Read this article to learn about the top twenty frequently asked questions on the Government Budget and the Economy.

Q.1. What are the objectives of a government budget? Explain.

OR

Explain any one objective of Government Budget.

ADVERTISEMENTS:

OR

Explain the ‘redistribution of income’ objective of a government budget

OR

Explain the ‘economic stability’ objective of a government budget.

ADVERTISEMENTS:

OR

How can Government budget be helpful in altering distribution of income in an economy? Explain.

OR

Explain the allocation function of a government budget.

ADVERTISEMENTS:

OR

How can a government budget help in reducing inequalities of income? Explain.

Ans. The objectives of budgetary policy of government are:

(i) Redistribution of income and wealth:

i. Equal distribution of wealth is a way of social justice.

ii. Through various fiscal tools of taxation, subsidies and transfer payments, government tries to bring about fair distribution of income.

iii. Government can influence distribution of income by imposing taxes on the rich and spending more on the welfare of the poor. It will reduce income of the rich and raise standard of living of the poor, thus reducing inequalities in the distribution of income.

iv. Progressive income tax rate is an example of how government collects more taxes from the rich and spends the money for welfare of the poor.

(ii) Reallocation of resources:

ADVERTISEMENTS:

i. Government reallocates the resources through its budgetary policy to meet its social and economic objectives.

ii. Private firms do not produce public goods like roads, bridges, parks etc.

iii. The government, through allocation of its resources, produces goods for public needs to maximize social welfare.

iv. Government can influence allocation of resources through (i) tax concessions, subsidies, etc. and (ii) directly producing goods and services. To encourage investment government can give tax concession, subsidies etc. to the producers. If private sector does not take interest, government can directly undertake the production.

ADVERTISEMENTS:

(iii) Economic stability:

i. The government handles business fluctuations through its various fiscal measures and maintains price stability and guarantees employment to people at large.

ii. Government can bring in economic stability, i.e. control fluctuation in general price level, through taxes, subsidies and expenditure. When there is inflation, government can reduce its own expenditure. When there is deflation, government can reduce taxes and give subsidies to encourage spending by the people.

iii. Economic stability is necessary for the growth and development of the economy as it encourages investment.

ADVERTISEMENTS:

(iv) Managing Public Enterprises:

i. Through public enterprises, the government increases the rate of growth of the economy.

ii. Public enterprises are generally encouraged in the areas of national monopolies like water, railways etc.

Q.2. Explain the role of government budget in allocation of resources.

Ans. Government can give tax concessions and subsidies to encourage certain industries. It can also undertake production directly.

Q.3. Explain the role of government in bringing economic stability

ADVERTISEMENTS:

Ans. Govt. can bring in economic stability i.e. avoiding fluctuation in prices through taxes and expenditure. In case of inflation, government can reduce its own expenditure or increase tax. In case of deflation government can give tax concession or increase expenditure to leave more disposable income in the hands of people.

Q.4. What is a tax? Distinguish between direct and indirect taxes giving suitable examples.

Ans. i. A tax is a compulsory payment imposed by the government.

ii. Taxes are generally of two types (i) Direct taxes and (ii) Indirect taxes.

Direct Taxes:

A tax is called direct tax when the burden of the tax falls on the same person who pays the tax.

ADVERTISEMENTS:

i. For example in case of income tax, the liability to pay the income tax is of the person whose income has been taxed. Direct taxes are thus those taxes where burden cannot be shifted to others. Gift tax, wealth tax, property tax etc. are other examples of direct taxes.

Indirect Taxes:

When a person paying the tax is in a position to shift the burden of tax to other persons it is called as Indirect Tax.

i. For example, Value Added Tax (VAT) is paid to the government by the shopkeepers alright, but they pass it to customers on whom therefore its burden falls. Entertainment tax, service tax, excise duty etc. are some other examples of indirect taxes.

Q.5. Distinguish between Plan Expenditure and Non Plan Expenditure.

Ans. Distinction between these two types of expenditures is as follows:

ADVERTISEMENTS:

Plan-Expenditure

i. It refers to the expenditure made by the government on various projects, programmes and schemes included in the central plans of the government.

ii. It includes both consumption and investment expenditure of the government.

iii. For example any expense of the government according to its five year plans will be called plan expenditure.

Non Plan Expenditure:

i. Any expenditure of the government which is not covered or included in the five year plan will be called a non plan expenditure.

ADVERTISEMENTS:

ii. For example government expenditure on relief work for flood victims will be a non plan expenditure.

Q.6. Distinguish between revenue receipts and capital receipts in a government budget. Give example in each case.

Ans. Revenue receipts are receipts which neither reduce assets nor increase liabilities Example tax etc. Capital receipts are receipts which either reduce assets or increase liabilities. Example: borrowing etc.

Q.7. Distinguish between:

Ans. (a) Capital receipts and revenue receipts.

(b) Direct tax and indirect tax.

(a) Receipts which lead to either reduction in assets or increase in liabilities are called capital receipts. Receipts which neither reduce assets not create any liability are revenue receipts.

(b) Direct tax is a tax whose incidence and impact fall on the same person. Indirect tax is tax whose incidence and impact fall on different persons.

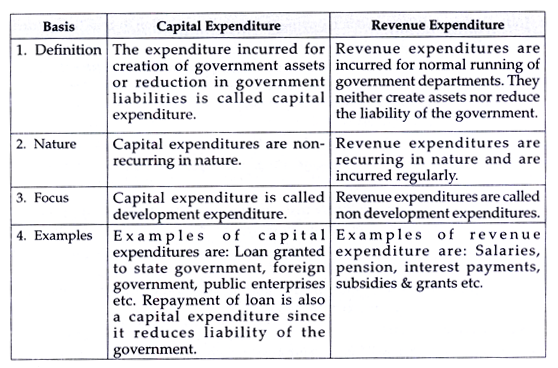

Q.8. Distinguish between Revenue Expenditure and Capital Expenditure in a government budget. Give examples.

Ans. Capital Expenditure and Revenue Expenditure can be distinguished as below:

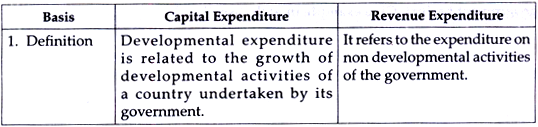

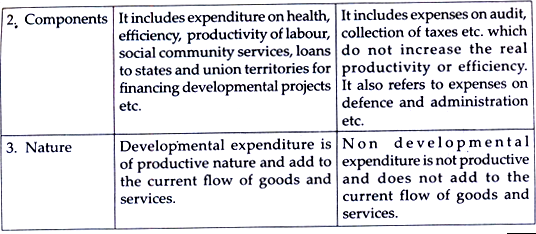

Q.9. Distinguish between Developmental and Non developmental expenditure.

Ans. Developmental and non developmental expenditure can be distinguished as under:

Q.10. Explain ‘revenue deficit’ in a Government budget? What does it indicate?

Ans. Revenue deficit is the excess of total revenue expenditure over total revenue receipts. It indicates that the government is spending more than the current income.

Q 11 Explain the concept of ‘fiscal deficit’ in a government budget. What does it Indicate?

Ans. Fiscal deficit refers to the excess of total budget expenditure (revenue expenditure + capital expenditure) over total budget receipts excluding borrowing. In this way it indicates borrowing requirements of the government during the current year.

Q.12. What are the consequences of fiscal deficit in a government budget? Explain.

Ans. The consequences of fiscal deficit are as under:

(i) Causes Inflation:

a. To finance the deficit, government generally resorts to deficit financing i.e. it borrows from Reserve Bank of India.

b. Since the deficit is financed by printing of new currency notes, the money supply increases which causes inflation in the economy.

(ii) Growing Indebtedness:

a. Government borrows from rest of the world, which increases its dependence on other countries.

b. There is always a threat of economic and political interference by the lender countries.

(iii) Reduces future growth and development:

a. Borrowing is a financial burden on future generations also as they have to repay the loan and interest thereon.

b. Borrowing thus retards the growth and development prospects of the country for future also.

(iv) Debt Trap:

i. The government soon falls in a debt trap. It has to take further loans to repay the huge amount of principal/interest.

ii. A vicious circle starts in which government takes new loans to repay earlier loans/interest.

Q.13. Describe the various measures to correct different deficits.

Ans. Deficit can be financed in the following ways:

(i) Monetary Expansion or Deficit Financing:

a. It means printing of new currency to the extent of deficit. The government borrows by issuing treasury bills and government gets cash to finance its deficit.

b. This method of deficit financing leads to inflation in the economy.

c. Thus, in an inflationary situation use of deficit financing is not advisable as it will lead to further inflation in the economy.

(ii) Borrowing from the Public:

i. The government can also borrow from the general public by issuing bonds of various types.

ii. These bonds carry interest at a fixed rate.

iii. The burden of interest is called ‘public debt interest’.

(iii) Disinvestment:

a. The government may decide to sell its share in public sector enterprises to general public or to private sector, which is called disinvestment.

b. Disinvestment can also be used to finance the deficit.

(iv) Lowering Government Expenditure:

a. The government can take necessary steps to reduce its non developmental expenditure.

b. The government can also reduce its expenditure by giving greater role to the private sector.

(v) Raising Government Revenue:

i. The government can also raise its revenues by increasing tax rates or by having a wider coverage through indirect taxes.

Q.14. Distinguish between capital receipts and revenue receipts.

Ans. i. Revenue receipts are those receipts which neither create any liability nor reduce the assets These can be of two types (i) Tax revenue and (ii) Non tax revenues. Income tax, sales tax, excise duty etc. are examples of tax revenues and fees, fines and penalties, forfeitures etc. are the examples of non tax revenues of the government.

ii. Capital receipts are those receipts which either create a liability or reduce assets. Recoveries of loans, market borrowings, external loans, provident funds, public provident funds etc. are examples of capital receipts.

Q.15. Distinguish between revenue expenditure and capital expenditure in Government budget. Give an example of each

Ans. Expenditure can be classified as (a) Revenue Expenditure & (b) Capital Expenditure

(i) Revenue Expenditure:

a. Those expenditures of the government which neither create any assets for it nor reduce any of its liabilities are called revenue expenditures.

b. For example payment of pension, interest etc.

c. Revenue expenditures are financed out of revenue receipts of the government.

(ii) Capital Expenditure:

a. Expenditures which result in creation of assets for government or reduction in its liabilities are called capital expenditures.

b. Capital expenditures are financed through borrowings from public and foreign bodies.

c. Examples of capital expenditures are construction of roads, bridges, grant of loan etc.

Q 16 .The fiscal deficit gives the borrowing requirement of the government’. Elucidate.

Ans. i. Fiscal deficit means the borrowing requirement of a government during the budget year. (Financial Year)

ii. FISCAL DEFICIT = Total Expenditure – Total Receipts (Except Borrowings)

Or Fiscal Deficit = Total Expenditure – Revenue Receipts – Non debt creating capital receipts

iii. Keeping financing side in view, fiscal deficit is defined as

iv. Fiscal Deficit = Net borrowings at home + Borrowings from RBI + Borrowings from Rest of the world.

v. Fiscal deficit thus shows the total borrowing requirements of a government from all sources. When Government’s borrowings increase, its liability to pay loans alongwith interest in future also increases. Payment of interest increases the revenue expenditure of the Government which leads to increase in revenue deficit thereafter.

Q.17. Give the relationship between the revenue deficit and the fiscal deficit.

Ans. Fiscal deficit is a wider term than the revenue deficit. Revenue deficit is the excess of revenue expenditure over the revenue receipts of the government.

Revenue Deficit = Revenue Expenditure (RE) – Revenue Receipts (RR)

It means revenue deficit in government budget can exist only when revenue expenditure of government is more than the revenue receipts.

Fiscal Deficit = Total Expenditure – Total Receipts (Except Borrowings)

Or Revenue Expenditure (RE) + Capital Expenditure (CE) – Revenue Receipts (RR) -Capital Receipts (CR) (Except Borrowings).

Or RE + CE – RR-CR (Except Borrowings)

Or Revenue Deficit + Capital Deficit (Except Borrowings)

Fiscal Deficit = Revenue Deficit + Capital Deficit (Except Borrowings and other liabilities).

Fiscal deficit does not take into account all types of receipts e.g. it does not take into account borrowings of the government. Hence, Fiscal deficit is excess of all expenditure over total receipts net of borrowings and is related to Revenue Deficit as above.

Q.18. Distinguish between revenue deficit and fiscal deficit.

Ans. 1. Excess of revenue expenditure over revenue receipts is called revenue deficit whereas the excess of total expenditure over total receipts excluding borrowings is called fiscal deficit.

2. a. Revenue Deficit = Revenue Expenditure (RE) – Revenue Receipts (RR)

b. Fiscal Deficit = Total Expenditure – Total Receipts (Except Borrowings)

Q.19. Distinguish between

(i) Direct tax and indirect tax

(ii) Revenue deficit and fiscal deficit.

Ans. (i) Direct tax is a tax whose liability to pay and incidence lie on the same person whereas in case of indirect tax incidence can be shifted to some other person.

(ii) Revenue deficit is the excess of total revenue expenditure over total revenue receipts whereas Fiscal deficit is the excess of total budgeted expenditure (both capital and revenue) over total budgeted receipts excluding borrowings.

Q.20. Discuss the issues of deficit reduction.

Ans. Government can bring down the deficit by taking following steps:

(i) Taxes should be increased:

a. The government can raise direct taxes to enhance its revenue.

b. The receipts of government can be augmented by increasing the tax rates or by levying new taxes.

(ii) Reduction in Government Expenditure:

i. The government should reduce its expenditure by functioning more efficiently.

ii. This can be achieved through better management.

(iii) Disinvestment:

i. The government can increase revenue by disinvesting its share in some of its resources.

ii. Public sector undertakings as are doing well and command good premium in the equity market.

(iv) Changing the role and scope of the government:

a. The government can withdraw its activities from some non-core areas so as to focus more on priority sectors for deficit reduction and hence for growth of nation.

(v) Privatization:

i. Normally, capital projects and core sector industries are catered to by Government itself.

ii. By encouraging private sector, government can share its burden with them, substantially reducing the deficit.