In this article we will discuss about Ricardian theory of comparative cost. Also learn about its assumptions and criticisms.

Before the publication of Adam Smith’s Wealth of Nations (1776) the prevalent theory of foreign trade was mercantilism. This doctrine suggested that a country should do all it could to increase exports, but should restrict imports and so build up ‘treasure’. This view was criticised by Adam Smith. He argued that restrictions on foreign trade limited the benefits which could be obtained from market forces.

In essence, the case for free trade is the one in favour of markets on a large scale. If complete free trade were introduced the market would consist of the whole world and consumers would benefit from a wide choice of goods. Moreover, international competition would force domestic firms to keep down prices. Innovations in production techniques and product design would spread more rapidly, so benefitting consumers.

Absolute Advantage:

ADVERTISEMENTS:

Smith argued that trade should be based on absolute advantage. This term describes the position when one country is absolutely more efficient at producing good A, whilst another country is absolutely ‘better’ at producing good B. Both countries would benefit if they specialised in producing the goods at which they have the advantage and then exchanged their products.

Thus, Britain has an absolute advantage compared to Jamaica in the production of cars whilst Jamaica has an absolute advantage in the production of tropical fruits. It will benefit both countries if they specialise and trade. Absolute advantage is a specific example of the advantages of specialisation and division of labour.

Comparative Advantage:

Smith’s argument about absolute advantage was refined and developed by David Ricardo in 1817. Ricardo, improving upon Adam Smith’s exposition, developed the theory of international trade based on what is known as the Principle of Comparative Advantage (Cost). International trade involves the extension of the principle of specialisation or division labour to the sphere of international exchange.

ADVERTISEMENTS:

As a person specialises in the trade in which he has best advantages, a country also specialises in the production of the commodity in which it has the best natural advantages. A country may produce many things at a time, but it may have comparative advantages in the production of some commodities (say, tea or jute as in India) over others and it will specialise in those goods.

Similarly, another country would produce those goods (say, machineries and engineering goods as in Germany or Japan) in which it has comparative advantage. If these two countries produce goods according to their respective areas of comparative advantage, each country would be able to produce the goods at the lowest cost; and both these countries will gain from trading with each other. This is the substance of the principle of comparative advantage (cost).

The principle of comparative cost states that (a) international trade takes place between two countries when the ratios of comparative cost of producing goods differ, and (b) each country would specialise in producing that commodity in which it has a comparative advantage. We may illustrate this principle after stating its assumptions first.

Assumptions of the Theory:

The classical version of the principle of comparative cost is based on several assumptions:

ADVERTISEMENTS:

(a) Trade takes place between two countries only, say A and B.

(b) They are trading with only two commodities, say, jute and cotton,

(c) The cost of production of these two goods in both the countries is expressed in terms of labour only,

(d) The production of these two goods in both the countries taken place at constant costs,

(e) There is no transport cost, or the transport cost, if any, is so small a part of product prices that it is ignored.

Illustration:

Ricardo was concerned about the position where a country was able to produce every commodity at an absolutely lower real cost than another country. He suggested that in this case each country should specialise in the production of those goods where its comparative advantage was greatest.

This can be explained by using the division of labour as an example. If A is ten times more efficient than B as a surgeon and twice as efficient as a road sweeper, then A should devote all his efforts to surgery and leave all the roads sweeping to B.

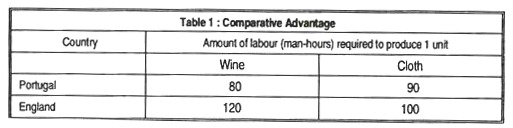

Ricardo developed his theory by comparing two countries, England and Portugal, and two commodities, wine and cloth. Table 1 shows that Portugal was more efficient in the production of both goods, but Ricardo argued that both countries could benefit if they specialised where their advantage was comparatively high and then traded.

ADVERTISEMENTS:

Portugal’s labour costs were lower than England’s in both cloth and wine, but the comparative advantage was greater in wine. The cost ratios were 9:10 for cloth and 8:12 for wine. Thus, it cost England roughly 1.1 times as much labour to produce cloth as it did Portugal, but 1.5 times as much to produce wine.

Ricardo showed that both countries would benefit if England specialised in cloth and Portugal in wine and; if after specialisation, a unit of wine is exchanged for a unit of cloth. England would gain 20 hours since it costs her 100 hours to produce cloth but 120 to produce wine.

Portugal would also benefit because she would trade a unit of wine which took 80 hours to produce and receive a unit of cloth which would have taken her 90 hours to produce. Hence, Portugal gains 10 hours.

ADVERTISEMENTS:

In Ricardo’s own words (referring to Portugal):

“It would be advantageous for her to export wine in exchange for cloth. She would obtain more cloth from England than she could produce by diverting a portion of her capital from the cultivation of wines to the manufacture of cloth”.

In the above example, Portugal has an absolute advantage in the production of both the commodities since the input requirements for both the commodities are less than those of England. But Portugal has a comparative cost advantage in wine. However, a situation of equal advantage, where one country is superior to another in the same ratio in all products, rules out the possibility of gainful trade.

Ricardo’s theory is a simple one. It ignores factors such as transport costs and assumes that goods are homogeneous. It also ignores intra-firm trade, such as that between subsidiaries of a multinational firm. Nevertheless, its conclusion is clear. Countries should specialise where their advantage is comparatively greatest (or, comparative disadvantage is least) and then trade.

ADVERTISEMENTS:

This principle has been restated in various ways, for example, by including all costs and not just labour costs. Another approach uses the terminology of opportunity costs to reach the same conclusion. In the example above, the opportunity cost to Portugal (what is given up) is minimised if Portugal concentrates on producing wine.

Criticisms of the Theory:

As with many other economic ideas there are criticisms to be levelled at this theory:

(i) It is much more complicated in the real world in deciding in which goods countries have a comparative cost advantage. This is so because there are a large number of goods and many countries.

(ii) In reality we find changing pattern of comparative advantage. A country may gain comparative advantage by raising its factor (labour) productivity or by imposing restrictions on trade such as an import tariff. So, comparative advantage is dynamic concept, and not a static one, as Ricardo thought.

(iii) The theory ignores the effects of transport costs. England might specialise in cloth and Portugal in wine. However, once transport costs are added any comparative advantage may be lost.

(iv) The theory assumes that if Portugal wants to specialise introducing more wine it can do so easily by transferring factors of production into wine production. However, it may be difficult to easily transfer these factors from cloth to wine production. In addition, textile workers might not know how to produce wine.

ADVERTISEMENTS:

(v) Modern theories, no longer based on Ricardo’s labour theory, have established that the only necessary condition for the possibility of gains from trade is that price ratios should differ between countries.

(vi) Ricardo ignored the role of demand completely and explained trade from supply side. The post-trade exchange rate between the commodities, whose determination Ricardo could not explain, is established by the Law of Reciprocal Demand, i.e., one country’s demand for another country’s product and vice versa.

(vii) Ricardo’s analysis is based on the labour theory of value as costs are expressed in terms of labour hours. However, the classical labour theory itself has lost its relevance.

(viii) Riocardo’s theory assumes the operation of the law of constant cost. Hence, it cannot be applied in the case of increasing or decreasing costs.

(ix) The classical writers have applied their principle in case of trade with two countries only and with two commodities only. So, the principle has a limited scope of application in practice. It cannot explain multi-lateral trade.

(x) Increasing returns or decreasing cost are a second great factor — in addition to differences in comparative costs — in explaining the basis of trade. Writes Paul Samuelson, “If economies of mass production are overwhelmingly important, costs may decrease as output expands. This would strengthen the case for international exchange of goods.”

ADVERTISEMENTS:

(xi) Trade may also occur due to a third factor, viz., difference in tastes between countries. America produces motor cars. It also imports cars from Japan because it has a special liking for Japanese cars. Here, trade occurs due to consumption bias.

(xii) Finally, the theory assumes that costs remain constant at all levels of output. But, in reality, we find that costs rise after a certain stage due to the operation of the law of diminishing returns. Thus, at some point, after each country has expanded the production of its speciality far enough the cost ratios may become equal.

At this point the basis for trade — difference in opportunity costs between the two nations — will have been eliminated. Moreover, at that point it is quite likely that each country will try to produce some amount of both the goods. Hence, when there are increasing costs, specialisation will not be as complete, nor the volume of trade as large, as is the case when costs are constant.