Read this article to learn about the frequently asked questions on National Income and Related Aggregates.

Q.1. Explain how ‘distribution of gross domestic product’ is a limitation in taking gross domestic product as an index of welfare.

Ans. It is possible that with rise in GDP, inequalities in the distribution of income may also increases. It means gap between rich and poor increases. So, the welfare of the people may not rise as much as the rise in GDP.

Q.2. Explain how ‘non-monetary exchanges’ are a limitation in taking gross domestic product as an index of welfare.

ADVERTISEMENTS:

Ans. Non-monetary exchanges refer mainly to the own account or self consumed goods and services like services of family members to each other, which are left out of GDP on account of non availability of data. But these do contribute to welfare. As such GDP under estimates welfare.

Q.3. Explain how distribution of gross domestic product is its limitation as a measure of economic welfare.

Ans. If with increase in GDP inequalities of income increase, poor become more poor while rich become more rich. This may lead to decline in welfare even though GDP has increased.

Q.4. Why should the aggregate final expenditure of an economy be equal to the aggregate factor payments? Explain.

ADVERTISEMENTS:

Ans. The revenue received by a firm is distributed among various factors of production in the form of rent, wages, interest and profit. Thus the sum of final expenditure of an economy has to be obviously equal to the aggregate factor payments. (The final expenditure however implies expenses related to final goods only and it does not include expenditure on intermediate goods.)

Q. 5. The value of the nominal GNP of an economy was Rs 2,500 crores in a particular year. The value of the GNP of that country during the same year, evaluated at the prices of same base year was Rs 3,000 crores. Calculate the value of the GNP deflator of the year in percentage terms. Has the price level risen between the base year and the year under consideration? Yes.

Ans. (a) GNP Deflator = Nominal GNP/Real GNP x 100

= 2.500/3,000 x 100

ADVERTISEMENTS:

= 83.33%

(b) Yes.

Q.6. In a single day, Raju, the barber, collects Rs 500 from haircuts; over this day, his equipment depreciates in value by Rs 50. Of the remaining Rs 450, Raju pays sales tax worth Rs 30, takes home Rs 200 and retains Rs 220 for improvement and buying of new equipment. He further pays t 20 as income tax from his income. Based on this information, complete Raju’s contribution to the following measures of income (a) Gross Domestic Product (b) NNP at market price (c) NNP at factor cost (d) Personal Income (e) Personal disposable income.

Ans. (a) Contribution to GDP = Rs 500

(b) Contribution to NNPMP = GDP – Depreciation = Rs 500 Rs 50 = Rs 450

(c) Contribution to NNPFC = Contribution to NNPMP – Sales Tax

= Rs450-Rs 30 = Rs420

(d) Personal Income = Contribution to NNP- Retained Earnings

= Rs 420-Rs 220

ADVERTISEMENTS:

= Rs 200

(e) Personal Disposable Income = Personal Income – Income tax

= Rs 200-Rs 20

= Rs 180

ADVERTISEMENTS:

Q.7. Will the following be a part of domestic factor income of India? Give reasons for your answer.

(i) Old age pension given by the government.

(ii) Factor income from abroad

(iii) Salaries to Indian resident working in Russian Embassy in India.

ADVERTISEMENTS:

(iv) Profits earned by a company in India, which is owned by non-residents.

Ans. (i) This is transfer given by the govt., so it will not be included in domestic factor income of India.

(ii) As it is the factor income received from external sector, so it will not be included in domestic factor income of India.

(iii) It will not be considered a part of domestic factor income of India as Russian embassy in India is not a part of domestic territory of India.

(iv) This profit will not be included in the domestic factor income of India as it will be a part of NFIA due to its ROW component.

Q.8. Will the following factor incomes be included in domestic factor income of India? Give reason for your answer.

ADVERTISEMENTS:

(i) COE to the resident of Japan working in Indian embassy in Japan.

(ii) Profits earned by a branch of foreign bank in India.

(iii) Rent received by an Indian resident from Russian Embassy in India.

(iv) Profits earned by a branch of State Bank of India in England.

Ans. (i) This income will be included in the domestic factor income of India as Indian Embassy in Japan is a part of domestic territory of India.

(ii) As the foreign bank is situated within the domestic territory of India so it will be included in the domestic factor income of India.

ADVERTISEMENTS:

(iii) This will not be a part of domestic factor income of India as Russian Embassy is not a part of domestic territory of India.

(iv) This profits will not be included in the domestic factor income of India as SBI is situated outside the domestic territory of India.

Q.9. Will the following be included in the national income of a country? Give reasons for your answers.

(i) School fees paid by students.

(ii) Purchase of new shares of a domestic firm.

(iii) Gift received from abroad

ADVERTISEMENTS:

(iv) Furniture purchased by households.

Ans. (i) School fees are the payment given by the students for getting education i.e. service/consumption so it will be included in the national income.

(ii) These are just change in ownership of paper claims, i.e. without production, so it will not be included is national income.

(iii) As these are transfer payments i.e. unilateral in nature, so these will not be included in national income.

(iv) As this is part of private final consumption expenditure, so it will be included in national income.

Q.10. Giving reasons, explain how the following are treated while estimating national income.

ADVERTISEMENTS:

(i) Payment of fees to the lawyer engaged by a firm.

(ii) Rent free house to an employee by an employer.

(iii) Purchases by foreign tourists

Ans. (i) As it is an intermediate expenditure so it will not be included in national income.

(ii) As it is a part of COE so it will be included in national income.

(iii) This will lead to the flow of goods & services i.e. production so it will be included in national income.

Q.11. How will you treat the following while estimating domestic factor income of India? Give reasons for your answer.

Ans. (i) Remittances from non-resident Indians to their families in India.

(ii) Rent paid by the embassy of Japan in India to a resident Indian.

(iii) Profits earned by branches of foreign bank in India.

(i) It will not be included in the domestic factor income of India as it is earned outside the domestic territory of India.

(ii) It will not be included in the domestic factor income of India as it is the part of NFIA.

(iii) It will also not be included in domestic factor income of India as it is a component of NFIA.

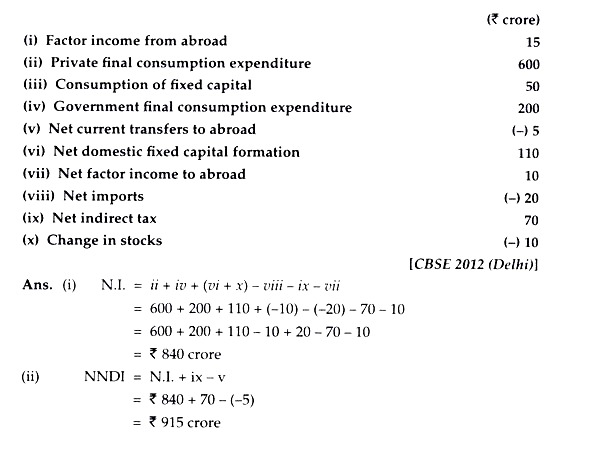

Q.12. Find out (a) national income and (b) net national disposable income:

Q.13. Giving reason explain how should the following be treated in estimating national income:

(i) Expenditure on fertilizers by a farmer.

(ii) Purchase of tractor by a farmer.

Ans. (i) It is intermediate cost for the farmer and deducted from value of output while arriving at national income. Therefore, not included.

(ii) It is included because it is capital formation/investment by the farmer.

Q.14. Giving reason explain how should the following be treated in estimating national income:

(i) Payment of bonus by a firm

(ii) Payment of interest on a loan taken by an employee from the employer

Ans. (i) Bonus is included because it is compensation of employees.

(ii) Not included because the loan is taken for consumption.

Q.15. Giving reason explain how should the following be treated in estimating national income:

(i) Interest paid by banks on deposits by individuals.

(ii) National debt interest.

Ans. (i) It is included because it is a factor payment by a producer.

(ii) It is not included because it is a loan taken by government to meet its consumption expenditure.

Q.16. Should the following be treated as final ‘expenditure or intermediate expenditure? Give reasons for your answer.

(i) Purchase of furniture by a firm.

(ii) Expenditure on maintenance by a firm.

Ans. (i) It is final expenditure because it is investment expenditure.

(ii) It is intermediate expenditure because it is an expenditure on single use producer goods.

Q.17. Giving reason, explain how should the following be treated while estimating national income:

(i) Expenditure on free services provided by government

(ii) Payment of interest by a government firm

Ans. (i) It should be included because it is private final consumption expenditure

(ii) It should not be included because it is an intermediate cost.

Q.18. How should the following be treated while estimating National Income? Give reasons.

(i) Expenditure on education of children by a family.

(ii) Payment of electricity bill by a school.

Ans. (i) It should be included because it is private final consumption expenditure.

(ii) It should not be included because it is an intermediate cost.

Q.19. Giving reasons classify the following into intermediate products and final products:

(i) Furniture purchased by a school.

(ii) Chalks, dusters, etc. purchased by a school.

Ans. (i) It is a final product because it is purchased for investment.

(ii) These are intermediate products because these are taken to be used up completely during the same year (or these are meant for resale).

Q.20. Giving reasons classify the following into intermediate products and final products:

(i) Computers installed in an office.

(ii) Mobile sets purchased by a mobile dealer.

Ans. (i) These are final products because these are purchased for investment.

(ii) These are intermediate products because these are purchased for resale.

Q.21. Giving reason identify whether the following are final expenditures or intermediate expenditure:

(i) Expenditure on maintenance of an office building.

(ii) Expenditure on improvement of a machine in a factory.

Ans. (i) These are final products because these are purchased for investment.

(ii) These are intermediate products because these are purchased for resale.

Q.22. Giving reasons, explain the treatment assigned to the following while estimating national income:

(i) Family members working free on the farm owned by the family.

(ii) Payment of interest on borrowings by general government.

Ans. (i) Imputed salaries of these members will be included in national income.

(ii) It will not be included in national income because it is a non-factor payment as general government borrows only for consumption purpose.

Q.23. Giving reasons, explain the treatment assigned to the following while estimating national income:

(i) Social security contributions by employees,

(ii) Pension paid after retirement

Ans. (i) Not included in national income because it is paid out of compensation of employees which is already included in national income.

(ii) Not included in national income in the year of actual payment because it was already counted as pension during the period when the person was employed/ because it is a deferred pa5anent.

Q.24. Giving reasons, explain the treatment assigned to the following while estimating national income:

(i) Expenditure on maintenance of building.

(ii) Expenditure on adding a floor to the building.

Ans. (i) It is treated as intermediate expenditure and so deducted from the value of output for arriving at national income.

(ii) It is treated as fresh expenditure on investment capital formation and therefore included in the estimation of national income.

Q.25. Giving reasons, classify the following into intermediate and final goods:

(i) Machines purchased by a dealer of machines.

(ii) A car purchased by a household.

Ans. (i) Intermediate as purchased for resale.

(ii) Final as purchased for consumption.

Q.26. How will you treat the following while estimating national income of India? Give reasons for your answer.

(i) Dividend received by a foreigner from investment in shares of an Indian company.

(ii) Profits earned by a branch of an Indian bank in Canada.

(iii) Scholarship given to Indian students studying in India by a foreign company.

Ans. (i) It is factor income to abroad, so it will be deducted from NDP to get NNP.

(ii) It is factor income from abroad, so it is included in NI.

(iii) It is a transfer payment. So, it is not included in NI.

Q.27. How will you treat the following while estimating domestic factor income of India? give reasons for your answer.

(i) Remittances from non-resident Indians to their families in India.

(ii) Rent paid by the embassy of Japan in India to a resident Indian.

(iii) Profits earned by branches of foreign bank in India.

Ans. (i) Not included because it is a transfer payment.

(ii) Not included because embassy of Japan is not a part of domestic territory of India.

(iii) Included because the branch of the foreign bank is located within the domestic territory of India.

Q.28. How will you treat the following while estimating national income of India? Give reasons for your answer.

(i) Salaries received by Indian residents working in Russian Embassy in India.

(ii) Profits earned by an Indian bank from its branches abroad.

(iii) Entertainment tax received by the government.

Ans. (i) Included in national income because it is factor income from abroad.

(ii) Included because it is factor income from abroad.

(iii) Not included because it is indirect tax and it is not a factor cost. No marks be given if the reason is not given.

Q.29. How will you treat the following while estimating national income of India? Give reasons for your answer.

(i) Salaries paid to Russians working in Indian Embassy in Russia.

(ii) Profits earned by an Indian company from its branch in Singapore.

(iii) Capital gains to Indian residents from sale of shares of a foreign company.

Ans. (i) Not included because it is factor income paid to abroad.

(ii) Included because it is factor income from abroad.

(iii) Not included because it is a transfer income.