Let us make the in-depth study of the IS-LM Model: 1. Views on the IS-LM Model 2. Limitations of the IS-LM Model.

Views on the IS-LM Model:

The Monetarist View:

The monetarists are so called because they consider monetary policy to be effective, at least in the short period.

They produced empirical evidence to show that changes in national income and price level are more closely related to changes in money stock than to changes in the government budget.

ADVERTISEMENTS:

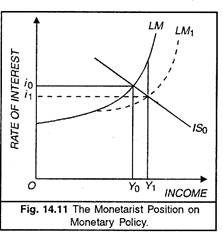

The monetarist position is explained with the help of the following figure 14.11.

Monetarists believe that the economy often operates under the classical range where the LM curve is near vertical. It is a near-full employment situation where the IS curve is interest-elastic because increase in money supply reduces the interest rate from i0 to i1 and that increases the income level from Y0 to Y1.

Since the investment function is not so interest insensitive as the Keynesians believed, monetary policy is capable of increasing the income level and restoring full employment. When the economy is operating at a level near full-employment, fiscal policy measures would just create an inflationary situation without the use of monetary policy.

ADVERTISEMENTS:

The Keynesian View on Fiscal Policy:

Keynesians believe that fiscal policy is more dependable than monetary policy because it bypasses the effect of interest rates and because it affects aggregate demand directly through changes in public expenditure and through changes in tax rates which affect consumption and investment. They believe that the income multiplier works to bring about the desired changes in income and employment.

But the monetarists doubt the effectiveness of fiscal policy if the money supply is not changed. Without an accommodating monetary policy, the additional government expenditure is financed by borrowing from the public. That will push up the interest rate and discourage private investment. Additional public expenditure, monetarists say, will crowd out private investment.

ADVERTISEMENTS:

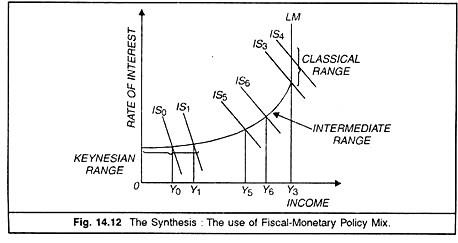

Thus, national income will not increase. The fiscal policy will be frustrated without the use of monetary policy. In the following figure, this situation prevails in the classical range where the IS curve shifts from its position IS3 to IS4 but the level of income remains stuck at Y3 because the LM curve is vertical here. Additional public expenditure simply raises the interest rate and crowds out private investment to the same extent.

The Modern Position:

The ‘intermediate range’ in the figure given above shows the modern view on the debate on Monetary Policy versus Fiscal Policy. It is now agreed that the classicals and the Keynesians were analysing the extreme situations of the economy. It is now conceded that both monetary policy and fiscal policy must be used as complementary policies in curing the economy of its ailments of inflation and unemployment. Keynesians insist on limited economic intervention in the form of fine tuning by way of fiscal policy while monetarists advocate the adoption of a rule for increasing money supply so as to ensure monetary stability.

Limitations of the IS-LM Model:

The IS-LM model, however, suffers from two serious limitations:

(a) It is a comparative-static equilibrium model. It ignores the time-lags which are important in examining the effects of economic policy changes.

(b) If has been called the fix-price model. The model does not enable us to examine the effects of changes in aggregate demand on both output and prices. If we take the Keynesian version of the model, then we have to assume a constant price level and so we cannot analyse the problem of inflation. On the other side, if we take the neoclassical version of the model, which applies when full employment is reached the price level is determined by the nominal money supply and output is assumed to be determined exogenously.

In view of these limitations of the IS-WI model, Professor Patinkin suggested a more detailed general equilibrium framework which could bring into sharp focus the differences between the classicals and the Keynesians. He has arrived at the conclusion that the two models are special cases of a general equilibrium model Prof. Milton Friedman has developed a new flex price model to determine also the price level.