In this article we will discuss about the concept of multi commodity and multi country trade developed by Ricardo.

Ricardo developed the principle of comparative advantage in terms of a two-commodity example. Now, let us this principle to explain multi-commodity trade.

The main difference between international trade when countries trade in only two goods and international trade when they trade in many goods is that in the latter case each country is likely to export and import a number of goods.

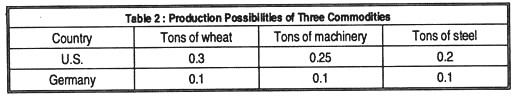

Also, it is generally impossible to determine solely from cost data (i.e., data on input productivities) which goods a country will import and which it will export. Top illustrate let us suppose that the U.S. and Germany produce three commodities: wheat, machinery and steel, and that the daily outputs of German and U.S. workers in these three industries are as shown in Table 2.

We can see that the U.S. has a comparative advantage in wheat, Germany in steel. So, the U.S. will export wheat and Germany steel. But, the question of which exports machinery will depend on the strength of the demand in the two countries for each of the three goods they produce.

For example, if U.S. demand for steel is great but German demand for wheat is slight, the U.S. may end up exporting both wheat and machinery to pay for its steel imports. On the other hand, if German demand for wheat is strong, but, U.S. demand for steel is slight, Germany will have to export both steel and machinery to pay for its wheat imports.

To keep things simple, Ricardo worked out the principle of comparative advantage for a world in which there were only two countries. But this principle can also be used to explain trade in a multi-country world, like the one we live in.

From the standpoint of a single country, trade in a world in which there are many countries does not differ, in essence, from trade in a world in which there are only two countries. The reason is simple. A country’s trading partners, no matter how numerous, can always be thought of as a single rest-of-the-world sector.

ADVERTISEMENTS:

From the standpoint of the world, however, multi- country trade does raise an interesting new possibility: International cost and demand conditions may be such that the countries that trade with each other can realise the full gains available from trade only if they engage in multilateral trade. Trade is said to follow a multilateral pattern whenever countries use exports to one area to pay for imports from some other area.

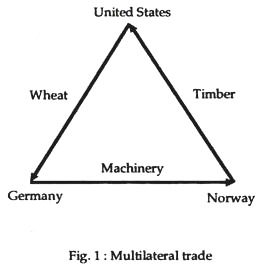

Here is an example of a multilateral trade pattern: Suppose that there are three countries, the United States, Germany and Norway and three goods, wheat, machinery and timber. The U.S. has a comparative advantage in wheat, Germany in machinery and Norway in timber. Let’s say that Germany has a high demand for wheat, Norway for machinery and the U.S. for timber.

Then, the pattern of trade that will bring the greatest gains to all three countries is one by which Germany exports machinery to Norway. Norway exports timber to the U.S. and the U.S. exports wheat to Germany. This multilateral trade pattern is shown in Fig. 1.

Nations differ in the amounts of capital relative to labour with which they are endowed. The U.S. and many Western European countries have much capital but little labour. On the other hand, the orient teems with people but has little capital.

ADVERTISEMENTS:

In most industries, capital and labour can be used in varying proportions to product output. Nevertheless in some industries firms typically use a lot of capital but not much labour, while in others firms typically use a lot of labour but not much capital.

Thus, for example, in any country the local oil refinery is likely to use more capital equipment but fewer workers than the local textile mill, the fact that there are capital-intensive industries (oil refining) and labour-intensive industries (textiles) means that, if one country has a higher capital-labour endowment than another, the opportunity cost of capital-intensive goods will be lower in the first country than in the second, while the opportunity cost of labour-intensive goods will be lower in the second country than in the first. Therefore:

Difference in relative capital-labour endowments are a second source of comparative advantage. A great deal of the trade between nations can be explained on the basis of differences in relative labour-capital endowments.

For example, the orient’s big labour supply is the reason why those countries export textiles, while Western Europe’s big capital supply is the reason why this area exports autos, aircraft, and other capital intensive goods.