The study of economics is rooted in scarcity. The resources necessary to produce goods and services are scarce relative to the material wants and needs those goods and services satisfy.

One way to lessen the scarcity problem is through increases in production due to specialisation.

Specialisation occurs when productive resources concentrate on a narrow range of tasks or on the production of a limited variety of goods and services. The concept applies to all factors of production but is most often associated with individuals and locations. For example, a doctor may specialise in heart surgery; a student may select economics as his (her) major; and West Bengal is known for its poor production of tea.

Specialisation permits greater levels of production than would be attained without it. By concentrating on one productive activity, a resource can be used more efficiently — and greater efficiency results in greater output without raising cost.

ADVERTISEMENTS:

Specialisation, however, depends on the ability to sell what one produces and buy what one needs from someone else, or on the ability to trade. Thus, access to appropriate markets where trade can take place is a prerequisite to specialisation.

Specialisation occurs on an international level when countries concentrate their productive efforts on the goods and services they are best at producing, and trade for the goods and services that are most costly to produce. A country in which the wage rate is low might specialise in producing goods requiring substantial labour inputs; a country with good agricultural resources might concentrate on growing crops or on livestock; and a country possessing technologically advanced equipment and production methods might use these to its benefit. When each country concentrates on what it does more efficiently than other countries; international specialisation increases total production and lessens the scarcity problem on a worldwide level.

The Principle Underlying International Trade:

International trade is the trade among countries or different geographical areas. The earliest trade between countries occurred when they were able to supply one another with goods which they were unable to produce for themselves. Now the sphere of international trade has widened both in volume and in value.

Countries nowadays import many things which they could not produce for themselves, in the same way that individuals purchase many things they could not make for themselves. Division of labour and specialisation, followed by exchange, result in a greater output of everything, and the same applies to international trade also.

ADVERTISEMENTS:

In truth, the principle underlying international trade is that a country should specialise in the production of those commodities for which it has the greater advantage over others. The result of such specialisation will be a larger total world output of these things than would be possible if every country tries to be nearly self- sufficient.

The theory of international trade is, therefore, based on the principle of comparative advantage (cost). We know that division of labour and specialisation within a country make necessary a greater amount of exchange. In a like manner greater division of labour in the international field necessitates an expansion of international trade. Specialisation leads to exchange among nations.

Absolute Advantage:

To explain why trade occurs between two I countries, the great classical economist, Adam Smith, developed the principle of absolute advantage. This was refined and modified by David Ricardo who developed the theory of comparative cost of advantage.

Before the publication of Smith’s book (The Wealth of Nations, 1776), the prevalent theory of foreign trade was mercantilism. This suggested that a country should do all it could to increase exports, but should restrict imports and so build up ‘treasure’. This view was criticised by Adam Smith. He argued that restrictions on foreign trade limited the benefits which could be obtained from market forces.

ADVERTISEMENTS:

In essence, the case for free trade is the case for markets on a larger scale. If complete free trade were introduced the market would consist of the whole world and consumers would benefit from a huge choice of goods. Moreover, international competition would force domestic firms to keep down prices. Innovations in production techniques and product design would spread more rapidly, so benefiting consumers.

Smith argued that trade should be based on absolute advantage. This phrase describes the position when one country is absolutely more efficient at producing good A, whilst another country is absolutely ‘better’ at producing good B. Both countries would benefit if they specialised in producing the good at which they have the advantage and then exchanged their products.

Thus Britain has an absolute advantage compared to Jamaica in the production of cars whilst Jamica has an absolute advantage in the production of tropical fruits. It will benefit both countries if they specialise and trade. Absolute advantage is a specific example of the advantages of specialisation and the division of labour.

Comparative Advantage:

According to Ricardo International trade can lessen the scarcity problem if each country produces and trades on the basis of its comparative advantage. Comparative advantage occurs when a country produces those goods and services in which it has an advantage in comparison to other countries, and trade for what it is less efficient at producing.

If countries produce and trade on the basis of their comparative advantage, the world will have more goods and services than if each country lived in isolation. In essence, the principle of comparative advantage is a restatement of the benefits of international specialisation.

A country has a comparative advantage in the production of a good or service when the (opportunity) cost of producing that item is less in that country than in another country. Fewer goods or services are given up to produce a unit of a particular item in the country with the comparative advantage than in another country.

Ricardo was concerned about the position where a country was able to produce every commodity at an absolutely lower labour cost than another country. He suggested that in this case each country should specialise in the production of those goods where its comparative advantage was greatest. This can be explained by using the division of labour as an example; if A is ten times more efficient than B as a surgeon and twice efficient as a road-sweeper, then A should devote all his efforts to surgery and leave all the road- sweeping to B.

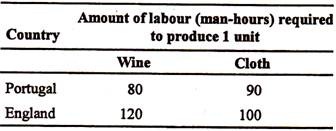

Table 21.1: Comparative Advantage

Portugal’s labour costs were lower than England’s in both cloth and wine, but the comparative advantage was greater in wine. The cost ratios were 9: 10 for cloth and 8: 12 for wine. Thus it cost England roughly 1.1 times as much labour to produce cloth as it did Portugal, but 1.5 times as much to produce wine.

ADVERTISEMENTS:

Ricardo showed that both countries would benefit if England specialised in cloth and Portugal in wine and they then exchanged a unit of wine for a unit of cloth. England would gain 20 hours since it costs her 100 hours to produce cloth but 120 to produce wine. Portugal would also benefit because she would trade a unit of wine which took 80 hours to produce and receive a unit of cloth which would have taken her 90 hours to produce. Hence Portugal gains 10 hours.

In Ricardo’s words (referring to Portugal):

‘It would be…advantageous for her to export wine in exchange for cloth…she would obtain more cloth from England than she could produce by diverting a portion of her capital from the cultivation of wines to the manufacture of cloth.’

ADVERTISEMENTS:

So the basis of international trade from the supply side is the theory of comparative cost (advantage). The law simply states that provided that the opportunity costs of producing particular products differ between two countries they may gain from trading with each other.

The law is based on the concept of opportunity cost. The opportunity cost of producing a commodity is the alternative which could have been produced with the resources which have, now been used up in producing the first commodity.

Theory and Practice:

Does the principle of comparative advantage work in the real world? How closely is it followed? In order to fully exercise comparative advantage and reap its benefits, an environment of free trade is necessary. Free trade occurs when goods and services can be bought and sold by anyone in any country with no restrictions.

Everyone is free to choose with whom he (or she) deals regardless of location, and there are no barriers to trade. Import taxes are not imposed to artificially raise prices and discourage purchases, and limits are not set on the amounts that can be bought and sold. This free flow of trade permits specialisation to grow to its fullest.

Prediction:

ADVERTISEMENTS:

The law of comparative cost(s) suggests that the countries can gain from trading with one another because the opportunity costs of producing the products differ between the two countries. Ricardo assumed that transport costs do not destroy the possible advantages and that free trade exists between the two countries, i.e., there are no obstacles to trade.

Criticisms of the Theory:

The Ricardian theory is based on a number of assumptions. But most of these are unrealistic.

This is why Ricardo’s theory has been criticised on the following grounds:

1. It is much more complicated in the real world in deciding in which goods countries have a comparative cost advantage. This is because there are a large number of goods and many countries.

2. It ignores the effects of transport costs. For instance, Australia might specialise in cars and the UK specialise in freezers. However, once transport costs are added, comparative advantages may be lost.

3. The theory assumes the existence of only one factor of production. But in reality there are various factors (viz., land, capital, organisation, etc.) all of which contribute to the production process and affect cost per unit.

ADVERTISEMENTS:

4. The theory also assumes that technology (or technique of production) remains fixed over time. India may not be efficient today in the production of oil. But, as a result of technological changes or discoveries of new oil resources, it may become a new exporter of oil in near future.

5. The theory assumes that there exist only two countries and two commodities, which is a very simplified and unrealistic assumption. It may, however, be noted that modern economists have extended the principle to more than two countries and more than two commodities.

6. The theory assumes that each country has a fixed supply of resources. But due to discovery of new resources or through reclamation of land or training of labour, a country can acquire the capacity to produce a commodity which it used to import before.

Conclusion:

These criticisms, no doubt, reduce the validity of the principle. But, nevertheless, it can be said to be a rough indicator of the principle that governs international trade. And it provides an adequate basis of trade.

The Ricardian model is a simple one. It ignores factors such as transport costs and assumes that goods are homogeneous. It also ignores intra-firm trade, such as that between subsidiaries of a multinational firm. Nevertheless, its conclusion is clear. Countries should specialise where their advantage is comparatively greatest (or comparative disadvantage is least) and then trade.

This principle has been restated in various ways, for example, by including all costs and not just labour costs. Another approach uses the concept of opportunity costs to reach the same conclusion. In the example above, the opportunity cost to Portugal (what is given up) is minimised if Portugal concentrates on producing wine.

Factor Endowments:

In order to improve Ricardo’s theory, two Swedish economists, E. Heckscher and B. Ohlin (Heckscher, 1919 and Ohlin 1933), developed a theory which stressed factor endowment as the basis for international trade. They suggested that countries such as India, with a huge supply of relatively cheap labour, would specialise in labour-intensive products, and countries such as the USA, with abundant capital, would specialise in the production of capital- intensive products.

ADVERTISEMENTS:

However, an investigation by W. W. Leontief (1954) found a paradox. His research showed that the USA actually exports labour and land-intensive products rather than capital-intensive goods. Despite this paradox, more modern versions of Heckscher and Ohlin’s ideas still provide the most widely accepted theories of international trade.

The Terms of Trade:

The amount of benefit a country obtains from trade depends on the terms on which it buys from and sells to other countries—in other words, the relationship between import and export prices. Index numbers for both sets of prices are calculated monthly in the same way as the retail price index.

The terms of trade show the export index as a percentage of the import index:

Terms of trade = Index of export prices/Index of import prices x 100

(In the base year the value will be 100.)

ADVERTISEMENTS:

In other words, the terms of trade are constructed by taking an index of prices received for exports, on the one hand, and an index of prices paid for imports, on the other, and then dividing the first by the second.

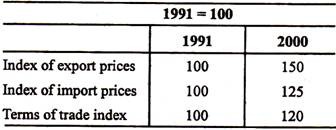

As the following example shows:

A rise in the terms of trade figure indicates that the general level of export prices has risen relatively to import prices. Such a movement is referred to as an improvement in the terms of trade. It means that a given quantity of exports will now buy a larger volume of imports. A reduction in the terms of trade figure is described as un-favourable because it means that the same amount of exports now exchanges for less imports.

By comparing the terms of trade index for different years one can see whether the terms of trade have improved or deteriorated. If export prices rise faster than import prices, the terms of trade index will improve. The implication is that a given quantity of exports will now finance a larger quantity of imports. If, on the other hand, import prices rise faster than export prices, the terms of trade will worsen. It is because in order to import the same amount of goods a larger quantity of goods will have to be exported.

Free Trade and Protectionism:

In practice, countries often impose restrictions that impede the international flow of goods and services. No doubt such policies reduce a country’s ability to fully exploit its various comparative advantages. Yet they are justified on the grounds that they are in the best interest of the nation that is imposing them.

ADVERTISEMENTS:

The belief that it is in a country’s best interest to restrict free trade is known as Protectionism. According to this viewpoint, unrestricted importing and/or exporting may lead to certain economic and noneconomic consequences injurious to the economy as a whole, to certain groups within the economy — are such as workers in particular industries, and/or to national security. Because of these potentially adverse effects, it is argued that, restrictions should be imposed on international trade.

Protectionist policies can be employed in varying degrees. One nation may have detailed regulations as to what, how, and with whom trade is conducted, while the import and export activity of another nation may be subject to very little restrictions. Also, a nation may alter the degree to which it relies on protectionist policies in the changes in economic and non- economic conditions.

The merits of free trade and protectionism have been debated for a long time. But arguing for free trade and for protectionism, we will examine the different types of trade-restricting policies that a country may employ.

Trade-Restricting Policies:

Three basic policies have traditionally been used to restrict trade tariffs, quotas, and embargos. In addition to these, some countries have developed more direct measures to discourage trade, such as setting very high product standards that must be met or a large number of restrictions that must be overcome in order to import a product.

A tariff is a tax placed on an import. Tariffs have the effect of raising import prices to domestic buyers, thereby making foreign goods more costly and thus less attractive to domestic buyers. This reduces the volume of imports demanded and makes it easier for domestic producers to sell their own products.

Quotas are restrictions on the quantities of various goods that can be imported into a country. For example, a country may impose a quota allowing only 10 million tones of wheat to be imported from another country over a one-year period. Once that amount is reached, no more wheat can flow in from the other country for the rest of the year. A quota, like a tariff, restricts the ability of foreign goods to compete with domestic goods.

Free-Trade Arguments:

Arguments favouring unrestricted international trade center on the ability of free trade to increase economic efficiency, increase the availability of goods and services and decrease their prices, and provide a source of competition.

1. Trade, specialisation and efficiency:

Free trade permits the markets in which goods and services are bought and sold to expand, and the possibility of additional sales from expanded markets makes it feasible for resources to specialise in narrower ranges of tasks. In turn, this specialisation allows resources to be used more efficiently than would otherwise be the case.

By using resources more efficiently, more goods and services can be produced, lessening the scarcity problem availability of iron ore as also technical helps from India.

2. Increased availability of goods and lower prices:

A second argument in favour of free trade is that it leads to lower prices and larger quantities of goods from which to choose. Since tariffs have the effect of raising prices, their absence benefits the consumer by making foreign goods available at lower prices; and the removal of quotas has the obvious effect of increasing the amounts of goods available for sale.

3. Trade and competition:

A third argument for free trade is that it increases competition in markets, which benefits consumers. We know that consumers fare better when there are more, rather than fewer, sellers in a market. As the number of sellers increases, the ability of an individual firm to exercise monopoly power over price and output decreases, and price moves toward cost. Thus, with foreign competitors in a market, domestic sellers are less able to make large (monopoly) profits.

In each of the three arguments just presented for free trade, the major beneficiary is the consumer. This is not the case with the protectionist arguments.

Protectionist Arguments:

The essence of the protectionist arguments is that, for either economic or noneconomic reasons, it is in the best interest of a nation to place restrictions on the international flow of goods and services. The major arguments in favour of protection (against free trade) include protection of infant industries and domestic employment and output, diversification, and national security.

1. Protection of Infant Industries:

As the name suggests, an infant industry is one which is in the early stage of its development. Technological changes in areas such as electronics or fuels, the availability of previously unknown or inaccessible resources, or the opening of new regions where production can take place, can promote the growth of new industries.

In the formative stage, or infancy, of an industry, strong competitive pressures from established foreign sellers of rival products may limit or even destroy any prospect for growth. When this appears likely, the government should impose trade restrictions to give the newly forming domestic industry a chance to establish itself and grow in a protected environment.

For example, free trade among nations leads to a more efficient allocation of resources and this in turn raises productivity of labour and others resources. It may be feasible for a country like Nepal to develop a domestic steel industry.

However, there are many countries, such as Japan and Germany, that also produce steel and whose products could compete in the developing industry’s domestic markets. In such a situation, it will be necessary for a developing country to impose tariffs or quotas on foreign steel to allow the young industry to develop a domestic market for its products.

2. Protection of domestic employment and output:

Another argument in favour of protection is that, both foreign and domestic goods compete for domestic consumers’ money. When consumer demand is not strong enough to support both foreign and domestic producers, the sale of one more unit of an imported good may come at the expense of its domestically produced counterpart. In other words, the availability of foreign goods may lead to lower domestic output and higher domestic unemployment than under free trade.

Simple solution to the problem is to impose trade restrictions that would make it difficult, or impossible, for foreign goods to compete in domestic markets. Such a policy, it is argued, would help to increase employment and output at home. Support for this argument frequently comes both from manufacturers and trade unions in specific industries facing strong foreign competition — such as the textile industry.

3. Diversification:

The protectionist argument for diversification is in support of the policy of not putting all one’s eggs in the same basket. In truth, there are risks associated with the dependency on foreign-produced goods because changes in the prices or availabilities of those goods can lead to economic disruptions at home.

Such situations could be averted, or at least their impacts reduced, by not specialising to the point where a country develops critical dependencies on foreign products. Rather, domestic production should be diversified so that there are feasible alternatives to imported goods. Such a strategy would reduce the potential for outside interests or events to disrupt the economy. So there is justification for, imposing tariffs and quotas to stimulate domestic production for the sake of diversification.

4. National Security:

For various of reasons, arguments have been put forward to impose tariffs, quotas, and embargos in the name of national security. These reasons include the need to develop strong domestic defence-related industries, and the need to diversify in anticipation of interruptions of foreign supplies resulting from military or economic aggression or some other type of international hostility.

The Real World of International Trade:

Most countries do not choose a strict free- trade or protectionist philosophy and then adhere only to policies aligned with that philosophy. Instead, these two philosophies are the extremes toward which a country may lean. A country may adopt a comprehensive trade policy based on the principles of free trade or protectionism, or it may adopt more liberal terms of trade with some of its favoured trading partners and restrict trade with other countries.

A country’s policies concerning international trade tend to shift from time to time with changing political and economic conditions.

Instead of restricting trade, a country will sometimes adopt policies to promote the export of a home produced good. One method of achieving this objective is to give subsidies to businesses which produce and export that good.

On many occasions a country has been accused of dumping its products in foreign markets. This occurs when a good is sold in a foreign market below its actual cost or below the price at which it is sold in its own domestic market. Countries adopt this policy to eliminate excess production or to gain a greater share of a foreign market.

In the interdependent world of foreign trade, change in a country’s trade philosophy — a change in a tariff, quota, embargo, or subsidy, or dumping — may cause retaliation by a trading partner. And there is always the danger that changing policies and retaliations will result in a trade war.

When a trade war breaks out, the benefits of specialisation on an international basis are jeopardised. No one seems to benefit. As the Nobel Laureate economist Sir W. A. Lewis comments: “National income cannot be increased by avoiding imports, since this will result only in diversifying resources to the production of articles of domestic consumption, thereby withdrawing them from the most profitable export markets. Nor can domestic employment be increased by reducing imports because this would reduce exports to the same extent.”

The Trade Agreements among Nations:

Since World War E (1939-1945), world trade has been carried out in a relatively liberal environment, thanks largely due to greater international cooperation to reduce tariffs and support organisations that facilitate the trading process. For example, the International Monetary Fund (IMF) provides loans and other financial assistance to nations seeking to improve their competitiveness in world trade.

Tariff reductions have occurred in large parts as a result of the General Agreement on Tariffs and Trade (GATT), under which countries held their first round of talks in 1947. Since then, there have been several rounds of negotiations, each leading to lower tariff rates.

As per the 1993 “Uruguay Round of GATT negotiations” the World Trade Organisation (WTO), was founded in 1995 to take over responsibilities of GATT.

World Trade Organisation (WTO):

Recognising both the drawback of short-sighted trade policy and the gains from trade, nations — large and small — have since World War II engaged in a variety of efforts to reduce trade barriers. At the global level, the prominent effort is known as the General Agreement on Tariffs and Trade (GATT). On a slightly smaller scale, regional trading blocs have also been developed.

After World War II, the countries of the world realised that there was much to be gained from establishing an international economic order in which barriers to trade were reduced. They established the GATT in 1947. In 1995, this was replaced by the WTO with its headquarters in Geneva, Switzerland.

The charters of the WTO speak of raising living standards through “substantial reduction of tariffs and other barriers to trade and the elimination of discriminatory treatment in international commerce”. The WTO currently has 132 member countries, which account for 90% of international trade.

GATT was founded on three guiding principles. The first was reciprocity if one country lowered its tariffs, it could expect other countries in GATT to lower theirs. The second was non-discrimination no member of GATT could offer a special trade deal that favoured only one or a few other countries. The third was transparency import quotas and other non-tariff barriers to trade should be converted into tariffs, so their effective impact could be measured.

GATT has proceeded in a number of stages, called rounds (the Kennedy Round, completed in 1967, the Tokyo Round, completed in 1979, and, the latest, the Uruguay Round, completed in 1993). Collectively, the rounds have reduced tariffs on industrial goods substantially. The average tariff on manufactured goods was 40% in 1947. By 1992, they had been reduced to 5%, and the Uruguay Round reduced them still further to 2%.

The Uruguay Round had achieved two important things. It began the process of extending the principles of free and fair trade to a number of much more difficult areas. There were, for instance, moves towards reducing agricultural subsidies, and ensuring that intellectual property rights — patents and copyrights — were respected. Secondly, it created the WTO to help enforce the trade agreements.

Previously, a country that believed that it was suffering from an ‘unfair trade’ practice could bring a case to a GATT panel that would examine the evidence. Even if the panel was unanimous, however, in finding that an unfair trade practice had occurred, there was little in the way of effective enforcement. Under the WTO, a country injured by an unfair trade practice will be authorised to engage in retaliatory actions.

The Objectives:

WTO was established for administering the new global trade rules, agreed in the Uruguay Round. These rules — achieved after long negotiations among 132 countries — establish the rule of law in international trade.

The WTO is more global in its membership than the GATT. Its prospective membership is more than 150 countries. All the 128 members of the old GATT automatically became WTO members upon acceptance of the Uruguay Round Agreements and submission of commitments on trade in goods and services.

On the assumption that negotiations on the current membership applications of over 20 countries are ultimately concluded successfully, the WTO will cover virtually the whole of world trade. It has a far wider scope than its predecessor, bringing into the multilateral trading system, for the first time, trade in services, intellectual property protection, and investment. It is a full-fledged international organisation in its own right while GATT was basically a provisional treaty.

The WTO seeks to remove export restraints on textiles and clothing, reform trade in agriculture and phase out “grey-area” trade measures — so- called voluntary export restraints.

The WTO supervises the implementation of the significant tariff cuts (averaging 40%) and reduction of non-tariff measures agreed to in the negotiations.

The WTO is a watchdog of international trade, regularly examining the trade regimes of individual members and resolving trade conflicts among them.

Trade disputes that cannot be solved through bilateral talks are adjudicated under the WTO dispute settlement “court”. Panels of independent experts are established to examine disputes in the light of WTO rules and provide rulings.

The WTO is also a management consultant for world trade. It keeps a close watch on the pulse of the global economy.

Finally, the WTO is a forum where countries continuously negotiate exchanges of trade concessions. The object is to further lower trade barriers all over the world.