Read this article to learn about the top nineteen frequently asked questions on Producer behaviour and supply.

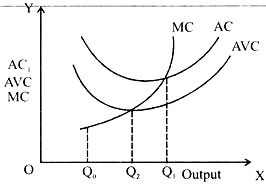

Q.1. How do the short run marginal cost, average variable cost and short run average cost curves look like?

Ans. Short run marginal cost, average variable cost and average cost curves are U-shaped. The U-shape of cost curves is because of law of the variable proportions.

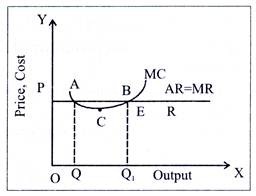

Where

Q0 = Output where MC is minimum

Q2 = Output where AVC is minimum

Q1 = Output where AC is minimum.

ADVERTISEMENTS:

Q.2. An individual is both the owner and the manager of a shop taken on rent. Identify implicit cost and explicit cost from this information. Explain

Implicit cost:

Ans. Estimated salary of the owner. Because the owner would have earned this salary if he had worked with a firm not owned by him.

Explicit cost:

ADVERTISEMENTS:

Rent paid.

Because it is actual money expenditure on input.

Q.3. A producer borrows money and opens a shop. The shop premises is owned by him. Identify the implicit and explicit costs from this information. Explain.

Ans. Implicit cost:

Imputed rent of the shop.

Because the owner would have earned rent if he had given his shop on rent.

Explicit cost:

Interest paid on the borrowed money.

Because it is the actual money expenditure on input.

ADVERTISEMENTS:

Q.4. A producer invests his own saving in starting a business and employs a manager to look after it. Identify implicit and explicit costs from this information. Explain.

Ans. Implicit cost:

imputed interest on savings.

Because he would have earned interest if he had lent his savings.

ADVERTISEMENTS:

Explicit cost:

Salary paid to the manager.

Because it is the actual money expenditure on input.

Q.5. A producer starts a business by investing his own savings and hiring the labour. Identify implicit and explicit costs from this information. Explain.

ADVERTISEMENTS:

Ans. Implicit cost:

Imputed interest on own savings.

Because he would have earned this interest if he had lent the saving

Explicit cost:

Wages paid to labour.

Because it is actually money expenditure on input.

ADVERTISEMENTS:

Q.6. A farmer takes a farm on rent and carries on farming with the help of family members. Identify explicit and implicit costs from this information. Explain.

Ans. Implicit cost:

Imputed interest on own savings.

Because he would have earned this interest if he had lent the savings.

Explicit cost:

Wages paid to labour.

ADVERTISEMENTS:

Because it is actual money expenditure on input.

Q.7. A producer borrows money and starts a business. He himself looks after the business. Identify implicit and explicit costs from this information. Explain.

Ans. Implicit cost:

Imputed salary of the owner.

Because the owner would have earned this salary if he had worked for some other firm.

Explicit Cost:

ADVERTISEMENTS:

Interest paid on borrowings. Because it is actual money expenditure.

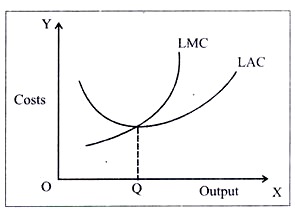

Q.8. Why do the long-run marginal cost and the average cost curves look like?

Ans. i. Long run AC (LAC) and long run MC (LMC) both curves are U-shaped. return to scale operate these cost curves fall.

ii. At minimum points on these cost curves constant returns to scale is applicable and when decreasing return to scale is applicable, both LAC & LMC tends to rise and acquire a ‘U’ shape curve.

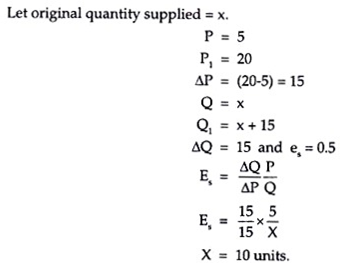

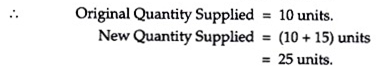

Q.9. The market price of a good changes from Rs 5 to Rs 20. As a result, the quantity supplied by a firm increases by 15 units. The price elasticity of firm’s supply curve is 0.5. Find the initial and final output level of the firm.

ADVERTISEMENTS:

Ans.

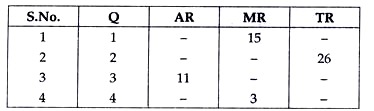

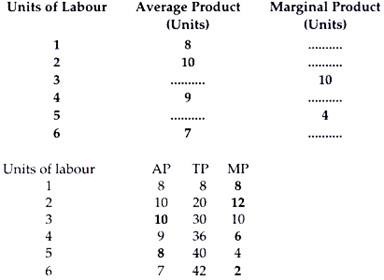

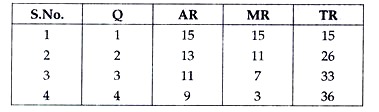

Q.10 Complete the following

Ans. By formula AR= TR /Q , MR= TRn – TRn and ∑MR= TR

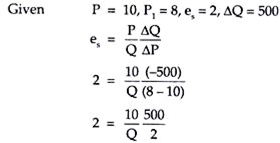

Q.11. The price elasticity of supply of a commodity is 2. when its price falls from Rs 10 to Rs 8 per unit, its quantity supplied falls by 500 units. Calculate quantity supplied at reduced price.

Ans.

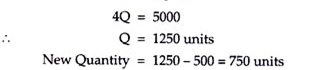

Q.12. Can there be a positive level of output that a profit maximising firm produces in a competitive market at which market price is not equal to marginal cost? Give an explanation.

Ans. i. P = MC, is a necessary condition for equilibrium for perfectly competitive firm. A firm under perfect competition can not earn maximum profits if P = MC.

ii. To prove that P = MC is a necessary condition let us assume that instead of OQ, the firm is operating at OQ1 level of output where P > MC. The profit at Q1 level is not maximum as if instead of OQ1 and if firm produces OQ level of output its profit can increase by the area of ANME.

iii. Similarly if firm is operating at OQ1 level where P < MC, this also cannot be the profit maximising situation since by curtailing its output to OQ firm can increase the profit.

iv. Thus, when P > MC and P < MC are not the profit maximising conditions, the only condition remain for equilibrium is where P = MC.

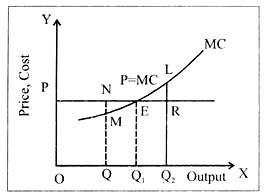

Q.13. Will a profit maximising firm in a competitive market ever produce a positive level of output in the range where the marginal cost is falling? Give an explanation.

Ans. i. No, the condition for Equilibrium is (i) MR = MC (ii) MC should be rising

ii. In the figure P = MC at two points A & B. At point A, MC is falling whereas at point B it is rising. The firm should choose to produce at point B because for output less than OQ, MR > MC and for output more than OQ1, MR < MC. Point A does not satisfy this condition. CB is the short rim supply curve in the above diagram.

Q.14. Complete the following table:

Ans.

Q.15. State whether the following statements are true or false. Give reasons for your answer.

(a) When total revenue is constant average revenue will also be constant.

(a) Average variable cost can fall even when marginal cost is rising.

(b) When marginal product falls, average product will also fall.

Ans. (a) False, because when TR is constant, AR will fall as output increases.

(b) True, provides MC<AVC.

(c) False, because AP falls only when MP<AP. AP falls not because MP falls but because MP<AP.

Q.16. State whether the following statements are true or false. Give reasons for your answer:

(i) When there are diminishing returns to a factor, total product first increases and then starts falling.

(ii) When marginal revenue falls to zero, average revenue becomes maximum.

(iii) The difference between total cost and total variable cost falls with increase in output.

Ans. (i) True because TP increases till falling MP is positive and then falls when falling MP is negative.

(ii) False, because when MR falls to zero TR becomes constant and so AR will fall as AR= TR/out put

(iii) False, because the difference between TC and TVC is equal to TFC which remains constant.

Q.17. State whether the following statements are true or false. Give reasons for your answer:

(i) When marginal revenue is constant and not equal to zero, then total revenue will also be constant.

(ii) As soon as marginal cost starts rising, average variable cost also starts rising.

(iii) Total product always increases whether there is increasing returns or diminishing returns to a factor.

Ans. (i) False. When MR is constant and not equal to zero, it may be positive or negative, TR increases when MR is positive and decreases when it is negative.

(ii) False. AVC will rise only when MC > AVC whether MC is rising or falling.

(iii) False. TP increases under increasing returns. It also increases under diminishing returns till MP is positive. TP falls under diminishing returns when MP is negative.

Q.18. Giving reasons, state whether following statements are true or false:

(i) When there are diminishing returns to a factor, total product always decreases.

(ii) Total product will increase only when marginal product increases.

(iii) When marginal revenue is zero, average revenue will be constant.

Ans. (i) False, because diminishing returns means diminishing MP, and so long as MP is positive, TP increase even though MP is falling.

(ii) False, because when MP decreases. TP will increase so long as MP is positive.

(iii) False, because MR = 0 is possible when TR is constant and as TR is constant AR will fall as output is increased.

Q.19. Giving reasons, state whether the following statements are true or false:

(i) Increase in total product always indicates that there are increasing returns to a factor.

(ii) Marginal revenue is always the price at which the last unit of a commodity is sold.

(iii) When there are diminishing returns to a factor marginal and total product both always fall.

Ans. (i) False because TP also increase when there are decreasing returns, (i.e. MP) to a factor as long as MP is positive.

(ii) False because MR is less then price (AR) when a firm can sell more units of a commodity only by lowering the price.

(iii) False because when MP falls (i.e., diminishing returns). TP can rise so long as MP is positive.