Now we turn to see what will happen to aggregate output if investment, instead of being fixed at a certain level depends on the interest rate?

As soon as interest rate comes into our analysis, we enter the money market in which interest rate is determined.

Increased government expenditure financed by budget deficits i.e., printing of additional notes, produces an impact on the money market.

Because of the operation of the government expenditure multiplier aggregate output/income will increase. This will now cause an increase in the demand for money.

ADVERTISEMENTS:

Since demand for money exceeds the supply of money (let us assume for the moment that M is fixed) interest rate tends to rise. This discourages private investment and consequently a lower volume of aggregate output would now be available.

Thus, the phenomenon, whereby increased government expenditure may lead to a squeezing of private investment expenditure, is referred to as the crowding-out effect. Government expenditure crowds out private sector investment expenditure. Thus, the multiplier effect of government expenditure (KG) is lessened because of the negative effect on private investment following higher interest rates. It is because of the crowding-out effect aggregate output declines but interest rate increases.

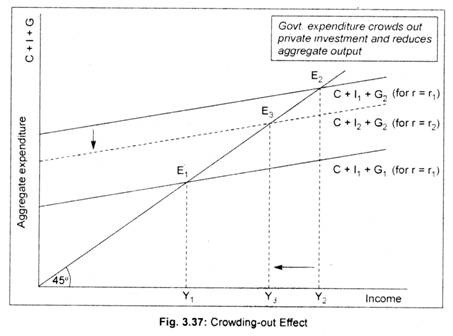

We can explain the phenomenon of crowding-out effect in terms of (i) aggregate demand (C + I + G) and aggregate output approach and (ii) the IS-LM approach. We have learnt that equilibrium national income is determined at that point where C + I + G line cuts the 45° line. This is demonstrated by C + I1 + G1 line when the rate of interest is assumed to be r1. In Fig. 3.37, C + I1 + G1 line cuts the 45° line at point E, and the equilibrium national income, thus, determined is OY1.

Let there be an increase in government expenditure from G1 to G2. This causes C + I1 + G1 (holding r = r1) line to shift up to C + I + G2 (for r = r1). This causes aggregate income to rise to OY2 (full multiplier effect). This higher income (OY2 > OY1), however, causes money demand and interest rate to rise from r1 to r2, leading to a fall in private planned investment expenditure from I1 to I2.

ADVERTISEMENTS:

This causes aggregate demand line to shift down to C + I2 + G2 (assuming r = r2 < r1). Equilibrium now occurs at point E3. Note that equilibrium income has declined to OY3 < OY2. This is crowding-out phenomenon private sector investment is being squeezed. Here we see ‘partial’ multiplier effect in operation.

However, there would not have been any crowding-out phenomenon if interest rate were to decline. Suppose, central bank increases money supply to finance government expenditures. Its impact can now be felt in the money market in the form of lower interest rate. This means that higher money demand by the public can be met by excess quantity of money. This may cause interest rate to fall, causing aggregate output to rise. In other words, instead of crowding-out effect, one may experience ‘crowding-in effect’.

Crowding-out phenomenon can be better explained in terms of IS-LM framework as it

combines both goods market and money market. Aggregate demand-aggregate output approach does not display the links between the goods market and the money market.

ADVERTISEMENTS:

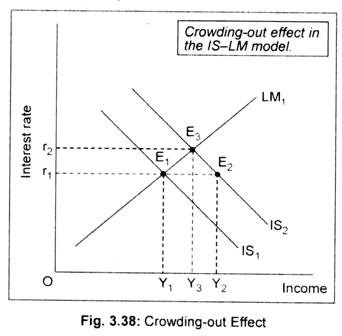

In Fig. 3.38, we have drawn IS and LM curves. For simplicity, we have not considered liquidity trap effect on the LM curve. Initially, our economy is at equilibrium at point E1. The corresponding income-interest rate combination is r1 – Y1.

An increase in government spending shifts the IS curve to IS2, shifting the equilibrium point to E2. Consequently, income rises to OY1 from OY, (a full multiplier effect of government spending). But the economy is out of equilibrium: goods market is in equilibrium (since planned expenditure equals aggregate output), but money market is out of equilibrium. This is because higher income causes money demand to rise.

This excess demand for money (in the money market) then pulls up the interest rate, leading to a fall in aggregate demand as it squeezes out some private investment, tending to reduce the size of the multiplier effect on income. Final equilibrium (determined by the IS-LM intersection) now occurs at point E3 and aggregate output declines to OY3. Note that the increase in aggregate income (OY3 – OY1) is less than the amount indicated by the multiplier (Y2 – Y1) having the ‘full’ effect. This feedback phenomenon is often referred to as a “crowding-out effect”. It reduces the size of government expenditure multiplier.

It may be noted here that the strength or impact of crowding-out effect depends on the interest sensitivity of investment function (i.e., the slope of the IS curve) and interest sensitivity of the money demand function (i.e., the slope of the LM curve). The greater the value of the interest-sensitivity of the investment function and lower the value of the money demand function, greater will be the crowding-out effect, and vice versa.