Balance of Payments of India

Introduction:

In the modern world, there is hardly any country which is self-sufficient in the sense that it produces all the goods and services it needs.

Every country imports from other countries the goods that cannot be produced at all in the country or can be produced only at an unduly high cost as compared to the foreign supplies.

Similarly, a country exports to other countries the commodities which those countries prefer to buy from abroad rather than producing at home. Besides, trade of goods and services, there are flows of capital. Foreign capital flows are in the form of portfolio investment by foreign institutional investors or in the form of foreign direct investment. The balance of payments is a systematic record of all economic transactions of residents of a country with the rest of the world during a given period of time.

ADVERTISEMENTS:

This record is so prepared as to measure the various components of a country’s external economic transactions. Thus, the aim is to present an account of all receipts and payments on account of goods exported, services rendered and capital received by the residents of a country, and goods imported, services received and capital transferred by residents of the country. The main purpose of keeping these records is to know the international economic position of a country which helps the Government in making decisions on monetary and fiscal policies on the one hand, and trade and payments policies on the other.

Balance of Trade and Balance of Payments:

Balance of trade and balance of payments are two related terms but they should be carefully distinguished from each other because they do not have exactly the same meaning. Balance of trade refers to the difference in values of imports and exports of commodities only, i.e., visible items only. Movement of goods between countries is known as visible trade because the movement of goods is open and visible and can be verified by the custom officials.

During a given period of time, the exports and imports may be exactly equal, in which case the balance of trade is said to be in balance. But this is not necessary because those who export and import are not necessarily the same persons. If the value of exports exceeds the value of imports, the country is said to have an export surplus. On the other hand, if the value of its imports exceeds the value of its exports, the country is said to have a deficit balance of trade.

Distinction between Current Account and Capital Account:

ADVERTISEMENTS:

The distinction between the current account and capital account of the balance of payment may be noted. The current account deals with payment for currently produced goods and services. It includes also interest earned or paid on claims and also gifts and donations.

The capital account, on the other hand, deals with capital receipts and payments of debts and claims. The current account of the balance of payments affects the level of national income directly. For instance, when India sells its currently produced goods and services to foreign countries, the producers of those goods get income from abroad.

In other words, current account receipts have the effect of increasing the flow of income in the country. On the other hand, when India imports goods and services from foreign countries and pays them money which would have been used to demand goods and services within the country money flows out to foreign countries.

Thus, current account payments to foreigners involve reduction of the flow of income within the country and constitute a leakage. Thus, the current account of the balance of payments has a direct effect on the level of income in a country. The capital account, however, does not have such a direct effect on the level of income; it influences the volume of assets which a country holds.

Balance of Payments on Current Account:

ADVERTISEMENTS:

Two types of Balance of Payments are distinguished:

(1) Balance of Payments on Current Account, and

(2) Balance of Payments on Capital Account.

We first explain the meaning and components of balance of payments on current account.

Balance of payments on current account is more comprehensive in scope than balance of trade. It includes not only imports and exports of goods which are visible items but also invisible items such as foreign travel, transportation (shipping, air transport etc.), insurance, tourism, investment income (e.g. interest on investments), transfer payments i.e. donations, gifts, etc.

A country, say India, has to make payments to the other countries not only for its imports of merchandise but also for tourists travelling abroad, insurance and shipping services rendered by other countries. Further, it has to pay the royalties to foreign firms, expenditure of Indians in foreign countries, interest on foreign investment in India. These are debit items for India, since the transactions involve payments made to the rest of the world. In the same way, foreign countries import goods from India, make use of Indian films and so on, for all of which they make payments to India.

An important item which has recently emerged as an item of invisible exports is software exports which has become good foreign exchange earner. These are the credit items for India as the latter receives payments. Balance of payments thus gives a comprehensive picture of all such transactions including imports and exports of goods and services concerned.

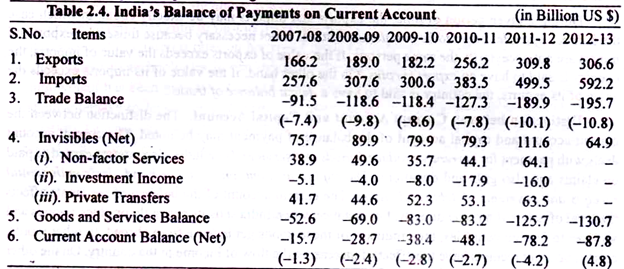

The Table 2.4 (given below) gives the position of India’s balance of payments on current account for the years 2007-08 to 2011-12. In this table balance of payments the visible as well as invisible items of trade are given. The visible items are export-import of goods and the invisible items of balance of payments on current account are travel, transportation and insurance, interest on loans given and other investment income on private and official transfers.

Both visible and invisible items together make up the current account. Interest on loans, tourist expenditure, banking and insurance charges, software services etc., are similar to visible trade since receipts from selling such services to the foreigners are very similar in their effects to the receipts from sales of goods; both provide income to the people who produce the goods or services.

ADVERTISEMENTS:

It will be noted from Table 2.4 above that the most important item in the balance of payments on current account is balance of trade which refers to imports and exports of goods. In Table 2.4 balance of trade does not balance and shows a deficit in all the seven years. In the years 2011-12 and 2012-13 trade deficit has substantially increased. Trade deficit was over 10 per cent of GDP in both these years.

In fact, it is huge trade deficit in these two years that has caused huge current account deficit of over 4% of GDP in these two years. Economic slowdown in advanced countries and its spillover effects in Emerging Market Economies coupled with high crude oil and gold prices were responsible for sharp increase in trade deficit.

Due to surplus in invisibles account, there was a surplus on current account during 2001-2002, 2002-03 and 2003-04. In India’s balance of payments on current account from 2004-05 onwards there has been a deficit. Contrary to popular perception, deficit on current account is not always bad provided it is within reasonable limits and can be easily met by non-debt capital receipts. In fact, deficit on current account represents the extent of absorption of capital inflows in India during a year.

ADVERTISEMENTS:

It may be noted that when there is deficit on the current account, it is financed either by using foreign exchange reserves held by Reserve Bank of India or by capital flows that come into the country in the form of foreign direct investment (FDI) and portfolio investment by FIIs, external commercial borrowing (ECB) from abroad and by NRI deposits in foreign exchange account in our banks.

However, due to global financial crisis in 2008-09, there was first slowdown and then decrease in exports. As a result, there was a large deficit of 2.4 of per cent of GDP on current account which could not be met by capital inflows as they were quite meagre ($ 8.6 billion) as a result of global financial crisis. Therefore, to finance the deficit on current account in 2008-09 we had to withdraw US $ 20 billion from our foreign exchange reserves. Again, in the two years 2011-12 and 2012-13 the current account deficit (CAD) had been quite high.

It may be noted that high current deficit tends to weaken the rupee by raising the demand for US dollars. In 2011- 12, the current account deficit tended to weaken the rupee by raising the demand for US dollars. In 2011-12, the current account deficit was 4.2 per cent of GDP. Since capital inflows in this year were not adequate to finance the current account deficit, RBI had to withdraw 12.8 billion US dollars from its foreign exchange reserves to meet the demand for US dollars.

In the year 2012-13 the current account deficit has been estimated to be even higher at 4.8 per cent of GDP, capital inflows through portfolio investment by FIIs had picked up in the latter half of 2012-13 but capital inflows through FDI had fallen. However, we managed to meet such large account deficit through capital inflows. In fact we added to our foreign exchange reserves by $3.8 billion in 2012-13.

ADVERTISEMENTS:

Thus current account deficit poses serious challenge to macroeconomic management of the economy. The dependence on volatile capital inflows through FIIs to meet the current account deficit is unsustainable as these capital flows go back when global situation worsens and thereby cause sharp depreciation in exchange rate of rupee and crash in stock market prices.

Since in the recent years, 2011-12 and 2012-13 current account deficit has widened, this has increased the balance of payments vulnerability to sudden reversal of capital flows, especially when sizable flows comprise debt and volatile portfolio investment by FIIs. The priority has therefore been to reduce current account deficit (CAD) through improving trade balance. Efforts have been made to promote exports by diversifying the export commodity basket and export destinations.

One way to limit imports is to bring domestic prices up to the international level so that users bear the full cost. Accordingly, petrol has been decontrolled and diesel prices have been revised upward in Jan. 2013 to curtail subsidy on it. To discourage the imports of gold which has played a significant role in causing trade deficit, customs duty on its import was raised from 6% to 8% and further to 10% in July 2013.

Further, to improve the current account deficit emphasis has been on facilitating remittances and encouraging software exports that have been responsible for surplus on the invisible account. In recent years this surplus has lowered the impact of widening trade deficit on current account deficit (CAD) significantly.

The two components together met nearly two-thirds of the trade deficit that was more than 10 per cent of GDP in 2011-12. Remittances particularly are known to exhibit resistance when the country is hit by external shock as was evident during the global crisis of2008.

Balance of Payments on Capital Account:

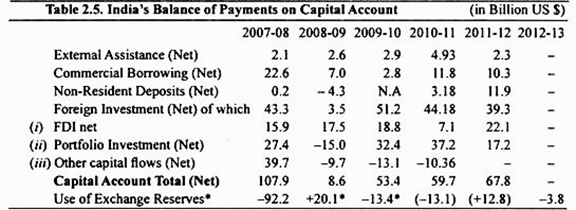

In the balance of payments on capital account given in Table 2.5 important items are borrowings from foreign countries and lending funds to other countries.

ADVERTISEMENTS:

This takes two forms:

(i) External assistance which means borrowing from foreign countries under concessional rate of interest;

(ii) Commercial borrowing under which the Indian Government and the private sector borrow funds from world money market at higher market rate of interest.

Besides non-resident deposits are another important item in capital account. These are the deposits made by non-resident Indians (NRI) who keep their surplus funds with Indian Banks. Another important item in balance of payments on capital account is foreign investment by foreign companies in India. There are two types of foreign investment. First is portfolio investment under which foreign institutional investors (FIIs) purchase shares (equity) and bonds of Indian companies and Government.

The second is foreign direct investment (FDI) under which foreign companies set up plants and factories on their own or in collaboration with the Indian companies. Still another item in capital account is other capital flows in which the important source of funds is remittances from abroad sent by the Indian citizens working in foreign countries. Table 2.5 gives the position of India’s capital account for the years 2007-08 to 2012-13.

Capital inflows in the capital account can be classified into debt creating and non-debt creating. Foreign investment (both direct and portfolio) represents non-debt creating capital inflows, whereas external assistance (i.e. concessional loans taken from abroad), external commercial borrowing (ECB) and non-resident deposits are debt-creating capital inflows.

It will be seen from Table 2.5 that during 2007-08, there was net capital inflow of 43.3 billion US dollars on account of foreign investment (both direct and portfolio). Table 2.5 gives the position of India’s balance of payments in capital account for seven years, 2007-08,2008-09,2009-10,2010- 11, 2011-12 and 2012-13.

When all items of balance of payments on capital account are taken into account we had a surplus of 107.9 billion US dollars in 2007-08. Taking into current account deficit of $ 15.7 billion on current account in year 2007-08 there was accretion to our foreign exchange reserves by $ 92.2 billion in 2007-08.

Global financial crisis affected our capital account balance as there was reversal of capital flows after Sept. 2008 with the result that we used $ 20.1 billion of our foreign exchange reserves in 2008-09 resulting in decrease of our foreign exchange reserves. That is, because we used our foreign exchange reserves equal to $ 20.1 billion, there was decline in our foreign exchange reserves by $ 20 billion in 2008-09.

The situation improved in 2009-10 as foreign direct investment (FDI) and portfolio investment by FIIs picked up. As a result there was net capital account surplus of $ 53.4 billion in 2009-10 and after meeting the current account deficit of $ 38 billion there was addition to our foreign exchange reserves by $ 13.4 billion in 2009-10. In 2010-11 also there was surplus on capital account of $ 59.7 billion and after meeting current deficit we added $ 13.1 billion in our foreign exchange reserves in 2010.11.

However, in 2011 -2012 and 2012-13 the situation regarding capital flows changed significantly and capital flows were not sufficient to meet the large current account deficit (CAD). Consequently, in 2011-12 withdrawal from foreign exchange reserves of 12.8 million US dollars was made. Capital flows are driven by pull factors such as economic fundamentals of recipient countries and push factors such as policy stance of source countries.

The capital flows have implications for exchange rate management, overall macroeconomic and financial stability including liquidity conditions. Capital account management therefore needs to emphasize promoting foreign direct investment (FDI) and reducing dependence on volatile portfolio capital inflows.

ADVERTISEMENTS:

This would ensure that to the extent current account defect is bridged through capital surplus it would be better if it is done through stable and growth-enhancing foreign direct investment flows. In the present international financial situation, reserves are the first line of defence against the volatile capital flows. However, the decline in reserves as a percentage of GDP is a source of concern.

When all items of balance of payments of capital account are taken into account we had a surplus of 6.8, 53.9 and 59.7 billion US dollars in 2008-09, 2009-10 and 2010-11. Small size surplus on capital account of 6.8 billion US dollars in 2008-09 was due to large portfolio capital outflows by FII, which occurred because of global financial crisis in 2008-09. As a result of this, capital flows fell short of current account deficit of 27.9 billion US dollars resulting in deficit of 20.1 billion US dollars in 2008-09.

As a consequence our foreign exchange reserves declined by $ 20.1 billion in 2008-09. However, in 2009-10 and 2010-11, there was enough capital account surplus so that after meeting current account deficit we added to our foreign exchange reserves by $ 13.4 and $ 13.1 billion in our foreign exchange reserves in 2009-10 and 2010-11.

Further, it is important to note that surplus on capital account is mainly due to foreign investment in India, external commercial borrowing and NRI deposits which do not belong to us. These investment funds, especially foreign institutional investment funds and Non-Resident Deposits, can flow out of India if situation in India is not favourable.

This in fact happened in the year 2008-09 when as a result of global financial crisis FIIs (Foreign Institutional Investors) sold corporate shares in the Indian stock market and capital outflow from India took place on a large scale.

Determinants of Balance of Payments:

It may be further noted that when there is a deficit in the current account, it has to be financed either by using foreign exchange reserves with Reserve of Bank, if any, or by capital inflows (in the form of foreign assurance, commercial borrowing from abroad, non-residential deposits).

ADVERTISEMENTS:

There are several variables which determine the balance of payments position of a country, viz., national income at home and abroad, the prices of goods and factors, the supply of money, the rate of interest, etc. all of which determine exports, imports, and demand and supply of foreign currency.

At the back of these variables lie the supply factors, production function, the state of technology, tastes, distribution of income, economic conditions, the state of expectations, etc. If there is a change in any of these variables and there are no appropriate changes in other variables, disequilibrium will be the result.

The main cause of disequilibrium in the balance of payments arises from imbalance between exports and imports of goods and services that is, deficit or surplus in balance of payments. When for one reason or another exports of goods and services of a country are smaller than their imports, disequilibrium in the balance of payments is the likely result.

Exports may be small due to the lack of exportable surplus which in turn results from low production or the exports may be small because of the high costs and prices of exportable goods and severe competition in the world markets.

Important causes of small exports are the inflation or rising prices in the country or over-valued exchange rate. When the prices of goods are high in the country, its exports are discouraged and imports encouraged. If it is not matched by other items in the balance of payments, disequilibrium emerges.

Does Balance of Payments Must Always Balance?

It is often said that balance of payments must always balance. What does it mean? The individuals and business firms of an economy have to pay for the imports from abroad. If exports are not sufficient to pay for the imports, then how the balance of payments will be in balance.

For example, the balance of payments on current account of India has been in deficit for most of the years till 2000 01. Deficit on current account implies that the residents of a country are spending more on imports of goods and services than the incomes they are earning from exports of goods and services.

For the overall balance of payments to be in balance, this deficit in the current account of the balance of payments must be financed by selling capital assets of such as shares and bonds of companies or other assets such as gold or foreign exchange reserves of a country or by borrowing from abroad.

Both by selling assets or by borrowing from abroad, foreign capital flows into the country as has been happening in the last several years in India. These foreign capital inflows are shown in the capital account of the balance of payments which must be in surplus to finance the deficit in the current account.

Thus current account + capital account surplus = 0…. (i)

The above fact has an important lesson that must be borne in mind. If a country has no foreign currency reserves or it has no assets to sell to pay for the imports and if nobody is willing to lend to it, it will have to cut down its imports which will reduce productive activity in the economy and adversely affect economic growth of the country.

Such a crisis situation arose in India in 1991 when our foreign exchange reserves had fallen to a very low level and no one was willing to lend to us or give us aid. In fact, due to loss of confidence of foreign investors, capital outflows were taking place.

Therefore, in 1991 India had to mortgage gold to Bank of England and Central Bank of Japan to get the necessary foreign exchange to pay for the needed imports. We had to accept the pre-conditions of IMF for providing us assistance to tide over the crisis. It is interesting to note this was done under the guidance of Dr. Manmohan Singh who was then the Finance Minister.

Capital Flows and Globalisation:

The globalization of the Indian economy has an important consequence with regard to capital flows into the economy. Suppose India faces given prices of its imports and a given demand for its exports of goods and services. Under these circumstances, if domestic rate of interest is higher as compared to what exists abroad, then given the mobility of capital, capital will flow into the Indian economy to a very large extent.

This principle can be expressed as follows:

BP = NX (Yd Yf, R) + CF (If – Id) … (ii)

where BP = balance of payments, NX is net exports (i.e. exports-imports which is also called trade balance, CF stands for surplus in the capital account of the balance of payments, that is, capital flows.

The above equation reveals that trade balance (NX) is a function of level of domestic income (Yd) and foreign income (Yf) and real rate of exchange (R). An increase in the domestic income due to higher industrial growth or fall in real exchange rate of rupee will adversely affect the trade balance (NX) by increasing imports. lf– Id in equation (ii) measures net foreign investment, i.e. net capital inflows.

Further, the above equation shows that higher interest rate in India as compared to that in the foreign country such as the United States will cause large capital inflows into India. Such capital inflows actually took place in India 2009-10 and 2010-11. Due to large capital inflows into the Indian economy our foreign exchange reserves increase. However, when there are large capital outflows as occurred during 2008-09, our foreign exchange reserves decline.