The following article highlights the two major types of trade policies. The two types are: 1. Trade under Free Trade 2. Trade under Protection.

1. Trade under Free Trade:

The trade theory (both the absolute advantage and comparative advantage theory) assumes the existence of free trade.

Here we want to explain how do free trade influence domestic production, consumption, and import. Such may be explained with the aid of demand-supply mechanism.

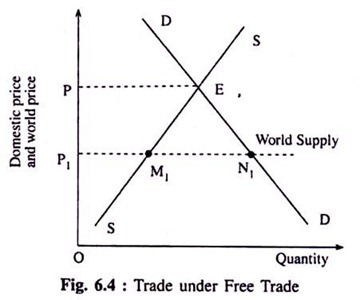

In Fig. 6.4, the curves DD and SS are the demand and supply curves of say, Indian consumers and producers, respectively. These two curves intersect each other at point E. Thus the pre-trade price prevailing in India is OP. However, as soon as this particular commodity goes outside the country where price is determined in the world market, it becomes lower than the domestic price OP.

Let the world price be OP, (<OP). Now in the absence of tariff and with the opening of trade, the price in India (OP) becomes equal to the world price (OP,). But, why? Since trade is free, the foreign country would then export in the Indian market where price is higher than the global price. It is because of competition between the countries price would then fall to OP, in the Indian market.

Note that at this lower price, Indian producers would reduce supply from PE to P1M1 while domestic demand would increase by M1N1. The horizontal line represents the supply curve for import. This is a perfectly elastic supply curve. Anyway, with the opening of trade, the supply- demand gap to the tune of M1N1 is to be met by imports from the foreign country.

The essence of the argument is that the strength of Indian demand for imports and supply of domestic good determine this volume of trade. In other words, it is the demand and supply that determines the volume of trade under free trade.

Free Trade: Arguments and Counterarguments:

International trade that takes place without barriers such as tariff, quotas, and foreign exchange control is called free trade. Thus, under free trade, goods and services flow between countries freely. In other words, free trade implies the absence of governmental intervention on international exchange among different countries of the world.

ADVERTISEMENTS:

There are many arguments for free trade:

Arguments in Favour of Free Trade:

Advantages of specialisation:

Firstly, free trade secures all the advantages of international division of labour. Each country will specialise in the production of those goods in which it has a comparative advantage over its trading partners. This will lead to an optimum and’ efficient utilisation of resources and, hence, economy in production.

ADVERTISEMENTS:

All-round prosperity:

Secondly, because of unrestricted trade, global output increases since specialisation, efficiency, etc., make production large scale. Free trade enables countries to obtain goods at a cheaper price. This leads to a rise in the standard of living of people of the world. Thus, free trade leads to higher production, higher consumption and higher all-round international prosperity.

Competitive spirit:

Thirdly, free trade keeps the spirit of competition of the economy. As there exists the possibility of intense foreign competition under free trade, domestic producers do not want to lose their grounds. Competition enhances efficiency. Moreover, it tends to prevent domestic monopolies and free the consumers from exploitation.

Accessibility of domestically produced goods and services:

Fourthly, free trade enables each country to get commodities which it cannot produce at all or can only produce inefficiently. Commodities and raw materials unavailable domestically can be procured through free movement even at a low price.

Greater international cooperation:

Fifthly, free trade safeguards against discrimination. Under free trade, there is no scope for cornering raw materials or commodities by any country. Free trade can thus promote international peace and stability through economic and political cooperation.

Free from interference:

ADVERTISEMENTS:

Finally, free trade is free from bureaucratic interferences. Bureaucracy and corruption are very much associated with unrestricted trade.

In brief, restricted trade prevents a nation from reaping the benefits of specialisation, forces it to adopt less efficient production techniques and forces consumers to pay higher prices for the production of protected industries.

Samuelson, P. A. and Nordhaus, W. D. argue that restricted or protected trade (opposed to free trade) ‘prevents the forces of comparative advantage from working to maximum advantages.’

Arguments Against Free Trade:

ADVERTISEMENTS:

Despite these virtues, several people justify trade restrictions.

Following arguments are often cited against free trade:

Advantageous not for LDCs:

First, free trade may be advantageous to the advanced countries but not to the backward economies. Free trade has brought enough misery to the poor, less developed countries, if past experience is any guide. India was a classic example of colonial dependence of UK’s imperialistic power prior to 1947. Free trade principles have brought colonial imperialism in its wake.

ADVERTISEMENTS:

Destruction of home industries/products:

Secondly, it may ruin domestic industries. Because of free trade, imported goods become available at a cheaper price. Thus, an unfair and cut-throat competition develops between domestic and foreign industries. In the process, domestic industries are wiped out. Indian handicrafts industries suffered tremendously during the British regime.

Inefficiency becomes perpetual:

Free trade cannot bring all-round development of industries. Comparative cost principle states that a country specialises in the production of a few commodities. On the other hand, inefficient industries remain neglected. Thus, under free trade, an all-round development is ruled out.

Danger of overdependence:

Fourthly, free trade brings in the danger of dependence. A country may face economic depression if its international trading partner suffers from it. The Great Depression that arose in 1929-30 in the US economy swept all over the world and all countries suffered badly even if their economies were not caught in the grip of the then Depression. Such over dependence following free trade also becomes catastrophic during war.

ADVERTISEMENTS:

Penetration of harmful foreign goods: Finally, a country may have to change its consumption habits. Because of free trade, even harmful commodities (drugs, etc.,) enter the domestic market. To prevent such, restrictions on trade are required to be imposed.

In view of all these arguments against free trade, governments of less developed countries in the post-Second World War period were encouraged to resort to some kind of trade restrictions to safeguard national interest.

2. Trade under Protection:

By protection we mean restricted trade. Foreign trade of a country may be free or restricted. Free trade eliminates tariff while protective trade imposes tariff or duty. When tariffs, duties and quotas are imposed to restrict the inflow of imports then we have protected trade. This means that government intervenes in trading activities.

Thus, protection is the anti-thesis of free trade or unrestricted trade. Government imposes tariffs on an ad valorem basis or imposes quotas on the volume of goods to be imported. Sometimes, export taxes and subsidies are given to domestic goods to protect them from foreign competition. These are the various forms of protection used by modem governments to restrict trade.

Now an important question arises:

What forces the government to protect trade? What are the chief arguments for protection? Can protection deliver all the goods that a nation needs? These questions are raised often because quite a large number of people regard foreign competition with suspicion. Such hostility against free competition often gets reflected by the campaigns to “buy home-produced goods”.

Protection: Arguments and Counter Arguments:

ADVERTISEMENTS:

The concept of protection is not a post-Second World War development. Its origin can be traced to the days of mercantilism (i.e., the 16th century). Since then, various arguments have been made in favour of protection. The case for protection for the developing countries received a strong support from Argentine economists R. D. Prebisch and Hans Singer in the 1950s.

All these arguments can be summed up under three heads:

(i) Fallacious or dubious arguments,

(ii) Economic arguments, and

(iii) Non-economic arguments.

Non-economic arguments make a trade-off between national objectives of a country and economic welfare. In this category, national objectives (e.g., defence preparation) are more important than a nation’s overall output and economic welfare.

ADVERTISEMENTS:

(i) Fallacious Arguments:

Fallacious arguments do not stand after scrutiny. These arguments are dubious in nature in the sense that both are true. This argument is based on a misunderstanding of economic logic. ‘To keep money at home’ is one such fallacious argument. By restricting trade, a country need not spend money to buy imported articles. If every nations pursues this goal, ultimately global trade will squeeze.

(ii) Economic Arguments:

Infant industry argument: Perhaps the oldest as well as the cogent argument for protection is the infant industry argument. When an industry is first established its costs will be higher. It is too immature to reap economies of scale at its infancy. Workers are not only inexperienced but also less efficient. If this infant industry is allowed to grow independently, surely it will be unable to compete effectively with the already established industries of other countries.

Thus, an infant industry needs protection of a temporary nature. Given time to develop- an industry, it is quite likely that in the near future it will be able to develop a comparative advantage, withstand foreign competition, and survive without protection. It is something like the dictum: Nurse the baby, protect the child and free the adult. Once an embryonic industry gets matured it can withstand competition.

Competition improves efficiency. Once efficiency is attained, protection may be withdrawn. Thus, an underdeveloped country attempting to have rapid industrialisation needs protection of certain industries.

ADVERTISEMENTS:

If we look at the history of the recent past, we see how this infant industry argument has been vindicated. India during the 1960s and 1970s followed import-substituting strategy of industrialisation. This strategy is based on this infant industry argument.

The country’s industrial base was poor when India got her independence. Thanks to the introduction of the said strategy, India has become a self-reliant country now than what she was in the 1960s and 1970s. In the early stages of industrialisation, many developing countries opted this strategy.

However, in actual practice, the infant industry argument, even in LDCs, loses some strength. Some economists suggest production subsidy rather than protection of certain infant industries. Protection, once granted to an industry, continues for a long time. On the other hand, subsidy is a temporary measure since continuance of it in the next year requires approval of the legislature. Above all, expenditure on subsidy is subject to financial audit. Thus, protection is something like a “gift”.

Secondly, protection saps the self-sufficiency outlook of the protected industries. Once protection is granted, it becomes difficult to withdraw it even after attaining maturity. That means infant industries, even after maturity, get ‘old age pension’. In other words, infant industries become too much dependent on tariffs and other countries.

Thirdly, it is difficult to identify potential comparative advantage industries. A time period of 5 to 10 years may be required by an industry to achieve maturity or self-sufficiency. Under the circumstances, infant industry argument loses force.

In view of these criticisms, it is said by experts that the argument “boils down to a case for the removal of obstacles to the growth of the infants. It does not demonstrate that a tariff is the most efficient means of attaining the objective.” Further, these people argue that the market principle should be adopted to select the industries to be protected.

These counter-arguments, however, do not deter us to foster the growth of infant industries in less developed countries by means of tariff, rather than subsidies.

Diversification argument:

As free trade increases specialisation, so protected trade brings in diversified industrial structure. By setting up newer and variety of industries through protective means, a country minimises the risk in production. Comparative advantage principle dictates narrow specialisation in production.

This sort of specialisation is not only undesirable from the viewpoint of economic development, but also a risky proposition. Efficiency in production in some products by some countries (e.g., coffee of Brazil, milk products of New Zealand, oil of Middle East countries) results in over-dependence on these products.

If war breaks out, or if political relations between countries change, or if recessionary demand condition for the product grow up abroad, the economies of these industries will be greatly injured. Above all, this sort of unbalanced industrial growth goes against the spirit of national self- sufficiency. Protection is the answer to this problem. A government encourages diverse industries to develop through protective means.

However, a counter-argument runs. Politics, rather than economics, may be the criterion for the selection of industries to be protected in order to produce diversification at a reasonable cost. But, one must not ignore economies of protection.

Employment argument:

Protection can raise the level of employment. Tariffs may reduce import and, in the process, import-competing industries flourish. In addition, import-substituting industries—the substitution of domestic production for imports of manufactures—develop.

The strategy of import-substituting industrialisation promotes domestic industry at the expense of foreign industries. Thus, employment potential under, protective regime is quite favourable. In brief, tariff stimulates investment in import- competing and import-substitution industries. Some investment produces favourable employment multiplier.

But, cut in imports following import- substituting industrialisation strategy may ultimately cause exports to decline. Above all, tariff is not an efficient instrument in creating more employment opportunities in an economy. It is strongly argued that the monetary and fiscal policy are the most important means of increasing employment potentiality in an economy.

Balance of payments argument:

A deficit in the balance of payments (BOP) can be cured by curtailing imports. However, imports will decline following a rise in tariff rate, provided other trading partners do not retaliate by imposing tariff on a country’s export. Import restrictions through tariff may be uncalled for if the balance of payments crisis becomes chronic. In view of this and other associated problems of tariff, it is said that tariff is a second-best policy.

Anti-dumping Argument:

Usually, we hear about unfair competition from firms of low-cost countries. One particular form of unfair competition is dumping which is outlawed by international trade pacts, such as the World Trade Organisation (WTO). Dumping is a form of price discrimination that occurs in trade.

Dumping occurs when a country sells a product abroad at a low price because of competition and at a high price in the home market because of monopoly power. In other words, dumping is a kind of subsidy given to export goods. This unfair practice can be prevented by imposing tariff. Other-wise, workers and firms competing with the dumped products will be hit hard.

Strategic trade advantage argument:

It is argued that tariffs and other import restrictions create a strategic advantage in producing some new products having potential for generating some net profit. There are some large firms who prevent entry of new firms because of the economies of large scale production. Thus, these large firms reap pure profits over the long run during which new firms may not dare enough to compete with these established large firms. Thus, the large scale economies themselves prevent entry of new firms.

But as far as new products are concerned, a new firm may develop and market these products and, ultimately, reap substantial profit. In the end, successful new firms producing new products become one of the few established firms in the industry. New firms showing potential for the future must be protected. “If protection in the domestic market can increase the chance that one of the protected domestic firms will become one of the established firms in the international market the protection may pay off.”

All these economic arguments are then based ‘on market power or macroeconomic imperfections’.

(iii) Non-economic Arguments:

National defense argument:

There are some industries which may be inefficient by birth or high cost due to many reasons and must be protected. This logic may apply to the production of national defence goods or necessary food items. Whatever the cost may be, there is no question of compromise for the defence industry since ‘defence is more important than opulence’. Dependence on foreign countries regarding supply of basic food items as well as defence products is absolutely unwise.

However, objections against this argument may be cited here. It is difficult to identify a particular item as a defence industry item because we have seen that many industries—from garlic to clothespin—applied for protection on defence grounds. Candle stick-maker (for emergency lighting) and toothpick-makers (to have good dental hygiene for the troops) demanded protection at different times at different places! A nation which builds up its military strength through tariff protection does not sound convincing. Thus, tariff is a second-best solution.

Arguments Against Protection:

There are some good ‘side-effects’ or ‘spillover effects’ of protection. This means that it produces some undesirable effects on the economy and the basic objective of protection can be attained rather in a costless manner by other direct means other than protection. That is, protection is never more than a second-best solution.

First, protection distorts the comparative advantage in production. This means that specialisation in production may be lost if a country imposes tariff. All these lead to squeezing of trade. Secondly, it imposes a cost on the society since consumers buy good at a high price.

Thirdly, often weak declining industries having no future potential stay on the economy under the protective umbrella. Fourthly, international tension often escalates, particularly when tariff war begins. Usually, a foreign country retaliates by imposing tariff on its imports from the tariff-imposing country.

Once the retaliatory attitude (i.e., ‘beggary-neighbour policy’) develops, benefits from protection will be lost. Under the circumstance, the argument that a tariff improves terms of trade of the tariff-imposing country loses potency. Ultimately, tariff war ensues. Finally, protection encourages bureaucracy. Increase in trade restrictions means expansion of governmental activity and, hence, rise in administrative cost. Bureaucracy ultimately leads to corruption.

(i) Tariff vs Quotas:

Governments of different countries have to intervene in the area of international trade for both economic and non-economic reasons. Such intervention goes by the name of protection. Protection means government policy of according protection to the domestic industries against foreign competition. There are various instruments or methods of protection which aim at raising exports or reducing imports. Here we are concerned with those methods that restricts import.

There are various methods of protection. The most important methods of protection are: tariff and quotas.

A tariff is a tax on imports. It is normally imposed by the government on the imports of a particular commodity. On the other hand, a quota is a quantity limit. It restricts imports of commodities physically. It specifies the maximum amount that can be imported during a given time period.

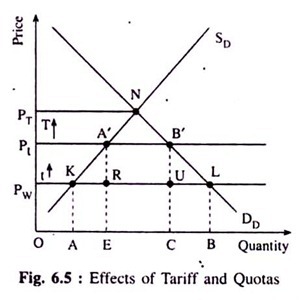

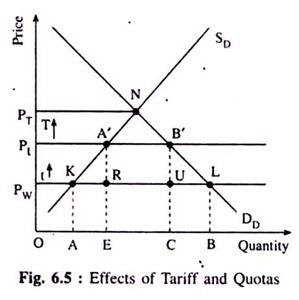

We can now make a comparison between tariffs and quotas in terms of partial equilibrium or demand-supply approach. Fig. 6.5 illustrates the effects of tariffs. The domestic supply curve is represented by the SD curve while the demand curve is given by the DD curve. These two curves intersect each other at point ‘N’. And the price that is determined is known as the autarkic price or pre-trade price (PT). If trade is free, the international price that would prevail is assumed to be Pw. At the international price Pw, a country produces OA but consumes OB and the country, therefore, imports AB.

Now, if a country imposes a tariff = t per unit on its import (small-sized arrow), immediately the price of the product will rise to Pt by the amount of tariff. This may be called ‘non-prohibitive tariff.’ This increase in price has the following effects.

Since tariff raises the price, consumers buy less. Now consumption declines from OB to OC. This is called the consumption effect of tariff. The second effect is the output effect or protective effect. Tariff raises domestic output from OA to OE; this is because higher price induces producers to produce more.

The third effect is import- reducing effect—as tariff is imposed or tariff rate is increased import declines from AB to EC. The fourth effect is the revenue effect earned by the government. The government revenue is the volume of import multiplied by the volume of tariff, i.e., the area A’B’UR. It is a transfer from the consumers to the government. However, if a tariff equal to ‘T’ were imposed, the price would have increased to PT. Consequently, imports would drop to zero. Such a situation is called ‘prohibitive tariff (big-sized arrow) that chokes off all imports.

(ii) Effects of Quotas:

Quotas are similar to tariffs. In fact, they can be represented by the same diagram. The main difference is that quotas restrict quantity while tariffs work through prices. Thus, a quota is a quantitative limit through imports. If an import quota of EC (Fig. 6.5) amount is imposed then price would rise to Pt because the total supply (domestic output plus imports) equals total demand at that price. As a result of this quota, domestic production, consumption, and imports would be the same as those of the tariffs. Thus, the output effect, the consumption effect and the import restrictive effect of tariffs and quotas are exactly the same.

The only difference is the area of revenue. We have already seen that a tariff raises revenue for the government while quotas generate no government revenue. All the benefits of quotas go to the producers and to the lucky importers who manage to get the scarce and valuable import permits. In such a situation, quotas differ from a tariff. However, if import licences are auctioned- off to the importers then the government would earn revenue from the auction. Under these circumstances, the effects of quota and tariff are equivalent.

Advantages of Quotas:

Quotas are superior to tariffs on the following grounds:

Foreign Exchange Implication:

The main advantage of quotas is that it keeps the volume of imports unchanged even when demand for imported articles increases. It is because quotas make the completely elastic (horizontal) import supply curve completely inelastic (vertical). But a tariff permits imports to rise when demand increases, particularly if the demand for imports becomes inelastic. Thus, a quota leads to greater foreign exchange savings compared to tariff (which may even lead to an increase in foreign exchange spending because imports may rise even after tariff).

Precise Outcome:

Another advantage of a quota is that its outcome is more certain and precise, while the outcome of a tariff is uncertain and unclear. This is so because the volume of imports remains unchanged if a quota is imposed. But this is not so in the case of a tariff.

Flexibility:

Finally, Ingo Walter argues that “quotas tend to be more flexible, more easily imposed, and more easily removed instruments of commercial policy than tariffs. Tariffs are often regarded as relatively permanent measures and rapidly built powerful vested interests which make them all the more difficult to remove.”

Disadvantages of Quotas:

But its disadvantages are nonetheless unimportant:

Corruption:

Quotas generate no revenue for the government. However, if the government auctions the right to import under quotas to the highest bidder then quotas are similar to tariffs. But quotas lead to corruption. Usually, officials charged with the allocation of import licenses are likely to be exposed to bribery. Under this situations tariffs are preferable to quotas.

Monopoly Profit:

Secondly, quotas create a monopoly profit for those with import licenses. This means that consumer surplus is converted into monopoly profits. Thus, a quota is likely to lead to a greater loss of consumer welfare. If a tariff is imposed, domestic price will be equal to import price plus tariff.

Monopoly Growth:

Thirdly, allied to this disadvantage of quotas is that quotas are much more restrictive in effect as it restricts competition. Thus, quotas may ultimately lead to concentration of monopoly power among importers and exporters.

Distortion in Trade:

Finally, a quota has the tendency to distort international trade much more than tariffs since its effects are more vigorous and arbitrary.

Thus, we will have to make a choice between a tariff and a quota. A tariff is usually considered a less objectionable method of trade restriction than an equivalent quota. A tariff permits imports to increase when demand increases and, consequently, the government is able to raise more revenue. In contrast, a quota is less obvious and more likely to remain in force for an indefinite period. For all these reasons, a tariff, while objectionable, is still preferable to a quota. The WTO condemns quotas.

Conclusion:

The classical golden age of free trade no longer exists in the world. But, free trade concept has not been abandoned since the case for free trade is the strongest in the long run. Protection is a short term measure. Thus, the issue for public policy is the best reconciliation of these two perspectives so that gains from trade (may be free or restricted) become the greatest.

In recent times, most countries (153) are the members of the World Trade Organisation (WTO) which favours more free trade than restricted trade. This philosophy gathered momentum in the Dunkel Draft and the General Agreement on Tariffs and Trade (G ATT) negotiations. The aims of the GATT (now abolished) and now the WTO are trade liberalisation rather than trade restriction.