The modern theory regarding exchange rate determination is known as the supply-demand theory. Suppose there are only two countries, the USA and UK and two currencies, the dollar and the pound. How is the rate at which dollar is exchanged for pound (i.e., dollar price of pound) determined?

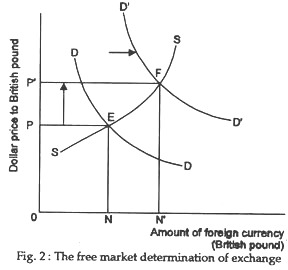

Under this system the exchange rate fluctuates from day to day according to the market forces of demand and supply. See Fig. 2. It is to be noted that the demand for a foreign currency is derived (indirect) demand.

There is need for dollar in Britain because British residents want to buy American goods or financial assets. If the rate of exchange were above E, there would be an excess supply of £ which would bring the exchange rate down to E (such as F).

ADVERTISEMENTS:

An increase in demand for British pounds, on the contrary, will raise the equilibrium Amount of foreign currency price from OP to OP’. Writes Samuelson, “Floating exchange rates are forced flexibly up or down by supply and demand for goods and for capital movements”.

Behind the American demand curve there is a desire of Americans to buy British goods or acquire British assets. Behind the British supply curve is Britain’s desire for American export goods and services and to pay interest on capital borrowed earlier. This is what happens under paper standard.

In the foreign exchange market, as in any other competitive market, an equilibrium price, once established, is maintained only so long as the conditions that underlie market supply and demand are constant. If these conditions change, then the market supply, and demand curves shift, and the equilibrium rate of exchange is altered.

Let us illustrate this point. Suppose that a shift in tastes leads British consumers to demand more US goods. This would cause British importers to demand more dollars (that is to offer a larger supply of pounds in exchange for dollars).

ADVERTISEMENTS:

As a result the supply curve of pounds will shift to the right. This means that the equilibrium exchange rate between dollar and pound will fall, i.e., pound will depreciate in terms of dollar (or dollar will appreciate in terms of pound)

Floating Exchange Rates and the Adjustment Process:

Freely fluctuating exchange rates perform three important functions:

(1) They automatically correct a disequilibrium in the balance of payments through the free play of international market forces;

ADVERTISEMENTS:

(2) They may make imports cheaper and exports dearer, or vice-versa, by altering the price of foreign exchange without necessarily affecting domestic or foreign price levels; and

(3) To the extent that they operate independently of domestic price and income levels, they bear the burden of balance-of-payments adjustments without imposing constraints on the domestic economy.

Managed Floating:

The present system is a mixture of (a) stable exchange rate system and (b) floating exchange rate system. It is possible that the exchange rate between A’s and B’s currency is officially fixed, but that by the official decision of the monetary authorities this ‘peg’ (fixity) can be altered from time to time. This is, broadly speaking, the institutional arrangement made by the International Monetary Fund in 1944. This is known as the adjustable peg system.