Read this article to learn about the top twenty-two frequently asked questions on the National Income and Related Aggregates.

Q.1. Give the meaning of primary, secondary and tertiary sector of an economy.

Ans. Primary Sector:

i. Production units producing goods by utilizing natural resources like land, water, forests, mines etc. come under this sector.

ADVERTISEMENTS:

ii. It includes agriculture and allied activities like fishing, forestry, mining, quarrying etc.

iii. Its output being input for secondary sector, it is of basic importance; hence its name.

Secondary Sector:

i. This sector is also called manufacturing sector.

ADVERTISEMENTS:

ii. It includes all those producing units which transform one type of commodity into another with the help of “3Ms” i.e. “Men, Materials and Machines”.

iii. For example cloth from cotton, sugar from sugarcane etc. Being dependent or being second to Primary Sector, it is called Secondary Sector.

Tertiary Sector:

i. This sector is also known as service sector consisting of units which provide services like banking, transport, insurance, trade, commerce etc.

ADVERTISEMENTS:

ii. Its growth is obviously wholly dependent on the earlier two sectors.

Q.2. Explain the basis of classifying goods into intermediate and final goods. Give suitable examples.

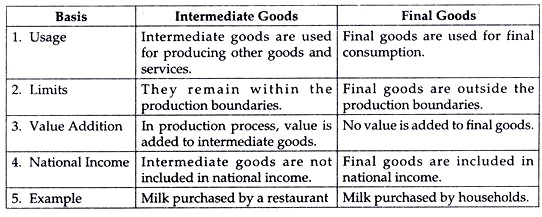

Ans. Goods which are purchased by a production unit from other production units and meant for resale or for using up completely during the same year are called intermediate goods.

Example:

Raw materials or any other example.

Goods which are purchased for consumption and investment are called final goods.

Examples:

Purchase of machinery for installation in factor or any other example.

Q.3. What are the various heads into which factor incomes are classified? Explain them briefly.

ADVERTISEMENTS:

Ans. Factor incomes or payments are classified into following heads:

(i) Compensation of Employees

(ii) Operating Surplus

(iii) Mixed Income of self employed

ADVERTISEMENTS:

(iv) Net factor income from abroad

(i) Compensation of Employees:

Compensation of employees includes pa5anent of wages and salaries in cash and kind and employer’s contribution to social security schemes like pension or retirement fund, provident fund, life insurance etc.

(ii) Operating Surplus:

ADVERTISEMENTS:

The sum of income from property and income from entrepreneurship is called operating surplus. Rent, Interest and Royalty are incomes from property and profit is income from entrepreneurship. Profit includes corporation tax, corporate savings and dividends.

(iii) Mixed Income of Self Employed:

In case of self-employed persons, all factors of production are owned by the entrepreneur himself. Their income is thus a mixture of wages, rent, interest and profit. Since it is not possible to bifurcate their income into rent, interest etc. it is added as it is under the head “mixed income of self-employed.”

(iv) Net factor income from Abroad:

Net factor income from abroad is the difference between factor income received by residents from abroad and factor income paid to the residents of other countries. It includes:

(a) Net compensation of employees

ADVERTISEMENTS:

(b) Net income from property and entrepreneurship

(c) Net retained earnings of resident companies abroad

Q.4. What are the components of net factor income from abroad?

Ans. The main components of net factor income from abroad are the net values of following:

(i) Compensation of employees

(ii) Income from property and entrepreneurship

ADVERTISEMENTS:

(iii) Retained earnings of resident companies abroad

(i) Net Compensation of Employees:

Net compensation of employees means the difference between compensation of resident workers of a country temporarily living and working abroad and similar payment made to nonresident workers in that country.

(ii) Net Income from Property and Entrepreneurship:

It is equal to the difference between rent, interest and profit received by residents of a country living abroad and similar payments made by that country to non residents staying in that country.

(iii) Net Retained Earnings of Resident Companies:

ADVERTISEMENTS:

Net retained earnings of resident companies of a country is the difference between the retained earnings (undistributed profits) of the resident companies located abroad and retained earnings of foreign (non resident) companies located in that particular country.

Thus,

Net factor income from Abroad = Net Compensation of employees from abroad + Net Income from property and entrepreneurship from abroad + Net retained earnings of resident companies from abroad.

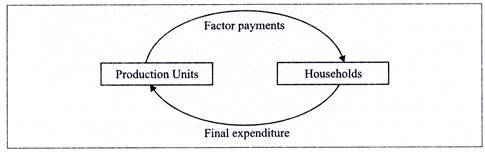

Q.5. Explain the circular flow of income.

Ans.

Income are first generated in production units due to the joint efforts of factor owners from households. These incomes are distributed to the factor owners who in turn spend the income on purchasing goods and services produced in production units. This makes the circular flow of income complete.

ADVERTISEMENTS:

Q.6. Distinguish between intermediate products and final products. Give examples. Distinction between Intermediate goods and Final goods is as follows:

Ans.

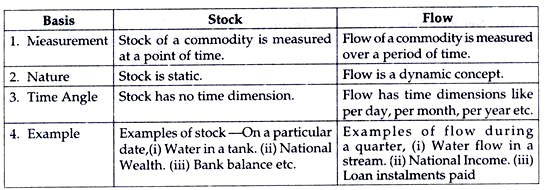

Q.7. Difference between stock and flow variables.

Ans. Differences between stock and flow variables are as follows:

Q.8. Distinguish between consumer goods and capital goods. Which of these are final goods?

Ans. Goods purchased for satisfying wants are consumer goods.

Durable goods purchased for use in production are capital goods.

Both are final goods.

Q.9. Explain domestic territory.

Ans. In economics, economic territory of a country is also called its domestic territory and it includes the following:

(i) Area lying within the political frontiers of the country including territorial water and air space too;

(ii) Its embassies, consulates, military bases etc. located abroad;

(iii) Ships, aircraft etc. owned by its residents and operated by them between two or more countries; Fishing vessels, oil and natural gas rigs etc. operated by the residents in the international waters or other areas where the country has exclusive rights.

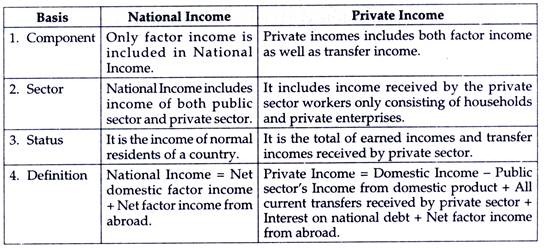

Q.10. Distinguish between National Income and Private Income.

Ans. Distinction between National Income and Private Income is as follows:

Q.11. Distinguish between real and nominal gross domestic product.

Ans. When GDP is calculated at current prices, it is nominal GDP. When GDP is calculated at constant prices, it is real GDP.

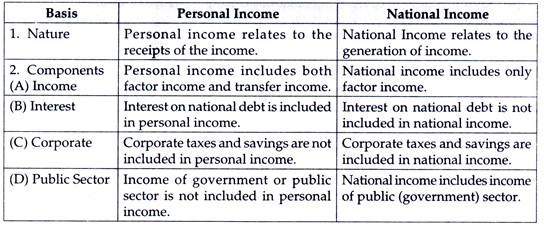

Q.12. Distinguish between Personal Income and National Income.

Ans. Distinction between Personal Income and National Income is given here below:

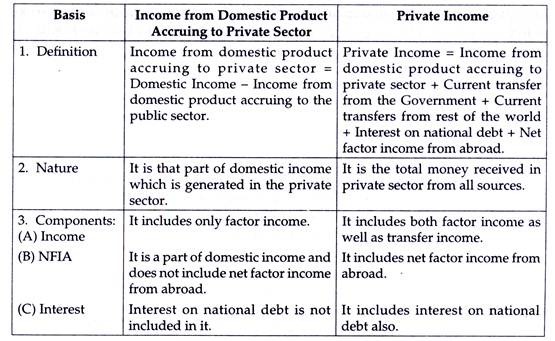

Q.13. Distinguish between Income from domestic product accruing to private sector and Private income.

Ans. The distinction between Income from domestic product accruing to private sector and Private Income is as follows:

Q.14. Giving reasons categories the following into stock and flow:

(i) Capital

(ii) Saving

(iii) Gross domestic product

(iv) Wealth

Ans. (i) Capital is stock because it is measured at a point of time.

(ii) Saving is flow because it is measured during a period of time.

(iii) Gross domestic product is a flow because it is measured during a period of time.

(iv) Wealth is stock because it is measured at a point of time.

Q.15. (a) Distinguish between stock and flow, (b) Between net investment and capital, which is a stock and which is a flow? (c) Compare net investment and capital with flow of water into a tank.

Ans. (a) Main differences between stock and flow are as follows:

(i) Stock of a commodity is always linked to a point of time whereas flow of a commodity is based on period of time.

(ii) Consequently while flow does have some time dimension, stock has none of same. For example, national income is a flow concept, whereas national capital is a stock concept.

(b) Net investment is a flow; Capital is a stock.

(c) Capital is a stock like water in a tank at a given point of time whereas net investment is a flow like amount of water flowing into the tank during some period of time.

Q.16. What is the difference between planned and unplanned inventory accumulation? Write down the relation between change in inventories and value added of a firm.

Ans. Planned Inventory:

Any conscious increase in the inventories as per a specific plan is called planned inventory accumulation. Depending on the market situation, a firm may plan to increase or decrease its inventory level.

Unplanned Inventory:

On the other hand, any unexpected increase in inventories because of internal/external factors is called unplanned inventory accumulation. Here again the factors can lead to unexpected drop also in the inventories. This is usually generated by some unsold part of output.

Gross Value Added of firm (GVA) = Gross Value of Output produced by the firm (Q) – Value of intermediate goods used by the firm (Z)

Or

GVA = Value of Sales by the firm (V) + Value of change in inventories (A) – value of intermediate goods used by the firm (Z)

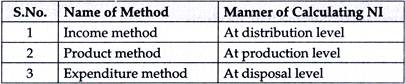

Q.17. Write down the three identities of calculating the GDP of a country by the three methods. Also briefly explain why each of these should give us the same value of GDP.

Ans. (a) The three identities are:

National Income = National Product = National Expenditure

(b) Each one of the above gives the same result.

The only difference lies in the manner of calculation of National Income (NI) as shown below:

Q.18. Calculate NDPFC from the following: (Rs in cores)

Ans. i. Gross national product at MP – 68,400

ii. Depreciation – 4,300

iii. Indirect taxes – 9,000

iv. Subsidies – 1,000

v. Net factor income from abroad – 1,340

NDPFC = GNPMP-Depreciation-NFIA-I.T. +Subsidies

NDPFC = (i) – (ii) – (v) – (iii) + (iv)

NDPFC= 68,400-4,300-1,340-9,000 +1,000

NDPFC = Rs 54,760 Crore

Q.19. (i) Net domestic products at MP – 64,800

(ii) Net Indirect taxes – 6,833

(iii) Net factor income from abroad – (-) 132

(iv) Depreciation – 4,367

From the data given above, calculate:

(a) GDPMP (b) NNPFC (Rs in Crores)

(i) GDP MP= NDP + Depreciation

GDP MP=(i) +(iv)

GDPMP= 64,800= 4,367

GDPMP= Rs 69,167

(ii) NNPFC = NDP MP + NFIA – NIT

NNPFC = (i) + (iii) – (ii)

NNPFC = 64,800+ (-132) – 6,833

NNPFC = Rs 57,835 Crores

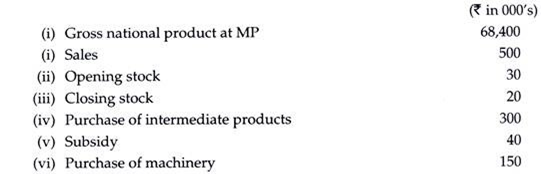

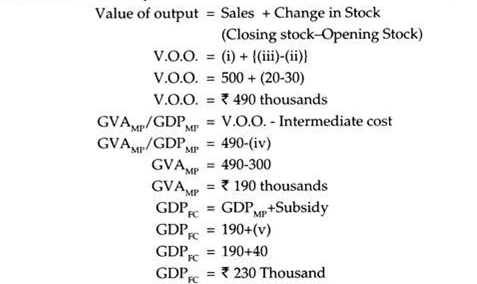

Q.20. From the following data about a firm ‘X’ calculate gross value added at factor cost

Ans.

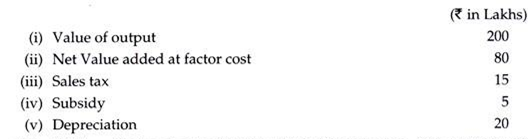

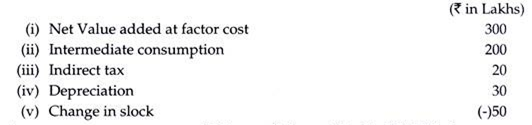

Q.21. Calculate ‘intermediate consumption’ from the following date:

Ans.

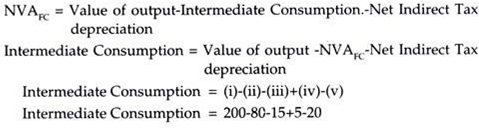

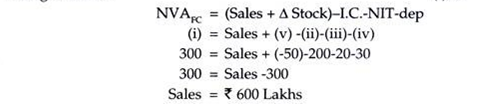

Q.22. Calculate ‘Sales’ from the following date:

Ans.