Read this article to learn about the seventeen frequently asked questions on the determination of income and employment.

Q.1. Explain the concept of equilibrium level of income with the help of C + I curve. Can there be unemployment at equilibrium level of income? Explain.

Ans.

i.e. C + I = C + S

ADVERTISEMENTS:

Ex-ante Investment = Ex-ante savings.

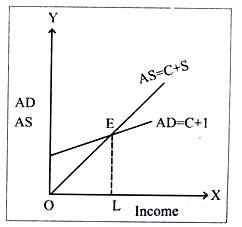

In the above diagram, OL is the equilibrium level of income as at this level aggregate expenditure (aggregate demand) and income (output) are equal. Sometimes disequilibrium can be attained when AD > AS and then with increasing demand, the level of output, employment & income will increase till economy reaches the equilibrium level again.

ADVERTISEMENTS:

When AD < AS, it means people do not have the tendency to consume more, stocks will get piled up. Further production will come down due to fall in demand Employment and Income too will fall till economy reaches the equilibrium level again. Yes, there can be unemployment at equilibrium level of income because equilibrium level of income does not necessarily mean full employment. The full employment level can be less or more than OL.

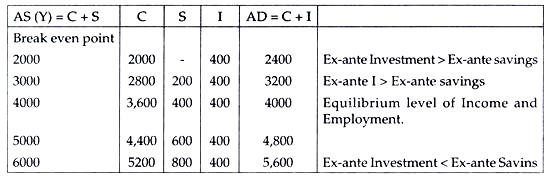

Q.2. Explain the equilibrium level of income with the help of saving and investment curves. If savings exceed planned investment, what changes will bring about the equality between them?

Ans. Equilibrium level of income is that level at which saving is equal to investment

In the diagram, at OL level of income, saving and investment are equal so OL is the equilibrium level of income. If savings exceed planned investment, there will be disequilibrium. It will result in piling up of inventories with the producers. Producers will reduce their output. The income will drop by reduction in output which will reduce the savings too. The reduction in output will be continued by producers till savings are equal to investment.

Q.3. What do you understand by ‘parametric shift of a line’? How does a line shift when (i) its slope decreases and (ii) its intercept increases?

Ans. Shift of a line:

Let the consumption function be given by

C = C + bY

Let C = 2 and b = 0.5 Thus, C = 2 + 0.5 y

Now, there can be two situations

(i) When b changes

(ii) When C changes

ADVERTISEMENTS:

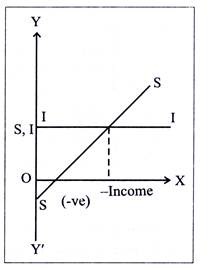

(i) When (MPC) b changes

I. b is the slope of consumption curve.

II. If it increases from 0.5 to 1, the consumption curve will swing upwards as shown in the figure below.

III. Such swing is called parametric shift of a line.

ADVERTISEMENTS:

IV. Thus when slope changes, there is a parametric shift in the curve.

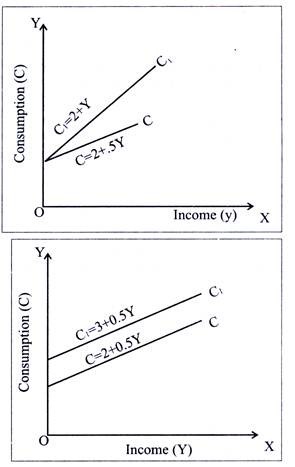

(ii) When C Changes:

i. It is a change in the autonomous part of the consumption function. Graphically it gives the intercept of the consumption curve.

ii. If autonomous consumption increases from 2 to 3, there will a leftward shift in the consumption curve and the new consumption curve will be parallel to the original curve as shown in the figure below:

ADVERTISEMENTS:

iii. Thus, when intercept increases there is a parallel upward shift in the curve.

Q.4. Distinguish between MPC and MPS. What is the relationship between the two?

Ans. According to J.M. Keynes, MPC and MPS are the relative measures of consumption function and saving function respectively. These measures can be put as under:

(a) Marginal propensity to consume (MPC)

MPC is the ratio of change in consumption to the change in income.

ADVERTISEMENTS:

MPC= ∆C/ ∆Y= C2– C1/ Y 2– Y1

The value of MPC fluctuates between O and 1

(b) Marginal propensity to save (MPS)

MPS is the ratio of change in savings to the change in income.

MPS= ∆S/∆Y= S2– S1 / Y1-Y1

Actually the value of MPS depends upon MPC as

ADVERTISEMENTS:

Y = C + S

The relation between MPC and MPS can be derived as under:

Y = C + S ∆Y = ∆C + ∆S

Dividing eq. (1) by AY on both sides

∆Y/∆Y =∆C /∆Y + ∆S/ ∆Y

1 = MPC + MPS

ADVERTISEMENTS:

MPC = 1-MPS

or MPS = 1-MPC

Q.5. C = 100 + 0.4 Y is the Consumption Function of an economy where C is Consumption Expenditure and Y is National Income. Investment expenditure is 1100.

Ans. (i) Equilibrium level of National Income.

(ii) Consumption expenditure at equilibrium level of national income.

(i) Y = C + I

ADVERTISEMENTS:

Y = 100 + 0.4Y + 1100

0.6Y = 1200

Y = 2000

(ii) C = 100 + 0.4Y (Given)

= 100 + (0.4 X 2000)

= 100 + 800 = 900

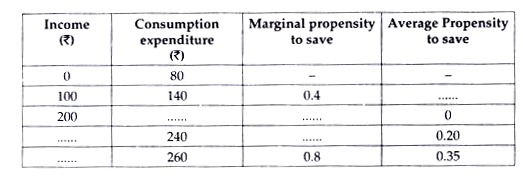

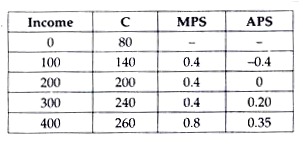

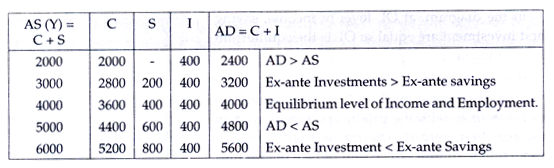

Q.6. Complete the following table:

Ans.

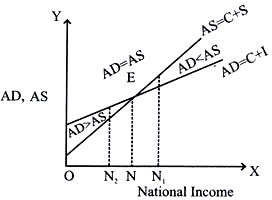

Q.7. Explain with the help of a diagram how equilibrium level of income is determined by aggregate demand and aggregate supply.

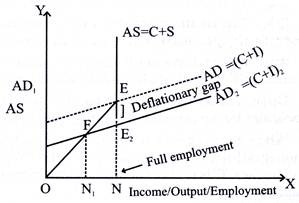

Ans. The equilibrium level of output, income and employment is determined when AD = AS. But in Keynes’s view, it is not necessary that at this point full employment may be prevailing. The equilibrium can better be understood by the following diagram.

(a) Aggregate Demand:

AD is the summation of expenditure on consumption and expenditure on investment in an economy during one accounting year i.e., AD = C+1

(b) Aggregate Supply:

AS is the total amount of goods and services produced in an economy during one accounting year in an economy i.e. AS = C+S. This is equal to National income.

From the said diagram, if National income is ON2 then it shows AD > AS. This will result in more profits to the producer which will further increase the production. This will go up to ON1 level of income.

Moreover, if National income is ON1 then at this level AS > AD. This will result in frilling of prices and profits. The producers will further decrease the production and supply. Thus the level of income will decrease the production and again the equilibrium will be reached.

Q.8. Explain the concept of ‘excess demand’ in macro-economics. Also explain the role of ‘open market operation’ in correcting it.

Ans. Excess demand refers to a situation when at the fall employment level of income AD exceeds AS. It creates inflationary situation in the economy. Open market operations refer to the sale and purchase of the government securities by the central bank in the open market.

When there is excess demand central bank sells securities. This leads to flow of money out of the commercial banks to the central bank when people make payment by cheques. This reduces deposits with the banks leading to decline in their lending capacity. Borrowing decline. AD declines.

Q.9. Explain the concept of ‘deficient demand’ in macro-economics. Also explain the role of Bank Rate in correcting it.

Ans. Deficient demand refers to a situation when at full employment level of income AD falls short of AS. It creates a deflationary situation. Bank rate is the interest rate at which the central bank lends money to the commercial banks. When there is deficient demand the central bank lowers the bank rate. This induces the commercial banks to reduce their lending rates. As a result people borrow more. AD rises.

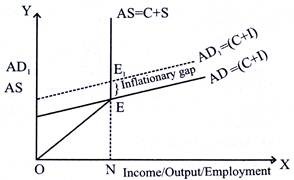

Q.10. Explain briefly the concept of inflationary gap. Use diagram.

Ans. i. Inflationary gap is also referred to as excess demand. Actually excess demand results in inflationary gap

ii. When AD>AS at full employment level in the economy this is referred to as inflationary gap or excess demand. This further results in increase of prices i.e., inflation. The concept can better be understood by diagram.

iii. In the diagram ON is the level of full employment, where AD = C +1. But the actual demand is AD = (C +1). This shows over full employment i.e., employment given beyond the capacity of the economy.

iv. Thus the difference between full employment equilibrium and over full employment equilibrium is inflationary gap. This is shown by EE1 in this diagram.

Q.11. Explain the concept of deflationary gap. Explain two fiscal measures to reduce this gap.

Ans. i. Deflationary gap is alternatively said as deficient demand.

ii. Deficient demand is a situation when aggregate demand is less than aggregate supply at the level of full employment. Actually, deficient demand results in deflationary gap.

iii. This further gives rise to under employment. In this condition the level of output, income and employment in the economy decreases. The concept can better be understood by the following diagram.

iv. In the diagram ON is the level of full employment i.e., ON is the full capacity of the economy. But actual demand is AD2, which is shown by ON1 level of employment. Thus the gap between full employment and under employment is EE2. In other words NN1 capacity of the economy is still unutilized. If this is corrected i.e., if we move from ON1 to ON, then full employment can be increased i.e., income, output and employment would be increased. Thus deficient demand would be corrected. Two fiscal measures to correct the deflationary gap can be put as under:

(a) Reduction in tax rates:

i. In order to correct the condition of deficient demand, the rates of taxes should be reduced.

ii. This will enhance the power to purchase and subsequently correct the deficient demand.

(b) Increase in public expenditure:

i. In the conditions of deficient demand, the govt., should increase the expenditure upon different heads like health, education, defence etc.

ii. This will raise the employment level and further correcting the situation of deficient demand.

Q.12. Explain the role of the following in correcting the inflationary gap in an economy: (i) Legal reserves (ii) Bank rate

Ans. (i) Legal reserves refer to a minimum percentage of deposits which commercial banks have to keep as cash either with themselves or with the central bank. The central bank has the power to change it .When there is inflationary gap the central bank can raise the minimum limit of these reserves so that less finds are available to the banks for lending. This will reduce AD.

(ii) Bank rate is that rate of interest at which the central bank lends to commercial banks. To correct inflationary gap central bank can raise the bank rate. This forces commercial banks to increase lending rates. This reduces demand for borrowing by the public for investment and consumption. Aggregate demand falls.

Q.13. Explain the role of the following in correcting the deflationary gap in an economy: (i) Open market operations (ii) Margin requirements

Ans. (i) Open market operations refer to the sale and purchase of securities by the central bank. Deflationary gap refers to AD falling short of AS at full employment In this situation the central bank buys securities in the open market and makes payment to the sellers .The money flows out of the central bank and ultimately reaches the commercial banks as deposits. This raises the lending capacity of the banks. People can borrow more. This will raise AD.

(ii) Margin refers to the margin on the security provided by the borrowers. When margin is lower, the borrowing capacity of the borrower is higher. The central bank has the power to change this margin. When central bank lowers the margin, the borrowing capacity of the borrower increases. This raises AD.

Q.14. Explain the concept of ‘inflationary gap’. Also explain the role of ‘legal reserves’ in reducing it.

Ans. Inflationary Gap refers to the excess of Aggregate Demand over Aggregate Supply at full employment level of income. It is called inflationary because it brings in inflationary tendencies. Legal reserves refer to that part of bank deposits which commercial banks are legally required to keep in the form of cash partly with themselves (Statutory Liquidity Ratio) and partly with the central bank (cash reserve ratio). In case of inflationary gap, the central bank can increase the legal reserve ratio (LRR) so that less money is available to the banks for lending. Borrowings are reduced. AD falls.

Q.15. Explain the concept of ‘deflationary gap’. Also explain the role of ‘margin requirements’ in reducing it.

Ans. Deflationary gap refers to Aggregate Demand falling short of Aggregate supply at the full employment level of income. It is called Deflationary because it brings in deflationary tendencies.

Margin requirement refer to the discount on the security mortgaged by the borrowers. It is determined by the central bank. In case of deflationary gap the central bank reduces the discount so that the capacity to borrow is increased. This raises AD.

Q.16. Explain the role of the following in correcting ‘deficient demand’ in an economy:

Ans. (i) Open market operations.

(ii) Bank rate.

(i) Open market operations refer to the sale and purchase of securities by the central bank. Deficient demand refers to AD falling short of AS at full employment .In this situation the central bank buys securities in the open market and makes payment to the sellers. The money flows out of the central bank and ultimately reaches the commercial banks as deposits. This raises the lending capacity of the banks. People can borrow more. This will raise AD.

(ii) Bank rate is the rate of interest which the central bank charges on the loans given to commercial banks. In case of deficient demand central banks can reduce the hank rate. This forces the commercial banks to reduce lending rate. Since borrowing becomes cheaper people borrow more. AD rises.

Q.17. Explain the role of the following in correcting ‘excess demand’ in an economy:

Ans. (i) Bank rate.

(ii) Open market operations.

(i) Bank rate is that rate of interest at which the central bank lends to commercial banks. To correct excess demand central bank can raise the bank rate. This forces commercial banks to increase lending rates. This reduces demand for borrowing by the public for investment and consumption. Aggregate demand falls.

(ii) Open market operations refer to the sale and purchase of securities by the central basic in the open market, excess demand refers to AD exceeding AS at the full employment level of income, in this situation the central bank can sell securities receiving payments from its buyers. The money flows out of the commercial banks into the central bank. This reduces the lending capacity of the banks and in turn reduces AD.