Read this article to learn about the top fourteen frequently asked questions on determination of Income and Employment.

Q.1. What is the relationship between APS and APC. Can the value of APS be negative? If yes, when?

Ans. Income can be consumed or saved, thus the sum of average propensity to consume and average propensity to save is always equal to one

APC + APS = 1

ADVERTISEMENTS:

Or APC = 1-APS

APS = 1-APC

Hence APS can be negative when APC is more than one i.e, when consumption expenditure is more than the income.

Q.2. What is marginal propensity to consume? How is it related to marginal propensity to save?

ADVERTISEMENTS:

Ans. Marginal propensity to consume (MPC)

MPC is the ratio of change in consumption to change in income

MPC = ∆C/∆Y

The value of MPC always lies between 0 and 1.

ADVERTISEMENTS:

Relationship between MPC and Marginal propensity to save (MPS):

Extent of savings depends on level of consumption.

Thus, MPC determines the level of MPS. The sum of the MPC and MPS is always equal to one.

MPC + MPS = 1

Or MPC = 1-MPS

Or MPS = 1-MPC

Q.3. What is the difference between ex-ante investment and ex-post investment? [NCERT Textbook]

Ans. Ex-ante Investment:

It is the planned investment during a given period. Ex-post Investment: It is the amount of realised investment. The actual or realised investment is equal to the sum of ex-ante (planned) investment and unplanned investment in the economy. Ex-post investment will be equal to ex-ante investment if unplanned investment = 0.

ADVERTISEMENTS:

Q.4. Explain ‘Paradox of Thrift’.

Ans. If all the people in the economy increase the proportion of their savings, the total volume of savings does not increase. It either decreases or remains unchanged. This is known as paradox of thrift. It states that when people become more thrifty, they start saving less or the same.

Q.5. If MPC is 0.9, what is the value of multiplier? How much investment is needed to increase national income by Rs 5,000 Crores Rs Calculate.

Ans. Here ΔY = 5,000 Cr., MPC = 0.9, K = ?, ΔI = ?

ADVERTISEMENTS:

By formula K = 1/1-MPC

K = -1/1-0-.9- = 1/0.1

K = 10

But K = ∆Y/∆I

ADVERTISEMENTS:

10 = 5,000/∆I

∆I= 5000/10= 500Cr

So K = 10 and ΔI = 500Cr.

Q.6. Measure the level of ex-ante aggregate demand when autonomous investment and consumption (A) is Rs 50 crores, and MPS is 0.2 and level of income Y is Rs 4,000 crores. State whether the economy is in equilibrium or not (cite reasons).

Ans. MFC = 1-MPS

= 1-0.2 = 0.8

ADVERTISEMENTS:

Y = Rs 4,000 crores

Now, Aggregate Demand,

AD = C + I

= a + by + I̅ (where b = MPC)

= a + I̅ + by

A + by (where A = a + I) a = autonomous consumption

ADVERTISEMENTS:

I̅ = autonomous investment

Now A is given as Rs 50 crores

AD = 50 + 0.8 (4,000)

= Rs 3,250 crores

Aggregate demand (Rs 3,250 crores) being less than the aggregate supply (Rs 4,000 crores), the economy is obviously not in equilibrium.

Q.7. In an economy, planned savings exceed planned investment. How will an equality between the two be achieved? Explain.

ADVERTISEMENTS:

Ans. The equilibrium level of National income can be established by the equality between planned savings and planned investment. As this is derived by the AD – AS approach itself.

AD = AS

C+1 = C+S

(Planned) I = S (Planned)

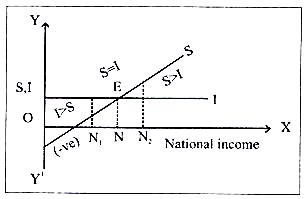

The equilibrium can better be understood by the following diagram:

From the diagram above, if S > I i.e. National income ON2. But increase in savings as compared to investment will result in decrease in production, income and employment in the economy. This will bring the income at equilibrium level i.e. where S = I i.e. at ON level of income.

ADVERTISEMENTS:

Moreover, if I > S i.e., level of National income is at ON1. This will result in increase in income, output level is reached i.e. ON level of income where S = I.

Q.8. In an economy 75 percent of the increase in income is spent on consumption. Investment is increased by Rs 1,000 crore. Calculate:

(a) Total increase in income.

(b) Total increase in consumption expenditure.

Ans. MPC = -3/4, MPS = -1/4 K= 4

(i) ∆Y = ∆I X K

= 1,000 x 4

= Rs 4,000 Crore

(ii) Given that ∆Y = ∆C + ∆I

∆C = ∆Y – ∆I

= 4,000-1,000

= Rs 3,000 Crore

OR

∆C – AY X MFC

= 4,000X0.75

= Rs 3,000 Crore.

Q.9. In an economy the equilibrium level of income is Rs 12,000 crore. The ratio of marginal propensity to consume and marginal propensity to save is 3: 1 Calculate the additional investment needed to reach a new equilibrium level of income of Rs 20,000 crore.

Ans. MFC = 0.75; AY needed = 8,000 Crores.

K= 1/ 1-MFC =1/ 1-0.75 =4

∆Y = ∆I.K

8,000= ∆ I X 4

∆I= 2,000

Q.10. Giving reasons, state whether the following statements are true or false:

(i) When marginal propensity to consume is zero, the value of investment multiplier will also be zero.

(ii) Value of average propensity to save can never be less than zero.

Ans. (i) False. When MFC = 0, Multiplier 1/ 1-MPC = 1/1/0=1

(ii) False. AFS or S/Y can be negative when S is negative at low level of income. At low level of income consumption expenditure is more than income.

Q.11. Giving reasons, state whether the following statements are true or false:

(i) There is an inverse relationship between the value of marginal propensity to save and investment multiplier.

(ii) When the value of average propensity to save is negative, the value of marginal propensity to save will also be negative.

Ans. (i) True, because investment multiplier (K) = 1/(MPS)

(ii) False, the value of MPS can never be negative, value of MFS varies between 0 and l.

Q.12. Giving reasons, state whether the following statements are true or false:

(i) If the ratio of marginal propensity to consume and marginal propensity to save is 4:1, the value of investment multiplier will be 4.

(ii) Sum of average propensity to consume and marginal propensity to consume is always equal to 1.

Ans. (i) False, When MFC: MPS = 4:1

Then MPS = 1/ 5

Investment multiplier = 1/MPS= 1/0.2 = 5

(ii) False, there can be no such relationship between APC and MPC. APC is the ratio of C and Y and MPC is the ratio of ∆C and ∆Y.

Q.13. State whether the following statements are true or false. Give reasons for your answer:

(a) When marginal propensity to consume is greater than marginal propensity to save, the value of investment multiplier will be greater than 5.

(b) The value of marginal propensity to save can never be negative.

Ans. (a) True, if MPC is greater than 0.8.

OR

False, if MPC is greater than 0.5 but not greater than 0.8

(b) True, since MPS = ∆S/∆Y, The individual may at the most spend the entire ∆Y so that ∆S = 0. So, MPS can at the most be zero.

Q.14. Giving reasons, state whether the following statements are true or false:

(i) Average propensity to save is always greater than zero.

(ii) Value of investment multiplier varies between zero and infinity.

Ans. (i) False, it can be negative at low level of income when consumption expenditure is greater than income.

(ii) False, it varies from 1 to infinity.