The price determination involves two distinct stages. First, the firms defines the price hat it would like to charge (P) in order to cover its total costs when its plant is operated within its optimal range of capacity and earn a (subjectively determined level of) ‘reasonable’ profit.

Secondly, the firm compares its estimated price with the level of price at which entry would occur, and sets the price at a level (P*) which would effectively deter entry. Let us examine this procedure of price determination in some detail.

Subjective estimate of the ‘desired’ price:

The firm uses the ‘mark-up’ rule

P = AVC + GPM

ADVERTISEMENTS:

The average variable cost (AVC) is assumed known to the firm with certainty. The firm concentrates on the straight stretch of the SAVC curve which represents normal utilization of its plant capacity. The firm looks at its long-run position and aims at the long-run profit maximization.

However, given the uncertainty in the environment, the firm bases its price on the short-run AVC; the firm believes that its costs will not increase if it expands its scale (in the long run) and probably they will be lower than in the short run. Thus the short-run AC is thought by businessmen to be a good approximation to the long-run average cost.

The gross profit margin will cover the average fixed cost (AFC) and yield a normal profit

GPM = AFC + NPM

ADVERTISEMENTS:

where NPM = net profit margin. The AFC element is determined by dividing the total fixed cost (TFC) by a ‘planned’ or ‘budgeted’ or ‘normal’ level of output (X*). This is a level of output (within the range for which the plant has been set up) which the firm expects to produce and sell with normal utilization of its plant. Thus

AFC = TFC / X*

where X* = ‘planned’, or ‘budgeted’, or ‘normal’ output.

The net profit margin is assumed to be known to the established firms ‘as a matter of experience’: it should yield a ‘fair’ return on capital (so that capital keeps flowing regularly in the industry for investment in the long run) and cover all risks peculiar to the product. For an already-produced commodity, firms have formed a fair view of what the net profit margin is from their past experience. For a new product the firm is assumed to make a fair judgement about what the NPM is ‘safe’, in the sense of not attracting entrants.

ADVERTISEMENTS:

The addition of AVC, AFC and NPM gives an estimate of the ‘desired’ price, that is, the price which the firm would wish to charge if it is to cover all its costs (with a normal utilization of its plant) and make what it thinks to be a normal profit.

Actual price setting:

However, the thus estimated price will not necessarily be charged. The ‘desired’ or ‘standard’ price will be taken as the initial basis of the price that will actually be charged (P*). The level of actual price depends mainly on the threat of potential entry (potential competition). Actual competition by existing firms is resolved by either tacit collusion or by price leadership. Tacit collusion takes various forms.

Typically it is realized within trade associations, which publish industry-wide average-cost information by product line. This information then becomes, by the common consent of the firms belonging to the particular trade association the basis of price calculations.

When firms in the industry have widely different costs, pricing on the basis of average costs by each firm independently may result in market instability and price wars. The ‘orderly co-ordination’ and functioning of the industry is often attained by price leadership. The price leader is among the largest firms with the lowest costs. The less efficient firms will be effectively price-takers. The price leader makes his price calculations according to the average-costing rule, but will actually charge a price, P, which depends

(a) On potential competition

(b) On general economic conditions (booming or depressed business).

Thus, if there are barriers to entry, P* will be higher than the normal price (P), and the price leader (and possibly other less efficient firms) will be making abnormal profit. However, if the threat of potential entry is strong, the quoted price (P*) will be equal to the leader’s normal price (P), who will be earning just normal profits. Thus the effective (realized) gross profit margin is competitively determined, by the threat of potential entrants.

There is also evidence that the gross profit margin is readjusted when an entrant charges a lower price, and when the general market conditions deviate from the normal in a sellers’ market a higher GPM is often charged while in periods of depressed trade the GPM is downward readjusted (see below).

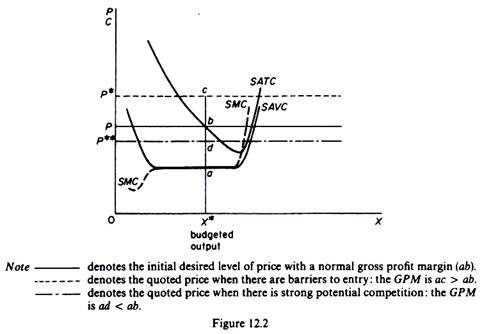

Figure 12.2 depicts the determination of price in our ‘representative’ average-cost pricing model. It should be stressed that the horizontal lines are not demand curves, but show the price that would be charged under certain conditions. At this price the firms would be prepared to sell whatever they could produce with their plant capacity. Their sales in any one period is ultimately determined by their ‘goodwill’.

ADVERTISEMENTS:

In figure 12.2 the SATC curve includes the net profit margin which the firms consider normal for the particular product. The price leader, given his cost structure, would normally desire to charge the price P which would cover his SAVC and his ‘normal gross profit margin’ (ab). At this price the firm leader would be prepared to sell what the market would take. (It should be noted that P is calculated on the assumption that the budgeted output will be X*.)

If barriers to entry exist (or sometimes in persistent booming trade) the leader would charge the price P* which would yield abnormal profits (at outputs equal or greater than the budgeted output) clearly the effective GPM at P* is ac > ab. If potential competition (threat of entry) is strong (or sometimes in periods of depressed business) the leader would actually charge the price P** (lower than the ‘desired’ or ‘initial-base’ price P) and at this price his effective GPM would be ad, which is smaller than the desired one ab.

The average-cost pricing model apparently discards demand curves. Price is based on the costs of the firm and in particular on the short-run costs, since the long-run costs are blurred with uncertainty. If the product is technically homogeneous there will be a unique price in the market in the long run.

ADVERTISEMENTS:

However, if products are differentiated (either with brand names, or in style and quality) there will be a cluster of prices in the industry, reflecting the differences in costs or the degree of strength of the preferences of the customers.