In this article we will discuss about the internal and external balances of a country.

A balance or equilibrium means a situation in which transactions tend to repeat themselves indefinitely, since there is-no force calling for increase or decrease in any variable.

The internal equilibrium or balance refers to such values of the economic variables within the economy that all the variables tend to be repeated at the same level.

If the magnitudes of the propensities to consume, save, import and invest are such that the volumes of consumption, savings, imports and investment remain the same from period to period and the variations in foreigners’ demand for domestic goods also are incapable of introducing any changes in the internal working of the system, the conditions of internal equilibrium are supposed to be fully satisfied.

ADVERTISEMENTS:

The existence of the situation like inflation, depression, over full employment and unemployment denotes an internal disequilibrium in the economy.

The external equilibrium or balance, on the other hand, is the condition in which ex-ante purchases of foreign goods, services, securities and transfer payments made to foreigners, equal ex-ante purchases of goods and services and debt of country concerned and transfer payments made by foreigners to home residents.

Meier defines the balance of payments equilibrium or an external equilibrium in these words, “…we shall consider the balance of payments to be in equilibrium if over the relevant time period a country can meet its international payments out of international receipts from current transactions and autonomous (ordinary or “acceptable”) capital inflows, without being compelled to endure excessive unemployment or to restrict imports merely to avoid a deficit in the balance of payments. When a passive balance on current account is not covered by an autonomous capital inflow, there is a need for induced (accommodating or “distress”) capital inflows, without being compelled to endure excessive unemployment or to restrict imports merely to avoid a deficit in the balance of payments. When a passive balance on current account is not covered by an autonomous capital inflow, there is a need for induced (accommodating or “distress”) capital transaction or a gold outflow. The country then suffers from an external disequilibrium which requires remedial action.”

Although national income, national expenditure and national output are necessarily equal in a closed economic system, yet there may be a divergence between them in an open system.

ADVERTISEMENTS:

The level of national output (O) can be expressed as-

O = C + I + (X – M) … (i)

Where C represents consumption and I, the home investment, X represents the value of all exports and M, the value of imports of goods and services. (X-M) represents the net trade balance.

In an open system, the level of national income may differ from the national output by the amount of net payments received from abroad (+R) on account of interest and dividends from foreign investments, private unilateral transfers and government aid or the net payments made abroad on these items (-R), so that-

ADVERTISEMENTS:

Y = O ± R … (ii)

Substituting (i) in (ii) we get-

Y = C + I + (X – M) ± R … (iii)

The total domestic expenditure of the community is an aggregate of domestic consumption and investment-

E = C + I … (iv)

Substituting (iv) in (v) we have-

Y = E + (X – M) ± R

or (X-M) ± R = (Y-E) …(v)

It is obvious from the above equations that the excess of aggregate expenditure over income reflects an external deficit. In case the aggregate income is greater than expenditure, there is the state of external surplus. Thus the external disequilibrium or imbalance may be a direct manifestation of internal disequilibrium denoted by the divergence between national income and national expenditure.

ADVERTISEMENTS:

The relationship between internal and external disequilibria cited above is also apparent when the Harrod-Domar theory of equilibrium growth is applied to the balance of payments. Harrod’s fundamental growth equation in an open model is written as-

GC = s – b … (vi)

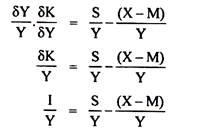

Where G is the ratio of increment in production to total production, C is the ratio of increment of capital (investment) to an increment in production, s is the saving-income ratio and b is the ratio of balance of trade to income or output. Thus equation (vi), given above can be expressed as-

ADVERTISEMENTS:

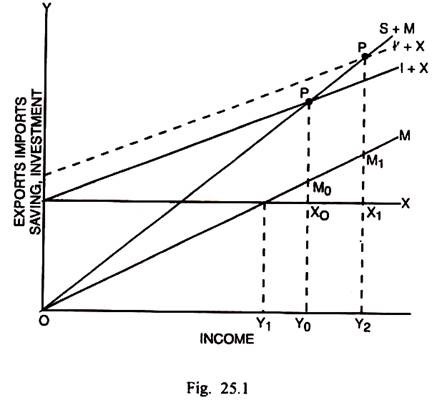

The equality between (1+X) and (S+M) reflects a state of equilibrium. But this equilibrium condition of national income is no guarantee of external equilibrium.

This may be depicted through Fig. 25.1 given below:

ADVERTISEMENTS:

If the country initiates a programme of economic development, there will be an increase in investment so that (I + X) function shifts upto (I’ + X) and the equilibrium level of income goes upto Y2. But the external deficit, at the same time, also increases from X0M0 to X1M1.

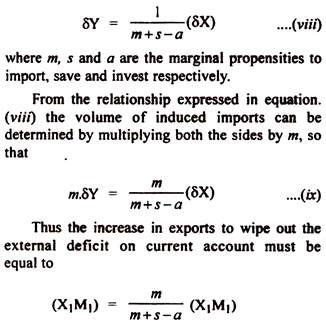

The removal of this deficit is, by no means, an easy thing. The deficit X1M1 must be removed through an increase in exports. But as the exports are raised, there will also be a rise in income which in turn will cause the people to import more from foreign countries. The rise in exports must, therefore, be sufficient to wipe out the deficit X1M1 as well as to neutralize the induced imports. The foreign trade multiplier can be expressed as-

In the case of developing countries, the problem of external disequilibrium, consequent upon an increase in income, becomes all the more serious, since the propensities to import, save and invest which have been assumed constant in the above analysis, do not actually remain so. In the developing countries, unless the propensity to save is sufficiently high, the rise in propensity to import, particularly in the earlier phases of development, will cause serious balance of payments deficit.

The propensity to import is substantially high, since the import component of investment in these countries is very high. The rising incomes themselves induce the people to import consumer goods in larger quantities.

The changes in distribution of income in favour of landlords and traders too cause the imports to rise rapidly since these groups have a strong tendency to import goods for conspicuous consumption. The shift of population from rural to urban areas, which generally accompanies the process of development, tends also to raise the imports of both consumption and production goods.

ADVERTISEMENTS:

The net effect of a programme of economic development is therefore to disturb almost certainly the external balance. “The poor country,” says Meier, “thus confronts a conflict between accelerating its internal development and maintaining external balance.”

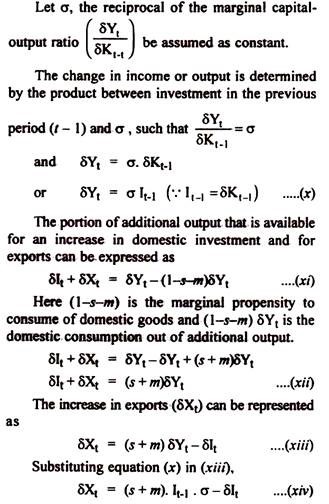

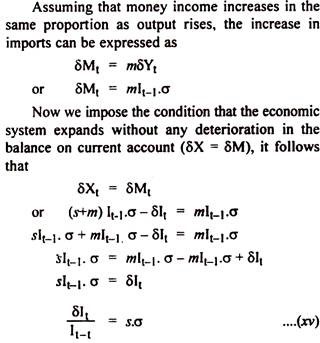

This poses a very crucial question whether the pace of economic development should be restricted for the sake of external balance. The question can be resolved by determining such a critical rate of maximum investment that can be sustained without encountering the balance of payments difficulties. This can be attempted in terms of Harrod-Domar theory.

Thus the maximum rate of investment that will not involve the balance of payments difficulties is one determined by the product of σ and s. If the rate of investment is greater than this, the rise in imports will over-swamp the exports and the developing country, faced with payments problems, will have to deplete either her exchange reserves or to receive an inflow of capital.