Read this article to learn about the most frequently asked questions on the Balance of Payments.

Q.1. What does balance of payments account show? Name the two parts of the balance of payments accounts.

Ans. BOP account shows a country’s inflows and outflows of foreign exchange. The two parts of the BOP are:

(1) The current account.

ADVERTISEMENTS:

(2) The capital account.

Q.2. State the components of capital account of balance of payments.

Ans. (1) Borrowings and lending’s to and from abroad.

(2) Investments to and from abroad.

ADVERTISEMENTS:

(3) Changes in foreign exchange reserves, (or any other way to describe components)

Q.3. State the components of current account of balance of payments

OR

List the transactions of current account of the Balance of Payment Account

ADVERTISEMENTS:

Ans. (1) Exports and imports of goods.

(2) Exports and imports of services.

(3) Income receipts and payments to and from abroad.

(4) Transfers to and from abroad.

Q.4. List the items of the current account of balance of payment account. Also define balance of ‘trade’.

Ans. Items of current account:

(i) Export and imports of goods.

(ii) Export and import of services.

(iii) Income from and to abroad.

ADVERTISEMENTS:

(iv) Transfers from and to abroad.

Balance of Bade is the difference between ‘exports of goods’ and imports of goods

Q.5 Distinguish between balance of trade and of balance of payments.

Ans. i. Balance of trade

ADVERTISEMENTS:

ii. Balance of trade is the difference between exports and imports of goods.

iii. Only visible items are considered.

iv. It follows that mathematically ,exchange of services between the country

v. is not considered.

ADVERTISEMENTS:

BOT = Vx-Vm

Vx = Value of exports of goods and

Vm = Value of imports of goods

Balance of Current Account:

i. The current account of Balance of Payment comprises of visible exports and imports of goods, invisible items (services) and unilateral transfers like gifts, remittances and donations etc.

ii. The net value of all these is the balance of current account.

ADVERTISEMENTS:

iii. Balance of trade is thus a part of current account of Balance of Payment.

Q.6. What are the sources of supply of foreign exchange?

Ans. Supply of foreign exchange comes from:

(i) Purchase of goods and services by foreigners

(ii) Inflow by the NRIs settled in foreign countries.

(iii) Foreign Direct Investment (FDI) into our country.

ADVERTISEMENTS:

(iv) Speculative purchase of home currency by NRIs/Foreigners.

Q.7. Giving two examples explain the relation between the rise in price of a foreign currency and its demand.

Ans. When Price of Foreign Currency Rises:

(i) Imports become dearer resulting in less imports and therefore falls demand for foreign currency.

(ii) Tourism abroad becomes costlier and so demand for foreign currency falls.

Q.8. When price of a foreign currency rises, its demand falls. Explain why.

ADVERTISEMENTS:

Ans. When price of foreign currency rises it makes imports costlier. This leads to fall in demand for imports. As a result demand for foreign exchange falls.

Q.9. When price of foreign currency rises, its supply also rises. Explain why.

Ans. When price of foreign currency rises it makes exports cheaper. This to rise in demand for exports. As a result supply of foreign currency rises.

Q.10. When price of a foreign currency falls, the demand for that foreign currency rises. Explain why.

Ans. When price of foreign currency falls it makes imports or investing abroad, etc. cheaper. As a result, demand for foreign exchange rises.

Q.11. When price of a foreign currency falls, the supply of that foreign currency also falls. Explain why.

ADVERTISEMENTS:

Ans. When price of foreign currency falls it makes exports investments by foreign residents-costlier. As a result supply of foreign currency falls.

Q.12. Giving two examples, explain why there is a rise in demand for a foreign currency when its price falls.

Ans. When price of foreign currency falls, imports are cheaper. So more demand for Foreign Exchange by importers. Tourism abroad is promoted as it becomes cheaper. So demand for foreign currency rises.

Q.13. What functions are performed by foreign exchange market?

Ans. The foreign Exchange market performs the following functions:

(i) Transfer of foreign currencies between countries:

Foreign Exchange market facilitates in flow of foreign Exchange from one nation to another.

(ii) Provides credit for foreign business:

Foreign exchange market makes available credit for foreign transactions.

(iii) Hedging risks:

Covering exchange risk is called hedging. By entering into forward contracts to buy or sell foreign exchange at a future date trough banks, exchange risks can be minimized.

Q.14. What are official reserve transactions? Explain their importance in the balance of payments.

Ans. i. Official reserve transactions means running down country’s reserves of foreign exchange in case of deficit in Balance of Payments by selling foreign currency in foreign exchange market.

ii. The decrease in official reserve of foreign exchange is called the overall BOP deficit. In case of surplus, the country can buy foreign exchange and increase its official reserves.

iii. Monetary authorities of a country are the ultimate financiers of the deficit in the BOP, or the recipient of any surplus.

iv. A country is said to be having its balance of payment in equilibrium when the sum of its current account and non reserve capital account equals zero which means current account deficit is financed entirely by international borrowings without any movement in the official reserves of the country.

Q.15. Are the concepts of demand for domestic goods and domestic demand for goods the same?

Ans. i. No, concepts of demand for domestic goods and domestic demand for goods are not at all the same. .

ii. Demand for domestic goods includes both, domestic demand as well as that from abroad.

iii. In sharp contrast, domestic demand for goods is simply the total demand for goods in a country. The goods may be domestic or imported, both are parts of domestic demand.

Q.16. What are the effects of disequilibrium in Balance of Payment?

Ans. Effects of disequilibrium in Balance of Payment are:

(i) Economic credibility of a country obviously goes down.

(ii) It results in reduction of FOREX reserves.

(iii) It has an adverse effect on the economic growth and prosperity of the nation.

(iv) Foreign dependence may lead to political dependence & can hence result in bleeding of resources and exploitation of the country.

Q.17. Explain the effect of appreciation of domestic currency on imports.

Ans. Appreciation of domestic currency means fall in exchange rate, i.e., price of foreign currency. It means that the importers have now to pay less domestic currency to buy one unit worth of foreign currency goods from abroad. Imports become cheaper. This raises demand for imports.

Q.18. Distinguish between devaluation and depreciation of domestic currency.

Ans. i. Under fixed exchange rate regime reduction in price of domestic currency in terms of all foreign currencies is called devaluation.

ii. Under flexible exchange rate regime, fall in market price of domestic currency in terms of a foreign currency is called depreciation.

Q.19. What are the causes of disequilibrium in Balance of Payment (BOP)?

Ans. Various causes of dis-equilibrium in Balance of Payment (BOP) are:

(A) Economic Factors:

(i) Inflation:

Inflation phenomenon i.e., higher wages, higher cost of raw materials, wages etc. make the exports costlier and decrease in exports. This leads to deficit in the BOP.

(ii) Exchange rate fluctuations:

The exchange rate also affects the BOP. When the value of currency of a country increases, imports become cheaper thus the value of imports rises and value of exports falls, which contributes to disequilibrium.

(iii) Population Growth:

Uncontrolled growth of population leads to fall m aggregate demand / fall export surplus and thus BOP becomes adverse.

(iv) Cyclic Business:

In any capitalistic country, trade cycles cause inflation and depression situations. During depression the exports to other countries are reduced. Thus disequilibrium in BOP may also arise due to depression m other countries.

(v) Demand Reduction:

A fall in demand for a country’s goods abroad will also reduce exports thereby causing disequilibrium.

(vi) Import of Services:

Developed countries are forced to import capital and other services from developed countries. Such imports, being extremely costly can cause major drop in BOP.

(vii) Cost of PR Function:

New independent countries have to set up embassies and missions abroad to create & maintain good relations with other nations. The huge expenditure in this regard also distorts BPO unfavourably.

(B) Social Factors:

People of an underdeveloped country tend to imitate the consumption pattern of the people of developed countries. Due to ouch psychology, the imports of the former country increase which again triggers disequilibrium. ‘

(C) Political Aspects:

Political instability, non-cordial international relations can also have adverse impact. Partition, unification of nation also affects the BOP.

Q.20. What is balance of payment? What are its components?

Ans. Balance of Payment is a systematic record of all economic transactions of a country with rest of the world in a given period of time which is usually one year.

The Balance of Payment account has two main components

(i) Current Account and

(ii) Capital Account.

(i) Current Account:

a. The current account of balance of payment records imports and exports of goods, services and unilateral transfers.

b. It includes record of services like shipping, banking, insurance etc.; interest and dividends flowing in and out of the country; receipts and payments from foreign travel and tourism; miscellaneous items like royalties, subscription, consultancy, telephone and telegraph services and transfer payments like gifts, remittances, donations etc.

c. The final balance of visible trade i.e., exports and imports of goods alone is known as trade balance. The total of visible and invisible items gives current account balance, which is moved to capital account.

(ii) Capital Account:

i. The capital account of balance of payment records those capital transfers between one nation and all other countries which result in change in the assets or liabilities of the citizens of that country or of its government.

ii. It consists of capital of various kinds e.g., gold. The flows of capital can be in the form of borrowings or lending’s to abroad by private sector and government or both.

iii. The final balance of capital account shows a country’s final position. It may be surplus or deficit.

Q.21. What is balance of payment? What are its main features?

Ans. Balance of Payment (BOP) is a systematic record of all economic transactions of a country with rest of the world during a given period which is usually one year.

The main features of BOP are:

(i) Systematic record:

It is a systematic record of all transactions of the residents of a country with rest of the world.

(ii) Fixed time:

It is a statement of account for a fixed period of time which is usually one year.

(iii) Comprehensive statement:

Balance of payment is a comprehensive statement of accounts which includes all transactions visible, invisible and capital transfers.

(iv) Double Entry system:

Balance of payment account is based on double entry system of book keeping. It means there is a credit for every debit entry. Receipts are recorded on the credit side and payments are recorded on the debit side.

(v) Balanced system:

In Double entry system debit and credit sides of the account are always equal i.e., total debits are always equal to total receipts hence it is a balanced system.

Q.22. Explain the meaning of deficit in balance of payments.

Ans. When autonomous foreign exchange payments exceed autonomous foreign exchange receipts, the difference is called balance of payments deficit.

Autonomous transactions in foreign exchanges are those which are undertaken for their own sake and independent of the State of balance of payments.

Q.23. What are the various categories of economic transactions which are recorded in Balance of Payment account?

Ans. Various categories of economic transactions in Balance of Payment are as follows:

(i) Visible items:

All types of physical goods which are exported and imported by a country are called visible items since such goods are made of some material and thus have physical existence.

(ii) Invisible Items:

Invisible items include different types of services, investment income and unilateral transfers. Shipping, banking, travel services, etc., are included in services. Interest, profit, dividend, royalties etc. form part of investment income and gifts, remittances, etc. are included in unilateral transfers.

(iii) Capital transfers:

Capital receipts and capital payments form part of capital transfers.

Q.24. Distinguish between balance of trade and balance on current account.

Ans. i. Exports of goods less imports of goods refers to balance of trade. Adding excess of inflows over the outflows on account of invisibles to the balance of trade is called balance on current account.

ii. Balance of Trade = Exports of Goods – Imports of goods Balance on current Account = Sum of credit on current account – sum of debits on current account

Q.25. Which transactions determine the balance of trade ? When is balance of trade in surplus?

Ans. Exports of goods and imports of goods.

When the value of exports of goods is greater than the value of imports of goods.

Q.26. Distinguish between Balance of Trade and Balance of Payments.

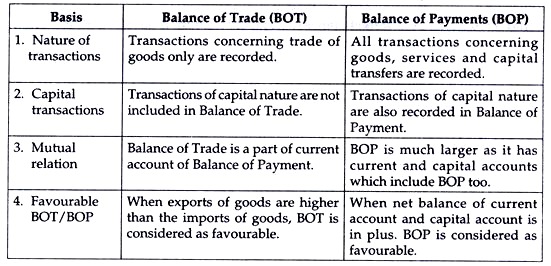

Ans. Distinction between Balance of Trade and Balance of Payment is as follows:

Q.27. Distinguish between Autonomous and Accommodating transactions in the balance of payments.

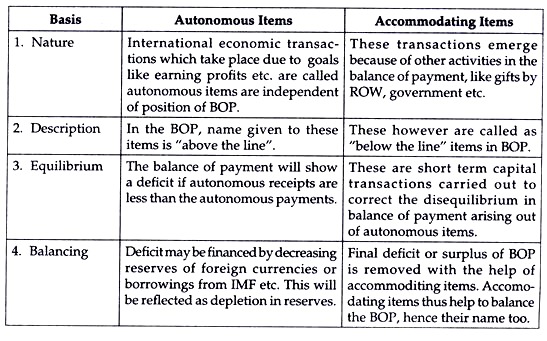

Ans. Difference between Autonomous Items and Accommodating items is detailed here below:

Q.30. How are foreign exchange rates determined? Explain.

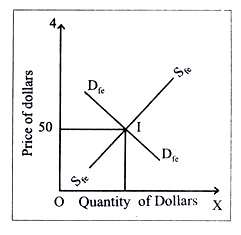

Ans. i. Foreign exchange rate is determined at the equilibrium point where demand for foreign exchange and supply of foreign exchange are equal.

ii. The demand curve for foreign exchange is downward sloping since there is an inverse relationship between price and demand of foreign exchange. At higher prices, demand for foreign exchange is upward sloping. If price of foreign exchange rises, the value of rupee will depreciate which will make domestic goods cheaper. Demand for export will rise which means more supply of foreign currency.

iii. In the diagram Dfe DFe and Sfe Sfe are demand and supply curves for dollars which are intersecting at I at which point Rs 50 will be the price of a dollar. An increase in demand for dollars will increase the price of dollar and an increase in supply of dollars will reduce the price of dollar.

iv. In the short run, there can be difference in demand and supply of foreign exchange.

v. But in the long run, the equilibrium rate of exchanges will prevail as in the situation of excess demand or excess supply the price will automatically come to the equilibrium level due to competition in foreign exchange market.

Q.28. Explain the meaning and two merits of fixed foreign exchange rate?

Ans. Fixed exchange rate is the rate fixed by government.

Merits:

(i) It ensures stability in exchange rate. The exporters and importers have not to operate under uncertainty about the exchange rate. Thus it promotes foreign trade.

(ii) It promotes capital movements. Fixed exchange rate system attracts foreign capital because a stable currency does not involve any uncertainties about exchange rate that may cause capital loss.

Q.29. Explain two sources each of demand and supply of foreign exchange rate.

Ans. Sources of demand for a foreign currency:

(i) For imports payment is to be made in foreign currency. So it is a source of its demand.

(ii) For transfer payments to other country in the form of gifts or remittance etc., foreign currency is needed.

(iii) For making investments in other countries foreign currency is needed Sources of supply of a foreign currency.

(i) Payment for exports are received in foreign currency. So exports are a source of its supply.

(ii) Factor income earned from abroad is a source of supply of foreign currency as it is received in foreign currency.

(iii) Remittances from abroad are also in foreign currency. So it is also a source of supply of foreign currency.

Q.30. Distinguish between fixed and flexible foreign exchange rate.

Ans. Fixed Exchange Rate:

i. Fixed exchange rate is the rate of exchange which is officially declared and fixed by the central bank government.

ii. The rate of exchange is fixed by legislation or intervention in currency market.

iii. Government buys and sells currencies according to the needs of the country Flexible or Floating Exchange Rate

iv. Flexible exchange rate is that rate which is determined by the market forces of demand and supply of a foreign currency.

v. The rate of exchange is allowed to adjust freely according to changes in forces of demand and supply of that currency.

Q.31. What are the merits of a flexible exchange rate?

Ans. The merits of a flexible exchange rate are:

(i) Problem of over-valuation or undervaluation of currencies, deficit or surplus of balance of payment is automatically solved.

(ii) Therefore Government gets rid of problem of disequilibrium of BOP.

(iii) The government is not required to keep reserves of foreign currencies.

(iv) Efficiency in the economy increases since optimum resource allocation is achieved.

Q.32. Differentiate between devaluation and depreciation.

Ans. Devaluation:

(i) Devaluation refers to the reduction in the external value of the currency of a country. It is a deliberate measure adopted by the government. In other words, currency of a country is made cheaper, in terms of foreign currency, by the government.

(ii) Devaluation occurs in a fixed exchange rate system.

(iii) Government may resort to devaluation of its currency to encourage exports and restrict imports whenever the country suffers from continued deficit m BOP.

Depreciation:

(i) Depredation of a currency means drop in the value of domestic currency in relation to foreign currency For example if value of rupee falls in terms of say dollars from Rs 40 to Rs 65, it will be called depreciation of the Indian rupee since more rupees will now be required to buy same one dollar.

(ii) Depreciation takes place in flexible exchange rate regime.

Q.33. Explain the distinction between autonomous and accommodating transactions in balance of payments. Also explain the concept of balance of payments ‘deficit’ in this context.

Ans. Autonomous Transactions:

Are independent of all other transactions in the BOP. These transactions are not influenced by the foreign exchange position of the country. Exports, imports etc. are some examples.

Accommodating Transactions:

Are undertaken to cover deficit or surplus in the autonomous transactions. Therefore, their magnitude is determined by the autonomous transactions. Deficit in BOP is determined only by the autonomous transactions. When autonomous foreign exchange payments exceed autonomous foreign receipts, the excess is called BOP deficit.

Q.34. Give the meaning of ‘foreign exchange’ and ‘foreign exchange rate’. Giving reason, explain the relation between foreign exchange rate and demand for foreign exchange.

Ans. Foreign exchange refers to any currency other than the domestic currency. Foreign exchange rate is the rate at which one currency can be converted into another currency. Suppose foreign exchange rate falls, it means that imports etc. have become cheaper because people now have to pay less for imports.

As a result demand for imports etc. rises. This leads to increase in demand for foreign exchange. Similarly if exchange rate rises, the demand for foreign exchange falls.