The following points highlight the top three aspects of Crowding-Out of Investment. The aspects are: 1. A Primary-Level Crowding-Out 2. A Secondary-Level Crowding-Out 3. A Third-Level Crowding-Out.

Aspect # 1. A Primary-Level Crowding-Out:

At the simplest level, in a static framework, an increase in G raises r, reducing I. The multiplier for G is smaller when we endogenise the r than when it is held exogenous. Then there is a full crowding-out on the demand side in case of a vertical LM curve.

In this case an increase in G raises r enough to provide an offsetting fall in I: – ∂I/∂r. dr = dG. This is a first stage of crowding-out which determines how far the C + I + G schedule shifts for a given dG.

Aspect # 2. A Secondary-Level Crowding-Out:

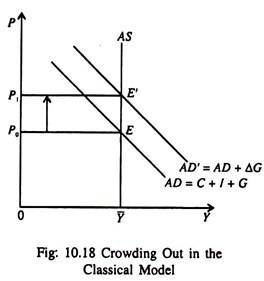

This type of crowding-out involves the AS curve and the price reaction to the shift in demand. Let us suppose the AD curve is downward sloping but the AS curve is vertical as in the classical model. In this case an increase in AD due to a rise in G simply raises the price level (P) enough to restore the original equilibrium value of Y as shown in Fig. 10.18.

ADVERTISEMENTS:

This price rise pushes up the interest rate enough so that once again – ∂I/∂r. dr = dG and fiscal expansion leads to full crowding-out of private investment.

Aspect # 3. A Third-Level Crowding-Out:

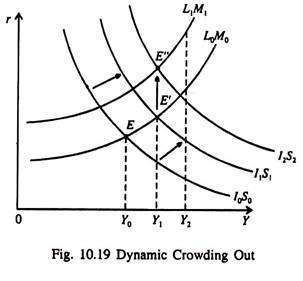

In Fig. 10.19 the movement from equilibrium position E to E’ with implicit changes in the price level, reflects partial crowding-out at the first two levels. The initial increase in G moves income from Y0 to Y1, where there is budget deficit.

Here the third level of dynamic crowding-out comes in. If the shift of the LM curve from point F due to budget deficit (G > T) exceeds the shift of the IS curve, I is reduced more than C is increased by the budget deficit and Y falls.

ADVERTISEMENTS:

If the shift of the IS curve exceeds that of the LM curve, Y increases toward Y2 where G = T. The effect of budget deficit on the LM curve is the crowding-out of I by raising r, thus, tending to reduce Y. This is balanced by a ‘crowding-in’ effect on C as budget deficit (especially public debt) increases wealth. Only if the investment effect outweighs the consumption effect the result is an unstable net crowding-out in the dynamic model.

Full Employment and Full Crowding-Out:

Is full employment consistent with full crowding-out?

ADVERTISEMENTS:

In a situation of full employment there is full crowding out. If output is at full employment level, any increase in G has to be at the expense of another component of aggregate demand and crowding-out is not only possible but inevitable.

If the demand for money is not related to r the LM curve is vertical (the classical case) so there is a unique level of Y at which the money market is in equilibrium and fiscal policy cannot affect Y.

In this case aggregate demand remains unchanged but there is a change in the composition of output. Investment spending is reduced by the amount exactly equal to the increase in government spending. Consumption spending remains unchanged due to fixity of Y and autonomous investment remains unchanged thus the increase in G is totally offset by the reduced investment spending.

This is known as fiscal crowding-out — the government spending crowds out some other component of spending and has no effect on total spending. This implicitly implies that G has no effects on output and employment.

The monetarists endorse the above view. This is why they place primary emphasis on the role of the money stock in determining the level of income. The monetarists’ view is that it is the supply of money that really matters. So the vertical LM curve is quite consistent with the monetarists’ view that the demand for money does not depend on the rate of interest.

Crowding-In Effect:

It is also possible that crowding in occurs, that is, other spending actually increased if conditions are such that the Keynesian multiplier works, or through favourable effects of an overall rise in spending on the confidence of private investors.

Oscar Lange has pointed out in 1938 that real deficits causing real increases in the value of public debt held by the private sector in excess of the rate of growth of real output is likely to occur under conditions of less than full employment. In these conditions, resulting increased real consumption may well encourage rather than reduce real investment, that is ‘crowd-in’ rather than ‘crowd-out’ investment.