The following article will guide you to learn about how disequilibrium in balance of payments be corrected.

The balance of payments must always balance. It is a truism. But it only means that the two sides of the account must always show the same total. It really does so. But what does it imply? It implies only an equality of totals as in a balance sheet.

In other words, it is just an equality of balance of payments, not equilibrium. And it is equilibrium, not equality, that indicates the true position or direction. Or, in other words, although a nation’s balance of payments always balances in the accounting sense, it need not balance in an economic sense.

Three Tests of Disequilibrium:

ADVERTISEMENTS:

How can we know whether the balance of payments is in equilibrium or not? Tests are more or less three in number; gold movements, volume of foreign loans, and foreign exchange rates of the country’s currency.

1. Decrease in Foreign Exchange:

If gold regularly flows out of the country, its balance of payments is supposed to be in disequilibrium. Now a days decrease in foreign exchange reserves indicates the same thing.

2. Increase in Foreign Loans:

ADVERTISEMENTS:

Secondly, if the volume of foreign loans increases, it only means that the country’s balance of payments is in disequilibrium. It imports more than it exports.

3. Exchange Depreciation:

Lastly, when a country suffers from balance of payments disequilibrium, the foreign exchange rates of its currency go down and down. Thus, a fall in exchange rates of a currency is a sign of balance of payments disequilibrium. So the above equality should not be interpreted to mean that a country never suffers from balance of payments problem and the international economic transactions of a country are always in equilibrium.

Reasons for Balance of Payments Difficulties:

ADVERTISEMENTS:

One of the basic problems of international economic policy is to find effective means for restoring external balance to a country whose balance of payments is seriously in deficit.

To start with, we may note that a country’s exports are a function of three key variables, viz., the national income of its trading partners, of tastes, and of relative prices. An increase in income abroad will have a favourable effect on the country’s exports. Similarly, a change in tastes abroad is in favour of imports. If the prices of import-competing goods abroad increase, the home country’s exports will benefit.

Similarly, its imports are a function of its national income, of tastes, and of relative prices. An increase in the country’s national income will lead to an increase in imports; so will a change in relative prices, which make import-competing goods relatively more expensive.

Hence a country’s exports and imports are influenced by different factors. Moreover, factors affecting exports and imports change continuously, and disturb equilibrium in the balance of payments.

A deficit in its balance of payments may be caused by a number of factors. In case of developing countries the root cause is perhaps domestic inflation. In the context of the Keynesian model if the country is already at full employment, an increase in income caused by either an increase in investment, giving rise to an increase in total demand, or an increase in consumption caused by a downward shift in the saving schedule, will cause an inflationary pressure that will give rise to an increase in imports.

1. Inflation:

Since most of balance of payments difficulties is the result of domestic inflation, the disequilibrium may be corrected by disinflation (eliminating the inflationary gap and reducing demand to the level of full employment) or at least by controlling inflation and adjusting the exchange rate.

2. Technological Change:

Technological change may cause balance of payments problems which is of a structural nature. An innovation in country A leads to increased exports to or reduced imports from B, with a transitional deficit for B until the position settles down with a new comparative advantage. Another innovation in A requires the process to be repeated.

ADVERTISEMENTS:

3. Fall in Demand:

A change in demand is equally important. Suppose there is a decline in the world demand for Indian textiles due to a change in taste. The resources previously engaged in textile production must shift into other lines of activity or adjust their expenditures downward.

For the country as a whole there may be a need to restrict imports or divert the displaced resources into another export line. If these desirable changes fail to take place or occur in adequate degree, the country will experience a structural disequilibrium.

4. Supply Shortage:

ADVERTISEMENTS:

A fall in supply may have similar effects. Due to crop failure or industrial strike India’s sugar production may fall and affect the supply of the country’s exports and produce a shortfall of exports below imports. A bumper crop abroad (of, say, tea) which lowered world prices would have much the same effect.

The loss of service income may also cause balance of payments deficit on current account. This may arise through bankruptcy of direct investments abroad or their confiscations or nationalisation. The Belgian loss of copper income from the Congo is a good example.

5. Speculation:

Movements of ‘hot money’ or short-term capital from a country due to higher interest rates abroad or speculative activities may cause problems.

ADVERTISEMENTS:

To quote B. Sodersten, “Simple causes for deficits, such as an excess in total demand, are quite easy to identify. More intricate causes, such as changes in productivity, can be very difficult to establish”.

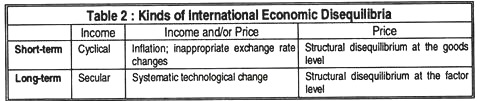

Table 2 below summarises the major kinds of disequilibria in balance of payments:

Correction of Disequilibrium:

According to classical economists, a disequilibrium is self-correcting in the long run. This is brought about automatically through alteration in prices and costs, according to the needs of the situation. According to Keynes and modern economists, it is brought about by changes in real (as opposed to monetary) variables like changes in output, income, employment, and demand. But certain measures must be taken to initiate the process of adjustment so that the equilibrium is restored quickly.

A number of steps can be taken to solve the balance of payments problem. A country may raise exports or reduce imports. It may cut back spending abroad, tie foreign aid and impose restrictions on foreign travel. It can also exercise control over capital movements.

ADVERTISEMENTS:

A government may raise interest rates to attract short-term capital to finance a deficit. The most popular form of adjustment is foreign exchange control, in which demand and supply are matched administratively, rather than through the price system.

A. Short-Run Measures:

If the balance of payments deficit is supposed to be of a transitory nature, certain immediate steps can be taken to correct it. A deficit country may borrow from a foreign country. It can also borrow from IMF on the basis of its quota.

If it has huge accumulated resources (of gold and foreign exchange) it can reduce the stock by selling some of its reserves to meet the deficit. It can also attract private capital from abroad by raising the domestic rate of interest and offering certain tax concessions to them so that the general investment climate becomes favourable.

B. Long-Term Measures:

If the problem is of a long-term (structural) nature, certain additional measures will have to be adopted.

ADVERTISEMENTS:

These usually take the form of:

(a) Raising exports or

(b) Reducing imports or

(c) A suitable combination of these two measures.

These are briefly discussed below:

1. Export Promotion:

ADVERTISEMENTS:

The more goods a country can export, the better her balance of trade will be. Thus the exchange rate and the wage level, which influence the number of goods a country can export, are important variables for determining a country’s balance-of-payments situation.

However, it is not always easy to raise exports. It depends not only on domestic supply conditions but also on demand conditions abroad, over which the home country has little control.

2. Import Control:

Imports may likewise be kept in check through the adoption of a wide variety of measures. Most balance of payments difficulties have adopted a strict import control policy.