The BOP of a country can be divided in two ways—vertical division and the horizontal division.

Vertically the BOP can be divided into two parts-the credit and the debit sides. All transactions which add to a country’s “payments claims” are credit transactions in its BOP.

Those transactions, in contrast, which create “payment obligations”, are debit transactions.

Thus, on the credit side we include all the payments claims by the country from the foreigners whereas on the debit side we include all the payments obligations by the county to the foreigners. The vertical division of BOP is essential from the accounting point of view.

ADVERTISEMENTS:

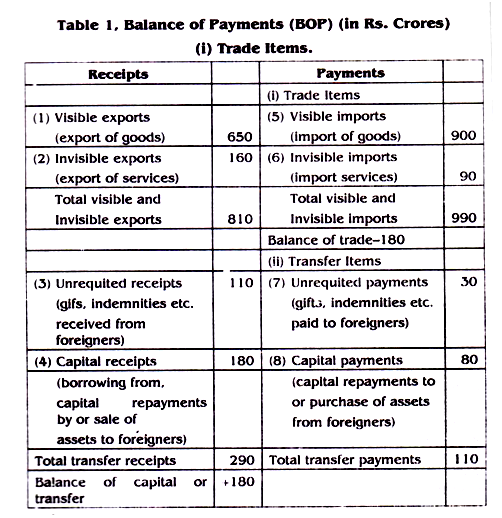

Horizontally the BOP can be broadly divided into two part the trade items and the transfer items. Trade items on the credit side include the visible exports and invisible exports, and on the debit side includes the visible imports and the invisible imports. The transfer items on the credit side include unrequited receipts and capital receipts; and on the debit side include unrequited payments and capital payments. Now, the BOP of a country is composed of eight items, namely, visible exports, invisible exports, visible imports, invisible imports, unrequited receipts, capital receipts, unrequited payments and capital payments.

Item 1, enumerates the receipts of the country from the export of commodities or merchandise to foreigners whereas item-2 enumerates the receipts of the country’ from the sale of current services to foreigners in the period in question. If the residents of the country in question have lent capital to foreigners in the past or own land or other income bearing property in foreign countries they will during the period in question be receiving interests, dividends and rents on these foreign investments.

Such payments are regarded as the payment made by the foreigners for the current services which they obtain from capital of the residents of the country under examination. Item-2 also includes receipt of the foreign money which the residents of the country receive from foreign tourists visiting the country and who purchase goods and services within the country during their stay in the country.

ADVERTISEMENTS:

The receipts of the country’s banks and other financial institutions from foreigners in respect of banking and similar services rendered by them to the foreigners for the transport of goods on behalf of foreign traders. Invisible exports also include remittances by MRI working in foreign countries. Item-5 numerates the payments of the country for the import of commodities or merchandise from foreigners whereas ltem-6 numerates the payments of the country for the purchase of current services from the foreigners.

Items 1, 2, 5 and 6 enumerate all the receipts and payments made In respect of the current trade in goods and services. There remain for numeration all those payments from the residents of one country to those of another which are not payments for a simultaneous flow of those and services in opposite direction. Such payments are called transfers.

They fall into two main categories; first gifts, reparations. Indemnities etc. which are called “unrequited transfers” payments from some person or body in one country to another person or body In another country in respect of which no present or future quid proquo is demanded; and secondly “capital transfers, payments made by way of loans or for purchase of capital assets for which no current return in the form of an immediate import of goods and services is obtained but from which some future benefit is expected.

Capital transfers may take very many forms:

ADVERTISEMENTS:

(i) The government or corporation or individual residents in the country is question may have borrowed money from the government or a cooperation or individual resident in a foreign country. The debt may be long-term or short-term and the interest and principal to be repaid may be fixed in the currency of the borrowing country or in lending country or in terms of some third country.

(ii) The government or a corporation, company or individual resident in the country in question may receive sums from abroad in repayment of some loan which it had previously extended to some borrowing agency in the foreign country.

(iii) The government or a corporation, company or individual resident in a foreign country may acquire foreign assets from the government or a corporation, company or individual residents in the country in question.

Table-II the Balance of trade and balance of transfers:

(Here, ‘+’ means surplus of receipts & ‘-‘ means deficit of receipts. Rs = crore

a. Balance of visible trade 650 – 900 – – 250 (item 1 and 5)

b. Balance of invisible trade 160 – 90 e 70 (items 2 and 6)

c. Balance of trade 810 – 990 = -180

d. Balance of unrequited transfers 1 10 – 30 = + 80 (items 3 and 7)

ADVERTISEMENTS:

e. Balance of capital transfers 180-80 = +100

f. Balance of transfer 290 – 1 10 = + 180

g. Balance of trade and transfers 1100 – 1100 = Nil