In this article we will discuss about the Swan’s model of internal and external stability of a country.

Harry G. Johnson has advocated the policies of expenditure changing and expenditure-switching for adjusting the internal demand and to affect a balance in external account. The impact of such policies on the balance of payments and the level of employment has been analysed by Trever Swan.

In his model, two main assumptions have been taken:

(i) There are no restrictions, tariff or non-tariff, upon trade.

ADVERTISEMENTS:

(ii) There is an absence of capital movements.

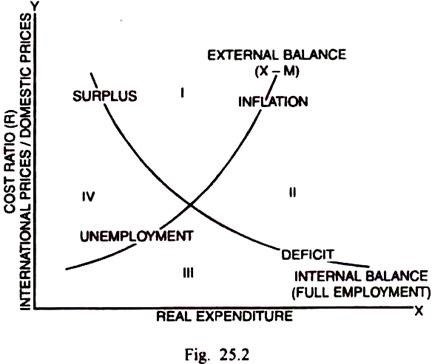

The simultaneous existence of internal and external disequilibria has been shown by Swan through Fig. 25.2.

The horizontal scale measures the real expenditure and the vertical scale, the cost ratio (R). It is a ratio of international prices to the domestic prices or to domestic wages. The internal balance curve slopes down from left to right. It indicates that lower the cost ratio which limits exports and import-substituting production, the higher must be the real expenditure to maintain full employment. Positions to the right and above the curve represent inflation with domestic real expenditure excessively high relatively to exports and import-substituting production. Below and to the left of the curve, there is unemployment.

ADVERTISEMENTS:

Another curve represents the external balance (X-M). It slopes upwards from left to right. Below and to the right of this curve, there is a payments deficit. Above and to the left is the payments surplus. Fig. 25.2 presents four zones – I with inflation and balance of payments surplus; II with inflation and a deficit; III with unemployment and a deficit; and IV with unemployment and a balance of payments surplus.

The complete equilibrium occurs only at one point where the two curves intersect each other. In the zones II and IV where the internal inflation and external deficit and unemployment and external surplus respectively co-exist, the movement towards equilibrium can be achieved through expenditure- changing policies. In zone II, a contraction and in zone IV, an expansion in real expenditure will help restore the balance.

In zones I and III, there is a coincidence of surplus and inflation and deficit and unemployment respectively. The alteration in the cost ratio through expenditure-switching policies like exchange, depreciation and appreciation are likely to bring the system in a state of balance.

The expenditure-changing policies can be split up into monetary and fiscal policies. The fiscal policies which can be represented by the national budget whether, deficit or surplus can have its effect upon both internal and external balances. The monetary policy can influence the balances in two ways.

ADVERTISEMENTS:

Firstly, the variations in interest rates affect business investment which through multiplier, affect also the consumption spending. Secondly, the interest variations cause movements in short term capital and can thus influence the balance of payments situations in the country.

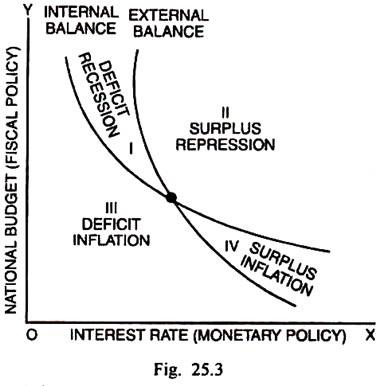

The use of monetary and fiscal policies for the achievement of internal and external balances can be depicted through Fig. 25.3.

The two curves in Fig. 25.3 represent the internal and external balances. The steeper slope of the external balance curve indicates that it is more responsive to the monetary policy, while the internal balance curve is more responsive to fiscal policy. These curves have been drawn on the basis of a given cost ratio of domestic and international prices.

A change in the cost ratio will cause a displacement of both the curves. An increase in the cost ratio would shift the external balance curve to the right. It will mean that a higher interest rate, given the budgetary surplus or deficit, will be required for the achievement of balance.

Such a change in the cost ratio would shift the internal balance curve downwards and to the left. It shows that a reduction in spending on exports and import-substitutes requires a higher budgetary deficit, at a given rate of interest, in order to maintain full employment.