In this article we will discuss about the Kravis theory of trade along with its weaknesses.

An important extension of international trade theory given by Heckscher and Ohlin is the availability approach to international trade. This approach was given by Irving B. Kravis in 1956. According to Kravis, it is the domestic availability or non-availability of goods that governs the pattern of trade. Kravis, while attempting to test the generalisation of H-O theory that labour-abundant countries export labour-intensive goods, found that the exporting-industries invariably had been paying relatively high wage rates even in those countries.

Kravis, therefore, asserted that the nations would export those products which were readily available in the home country. They would tend to import, on the contrary, such products the domestic supply of which had been short of their demand. According to him, the essential basis of international trade has been the ‘non-availability of goods at home’. The non-availability of goods in the home country may either be in the absolute or the relative sense.

In the former case, certain goods may not be available at all in the home country such as diamonds in the U.S. economy. The non-availability in the relative sense signifies that the domestic supply of products is short of their demand and the additional output of those goods can be possible in the home country at much higher costs. The principle of comparative advantage in such a case comes into its own and countries prefer to import such products from abroad rather than to produce them at home at the prohibitive costs.

ADVERTISEMENTS:

Kravis maintains that the domestic availability or otherwise of certain specified products in a particular country is governed by:

(i) Natural Resources:

If a country is well- endowed with minerals like iron ore, bauxite and oil, the products which involve the use of such materials will be produced in large quantity in the home country. A part of production of these products will be exported abroad. On the opposite, if there is scarcity of forest products in a given country, the scarcity thereof can be met by importing them from abroad. Thus the pattern of trade of a given country is influenced by the relative abundance or scarcity of natural resources.

(ii) Technical Progress:

ADVERTISEMENTS:

The technical progress can have a significant impact upon factor utilisation, factor costs, expansion in the scale of production and improvement in the quality of product. In general, technical progress can increase considerably the domestic availability of certain categories of products, the surplus quantities of which can be exported abroad.

(iii) Product Differentiation:

The producers in different countries are inclined to produce different varieties of products. The production of such goods confers temporary monopoly to a specific innovating country and it disposes of its special product variety in the foreign markets.

(iv) Government Policy:

ADVERTISEMENTS:

The tariff and non- tariff trade restrictions tend to restrict the international flows of goods. The international cartels like OPEC too follow restrictive policy measures and the availability of a large range of products gets affected on the international plane.

While natural resources, technical progress and product differentiation together lead probably to expansion in the volume of international trade, the trade restrictions imposed by the countries tend to have a limiting impact upon trade.

Kravis’ availability theory of trade can be explained through a hypothetical example. It is supposed that there are four countries—A, B, C and D. There are two commodities, wheat and steel. The production of both the commodities requires labour and capital. In addition, the production of wheat requires fertile agricultural land whereas the production of steel requires iron ore. Out of the four countries. A, B and C are endowed with agricultural land.

The countries B, C and D are endowed with iron ore. Given these factor endowments, country A can produce only wheat and country D can produce only steel. The countries C and D can produce both wheat and steel. Now according to the availability doctrine, country A will export wheat to country D and latter will export steel to the former. Since B and C are capable of producing both the commodities, the trade between them will be governed by their respective comparative cost advantages.

Suppose the domestic exchange ratio between wheat and steel in country B is 6 units of wheat = 1 unit of steel. It is 3 units of wheat = 1 unit of steel in country C. If the international exchange ratio is settled at 4 units of wheat = 1 unit of steel, country B will export wheat to country C and latter will export steel to country B.

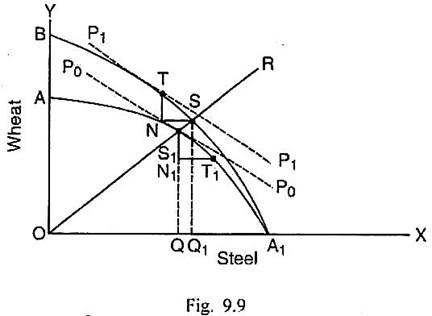

The availability approach has been discussed by R. Findlay in relation to the factor proportions approach. It is supposed that two countries A and B can produce two commodities, wheat and steel. They have equal endowments of labour, capital and iron ore. However, country B has more agricultural land than the country A. The pattern of trade between these two countries may be explained through Fig. 9.9.

In Fig. 9.9, commodity steel is measured along the horizontal scale and commodity wheat is measured along the vertical scale. Given the equal availability of labour, capital and iron ore in two countries and relatively large availability of wheat- producing land in country B, AA1 is the production possibility curve of country A and A1B is the production possibility curve of country B. P0P0 and P1P1 are the terms of trade lines which have the same slope.

The line OR starting from origin indicates the demand proportions of two commodities in these countries. OR intersects AA1 and A1B at S1 and S respectively. The point S1 indicates that country A requires OQ quantity of steel and S1Q quantity of wheat. The point S indicates that country B requires OQ1 quantity of steel and SQ1 quantity of wheat. The point of production in country A is T1.

ADVERTISEMENTS:

Thus country A has TjN1 quantity of steel over and above the quantity required by it. The excess availability of steel in this country will be exported to country B. The point of production in country B is T. At this point country B has TN quantity of wheat over and above its domestic requirement. The excess availability of wheat in this country will be exported to country A.

Findley argues that availability approach has superiority over the factor proportions approach. Although two countries have equal endowments of labour and capital, yet country A produces and exports the capital-intensive commodity steel and country B produces and exports the relatively less capital-intensive commodity wheat. It is not fully consistent with the factor proportions theory.

However, the availability theory recognises that the trade pattern between these two countries is governed by the availability of more land in country B and iron ore in country A. Thus Kravis’ availability theory seems to be better than the factor proportions theory.

Weaknesses:

ADVERTISEMENTS:

No doubt, Kravis’ availability theory provides a more precise and specific explanation of the pattern of trade. It is, in some respects, even better than both comparative costs and factor proportions approaches. But there are certain weaknesses in this model of trade.

(i) Limited Applicability:

In this model, the pattern of trade is explained on the basis of availability of more land in one country and more iron ore in the other country. The number of product- specific resources may be quite large. The determination of the trade pattern, in such a situation, is likely to be very difficult and complex. The multi- commodity approach based on comparative advantage may seem to be more appropriate in such a situation.

(ii) Methodological Weakness:

ADVERTISEMENTS:

Although Jagdish Bhagwati attempted to derive a number of hypothesis concerning the availability theory such as:

(a) Domestic inelasticity of supply of importable goods;

(b) Excess of foreign over domestic elasticity of supply of importable goods;

(c) Higher rate of technical progress in export industries of the home country than the overall average rate of technical progress in the country;

(d) The excess of rate of technical progress in domestic export industries than the rate of technical progress in the same industries in the foreign countries; and

(e) The intensity of use in export goods of those materials which are relatively abundant in the home country.

ADVERTISEMENTS:

However, neither such hypotheses have been systematically formulated, nor these have been scientifically tested.

(iii) Neglect of Demand Pattern:

This theory recognises that the bases of availability factor are natural resources, technical progress, product differentiation and the government policies. The pattern of demand or consumer preferences in foreign countries is a very crucial factor in influencing trade pattern. This factor, however, has been overlooked in Kravis’ approach.

(iv) Not Relevant to Trade among Advanced Countries:

The advanced countries generally have similar factor endowments and technical know-how. The availability factor may not exercise a significant impact upon their pattern of trade. In the same way, the trade among less developed countries may also not be based on availability factor as they also generally have similar factor endowments. It is only in the case of trade between the North and the South that the availability factor may have some relevance.

(v) Limited Empirical Support:

ADVERTISEMENTS:

Kravis’ theory of availability has doubtful validity as there has been very limited empirical support for it.