of cars for the rest of the year) or it may be administered by the grant of licenses or permits to individual persons to import motor cars that is, persons W, X, Y and Z) are each given a license to import one color car this year and in this latter case the license may or may not they from what source the commodity is to be procured.

The purpose of this quantitative import restriction will be to reduce the value of the country’s import of this commodity by a certain amount. This it will certainly do if it takes the form of limiting, in- total value of the class of imports in question. But if it takes the fill in of a limitation on the volume of the commodity which may be Imported it is not certain that it will achieve this objective even if it is lift lively enforced.

When imports are restricted by the fiscal means of an import tax or by the monetary means of the multiple exchange rate, the problem of “margin” between demand and supply price does not arise. But this “margin” automatically accrues to the authorities of the importing country in the form of a revenue from the import duty in the case of the tax and in the form of a profit on the dealings of the exchange control authority in the case of a multiple exchange rate.

ADVERTISEMENTS:

But with an exchange control which merely restricts the amount of money which may be spent on the particular imports or with a quantitative import restrictions which limits a particular import by value or by quantity, this problem of the margin between demand and supply price arises.

(v) State Trading:

A further refinement of quantitative import control is the state trading monopoly. Under this method, all import of the chosen commodity by the private sector is forbidden, and importantly is done only by a state operated organization. The state plays a direct role in international trade by making its own purchases and sales. It can take the form of a government agency or monopoly operating more or less according to the same principles as a private firm, or it can be a ministry or an organization that completely controls the country’s international trade, as in most communist countries.

Given such control, the state organization is able to regulate the amount of the commodity which is imported to accord with national balance of payments policies. Here again, a margin appears between the importer’s supply price and the public’s demand price under conditions of scarcity; the margin in this case accrues to the state organization in the form of abnormal profit.

In times of balance of payments pressure, governments often introduce rules about buying home products, so that government officials are urged to use only domestic airlines, embassies to serve only domestic wines etc. Thereby a double standard is used: no tariffs or quantitative restrictions for balance of payments reasons for the private sector, but near autarky as far as government purchases are concerned.

Some products, such as tobacco and alcohol, are frequently handled as government monopolies. In many countries, a tradition of state trading has long existed. State trading expanding greatly during the 1930s when several countries started to engage in direct trading in connection with schemes for supporting domestic industries, especially agriculture.

ADVERTISEMENTS:

State trading has also played an important role for many less developed countries in recent years. These countries have often tried to organize market boards for important agricultural products. This has been done with the double intention of rationalizing the internal market structure and helping to improve agricultural technique. Another important objective has been to get some control over the country’s foreign trade and to improve the terms of trade by taking advantage of monopoly power.

Controls of Capital Movements:

Control of capital movements may be of two categories: the control of short-term and long-term capital movements. In the pursuit of balance-of-payments adjustment from the classic gold standard to the manipulative interest rate policies, short-term money movements have played both a constructive and destructive role. Equalizing short- term capital movements have a useful role to play in a price adjustment (or an income adjustment) system.

They are essential to the smooth achievement of adjustment by those means or to the accommodating of balance of payments to major capital transfers. At the same time, it is evident historically that there is a genus of short- term capital movements which is an inimical to balance-of-payments stability as the equalizing type is necessary. How, for purposes of control are we to distinguish between these two types?

The fact is that the is impossible for purposes of control to distinguish between stabilizing and destabilizing short-term capital, and this difficulty of segregation makes it inevitable that both (or neither) should be controlled. It is possible, of course, to proceed piecemeal and to legislate against particular imports of short-term capital (and thus against their subsequent export) by closing the channels through which they enter.

In the case of long-term capital movements it is easier to distinguish between the desirable and undesirable in the light of balance-of-payments policy. Moreover, it is easier to justify control. A country with a recurrent account cannot be an extensive long-term lender abroad. It is possible that control may be desirable or political and non-economic reasons in order to coordinate monetary and political policies.

A simple control of long-term overseas investment can be imposed by the monetary authority requiring that ail schemes of overseas direct investment and all applications to raise money in its own capital market should be subject to its approval, and that all earnings attributable to foreign investment should be repatriated to the investing country.

Complete control of capital movements, even if desirable, is elusive. In the first place it is not possible to impose it in isolation. To have any chance of success it must involve a control and quantitative examination of all foreign payments, capital and current. Often apparently routine transactions can conceal a capital transfer.

Sometimes perfectly legal procedures can take on the role of a capital movement and defy control. The so called leads and lags effects in payments for imports and exports is an obvious example. Here immediate payment for imports by home buyers and delayed payments for exports by foreigners is equivalent to a speculative capital outflow in its effect on the country concerned.

To a large trading country suspected of impending devaluation, such a speculative attack, in however innocent a guise, can be fatal. Even if we abandon the idea of imposing and administering a completely “capital tight” exchange control we must still decide whether some form of control on capital movement is desirable. The answer to this depends on how the balance of advantage is deemed to lie.

On the one hand, experience of “hot money” movements in the interwar period and to some extent since 1945 would lead to advocacy of control. On the other hand, if, in order to control capital movements, it is necessary to set up the whole constricting paraphernalia of exchange control on current payments, then that is too high a price to pay and we must accommodate over selves to capital movements as best we can.

Conclusion:

The above discussion of main types of controls which may be used by a country to correct imbalance in its external, trade serves to show the wide range of mechanism which are available. They have been widely used, and a high degree of expertise in their use has been acquired.

Let us attempt a practical appraisal of controls in examining their usefulness and range of applicability. First, if the elasticities of demand for imports are high, then adjustment through price changes will be possible without too great a movement of the terms of trade; if the elasticities are low then resort to direct controls is likely, if not inevitable, if both stable domestic incomes and external balance are to be maintained. As one writer puts it, controls can keep balance of payments in order when other methods of adjustment would work painfully, if at all.

Something like this argument is used by opponents of the post-war system of IMT fixed exchanges to show the inevitability of controls. They argue that, robbed of exchange rate variation as an adjustment device, deprived of income and price variation as the determination of governments to preserve full employment and growth, governments fall back upon the only method left to deal with balance of payments imbalance, direct controls.

A second argument for controls is that they are swift and sure in application. A country whose foreign balance is subjected to a sudden and unexpected external influence may by their use counteract such shocks effectively and quickly. The form of control may be varied to suit the circumstances. In such conditions, market adjusters such as the exchange rate may work, but they will not work as quickly.

A third supporting argument is more problematical. It is conceivable that when a balance of payments deficit is threatened the choice between controls and exchange depreciation must the conditioned by which of these has the least impact on the correcting country’s terms of trade. While both methods will make imported goods more expensive, controls can be used to minimize the terms-of- It.ide effect. It is, at least theoretically, possible for the authorities to those the form of control and apply it discriminately so as to obtain the optimum effects on the terms of trade and on the balance of trade.

Fourthly, direct controls can reduce imports selectively, preventing scarce foreign exchange from being wasted on non-essential imports. I he ordinary forces of the market can exercise no such discrimination.

Let us close the discussion by listing some further defects which .ire less general. First, the use of controls tends to create vested Interests for the continuance of the controls. Although most often thought of as balance-of-payments devices, they may be used protectively for industries just as tariffs may be.

The commonest situation is one in which controls are imposed primarily for balance-of- payments reasons but are used discriminately as well to protect particular industries. To attempt removal of the controls which balance-of-payments conditions no longer warrant them is then to evoke howls of protest from these; industries.

Another group with an Interest in the continuance of controls is that which has been receiving the scarcity profits resultant upon the restriction. These are joined in turn by the administrators and the organizers of the control system. A large lobby builds up for retention.

Second, it is argued that controls produce inequities far beyond what is justified by their effectiveness as a balance of payments policy. Examples of such inequities occur frequently in the literature: the special profits of the importers who are favoured above him whose trading is curtailed by arbitrary choice, the trader who is allowed foreign currency for some favoured project as compared with him who is denied it. In the complex web of regulations, in the multiplicity of arbitrary decisions made by a growing bureaucracy of controllers, the potentiality for injustice is great.