Let us make in-depth study of the derivation, slope, shift and essential features of LM curve in money market equilibrium.

Derivation of the LM Curve:

The LM curve can be derived from the Keynesian theory from its analysis of money market equilibrium.

According to Keynes, demand for money to hold depends upon transactions motive and speculative motive. It is the money held for transactions motive which is a function of income. The greater the level of income, the greater the amount of money held for transactions motive and therefore higher the level of money demand curve.

The demand for money depends on the level of income because they have to finance their expenditure, that is, their transactions of buying goods and services. The demand for money also depends on the rate of interest which is the cost of holding money. This is because by holding money rather than lending it and buying other financial assets, one has to forgo interest.

ADVERTISEMENTS:

Thus demand for money (Md) can be expressed as:

Md = L(Y, r)

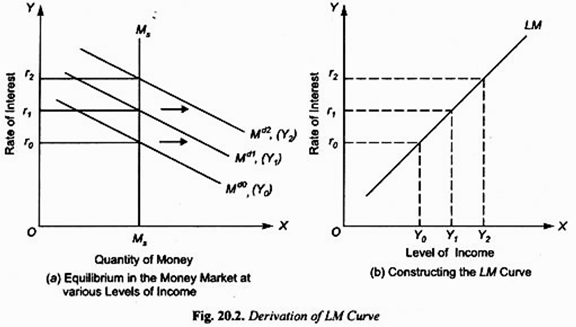

where Md stands for demand for money, Y for real income and r for rate of interest. Thus, we can draw a family of money demand curves at various levels of income. Now, the intersection of these various money demand curves corresponding to different income levels with the supply curve of money fixed by the monetary authority would gives us the LM curve.

The LM curve relates the level of income with the rate of interest which is determined by money-market equilibrium corresponding to different levels of demand for money. The LM curve tells what the various rates of interest will be (given the quantity of money and the family of demand curves for money) at different levels of income.

ADVERTISEMENTS:

But the money demand curve or what Keynes calls the liquidity preference curve alone rises. In Fig. 20.2 (b) we measure income on the X-axis and plot the income level corresponding to the various interest rates determined at those income levels through money market equilibrium by the equality of demand for and the supply of money in Fig. 20.2 (a).

Slope of LM Curve:

It will be noticed from Fig. 20.2 (b) that the LM curve slopes upward to the right. This is because with higher levels of income, demand curve for money (Md) is higher and consequently the money- market equilibrium, that is, the equality of the given money supply with money demand curve occurs at a higher rate of interest. This implies that rate of interest varies directly with income.

It is important to know the factors on which the slope of the LM curve depends. There are two factors on which the slope of the LM curve depends. First, the responsiveness of demand for money (i.e., liquidity preference) to the changes in income. As the income increases, say from Y0 to Y1, the demand curve for money shifts from Md0 to Md1, that is, with an increase in income, demand for money would increase for being held for transactions motive, Md or L1 =f(Y).

ADVERTISEMENTS:

This extra demand for money would disturb the money market equilibrium and for the equilibrium to be restored the rate of interest will rise to the level where the given money supply curve intersects the new demand curve corresponding to the higher income level. It is worth noting that in the new equilibrium position, with the given stock of money supply, money held under the transactions motive will increase whereas the money held for speculative motive will decline.

The greater the extent to which demand for money for transactions motive increases with the increase in income, the greater the decline in the supply of money available for speculative motive and, given the demand for money for speculative motive, the higher the rise in the rate of interest and consequently the steeper the LM curve, r = f (M2, L2) where r is the rate of interest, M2 is the stock of money available for speculative motive and L2 is the money demand or liquidity preference function for speculative motive.

The second factor which determines the slope of the LM curve is the elasticity or responsiveness of demand for money (i.e., liquidity preference for speculative motive) to the changes in rate of interest. The lower the elasticity of liquidity preference for speculative motive with respect to the changes in the rate of interest, the steeper will be the LM curve. On the other hand, if the elasticity of liquidity preference (money demand function) to the changes in the rate of interest is high, the LM curve will be flatter or less steep.

Shifts in the LM Curve:

Another important thing to know about the IS-LM curve model is that what brings about shifts in the LM curve or, in other words, what determines the position of the LM curve. A LM curve is drawn by keeping the stock or money supply fixed. Therefore, when the money supply increases, given the money demand function, it will lower the rate of interest at the given level of income.

This is because with income fixed, the rate of interest must fall so that demand for money for speculative and transactions motive rises to become equal to the greater money supply. This will cause the LM curve to shift outward to the right.

The other factor which causes a shift in the LM curve is the change in liquidity preference (money demand function) for a given level of income. If the liquidity preference function for a given level of income shifts upward, this, given the stock of money, will lead to the rise in the rate of interest for a given level of income. This will bring about a shift in the LM curve to the left.

It therefore follows from above that increase in the money demand function causes the LM curve to shift to the left. Similarly, on the contrary, if the money demand function for a given level of income declines, it will lower the rate of interest for a given level of income and will therefore shift the LM curve to the right.

Essential Features:

From our analysis of the LM curve, we arrive at its following essential features:

1. The LM curve is a schedule that describes the combinations of rate of interest and level of income at which money market is in equilibrium.

ADVERTISEMENTS:

2. The LM curve slopes upward to the right.

3. The LM curve is flatter if the interest elasticity of demand for money is high. On the contrary, the LM curve is steep if the interest elasticity demand for money is low.

4. The LM curve shifts to the right when the stock of money supply is increased and it shifts to the left if the stock of money supply is reduced.

5. The LM curve shifts to the left if there is an increase in the money demand function which raises the quantity of money demanded at the given interest rate and income level. On the other hand, the LM curve shifts to the right if there is a decrease in the money demand function which lowers the amount of money demanded at given levels of interest rate and income.